Category Archive: 2) Swiss and European Macro

Droht uns ein Währungskrieg?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Droht uns ein Währungskrieg oder vielleicht sogar ein Handelskrieg mit den USA? Angesichts der jüngsten Äußerungen von Präsident Trump, könnte man auf die Idee kommen. Es gibt allerdings in seinem Wahlprogramm einen Punkt, den ich für wirklich gefährlich …

Read More »

Read More »

LSE Events | Hans-Werner Sinn | How to Fight Climate Change: economic and technical challenges

Recorded 22nd January 2018 While mankind has to fight climate change, the economic and technical constraints are severe. Hans-Werner Sinn will give an overview of some of the challenges and potential solutions. Hans-Werner Sinn (@HansWernerSinn) is President emeritus at the Ifo Institute and Professor at the University of Munich. Robert Falkner (@robert_falkner) is Research Director, …

Read More »

Read More »

Bei kalten (Handels-)Kriegen hilft nur friedliche Koexistenz

Nach Zins- und Inflationsangst sorgt aktuell der von Donald Trump wiederbelebte amerikanische Handelsprotektionismus für Sorgen am Aktienmarkt. Wie stellt sich der Welthandel zurzeit dar? Welche konkreten Folgen hätte ein gegenseitiges Hochschaukeln von Strafzöllen in der Real- aber auch Finanzwirtschaft? Und wo könnten sich Lösungen im Handelsstreit abzeichnen? Robert Halver mit seiner Einschätzung aus der Börse …

Read More »

Read More »

Wykład Instytutu Studiów Zaawansowanych. Prof. Heiner Flassbeck część 1

prof. HEINER FLASSBECK Division on Globalization and Development Strategies UNCTAD, Geneva Wykład: Kryzys euro i przyszłość Unii Europejskiej Czy za obecny kryzys odpowiada szaleństwo. prof. HEINER FLASSBECK Division on Globalization and Development Strategies UNCTAD, Geneva Wykład: Kryzys euro i przyszłość Unii Europejskiej Czy za obecny kryzys odpowiada szaleństwo. prof. JAN KREGEL Tallin University of Technology; …

Read More »

Read More »

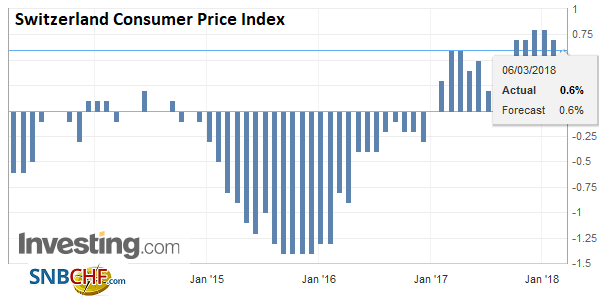

Swiss Consumer Price Index in February 2018: +0.6 percent YoY, +0.4 percent MoM

The consumer price index (CPI) increased by 0.4% in February 2018 compared with the previous month, reaching 101.1 points (December 2015=100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Wykład Instytutu Studiów Zaawansowanych. Prof. Heiner Flassbeck część 2

prof. HEINER FLASSBECK Division on Globalization and Development Strategies UNCTAD, Geneva Wykład: Kryzys euro i przyszłość Unii Europejskiej Czy za obecny kryzys odpowiada szaleństwo. prof. HEINER FLASSBECK Division on Globalization and Development Strategies UNCTAD, Geneva Wykład: Kryzys euro i przyszłość Unii Europejskiej Czy za obecny kryzys odpowiada szaleństwo. prof. JAN KREGEL Tallin University of Technology; …

Read More »

Read More »

Kapital verdoppeln mit Dividenden?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Kapital verdoppeln, mit Dividenden? Das ist durchaus möglich, wenn man die richtige Aktie im Depot hat. Welche das sein könnte, erfahrt ihr im Video. Darüber hinaus stelle ich euch heute das Unternehmen mit der höchsten Dividenden-Rendite überhaupt vor, …

Read More »

Read More »

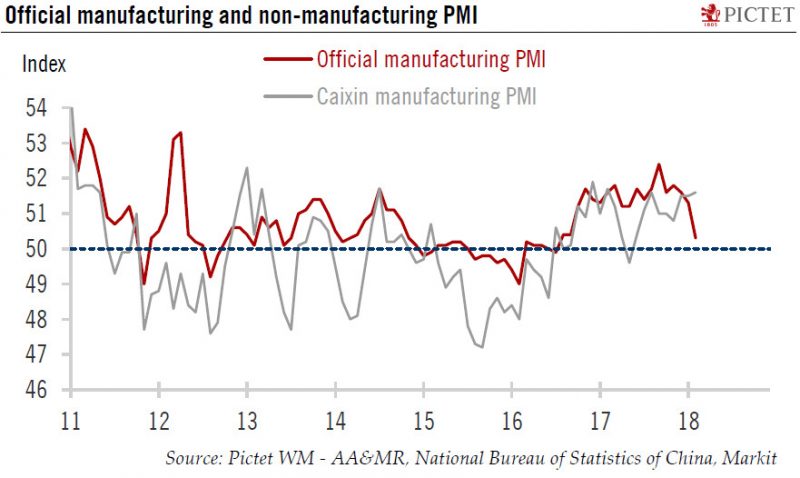

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

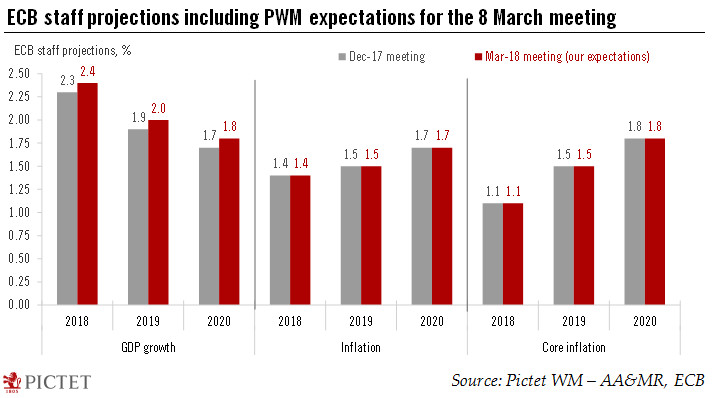

Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

Maischberger-Talk mit Yanis Varoufakis, Sahra Wagenknecht und Lindner 10.02.2016 – Bananen

Google+: ▻ Zweiter-Upload-Kanal: ▻ Backup-Kanal: Maischberger 10.02.2016 Talk Erst Eurokrise, jetzt Flüchtlingsstreit – Wieder Ärger mit Griechenland? Das Schuldendrama schien im Sommer beendet, der . Google+: ▻ Zweiter-Upload-Kanal:. ‘Erst Eurokrise, jetzt Flüchtlingsstreit – Wieder Ärger mit Griechenland?’ Maischberger mit Varoufakis u. Wagenknecht Maischberger vom 10.02.2016 Das Schuldendrama schien im Sommer...

Read More »

Read More »

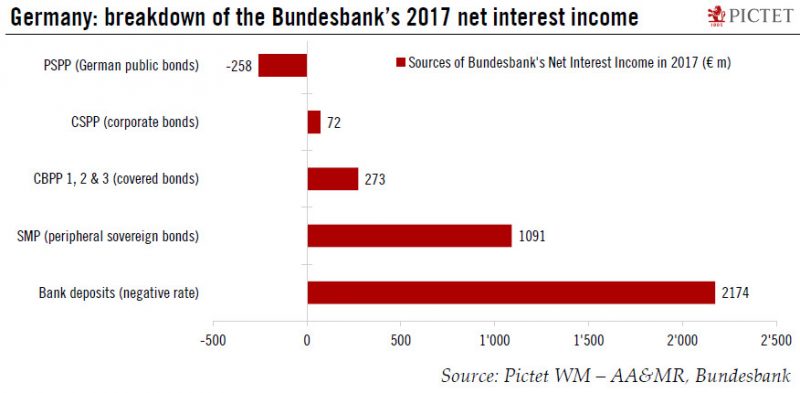

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

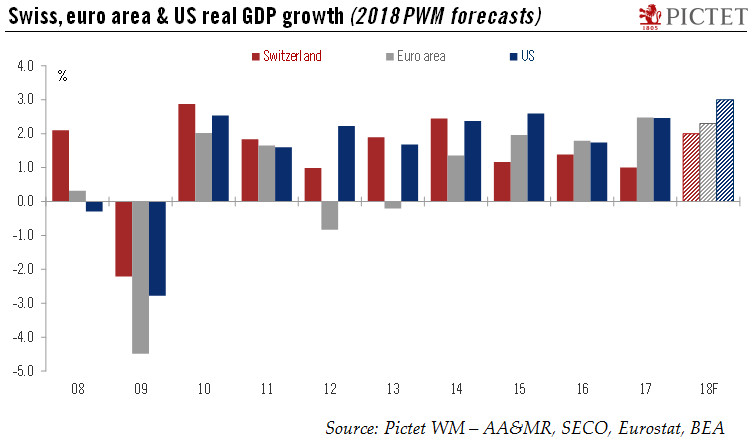

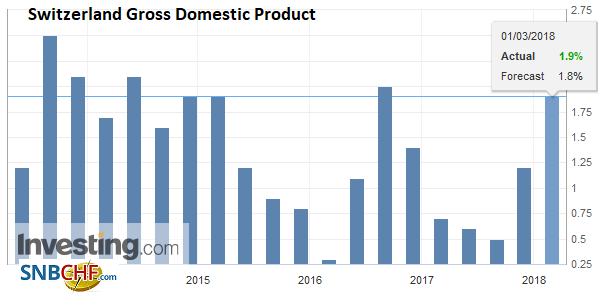

Switzerland: So far so good

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

Read More »

Read More »

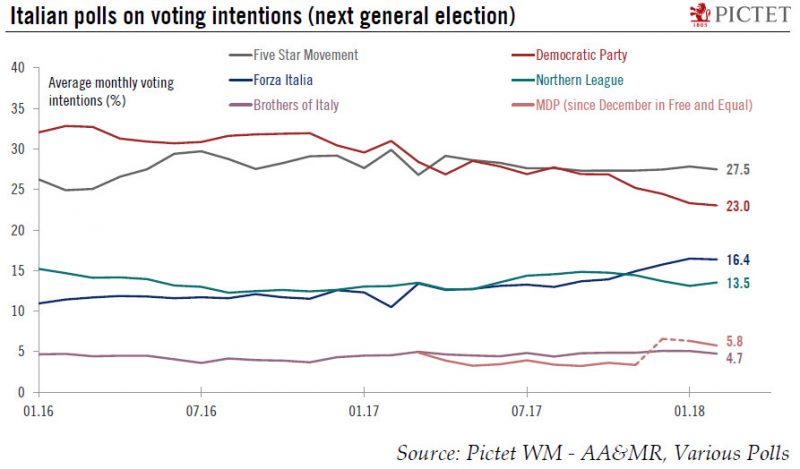

Who will tackle Italy’s root problems?

The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of "first-past-the-post" and 61% via proportional representation, with the remaining 2% reserved for overseas constituencies (see our previous Flash Note for further details).

Read More »

Read More »

Heiner Flassbeck – Nachtspiel

Nachgespräch zu “Warten auf Godot” am 19.01.2018 in der Tribüne Linz. Wir haben eine arbeitsteilige Gesellschaft. Wir sind aufeinander angewiesen, wir funktionieren nur als „Wir“. Was bedeutet es, wenn dieses „Wir“ zur bloßen Behauptung wird? Was wäre echte Solidarität? Hieße das nicht, gemeinsam Veränderungen herbeizuführen, sich zu bewegen? Die Notwendigkeit des Handelns liegt auf der …

Read More »

Read More »

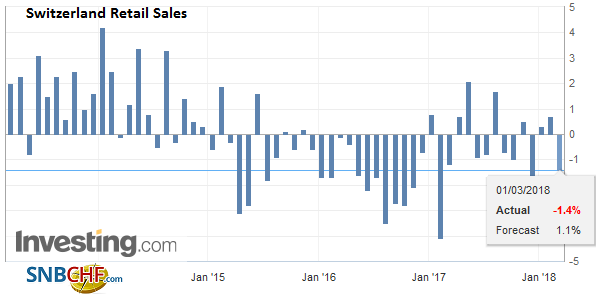

Swiss Retail Sales, January: -0.8 Percent Nominal and -0.6 Percent Real

Turnover in the retail sector fell by 0.8% in nominal terms in January 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Switzerland GDP Q4 2017: +0.6 percent QoQ, +1.9 percent YoY

Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade.

Read More »

Read More »

Yanis Varoufakis – Bloody Sunday, Brexit & The Democratic Process

Yanis Varoufakis’s lecture delivered on Sunday 28th January 2018. Yanis was the former Greek Finance Minister who resigned when his Syriza government capitulated to EU demands. In 2016 he launched the democracy in Europe 2025 movement (DiEM 25). An acclaimed author and economist, his lecture explores these seemingly disparate themes.

Read More »

Read More »

Yanis Varoufakis on the urgency of collaboration on the world economy

“Do we need to have a great war to that which is absolutely necessary for the people?” Yanis Varoufakis speaks to us at SuperReturn International 2018 about the world economy and his views on the future private equity. Find out more about SuperReturn International 2018 at https://goo.gl/cgSswE.

Read More »

Read More »