Tag Archive: Basic Reports

Recovery: GDP vs MPoD, 2 November

On Wednesday last week, the price of silver dropped from over $24.25 to just a bit over $23 before bouncing back to around $23.50. The next day, the price dropped again, briefly to around $22.60 before mostly recovering (but a dime to a quarter down).

Read More »

Read More »

Why These Gold Standardites Are Wrong, 13 October

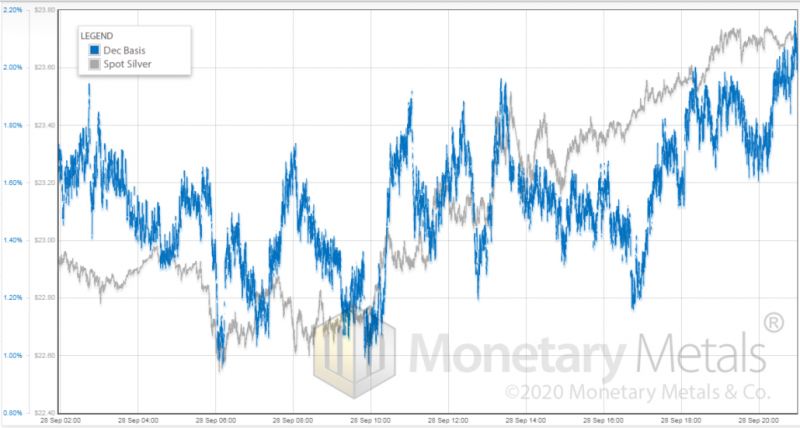

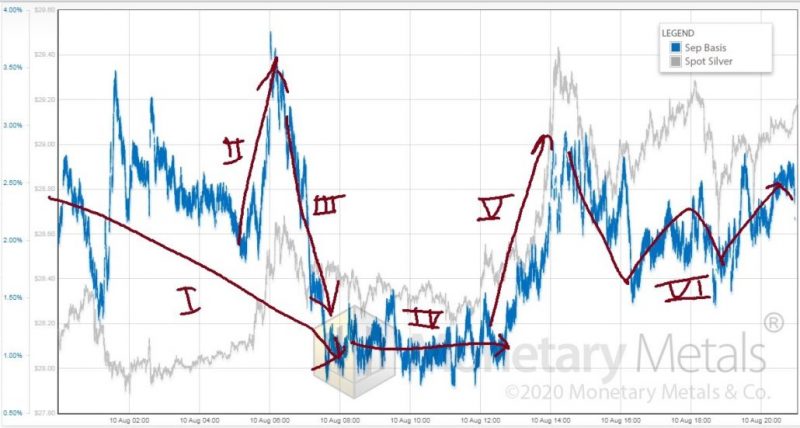

On Friday, the price of silver went up from $24.25 to $25.20, or +4%. Let’s look at the graph of the price and basis (i.e. abundance) action. For the first part of the day, the action is from speculators, for the most part.

Read More »

Read More »

Silver Falls, We’ve Got #$*&! Mail

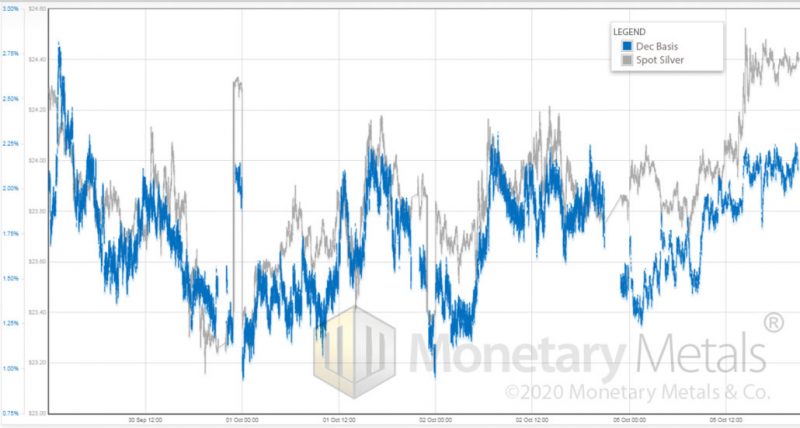

There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution.

Read More »

Read More »

Silver Rises, JP Morgan Manipulates!

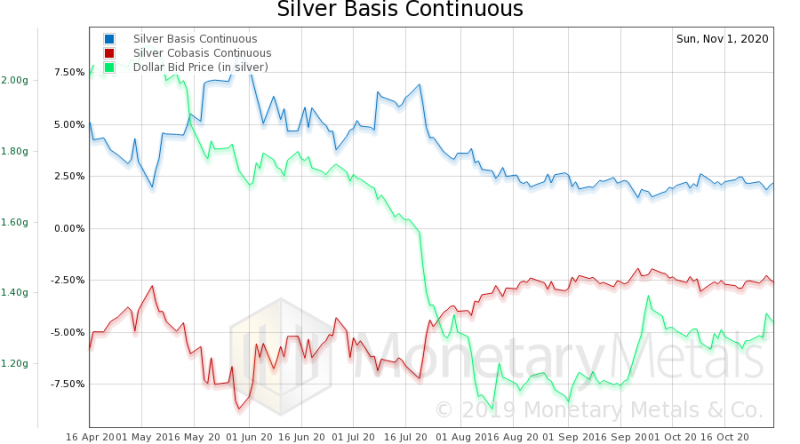

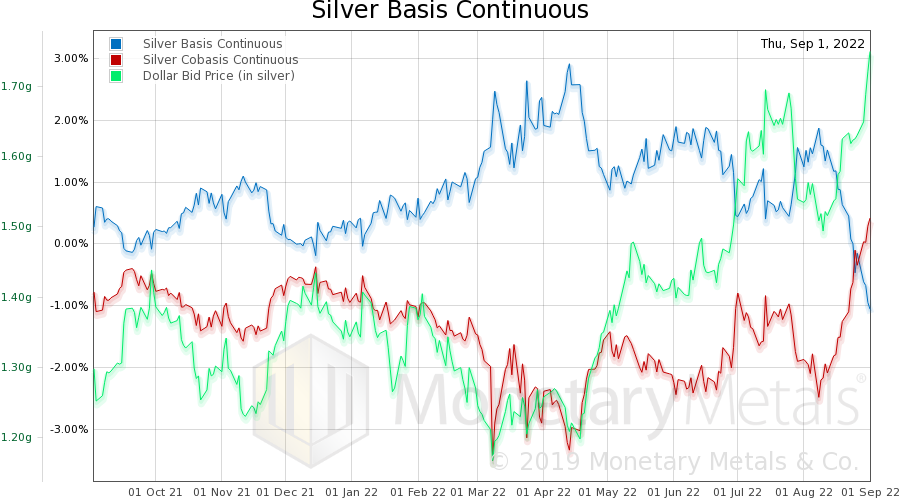

While the silver price was dropping recently, we published analyses here and here. At that time, we saw a basis that fell with price, but which recovered during “off” days. In short, there was not much of a decrease in abundance of the metal to the markets commensurate with the price drops.

Read More »

Read More »

And Silver Crashes Some More! 24 Sept

A few days ago, we wrote about a big silver crash. The price dropped around 7.5%. And the basis dropped from around 2% to 0.6%. At the end, we said: “The key question is: what is the follow-through? If the price stays down and the basis goes back up, that will be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.”

Read More »

Read More »

Warren Buffett Shorts The Economy, 18 August

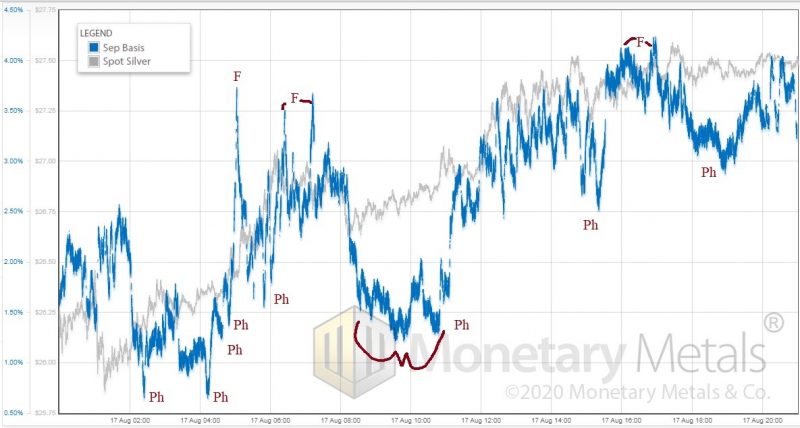

It must be Monday, because the price of silver skyrocketed. From $26.10, it shot up to $27.50, or +5.4%. The last time we wrote about silver was after its crash to $25. Silver is now priced 10% above that low point.

Read More »

Read More »

Silver Supply & Demand Still Strong at $29, 11 Aug

And, *bam!* Just like that, silver sells for $29. It seems so simple, so obvious, so black-and-white. Seeing the price chart in recent weeks, you wouldn’t know that silver speculators have been waiting for this moment since March, 2013 (when silver crossed the $29 line to the downside, and has not looked back until now).

Read More »

Read More »

One of These Silver Days is Not Like the Other, 23 July

Yesterday, the price of silver spiked about 10%. We wrote that it was driven by: “…buying of physical metal.” And we added: “This is a pretty good signal that a bull market may be returning to silver. Let’s watch the basis and price action closely and see how it develops, before we join the pack…”

Read More »

Read More »

About that Spike in the Silver Price… 22 July

The price of silver has just spiked up about $2.00—that’s about 10%. All the usual suspects have been calling for silver to skyrocket. With some amusement, we have been watching ads from a guy known for savvy junior mining stock investments, who has been calling for gold to go up for a while.

Read More »

Read More »

Dear Bullion Banks, Please Come Back! Market Report

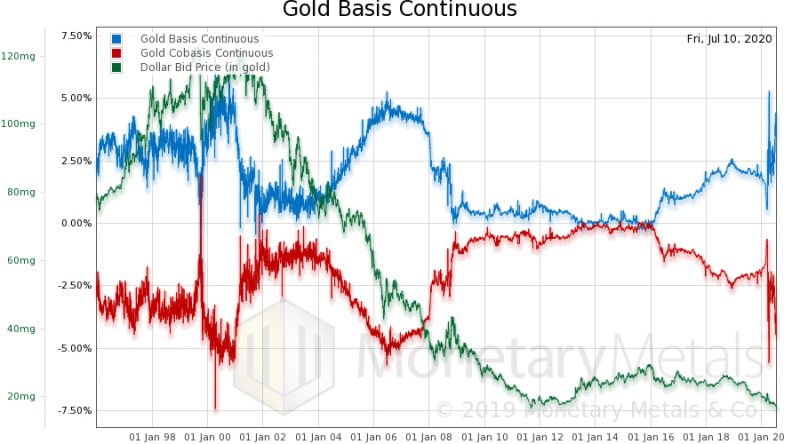

One of our colleagues recently wrote an open letter to Ted Butler. The point was that Monetary Metals gold leasing is a different kind of activity than what is called “gold leasing” in the institutional bullion market. We make it possible for gold owners to lease their metal to gold-using businesses, and thereby earn interest in gold.

Read More »

Read More »

Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission.

Read More »

Read More »

Growing Dollar Demand, Silver Weirdness, Market Report, 15 June

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet...

Read More »

Read More »

When Is a Capital Gain Capital Consumption? Market Report, 25 May

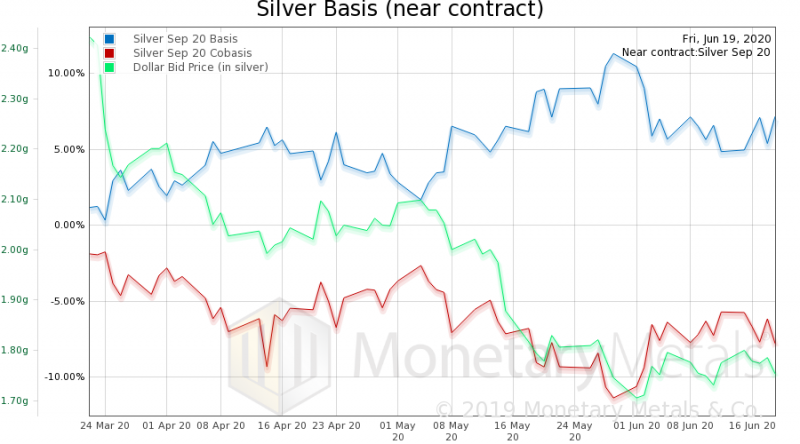

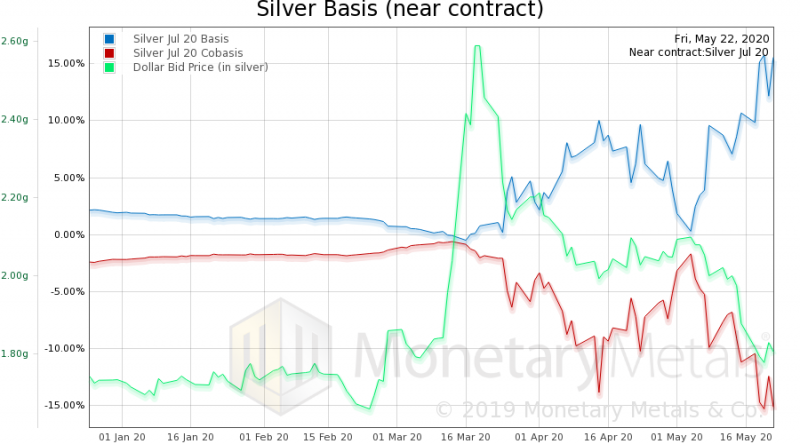

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals.

Read More »

Read More »

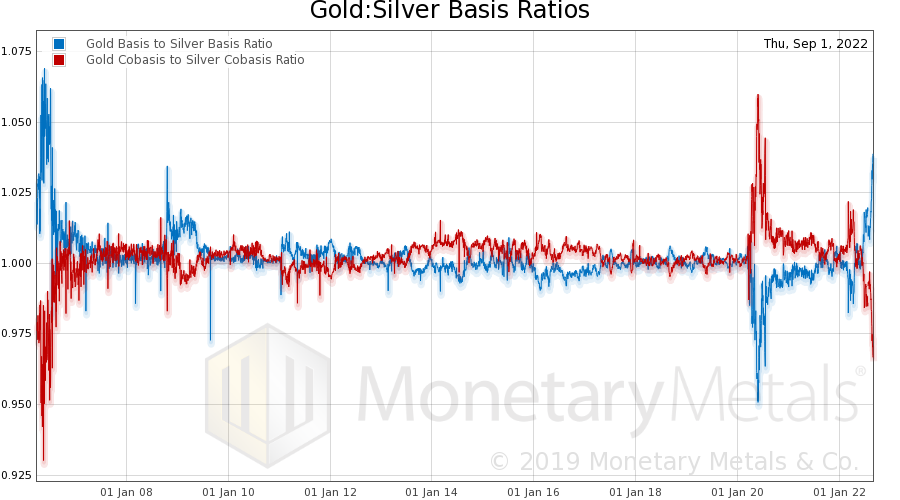

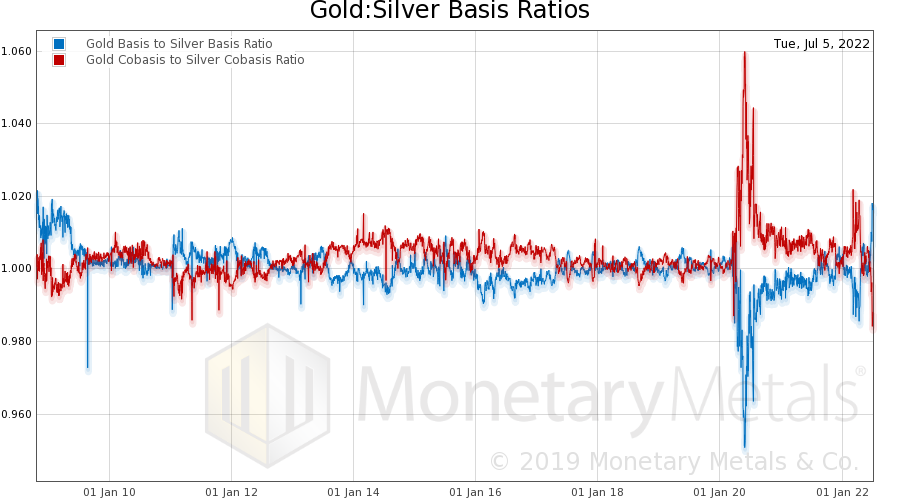

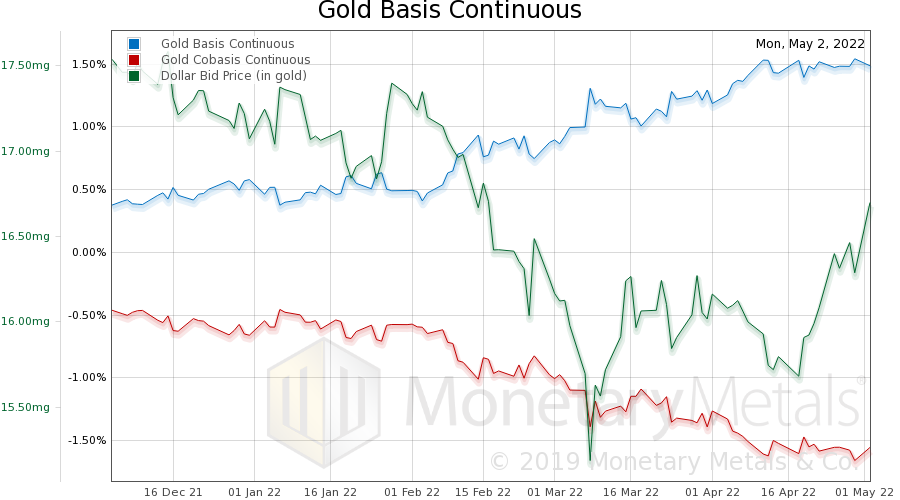

Gold and Silver Markets Start to Normalize, Report 4 May

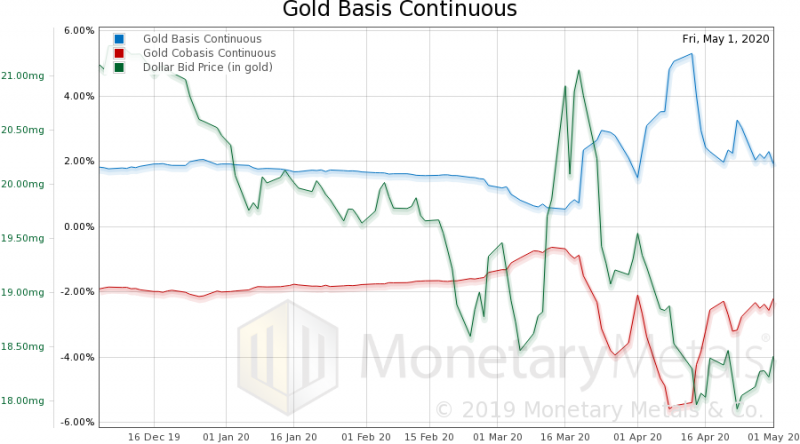

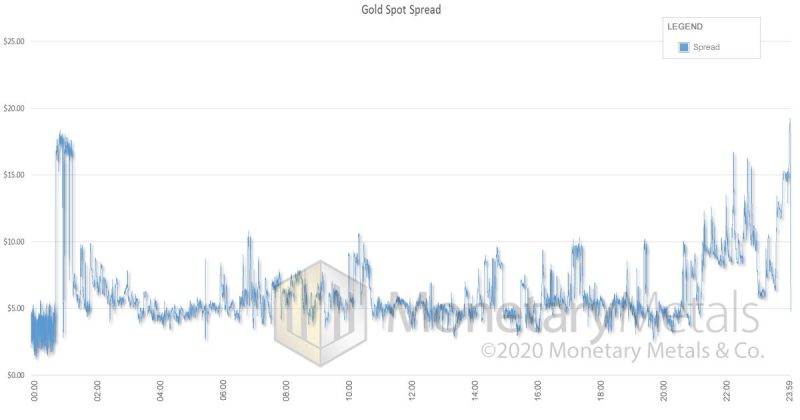

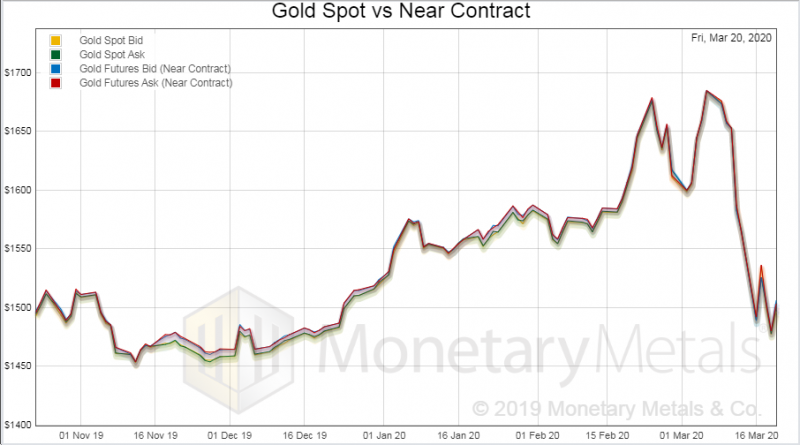

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis.

Read More »

Read More »

It’s Only Paper, Market Report 27 Apr

The response to the virus has added a new mechanism of capital consumption to the many we have documented over the years. Businesses are shut down, yet they continue to incur expenses. There is a popular misconception out there that this is merely a paper loss. One can almost picture a neutron bomb that somehow wipes out only paper, leaving all the physical assets and plant unscathed.

Read More »

Read More »

Crouching Silver, Hidden Oil Market Report 20 Apr

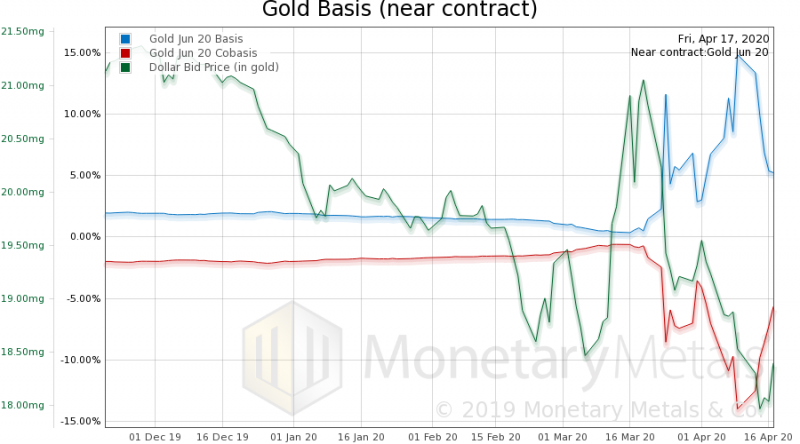

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19.

Read More »

Read More »

The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot).

Read More »

Read More »

Alchemy Rediscovered by Research Scientist, Report 1 April

“The Medievals were smarter than most people think,” says Dr. Michael Mus. “I mean, sure, they tortured people for believing that the sun was the center of our solar system, and they burned witches at the stake. But they knew a thing or two about gold.”

Read More »

Read More »

Cash is Toilet Paper, Market Report 23 March

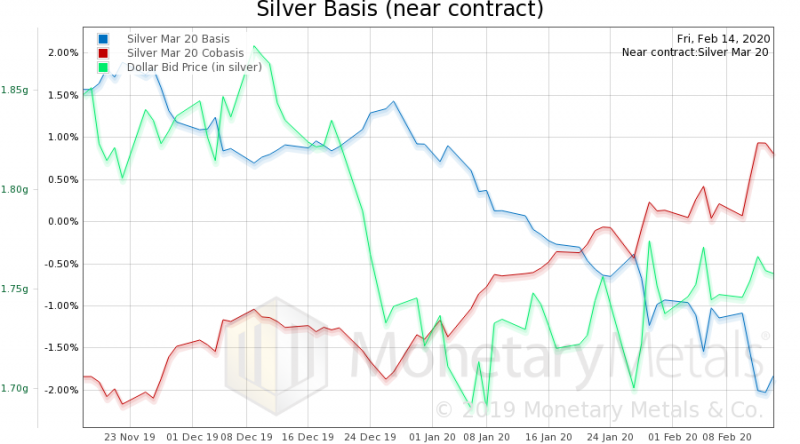

The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession.

Last week, we were warming up to silver, if not recommending it.

Read More »

Read More »

Is Now a Good Time to Buy Gold? Market Report 16 March

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

Wie du 100 € skalierst und wirklich unabhängig wirst

Wie du 100 € skalierst und wirklich unabhängig wirst -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

More from this category

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

Silver Update: Scarcity Gets More Extreme

Silver Update: Scarcity Gets More Extreme5 Sep 2022

The Silver Phoenix Market

The Silver Phoenix Market2 Sep 2022

Buy Gold, Because…

Buy Gold, Because…11 Aug 2022

What the Heck Is Happening to Silver?!

What the Heck Is Happening to Silver?!20 Jul 2022

Rare Gold-Silver Crystal Sighting

Rare Gold-Silver Crystal Sighting8 Jul 2022

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

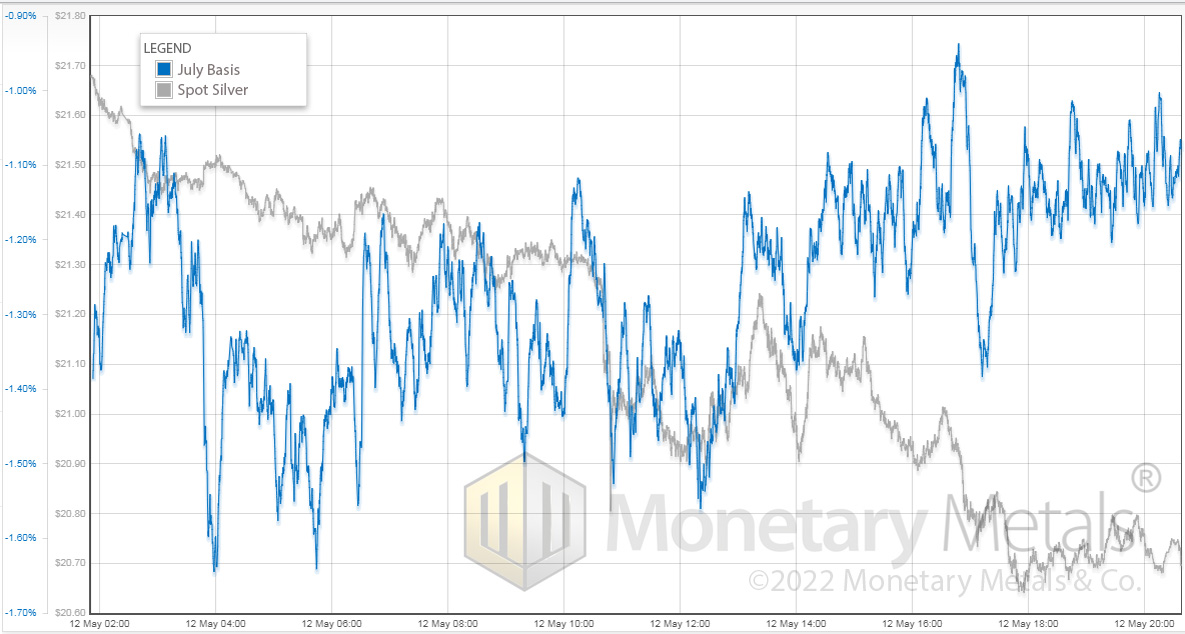

The Silver Chart THEY Don’t Want You to See!

The Silver Chart THEY Don’t Want You to See!16 May 2022

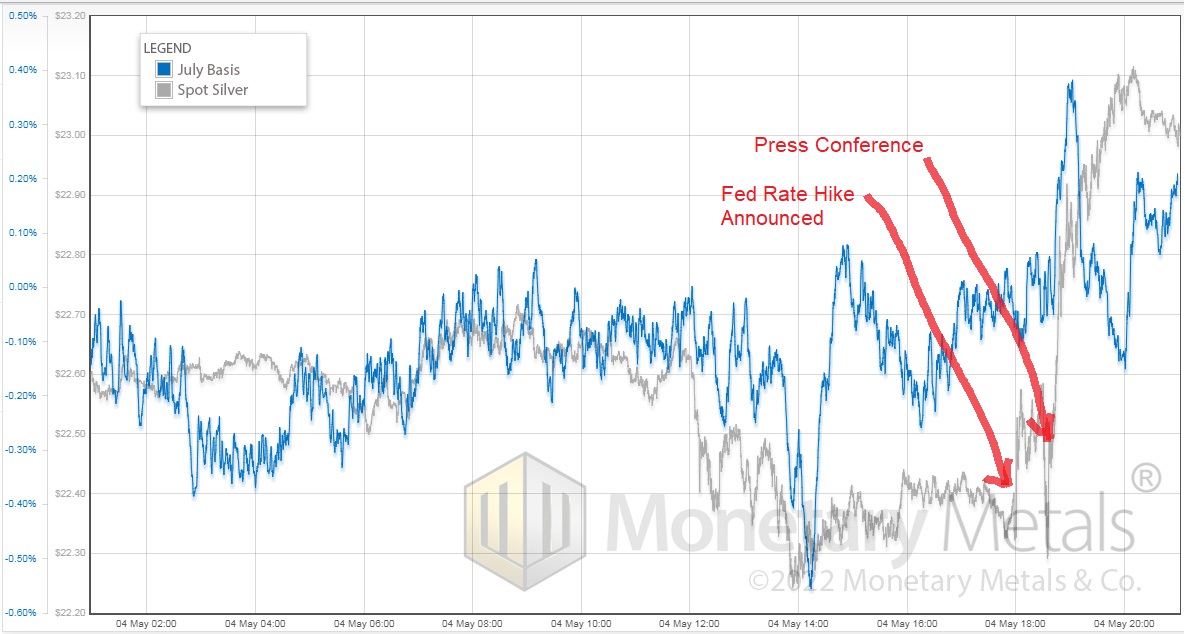

Forensic Analysis of Fed Action on Silver Price

Forensic Analysis of Fed Action on Silver Price9 May 2022

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022

Oil, the Ruble and Gold Walk into a Bar…Part III

Oil, the Ruble and Gold Walk into a Bar…Part III 12 Apr 2022

Oil, the Ruble, and Gold Walk into a Bar…

Oil, the Ruble, and Gold Walk into a Bar… 5 Apr 2022

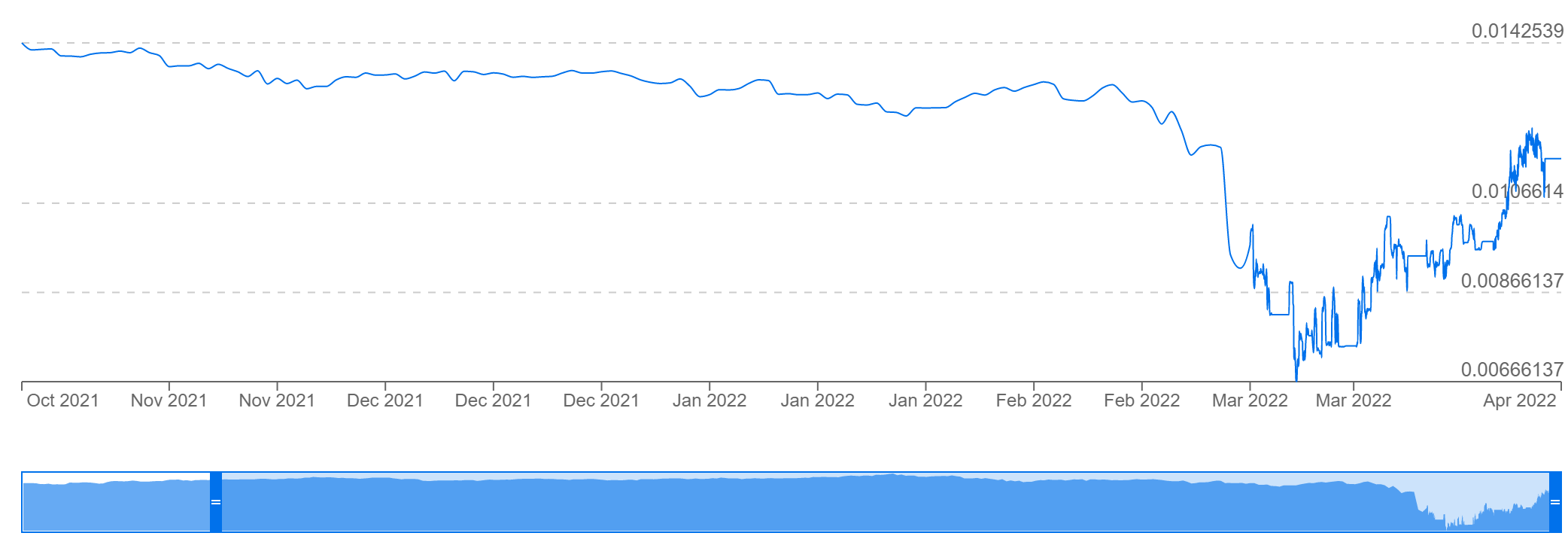

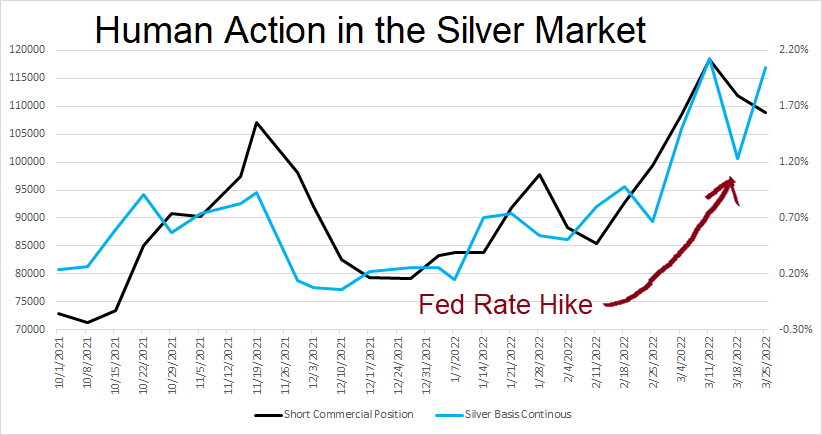

Human Action in the Silver Market

Human Action in the Silver Market29 Mar 2022

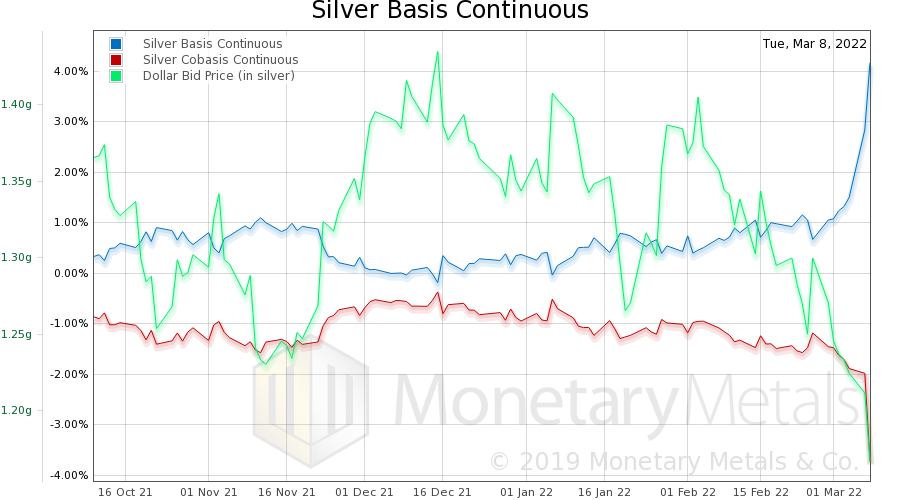

This is Not The Silver Breakout You’re Looking For!

This is Not The Silver Breakout You’re Looking For!10 Mar 2022

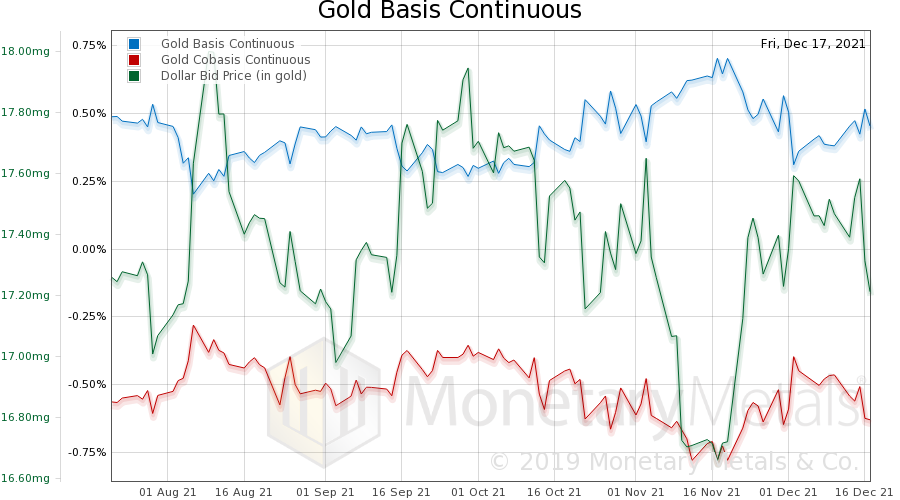

Inflation and Gold: What Gives?

Inflation and Gold: What Gives?21 Dec 2021

What’s In Your Loan?

What’s In Your Loan?23 Nov 2021

Perversity Thy Name is Dollar

Perversity Thy Name is Dollar16 Nov 2021

Rising Fundamentals of Gold and Silver

Rising Fundamentals of Gold and Silver10 Nov 2021

Why a Yield on Gold Matters

Why a Yield on Gold Matters3 Nov 2021