Tag Archive: Article 50

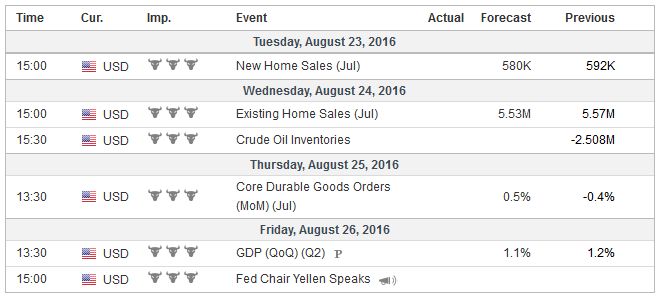

FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley.

Read More »

Read More »

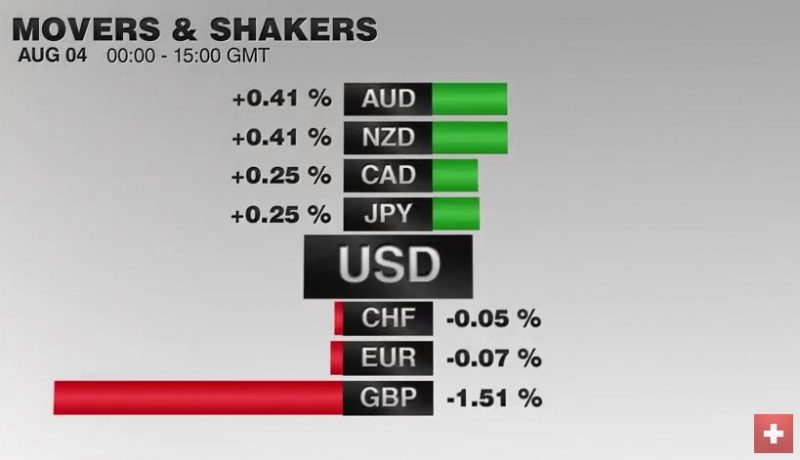

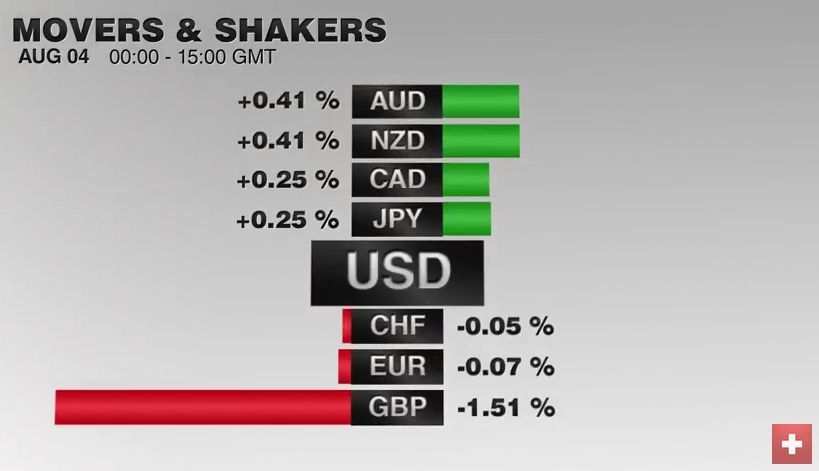

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents.

Read More »

Read More »

Squaring the Circle: Can Article 7 be Used to Force Article 50?

Article 7 would suspend the UK's EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what "is" means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not.

Read More »

Read More »

FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Key event in Europe is not on many calendars--it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ's meeting at the end of the month.

Read More »

Read More »

FX Daily, July 13: Sterling and Yen Momentum Slows

The two main developments in the foreign exchange market this week in recent days has been the opposite of what has transpired over the past several weeks. Sterling moved higher quickly. The yen moved down just as fast. Over the past five sessions through late-morning levels, sterling has gained 2.5% while the yen has shed 2.8%.

Read More »

Read More »

Caixin Monthly Column: Brexit

(Here is the latest monthly column I write for Caixin. It is on Brexit and I wrote it as an email to my mother. Here is the link. The text follows) To: Mother, Date: July 4, 2016, Glad to see you figured out how to access your email account. I smiled when I saw your note in my inbox. Thank you, though I am not sure that Thomas Watson felt the same way when Alexander Graham Bell called him.

Read More »

Read More »

Great Graphic: More Thoughts on Banks

Italian banks have done worse that European banks. Italian banks outperformed Germany banks from end of H1 12 through H1 15. US banks and financials more broadly have outperformed Europe.

Read More »

Read More »

Is Carney the Sole Adult in UK’s Political Morass?

Sterling has fallen to $1.3050. Two real estate funds have suspended trading (liquidation). Constitutional crisis over who has authority to trigger Article 50 may have begun.

Read More »

Read More »

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

Great Graphic: What are UK Equities Doing?

Domestic-oriented UK companies have been marked down. The outperformance by UK's global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy.

Read More »

Read More »

The Worst is Yet to Come–Don’t be Seduced by the Price Action

The two-day bounce in sterling seems technically driven rather than fundamental. The Brexit decision has set off a unfathomable chain of events whose impact and implications are far from clear. The economic hit on the UK may spur a BOE rate cut, even if not QE, as early as next month.

Read More »

Read More »

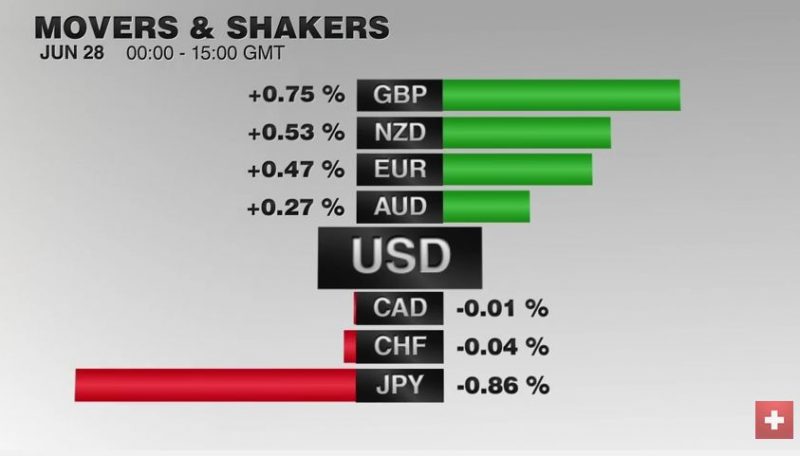

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

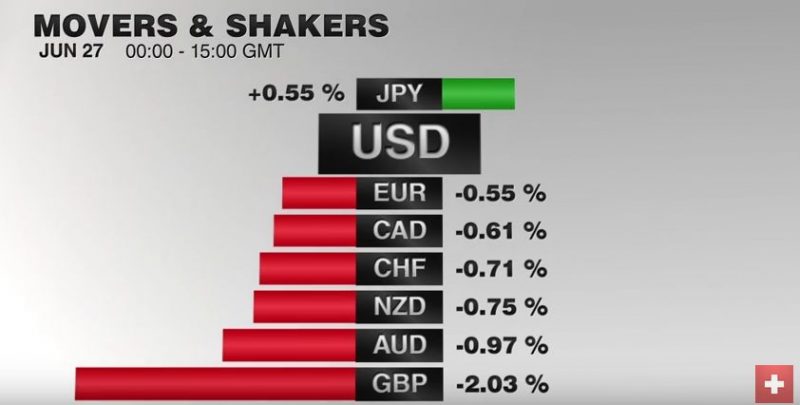

FX Daily, June 27: Post-Referendum Confusion Continues

Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to medium-term negative economic implications.

Read More »

Read More »

FX Weekly Preview: Post-Brexit: Week One

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week.

Read More »

Read More »

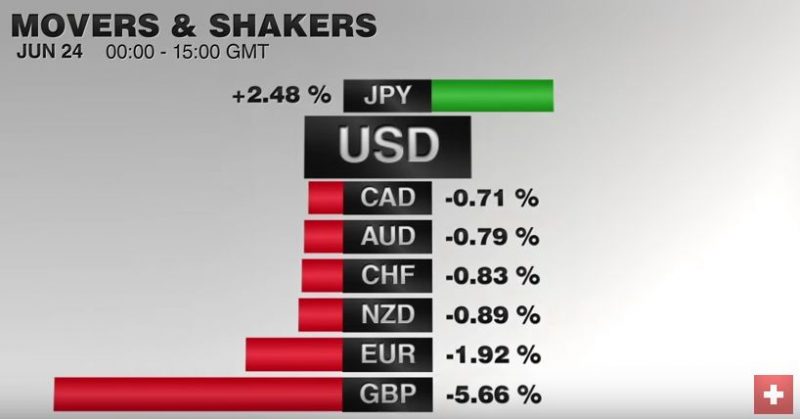

FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

The UK's decision to leave the EU spurred a dramatic risk-off move through the capital markets. The dollar, yen, and gold soared. Equities and emerging market assets sold off hard. The SNB had to intervene.

Read More »

Read More »

British Discontent About The EU: Only A Precursor To Unrest On The Continent

Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they have lost control over their fate, and are gaining popularity

Read More »

Read More »