Tag Archive: Ben Bernanke

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

Janet Yellen – Backtracking Again

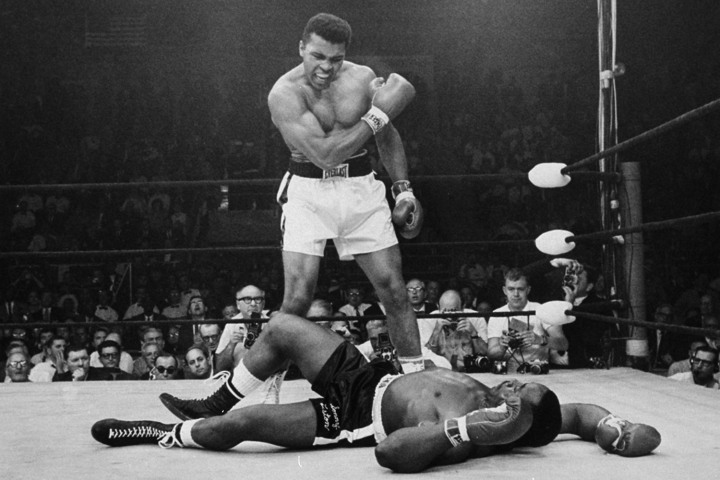

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather ...

Read More »

Read More »

Why is Freddie Mac Reporting a Loss?

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b...

Read More »

Read More »

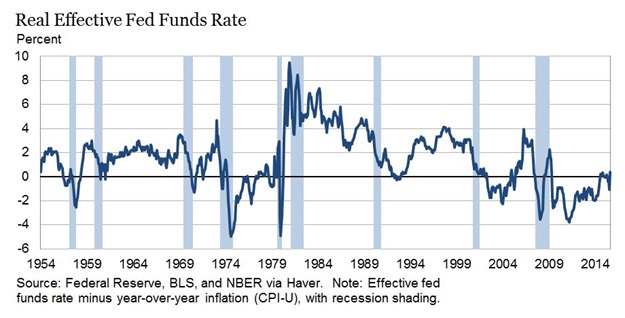

Gold And Negative Interest Rates

Submitted by Dan Popescu via Acting-Man.com,

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed h...

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »

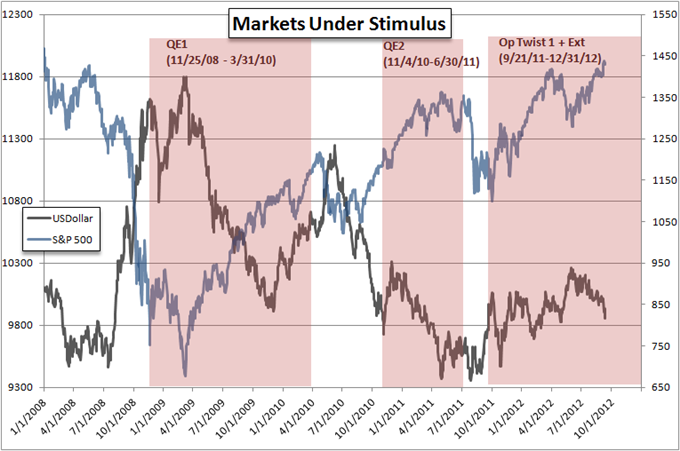

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

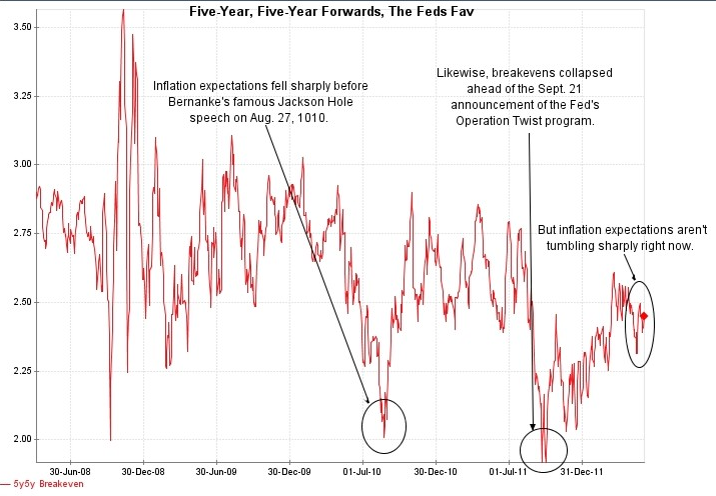

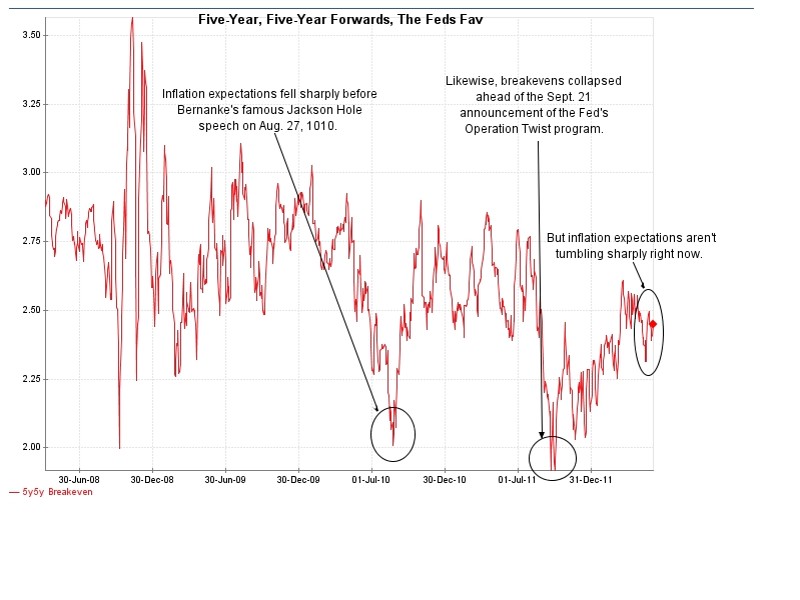

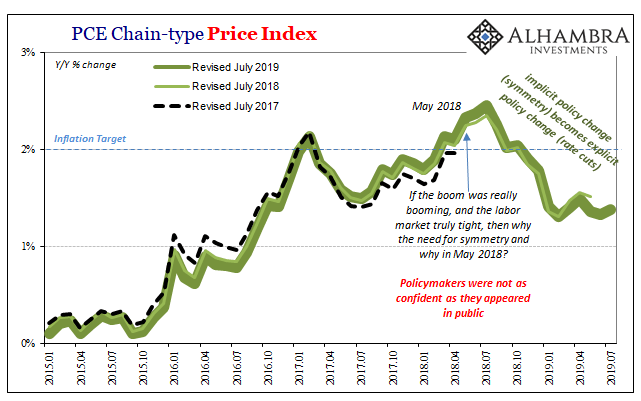

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »

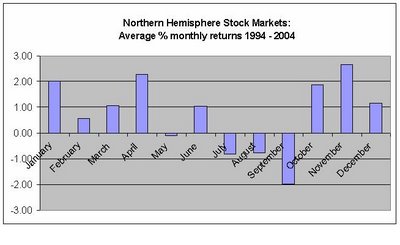

The “Sell in May, come back in October” effect and its equivalent for the SNB

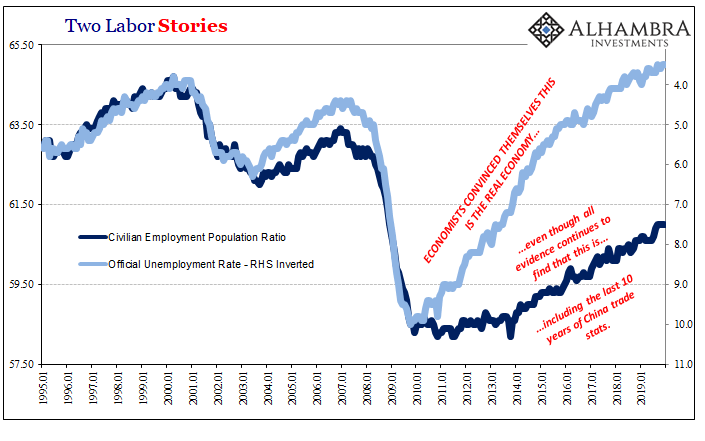

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »