Category Archive: 2) Swiss and European Macro

Kauf-Chance bei Silber!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Ich werfe für euch heute einen ganz genauen Blick auf Silber, Gold und meinen absoluten Top-Favoriten, aus dem Edelmetallsektor. Legen wir los! ——– ➤ Mein YouTube-Kanal zum Thema Trading: http://youtube.com/tradermacherde ➤ Folge mir bei Facebook: https://www.facebook.com/ErichsenGeld/ ➤ Folge …

Read More »

Read More »

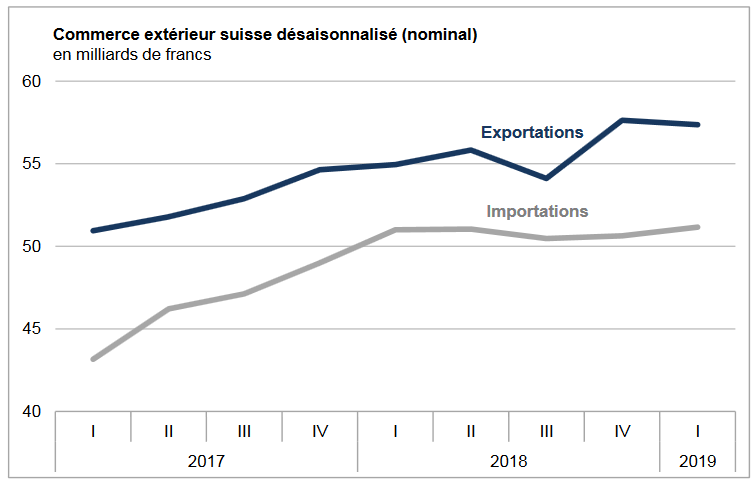

Swiss Trade Balance Q1 2019: Foreign trade at a high level

Swiss foreign trade saw a mixed evolution during the first half of 2019. In seasonally adjusted terms, exports fell slightly, still remaining above the 57 billion franc mark. Imports, on the other hand, continued to rise (+1 , 0%) to reach a record level of 51.2 billion francs. The trade balance closes with a surplus of 6.2 billion francs.

Read More »

Read More »

Wirecard: Wann ich kaufe!

► Mein Podcast auf Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ ► Mein Podcast auf iTunes: https://itunes.apple.com/de/podcast/erichsen-geld-gold-der-podcast-für-die-erfolgreiche/id1455853622 ► Mein Podcast auf Spotify: https://open.spotify.com/show/1a7eKRMaWXm8VazZH2uVAf ► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis:...

Read More »

Read More »

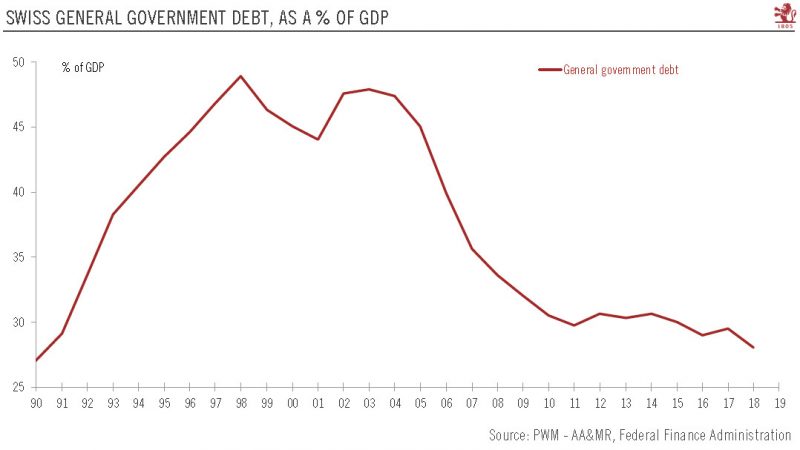

Swiss Policy Mix Review

The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295 million.

Read More »

Read More »

Frühlingserwachen der deutschen Konjunktur?

In den letzten Monaten durchschritt Deutschland ein konjunkturelles Tal der Tränen. Eine schlechte Konjunkturnachricht jagte die andere. Eine Rezession mit fundamentalen Begleitschäden am Aktienmarkt schien so sicher wie das Amen in der Kirche. Zuletzt jedoch hellte sich die wirtschaftliche Stimmung wieder auf. Ist also nur mit einer vorübergehenden Konjunkturdelle, nicht aber einer nachhaltigen -beule zu …

Read More »

Read More »

Spitzenkandidat debate featuring Yanis Varoufakis – March 26, 2019, Brussels | DiEM25

Yanis Varoufakis, DiEM25 co-founder and Demokratie in Europa lead candidate for the European Parliament elections in Germany, was the first guest of the jointly organised Bruegel-FT Spitzenkandidaten series. This event was part of a series of talks and debates with Europe’s Spitzenkandidaten and political leaders. Journalists from the FT, along with a Bruegel Director explore …

Read More »

Read More »

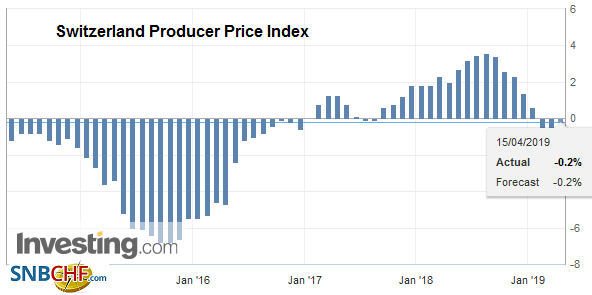

Swiss Producer and Import Price Index in March 2019: -0.2 percent YoY, +0.3 percent MoM

15.04.2019 - The Producer and Import Price Index increased in March 2019 by 0.3% compared with the previous month, reaching 102.2 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products. Compared with March 2018, the price level of the whole range of domestic and imported products fell by 0.2%.

Read More »

Read More »

Passives Einkommen aus Dividenden

► Link zum Video von Mission Money “Darum steht uns der KAPUTTESTE Börsen-BOOM aller Zeiten bevor”: https://youtu.be/OtAvIwxljxo ► Mein Podcast auf Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ ► Mein Podcast auf iTunes: https://itunes.apple.com/de/podcast/erichsen-geld-gold-der-podcast-für-die-erfolgreiche/id1455853622 ► Mein Podcast auf Spotify:...

Read More »

Read More »

Eyes on Europe: Tête-à-tête with Yanis Varoufakis

After a 2 hours conference on his political program on the 25th of March, Yanis Varoufakis agreed to join us for a tête-à-tête interview with our editor-in-chief Niklas Franke. He gave us some insights into his personal motivation and how he would like to spend his free time. Although his political project is foredoomed, he …

Read More »

Read More »

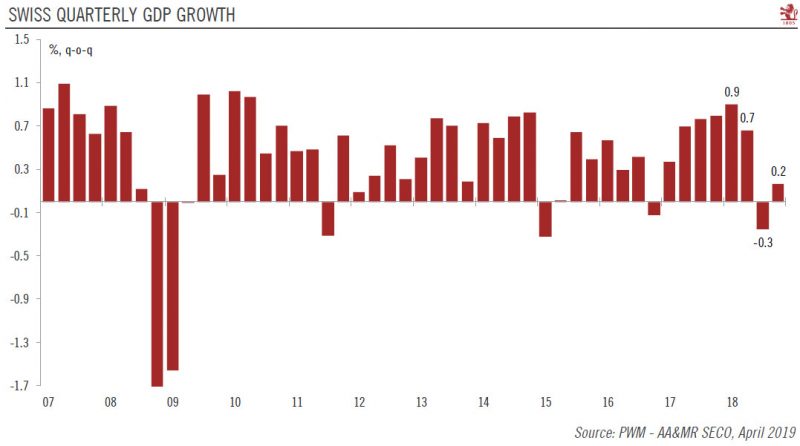

Switzerland: Lower growth, lower inflation

Growth and price rises should moderate in 2019.The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.

Read More »

Read More »

Frank Schäffler (FDP) – Appell an die SPD

Ausschnitt aus der Rede des Bundestagsabgeordneten Frank Schäffler zum Antrag der AfD “Target-Forderungen unabhängig von bestehen des Euros sichern”. Der Ausschnitt zeigt einen abschließenden Appell an die SPD, die Commerzbank und Deutsche Bank nicht weiter in eine Fusion zu führen.

Read More »

Read More »

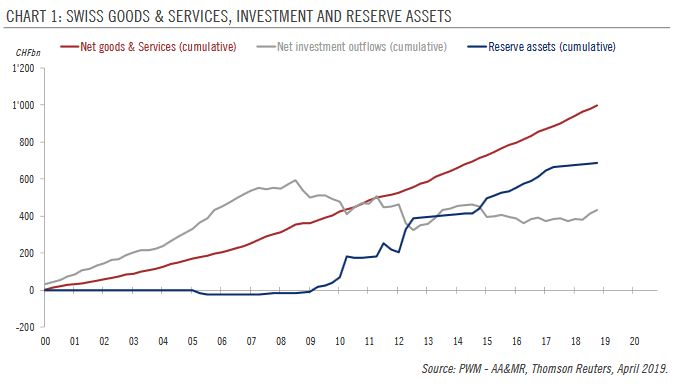

Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less...

Read More »

Read More »

Frank Schäffler (FDP) – Rede zu Target-Forderungen

“Wir wollen den Euro erhalten. Wir wollen ihn nicht abwickeln.” In meiner heutigen Rede zu den Target-Forderungen habe ich deutlich gemacht, was uns vor allem von der AfD unterscheidet und warum auch der Weg, der Regierung und der Linken, der Falsche ist und wie wir als FDP die Probleme lösen wollen.

Read More »

Read More »

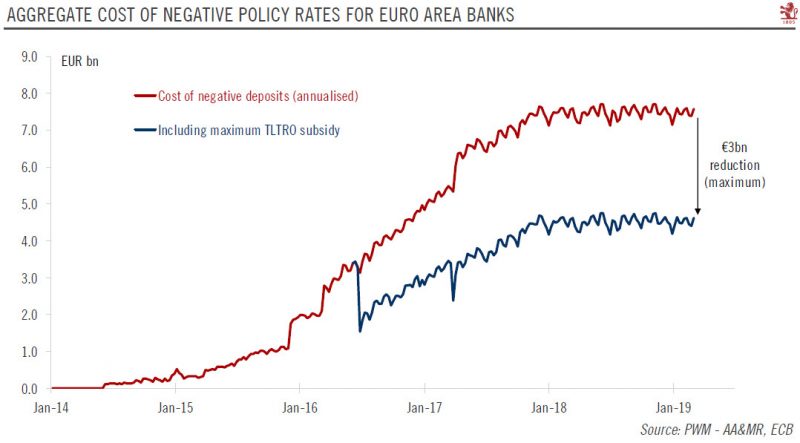

Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.

Read More »

Read More »

Künstliche Intelligenz: Risiko für die Menschheit!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Heute geht es um zwei ganz konkrete Bedrohungs-Szenarien, die von künstlicher Intelligenz ausgehen. Selbstverständlich werde ich euch auch meine zwei Aktienfavoriten aus diesem Sektor nennen. Los geht´s! ——– ➤ Mein YouTube-Kanal zum Thema Trading: http://youtube.com/tradermacherde ➤ Folge mir …

Read More »

Read More »

Vernunftehe mit China als Trost für verlorene Liebe Amerikas zu Europa?

Nach vielen Jahrzehnten verschmäht Amerika neuerdings seine frühere europäische Geliebte mit allen geo-, wirtschafts- und handelspolitischen Konsequenzen. Können intensivere Handelsbeziehungen zu China zumindest auf der platonischen Ebene Ersatz zu bieten? Welche Chancen, Risiken und Herausforderungen sind mit dieser Zweckehe für Europa verbunden? Robert Halver mit seinen Einschätzungen anlässlich des EU-China-Gipfels in Brüssel

Read More »

Read More »

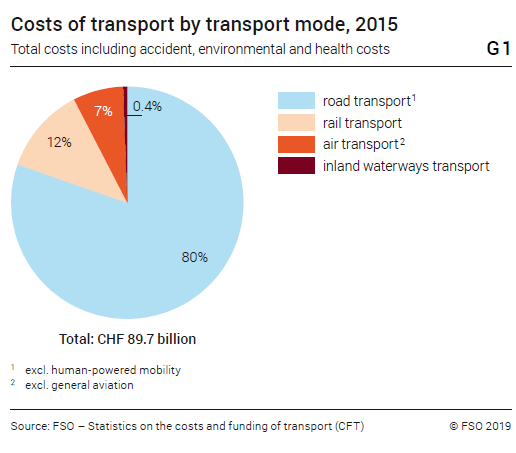

Transport costs have increased by 4 percent within five years

In 2015, transport in Switzerland generated economic costs of around CHF 90 billion. This was 4% more than in 2010. Aviation (+14%) and rail transport (+12%) recorded the largest increases. In comparison, costs for motorised road transport remained rather stable (+2%) and accounted for four fifths of the total transport costs. None of the various transport user groups fully funded the generated costs themselves.

Read More »

Read More »

Der Jahrhundert-Trade?

► Mein Podcast auf Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ ► Mein Podcast auf iTunes: https://itunes.apple.com/de/podcast/erichsen-geld-gold-der-podcast-für-die-erfolgreiche/id1455853622 ► Mein Podcast auf Spotify: https://open.spotify.com/show/1a7eKRMaWXm8VazZH2uVAf ► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis:...

Read More »

Read More »

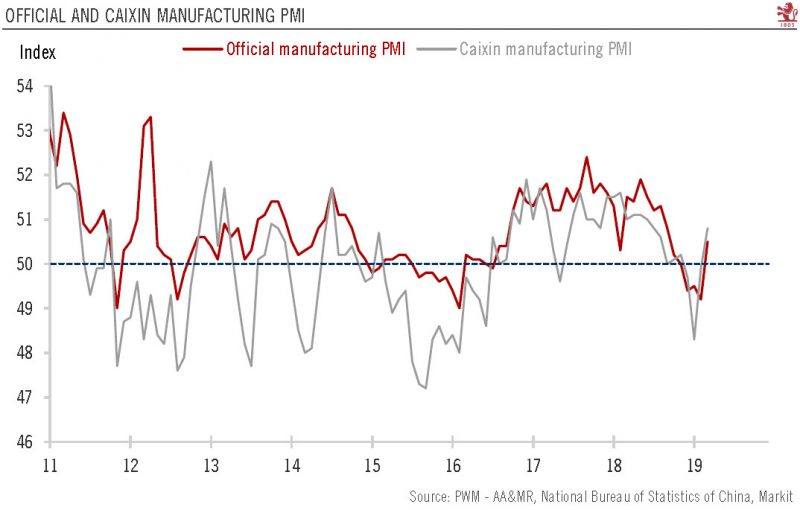

China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0.

Read More »

Read More »