Tag Archive: Articles

Dollar Firm as Markets Await Fresh Drivers

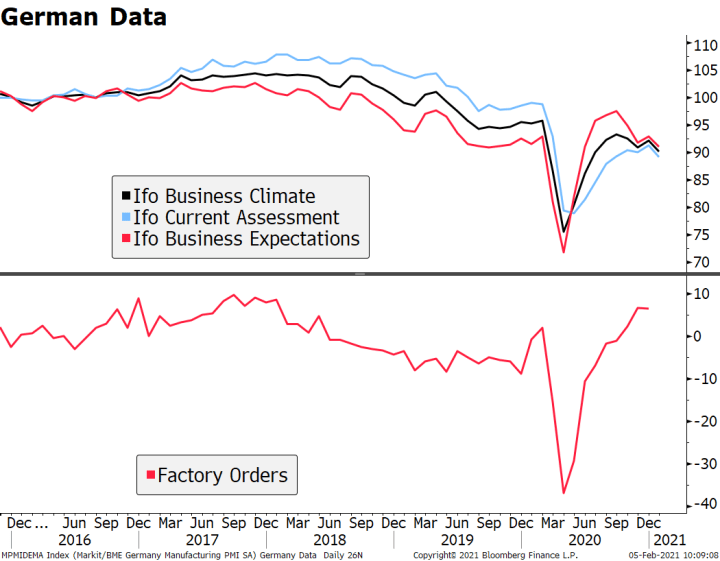

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way. The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp. Germany reported very weak December factory orders; all is not well in the German state of Thuringia.

Read More »

Read More »

EM Preview for the Week Ahead

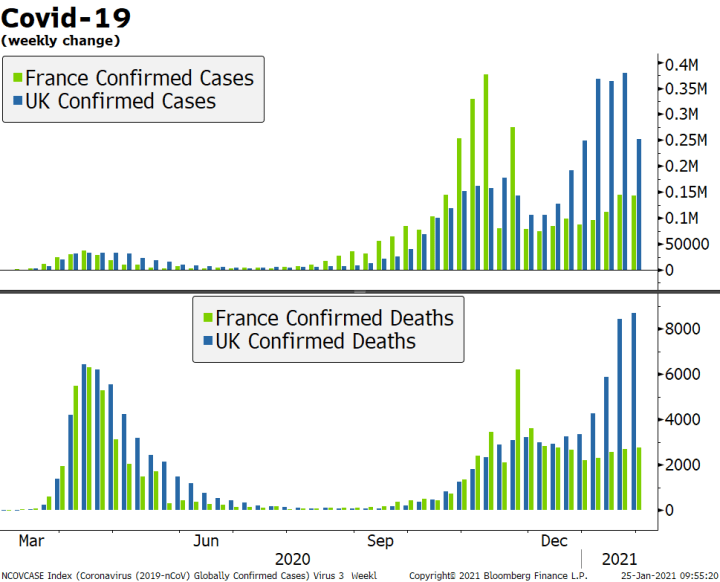

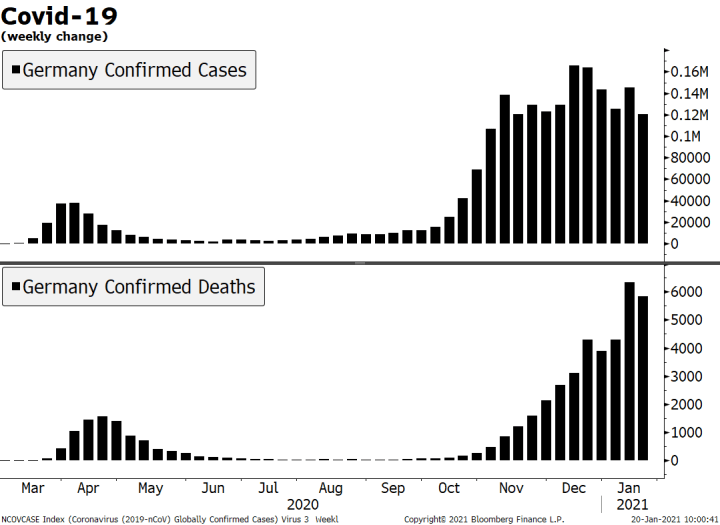

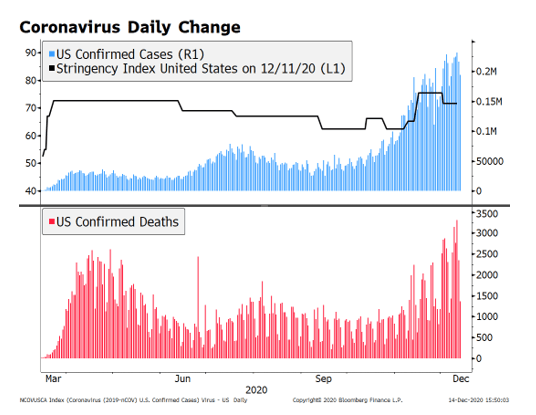

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty.

Read More »

Read More »

Tentative Stabilization

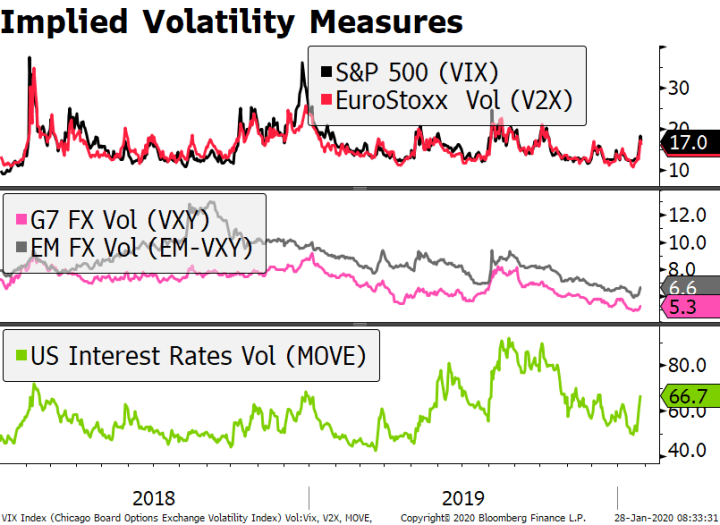

Risk-off continues in Asia, but moves have been less dramatic. European market jittery but stable. Implied rates now pricing in a full Fed cut by September. The UK will announce its decision on Huawei’s access to the country’s 5G network.

Read More »

Read More »

Sharp Sell-Off on Virus Concerns

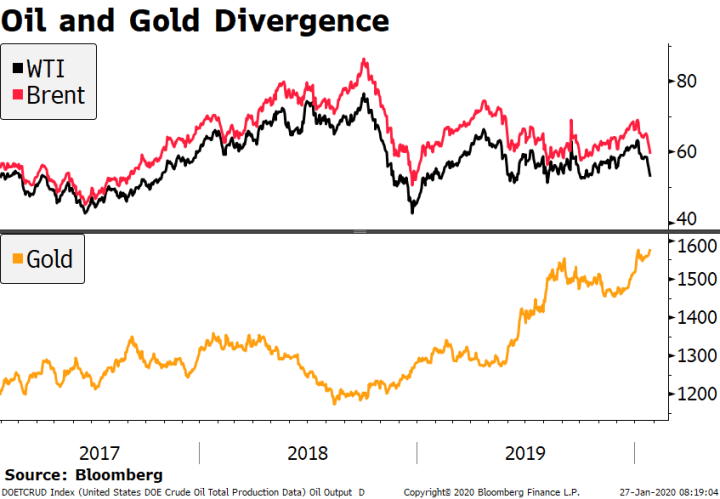

Global stocks lower on virus fears, yen appreciates, and yield curves flatten. Oil prices continue to fall while gold rises. Italian assets outperform on favorable election results for ruling coalition. German IFO survey disappoints, trimming nascent green shoots.

Read More »

Read More »

EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus.

Read More »

Read More »

Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus. US steps up trade rhetoric against EU and pushes back against UK digital tax plan. AUD stronger on solid Australian jobs report and pricing out of RBA easing. CAD weaker on dovish BOC communication yesterday.

Read More »

Read More »

Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight. US President Trump and French president Macron agreed to take a step back from the digital tax dispute. The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light. The UK reported firm jobs data for November; BOJ kept policy steady, as expected.

Read More »

Read More »

EM Preview for the Week Ahead

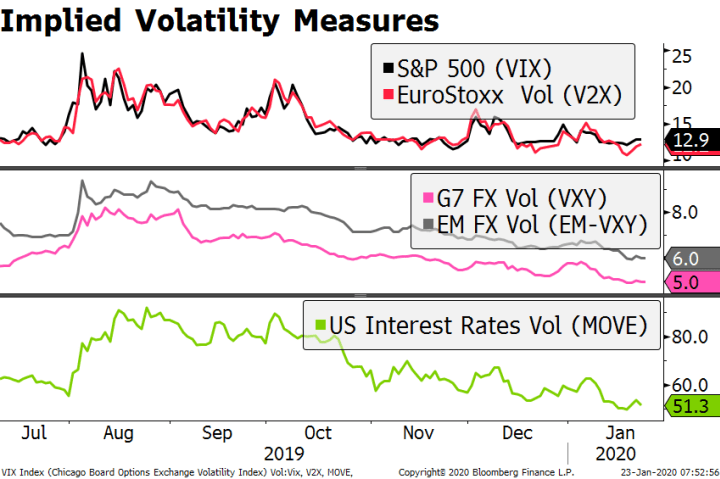

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week.

Read More »

Read More »

Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal. The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today. Bank of England credit survey showed demand for loans fell in Q4. Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5%.

Read More »

Read More »

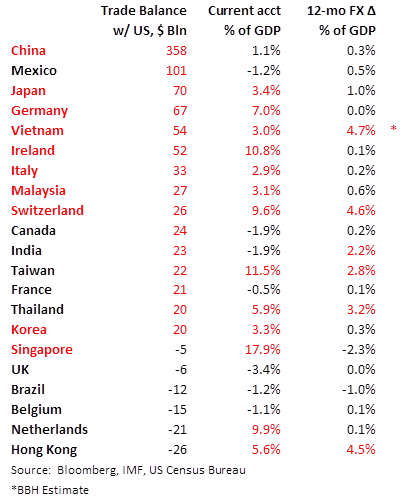

Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes.

Read More »

Read More »

Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction. The North American session is quiet in terms of US data. Mexico reports December CPI; Peru is expected to keep rates steady at 2.25%. German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney.

Read More »

Read More »

EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe.

Read More »

Read More »

EM Preview for the Week Ahead

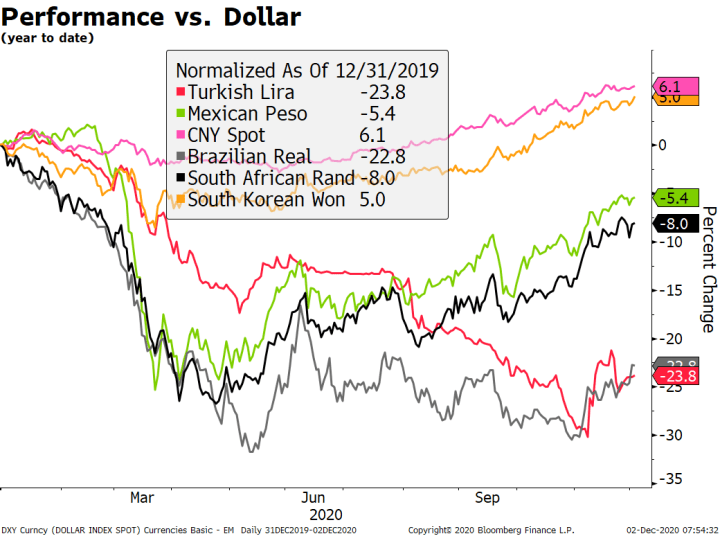

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020.

Read More »

Read More »

Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled.

Read More »

Read More »

Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off. During the North American session, US November retail sales will be reported. Russia central bank cut rates 25 bp to 6.25%, as expected.

Read More »

Read More »

EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high. Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial.

Read More »

Read More »

Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday. Tariff man is back. The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday. The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y.

Read More »

Read More »