Category Archive: 2) Swiss and European Macro

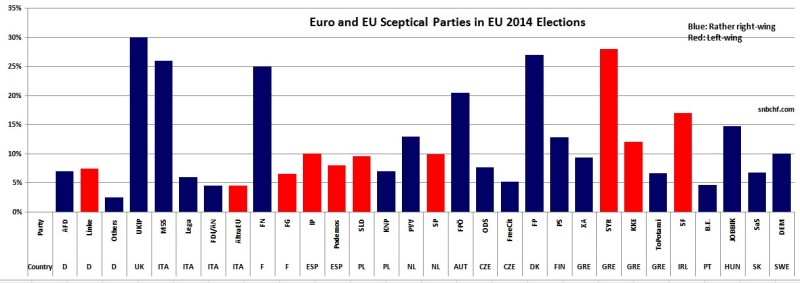

Euro and EU sceptical Parties in EU 2014 Elections: The Economic Danger Is Left not Right

The tendency of the European parliament elections seems to be that in the Northern countries rather right-wing parties obtain more votes, like British UKIP, German AFD, Danish People’s Party, Austrian FPÖ or Sweden Democrats. In the austerity countries the left-wing movements are getting stronger and stronger, led by SYRIZA in Greece and Sinn Fein in …

Read More »

Read More »

Heiner Flassbeck zu „Wem gehört Deutschland?”

Jens Berger hat wieder ein wichtiges Buch geschrieben. Er klärt auf über “unsere Verhältnisse” und zeigt nicht nur, wem Deutschland gehört, sondern trägt zur Versachlichung der Diskussion bei, indem er die wichtigsten Fakten zur Einkommens- und Vermögensverteilung weit über Deutschland hinaus präsentiert und erläutert. Das ist wichtig, weil die Menschen verstehen müssen, dass Reichtum kein …

Read More »

Read More »

Grußworte Marcel Fratzscher zu 100 Jahren IfW

Prof. Marcel Fratzscher, Präsident Deutsches Institut für Wirtschaftsforschung/DIW Berlin, gratuliert dem Institut für Weltwirtschaft anlässlich seines 100. Jubiläums im Februar 2014. Institut für Weltwirtschaft (IfW): http://www.ifw-kiel.de

Read More »

Read More »

Marcel Fratzscher: Risiko gegen Risiko getauscht

War die Politik der Geldschwemme die richtige Antwort auf die Finanzkrise? Marcel Fratzscher, Präsident des Deutschen Instituts für Wirtschaftsforschung, meint dazu: Ja, aber … Wenn die Krise zum Alltag wird, birgt das neue Risiken. Weitere Videos zum Thema: Joseph Huber: Giralgeld ist außer Kontrolle Martin Hellwig: Verdrängte Risiken der Finanzkrise Moritz Schularick: Gefährliche Vereinfachungen in …

Read More »

Read More »

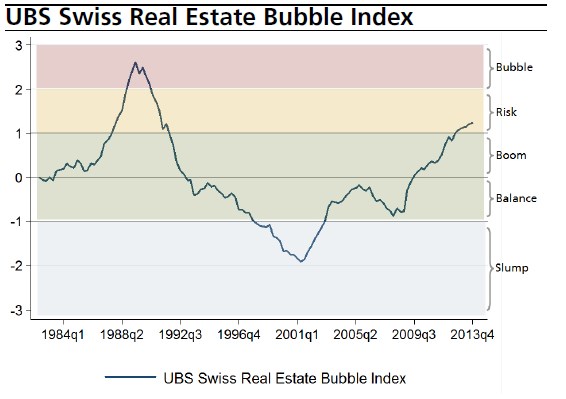

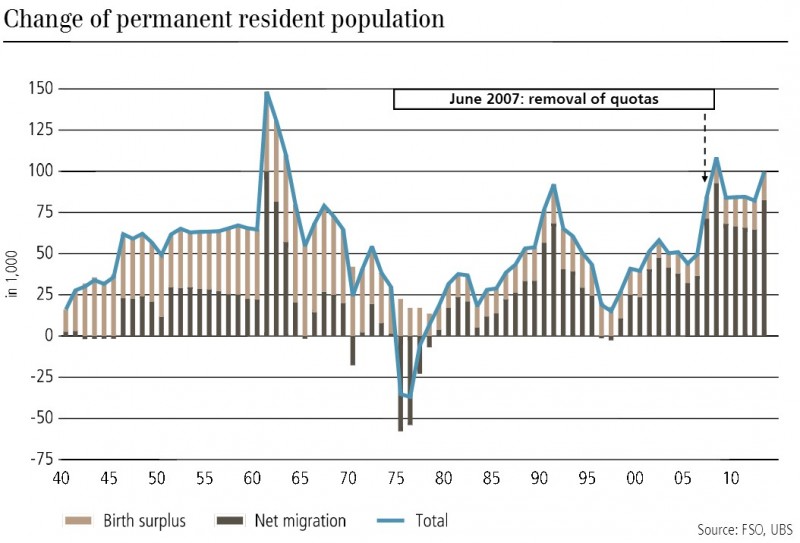

Update 2014: Swiss home price to income ratio small in historic and global comparison

Based on four different data sources, we prove that Swiss the home price to income ratio is small in global comparison and in a historic perspective. Combined with another decade of near zero interest rates, reason enough to think that the Swiss real estate boom should continue for another decade.

Read More »

Read More »

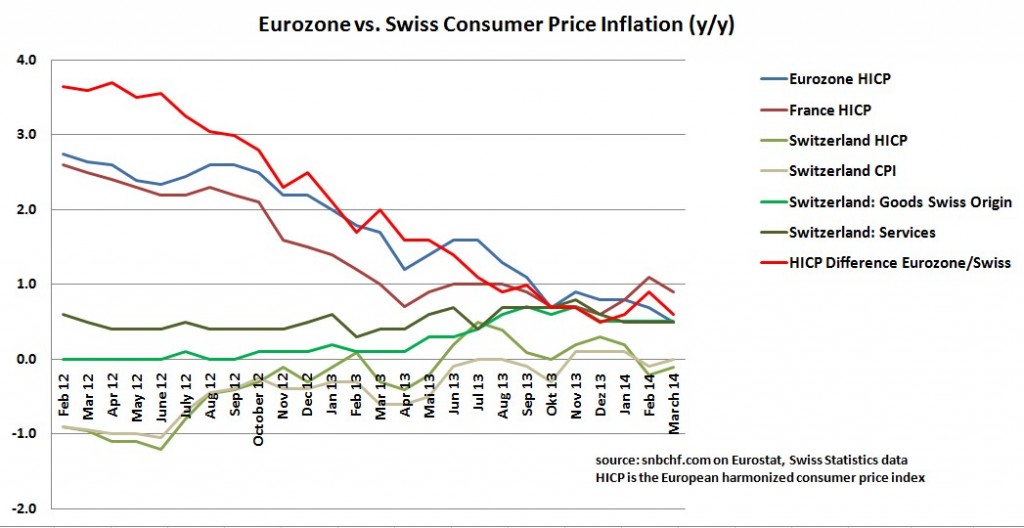

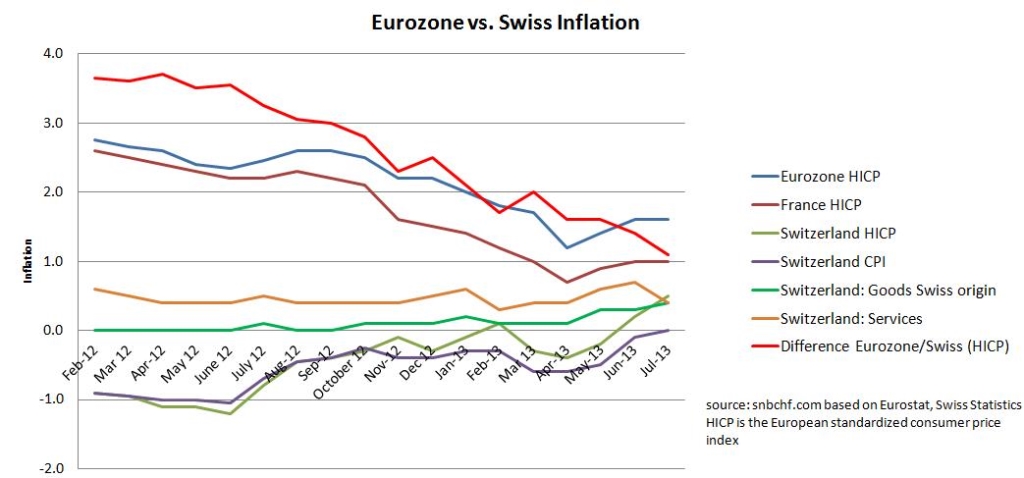

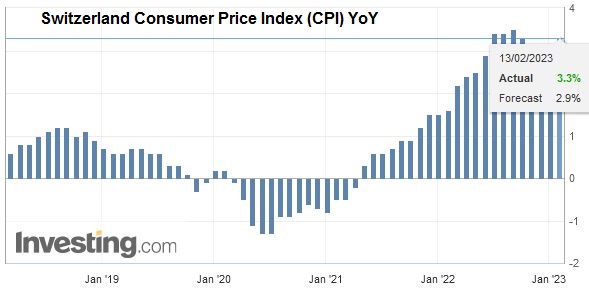

Swiss Yearly Inflation Rate Overtakes First Eurozone Countries

According to Swiss Statistics the yearly inflation rate is at 0.0%, and the monthly rate is +0.4%. The Spanish CPI is already under zero at -0.2%, and the Italian one is at +0.3%, not to speak about severe Cyprus or Greek deflation . Still in February 2012, the difference between the Swiss and Euro …

Read More »

Read More »

Heiner Flassbeck: Europa braucht einen Neuanfang

Referat von Heiner Flassbeck auf einer Veranstaltung vom DGB, IG Metall und ver.di in Kiel am 25. März 2014: “Europas Wirtschafts- und Sozialpolitik in der Krise – Europa braucht einen Neuanfang”

Read More »

Read More »

The New Widow-Maker Trade: Short Italian Government Bonds

We think that, similarly as Japanese JGBs, Spanish and Italian Government Bond Yields will continue its race to the bottom, Short Italian Bonds is the new Widow-Maker Trade.

Read More »

Read More »

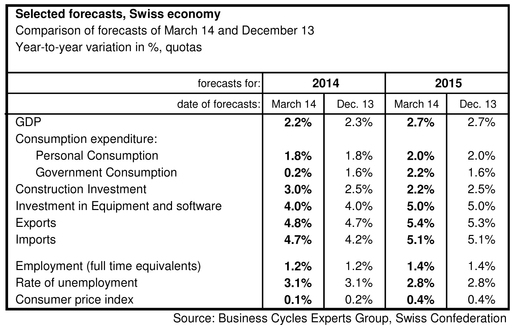

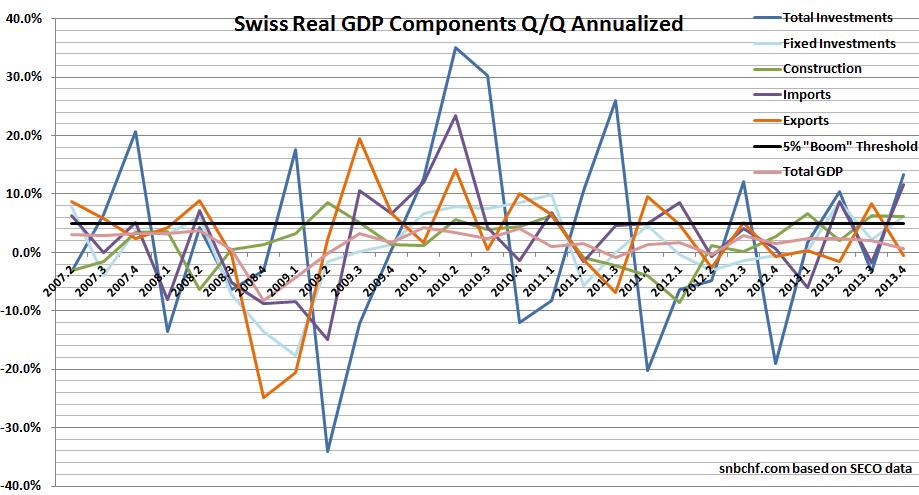

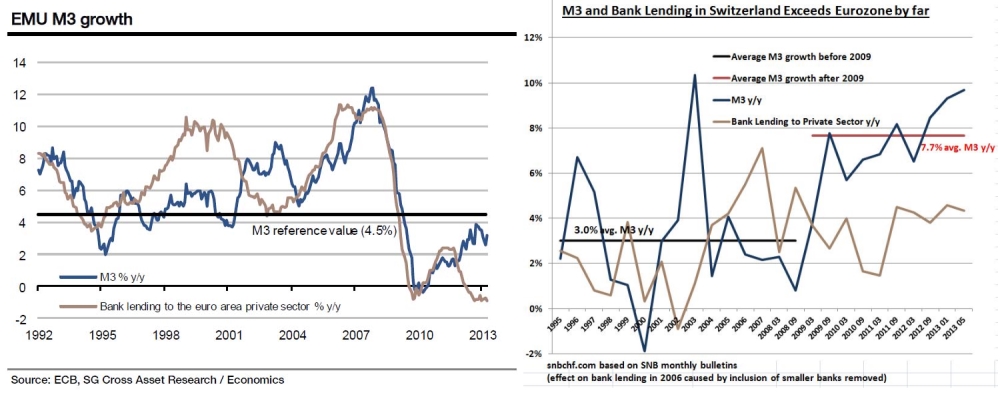

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

Pelzig hat den Wirtschafts”weisen” Peter Bofinger zu Gast (11.02.2014)

Bofinger gibt sich ziemlich unwissend zum Freihandelsabkommen mit der USA. Woran mag das wohl liegen?

Read More »

Read More »

Freihandelsabkommen TTIP und Peter Bofinger bei Pelzig hält sich 11.02.2014 – die Bananenrepublik

► Homepage: http://www.Bananenrepublik.tv – Bananenrepublik.tv ► Google+: https://plus.google.com/u/0/106701079280378758319/posts ► Zweiter-Upload-Kanal: http://www.youtube.com/user/Bananenrepublik1 ► Backup-Kanal: http://www.youtube.com/user/diebananenrepublik2 ► Twitter: https://twitter.com/Stimmbuerger – Bananenrepublik ► Quelle:...

Read More »

Read More »

UBS Consumption Indicator Points to 2.5 Percent Swiss GDP Growth in 2014

FacebookShare As usual, the Swiss economy seems to be better than economists thought. After 1.40 still in December, the UBS consumption indicator has risen to 1.81, a value higher than the ones in 2012, when private consumption increased by 2.4%. Similarly as last year, the latest reading contradicts UBS’s own growth forecasts, albeit this year …

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

Prof. Peter Bofinger – CFO-Forum – ZIB

Österreichs exklusiver Treffpunkt für Finanzchefs: Finanzielle Unternehmensführung, Erfahrungen – Analysen – Einschätzungen – Perspektiven Alle Infos zum CFO Forum findest du hier: https://businesscircle.at/finanzen-controlling-rw/konferenz/cfo-forum

Read More »

Read More »

Inflation Difference between Eurozone and Switzerland Narrows to 0.5 percent

Another five months till Swiss inflation is higher? When the European economy starts to expand again, who will hike rates first, the SNB or the ECB? December Update According to Swiss Statistics the inflation rate remained stable at 0.1% y/y, while the inflation measured by the European HICP standard was +0.3% y/y, slightly higher than … Continue reading »

Read More »

Read More »