Category Archive: 2) Swiss and European Macro

Kennt Ihr das Risiko?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Wie lange kann die aktuelle Hochphase der Bullen an der Börse eigentlich noch anhalten? Steht uns der nächste Crash bevor oder kommt das Beste erst noch? Dazu hat sich der Altmeister der Börsenberichterstattung Markus Koch kürzlich in einem …

Read More »

Read More »

Hans-Werner Sinn und Ernst Fehr: Wenn Ökonomen sich einmischen (ECO Talk)

Sie rechnen, sie analysieren, sie schreiben – und dann? Meistens gelangen die Forschungsergebnisse von Ökonomen nicht in die breite Öffentlichkeit. Seit 10 Jahren müssen sich Volkswirtschaftler den Vorwurf gefallen lassen, dass sie nicht vor der Finanzkrise gewarnt hätten. Wann entscheiden sich Ökonomen, ihre Meinung kundzutun? Weshalb? Und wie gehen sie mit Gegenwind um? Reto Lipp …

Read More »

Read More »

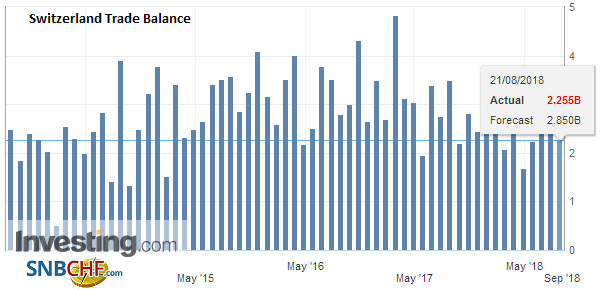

Swiss Trade Balance July 2018: Slowdown to a High Level

After stagnating the previous month, both exports and imports fell in July 2018. In seasonally adjusted terms, they fell by 3.0 and 2.8%, respectively. The decline in the chemicals-pharmaceuticals sector weighed on the result in both directions of the traffic. The trade balance is closing with a surplus of 1.2 billion francs.

Read More »

Read More »

Mit Griechenland wird jetzt alles gut, oder?

Die griechische Finanzkrise seit 2010 war spannender als jeder Krimi. Immerhin, nach acht Jahren und drei Hilfsprogrammen hat Griechenland den Rettungsschirm jetzt verlassen. Ist damit das griechische Schuldendrama beendet und hat auch Europa insgesamt Stabilität zurückgewonnen? Robert Halver mit seinen Beobachtungen und Einschätzungen aus dem Frankfurter Börsensaal

Read More »

Read More »

Yanis Varoufakis on How Capitalism Works and How it Fails

Yanis Varoufakis is a Greek academic, economist and politician who served as the Greek Minister of Finance in the first half of 2015. He’s currently professor of economics at the University of Athens. Varoufakis recently wrote a book, just translated into English, called “Talking to My Daughter About the Economy, or How Capitalism Works and …

Read More »

Read More »

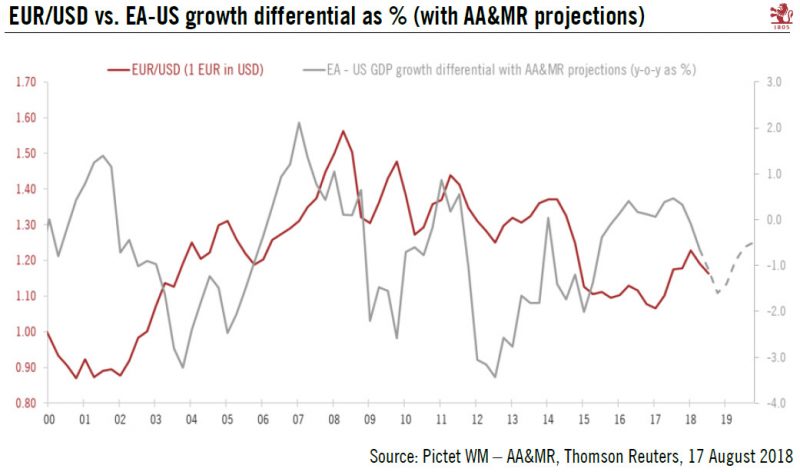

A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the...

Read More »

Read More »

DAX abschaffen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Aktien, ETFs, Gold & Co. – 100% gratis: http://lars-erichsen.de/ Den Dax abschaffen? Ich gebe zu, das wäre eine drastische Maßnahme. Aber, der deutsche Anleger investiert vorwiegend in diesen Index und das ist ein Fehler. Der Dax ist ein schwacher Kandidat. Warum das der Fall ist und wie … Continue...

Read More »

Read More »

London House Prices Fall At Fastest Rate Since Height Of Financial Crisis

– London house prices fall at the fastest annual rate since height of the financial crisis

– London house prices fall in 5th month in row, worst falls since 2009

– London rents dropped at the fastest rate in eight years – ONS

– Brexit, London property slump put brake on UK house price growth

– Consumer spending declined in July as inflation increased

Read More »

Read More »

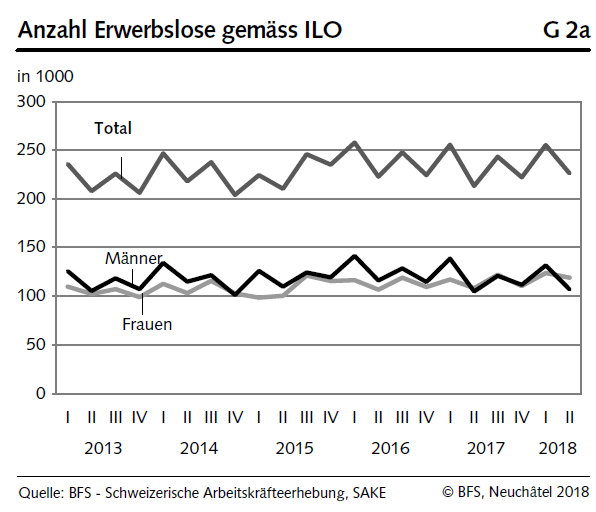

Swiss Labour Force Survey in 2nd quarter 2018: Number of persons in employment rises by 0.7 percent, unemployment rate based on ILO at 4.6 percent

The number of employed persons in Switzerland rose by 0.7% in the 2nd quarter 2018 compared with the same quarter of the previous year. The unemployment rate as defined by the International Labour Organisation (ILO) rose during the same period by 0.2 percentage points to 4.6%. The EU's unemployment rate based on the ILO definition decreased from 7.6% to 6.9%.

Read More »

Read More »

Darum kaufe ich keine Netflix-Aktien!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ In diesem Video werde ich euch sagen, warum ich keine Netflix-Aktien in mein langfristiges Portfolio aufnehme. Ich werde euch aber auch sagen, warum ich genau jetzt Netflix aus spekulativer Sicht heraus, ganz interessant finde. Los geht´s! ——– ➤ …

Read More »

Read More »

Inwieweit ist die Währungskrise der Türkei eine Gefahr für die Finanzwelt?

Der dramatische Währungsverfall der türkischen Lira ist die nächste Krise, die die Finanzwelt heimsucht. Wie könnte die weitere Entwicklung aussehen? Welche handelnden Personen spielen die entscheidenden Rollen? Wie viel Eskalierungspotenzial ist vorhanden und wo zeichnen sich Lösungsmöglichkeiten ab? Und was sind die Auswirkungen auf die Aktienmärkte? Robert Halver mit seiner Einschätzung der Lage

Read More »

Read More »

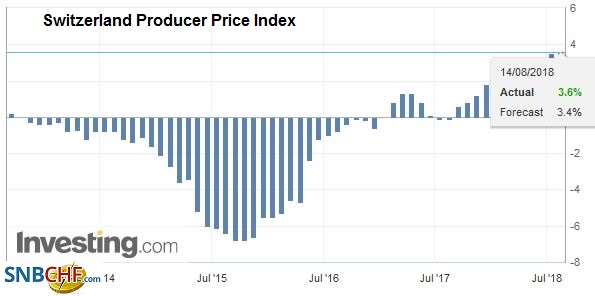

Swiss Producer and Import Price Index in July 2018: +3.6 YoY, +0.1 MoM

The Producer and Import Price Index increased in July 2018 by 0.1% compared with the previous month, reaching 103.3 points (December 2015 = 100). The rise is due in particular to higher prices for watches, petroleum and natural gas. Compared with July 2017, the price level of the whole range of domestic and imported products rose by 3.6%.

Read More »

Read More »

Mit ETFs immer gewinnen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu ETFs, Gold, Aktien & Co. – 100% gratis: http://lars-erichsen.de/ Die Anbieter von ETFs sind mittlerweile recht einfallsreich geworden, wenn es um die Vermarktung ihrer Produkte geht. Heute möchte ich darauf hinweisen, dass die Vorstellung, mit ETFs nur gewinnen zu können, äußerst gefährlich ist. Sprechen wir also über …

Read More »

Read More »

Ein Flüchtling kostet uns 450.000 Euro. Die Generationenrechnung Hans Werner Sinn

Quelle: politikbildung de 15.05.2018 Der bekannteste Ökonom Deutschlands hat anhand der Generationenrechnung von Bernd Raffelbüschel die Kosten pro Migranten (Flüchtlinge und Armutswanderer) für die Bundesrepublik Deutschland auf 450.000 € kalkuliert. “18% aller Hartz4 Empfänger sind Ausländer, während der Anteil der Ausländer bei 7,3% liegt.” – Hans-Werner Sinn (ifo Institut) Mehr wichtige Informationen über sozioökonomische...

Read More »

Read More »

Switzerland Unemployment in July 2018: Unchanged at 2.4percent, seasonally adjusted unchanged at 2.6percent

Registered unemployment in July 2018 - According to SECO surveys, at the end of July 2018, 106,052 unemployed people were enrolled in the Regional Employment Centers (RAV), 527 less than in the previous month. The unemployment rate remained at 2.4% in the month under review. Compared to the same month of the previous year, unemployment fell by 27,874 (-20.8%).

Read More »

Read More »

Wirtschaftliche Auswirkungen der neuen US-Sanktionen gegen den Iran

US-Präsident Donald Trump hat es wieder getan. Er hat neue Sanktionen gegen den Iran verhängt. Welche Konsequenzen haben sie für die deutsche Industrie, die liebend gerne die marode Infrastruktur des Iran modernisieren würde? Und bedeuten Exportbeschränkungen für iranisches Öl höherer Produktionskosten für die Weltwirtschaft, steigende Inflation und eine restriktivere Geldpolitik? Robert Halver mit seinen Ansichten …

Read More »

Read More »

Silber: Bereit für den perfekten Einstieg?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Silber, Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Im letzten Drittel einer Edelmetallhausse performt Silber deutlich stärker als Gold, die Zugewinne fallen also wesentlich dramatischer aus. Beim letzten Mal gab es eine Kursvervielfachung innerhalb weniger Monate. Wann ist es das nächste Mal soweit? Darüber sprechen …

Read More »

Read More »

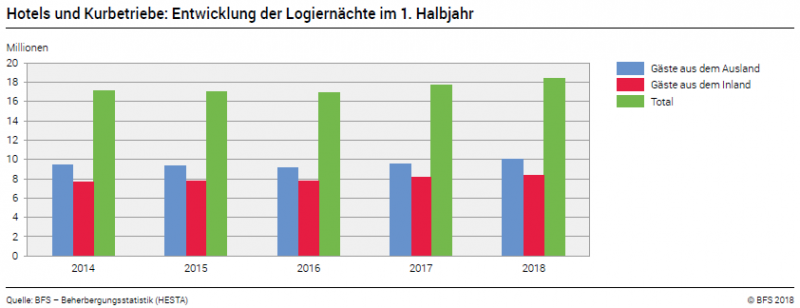

Overnight Stays Increased by 3.8 percent in the First Half of 2018

The hotel sector registered 18.4 million overnight stays in Switzerland in the first half of 2018, representing an increase of 3.8% (+670,000 overnight stays) compared with the same period a year earlier. With a total of 10.0 million overnight stays, foreign demand rose by 4.6% (+444,000). Domestic visitors registered 8.3 million overnight stays, i.e. an increase of 2.8% (+226,000).

Read More »

Read More »

Hans Werner Sinn zum Euro – Wir werden einen heißen Herbst erleben

Quelle: www.noz.de Ist der Euro gesichert? Auch wenn Griechenland nun das Rettungsprogramm verlässt, bleibt der renommierte Ökonom Hans-Werner Sinn skeptisch. Europa stehe ein heißer Herbst bevor, wenn Griechenland weiter über seine Verhältnisse leben und die italienische Regierung ihre Pläne wahr mache. Der ehemalige Chef des Münchner Ifo-Instituts fordert eine atmende Währungsunion, bei der Länder auch …

Read More »

Read More »

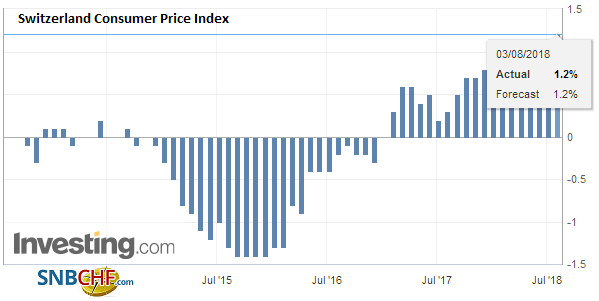

Swiss Consumer Price Index in July 2018: +1.2 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in July 2018 compared with the previous month, reaching 101.8 points (December 2015=100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO).

Read More »

Read More »