Category Archive: 2.) Europe and Euro Crisis

Europe Debates The Burkini: “We Will Colonize You With Your Democratic Laws”

"We will colonize you with your democratic laws." — Yusuf al-Qaradawi, Egyptian Islamic cleric and chairman of the International Union of Muslim Scholars. "Beaches, like any public space, must be protected from religious claims. The burkini is an anti-social political project aimed in particular at subjugating women.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

European Court of Justice Ruling Weighs on Italian Banks

ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event.

Read More »

Read More »

Three Developments in Spain

Favorable initial ruling for Spanish banks that overcharged on mortgages. The EC may be lenient on Spain (and Portugal) for the excessive deficits in 2015. There is a window of opportunity for Rajoy to form a minority government.

Read More »

Read More »

New Wrinkle in European Bail-In Efforts

European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness.

Read More »

Read More »

Great Graphic: More Thoughts on Banks

Italian banks have done worse that European banks. Italian banks outperformed Germany banks from end of H1 12 through H1 15. US banks and financials more broadly have outperformed Europe.

Read More »

Read More »

Return of the Repressed: Europe’s Unresolved Banking Crisis

The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy's banks, and Three UK commercial real estate funds have been frozen to prevent redemptions.

Read More »

Read More »

Outlook for Spain’s Election

The pace of reform in Spain has slowed, with electoral considerations likely playing a role. A new center-right government may resume efforts to reform the labor market, even if leading a government costs Rajoy his job. Representation of Podemos i...

Read More »

Read More »

France, Schengen and the Future of Europe

The second round of French regional elections will be held this weekend. The first round last weekend saw the National Front do best in terms of popular votes and led in six of the twelve regions. The National Front is not simply anti-austerity, but it is anti-EMU. In regions that NF garnered more than 40% … Continue reading »

Read More »

Read More »

Is Grexit Back on the Table?

Defying the expectations a few months ago, Greece remained in the Economic and Monetary Union. It recently succeeded in implementing sufficient reforms to earn another tranche of aid. However, the entire exercise exhausted whatever trust the...

Read More »

Read More »

France’s Revival or Politics Trumps Economics

With the ECB poised to take additional steps down the unorthodox monetary policy route, financial and economic forces are as potent as ever. However, there is a subtle shift taking place that few seem to recognize. It is the re-emergence of...

Read More »

Read More »

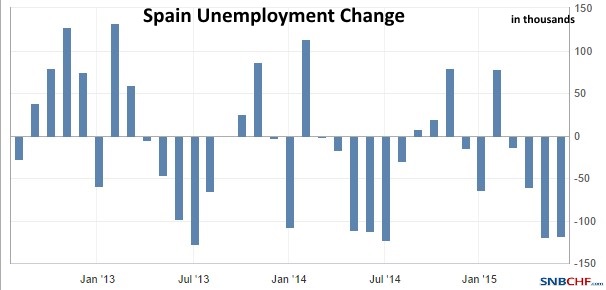

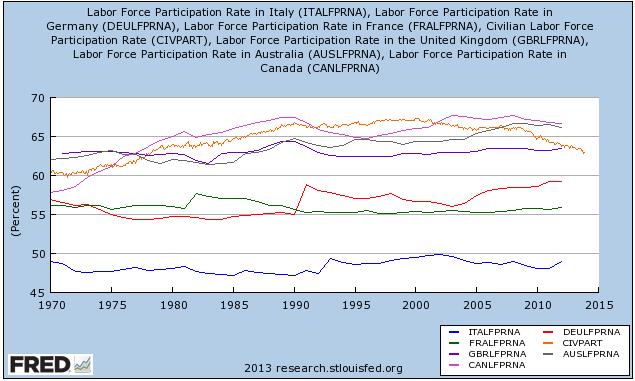

Eurocrisis, Myth and Reality, part 1: Big Job Creation in Spain

In the new series George Dorgan suggests that the euro crisis is a temporary development but not a long-lasting crisis. In the first part he shows that Spain actually created a lot of jobs in last twenty five years.

Read More »

Read More »

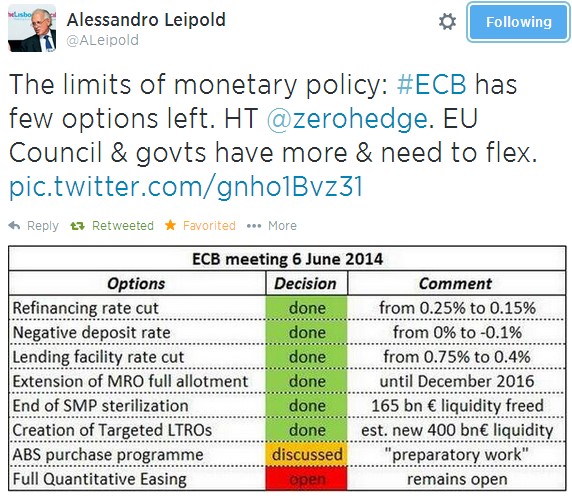

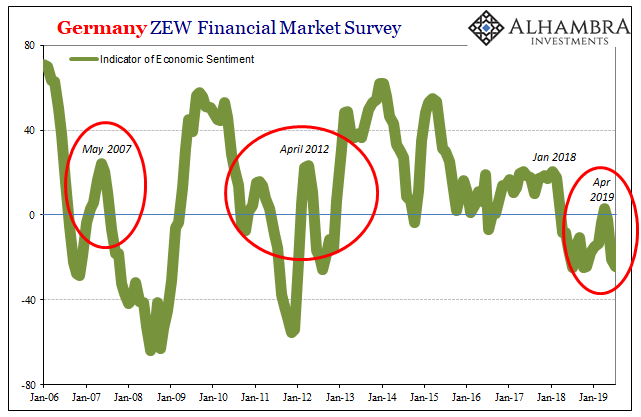

ECB Measures Background: How to Reduce German Competitiveness and Talk down the Euro

In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness. The ECB wanted to talk down the euro but will not succeed. We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the … Continue...

Read More »

Read More »

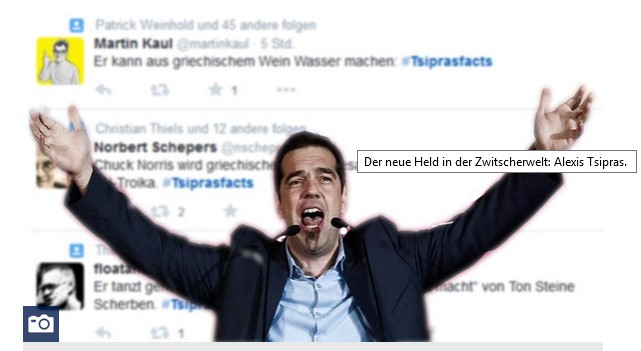

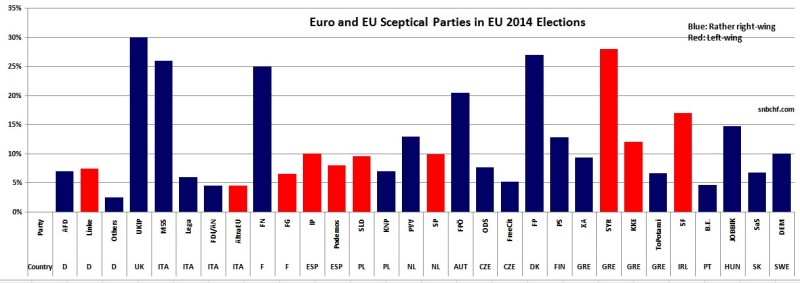

Euro and EU sceptical Parties in EU 2014 Elections: The Economic Danger Is Left not Right

The tendency of the European parliament elections seems to be that in the Northern countries rather right-wing parties obtain more votes, like British UKIP, German AFD, Danish People’s Party, Austrian FPÖ or Sweden Democrats. In the austerity countries the left-wing movements are getting stronger and stronger, led by SYRIZA in Greece and Sinn Fein in …

Read More »

Read More »

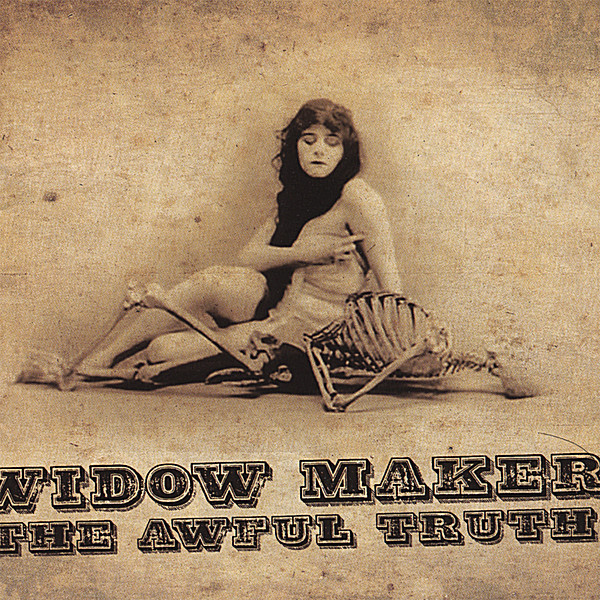

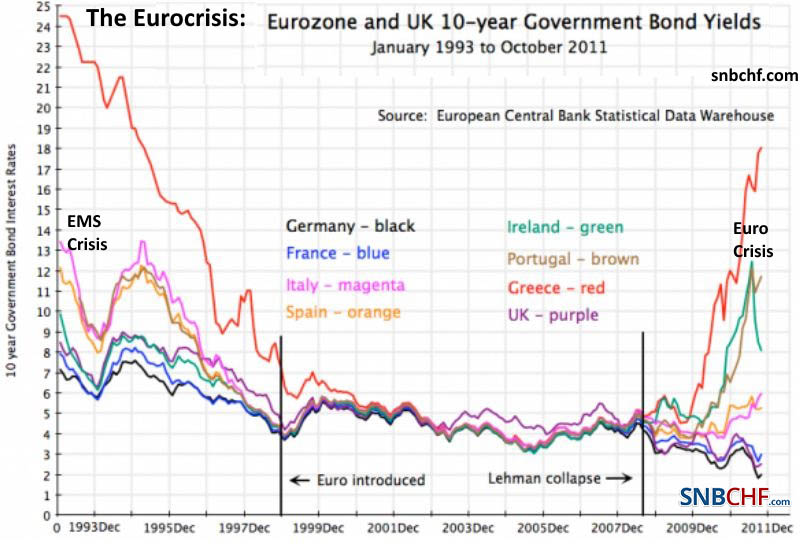

The New Widow-Maker Trade: Short Italian Government Bonds

We think that, similarly as Japanese JGBs, Spanish and Italian Government Bond Yields will continue its race to the bottom, Short Italian Bonds is the new Widow-Maker Trade.

Read More »

Read More »

2013 Posts on Euro Crisis and Euro Macro

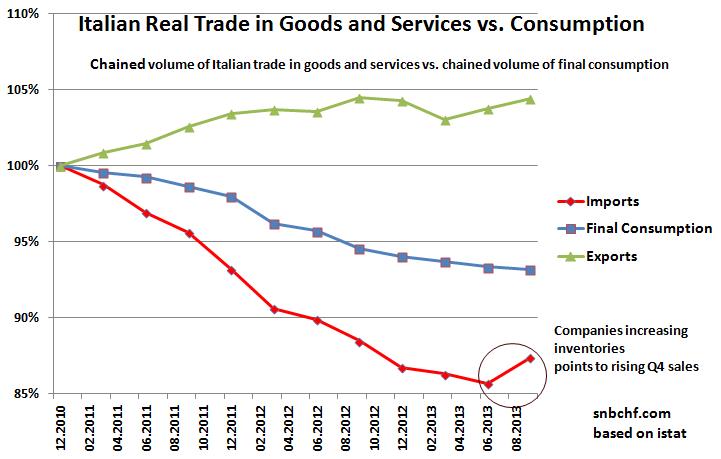

An Upcoming Italian Success Story?

While the mainstream is still talking about potential riots in Italian streets, we rather see positive adjustments in the Italian economy.

Read More »

Read More »

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »