Category Archive: 2) Swiss and European Macro

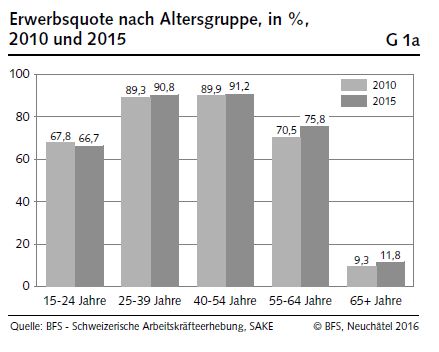

Swiss Labour Force Survey 2015: Large increase in labour market participation of 55 to 64 year-olds

19.04.2016 09:15 - FSO, Labour Force (0353-1603-90) Swiss Labour Force Survey 2015 Neuchâtel, 19.04.2016 (FSO) – In 2015 the average age of the economically active population was 41.6 years (+0.7 years compared with 2010). The ageing of the economic...

Read More »

Read More »

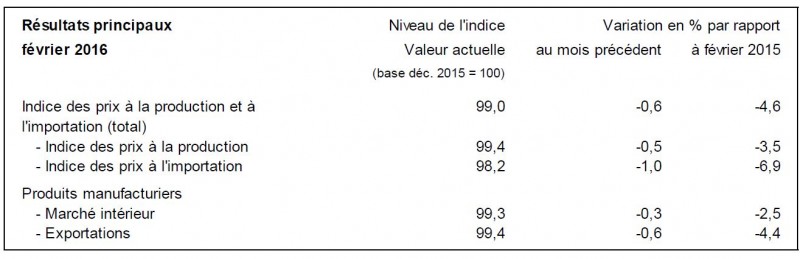

Swiss Producer and Import Price Index in March 2016: The Producer and Import Price Index remains stable overall

The Producer and Import Price Index remained unchanged in March 2016 compared with the previous month at 99.0 points (base December 2015 = 100). Whereas the Producer Price Index increased by 0.1%, the Import Price Index remained unchanged on average. Compared with March 2015, the price level of the whole range of domestic and imported products fell by 4.7%. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

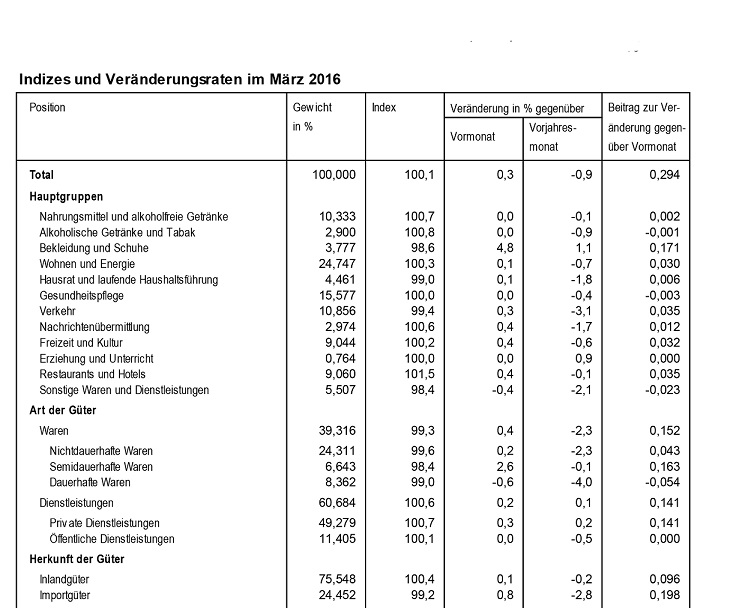

Swiss Consumer Price Index in March 2016: -0.9 percent against 2015, +0.3 percent against last month

08.04.2016 09:15 - FSO, Prices (0353-1603-50) Swiss Consumer Price Index in March 2016 Neuchâtel, 08.04.2016 (FSO) – The Swiss Consumer Price Index increased by 0.3% in March 2016 compared with the previous month, reaching 100.1 points (December 201...

Read More »

Read More »

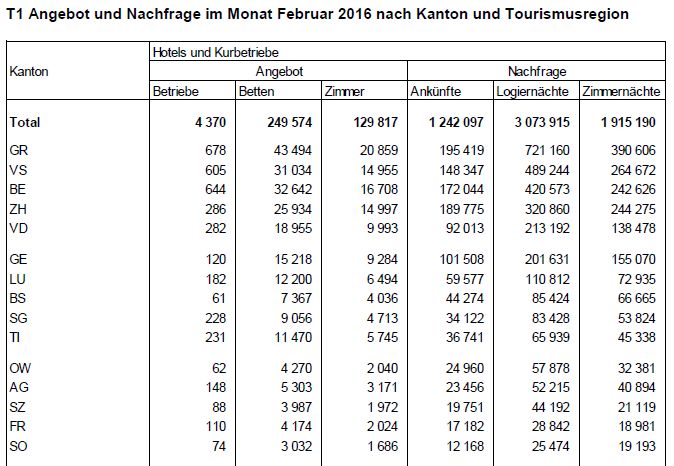

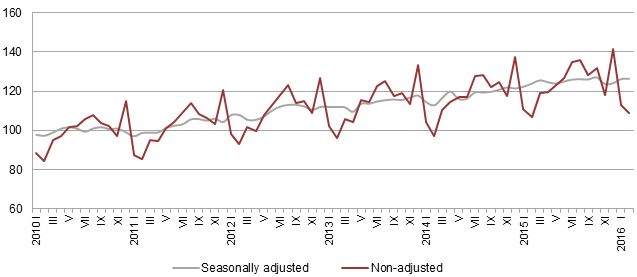

Statistics on tourist accommodation in February 2016: Overnight stays in February fall despite rise in domestic demand

07.04.2016 09:15 - FSO, Tourism (0353-1603-40) Statistics on tourist accommodation in February 2016 Neuchâtel, 07.04.2016 (FSO) – The Swiss hotel industry registered 3.1 million overnight stays in February 2016, which corresponds to a decrease of 1....

Read More »

Read More »

Prof. Dr. Heiner Flassbeck – „Die Volkswirtschaft jenseits von Ideologien und Vorurteilen“

22.03.2016 Vortrag von Prof. Dr. Heiner Flassbeck am Justus-Knecht-Gymnasium in Bruchsal Thema: Volkswirtschaft jenseits von Ideologien und Vorurteilen Der weltweit renommierte Ökonom und ehemalige Chefvolkswirt der UNCTAD Prof. Dr. Heiner Flassbeck analysiert vor den Schülerinnen und Schülern der Leistungskurse Gemeinschaftskunde und Wirtschaft am Justus-Knecht-Gymnasium die Weltwirtschaft. Heiner Flassbeck präsentiert seine Ansätze zur...

Read More »

Read More »

Angehende Abiturienten diskutieren mit Prof. Dr. Heiner Flassbeck

22.03.2016 Der weltweit renommierte Ökonom und ehemalige Chefvolkswirt der UNCTAD Prof. Dr. Heiner Flassbeck diskutiert mit den Schülerinnen und Schülern der Leistungskurse Gemeinschaftskunde und Wirtschaft am Justus-Knecht-Gymnasium in Bruchsal interessante Aspekte rund um das wirtschaftliche Geschehen in Deutschland, Europa und der Welt. Organisiert und moderiert wurde die Veranstaltung durch den Gemeinschaftskundelehrer Mathias Fuchs.

Read More »

Read More »

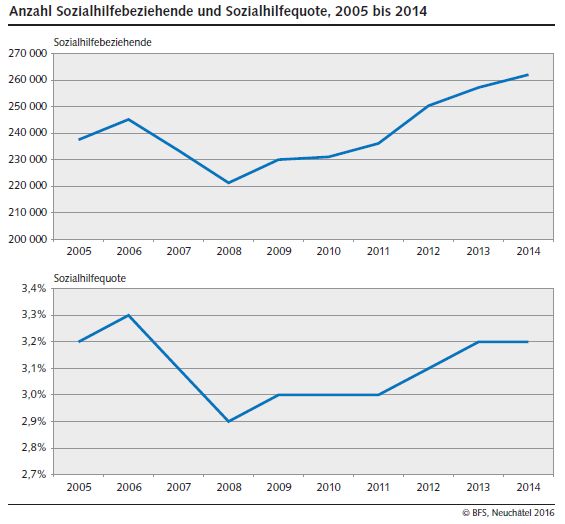

10 years of Swiss Social Assistance Statistics: Social assistance rate the same as 10 years ago

04.04.2016 11:00 - FSO, Social Assistance (0353-1603-30) 10 years of Swiss Social Assistance Statistics Neuchâtel, 04.04.2016 (BFS) – The Swiss Social Assistance Statistics cover ten years of observation with the latest data from 2014. The social as...

Read More »

Read More »

February Swiss Retail Sales -0.3percent YoY(Real), Core Retail Sales +0.3percent

01.04.2016 09:15 - FSO, Economic Surveys (0353-1603-20) Retail trade turnover in February 2016 Neuchâtel, 01.04.2016 (FSO) – Turnover in the retail sector fell by 0.9% in nominal terms in February 2016 compared with the previous year. Seasonally adj...

Read More »

Read More »

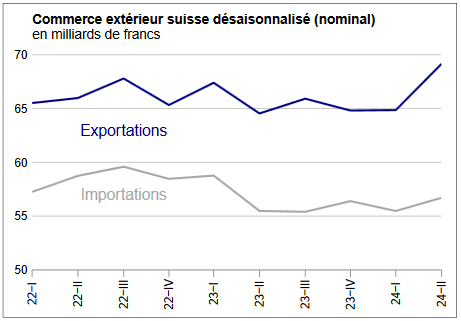

Swiss and Eurozone Trade Anomalies

Marc Chandler emphasises the discrepancies between overvalued franc and - despite being overvalued - the massive Swiss trade surplus. Will it continue like that?

Read More »

Read More »

Dirk Müller und Heiner Flassbeck zur Wirtschaft und Politik 25.01.2015 – Bananenrepublik

► Homepage: http://www.Bananenrepublik.tv – Bananenrepublik.tv ► Erster-Upload-Kanal: https://www.youtube.com/user/Bananenrepublik1/videos ► Google+: https://plus.google.com/116548748293938083517/posts ► Zweiter-Upload-Kanal: https://www.youtube.com/user/diebananenrepublik2/videos ► Twitter: https://twitter.com/Stimmbuerger – Bananenrepublik ► Google+ Aktuell: https://plus.google.com/u/0/106701079280378758319/posts ► Backup-Kanal:...

Read More »

Read More »

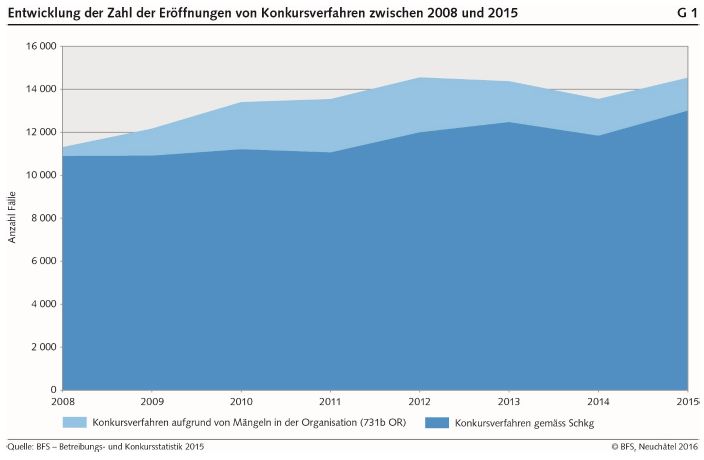

Bankruptcy Statistics 2015: Increase in the number of bankruptcies

24.03.2016 09:15 - FSO, Economic structure and analyses (0353-1602-90) Bankruptcy Statistics 2015 Neuchâtel, 24.03.2016 (FSO) – The number of bankruptcy proceedings opened in 2015 rose to 13,016 cases, a 9.9% increase compared with 2014. The Lake Ge...

Read More »

Read More »

Pictet Perspectives – Playing the rebound in equity markets

Alexandre Tavazzi, Chief Equity Strategist at Pictet Wealth Management, explains what is driving the current market rebound, and the key choices faced by investors seeking to profit from it.

Read More »

Read More »

Pictet Perspectives – Playing the rebound in equity markets

Alexandre Tavazzi, Chief Equity Strategist at Pictet Wealth Management, explains what is driving the current market rebound, and the key choices faced by investors seeking to profit from it.

Read More »

Read More »

Labour costs 2014: Labour costs in Switzerland: marked differences according to enterprise size

22.03.2016 09:15 - FSO, Economic Surveys (0353-1601-50) Labour costs 2014 Neuchâtel, 22.03.2016 (FSO) – In 2014, average labour costs in Switzerland amounted to CHF 59.60 per hour worked across the secondary and tertiary sectors. According to the Fe...

Read More »

Read More »

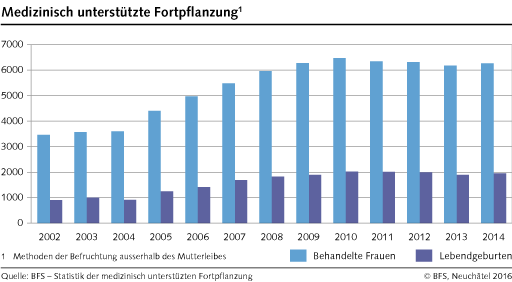

Assisted reproductive technology in 2014: definitive data: Uptake of in-vitro fertilisation on the rise again

22.03.2016 09:15 - FSO, Health (0353-1603-60) Assisted reproductive technology in 2014: definitive data Neuchâtel, 22.03.2016 (FSO) – In 2014, 6269 couples wishing to have children turned to in-vitro fertilisation. This resulted in the birth of 1955...

Read More »

Read More »

Pictet Suisse romande

Avec désormais plus de 2200 collaborateurs en Suisse, installés pour la plupart à Genève et dans le canton de Vaud, Pictet est profondément attaché à la Suisse romande…. Lire la suite: http://www.pictet.com/suisseromande Banque Pictet & Cie S.A. Route des Acacias 60 1211 Genève Tél. +41 58 323 51 51 Avenue de Montbenon 2 1003 Lausanne …

Read More »

Read More »

Das Musterland der Eurozone – Heiner Flassbeck 2015 – Bananenrepublik

► Google+: https://plus.google.com/u/0/106701079280378758319/posts ► Zweiter-Upload-Kanal: http://www.youtube.com/user/dieBananenrepublik ► Backup-Kanal: http://www.youtube.com/user/diebananenrepublik2 ► Twitter: https://twitter.com/Stimmbuerger – Bananenrepublik ► Quelle: Heiner Flassbeck: Die Eurokrise und die Rolle Deutschlands – Musterland der Eurozone? 27.10.2015 https://www.youtube.com/watch?v=lbmH8HfeVSA Homepage:...

Read More »

Read More »

Swiss Producer and Import Prices Index February 2016: 0.6 percent MoM, 4.6 percent YoY

17.03.2016 09:15 - FSO, Prices (0353-1602-50) Producer and Import Price Index in February 2016 Neuchâtel, 17.03.2016 (FSO) – The Producer and Import Price Index fell in February 2016 by 0.6% compared with the previous month, reaching 99.0 points (ba...

Read More »

Read More »