Category Archive: 2.) Europe and Euro Crisis

Draghi Lets Steam out of Euro

US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration.

Read More »

Read More »

ECB Assets Hit 35 percent Of Eurozone GDP; Draghi Owns 9.2 percent Of European Corporate Bond Market

As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global "helicopter money", by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

Read More »

Read More »

ECB: Dovish Taper or Hawkish Ease?

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

Cool Video: Discussing the ECB on Bloomberg TV

Tired of reading what analysts are saying? Here is a 4.3 minute video clip of my discussion earlier today on Bloomberg TV about the outlook for tomorrow's ECB meeting. The discussion covers various aspects of the ECB's decision.

Read More »

Read More »

ECB and the Future of QE

ECB will likely extend asset purchases in full. It may modify the rules by which it buys securities. It may adjust the rules of engagement for its securities lending program.

Read More »

Read More »

Greek Bonds may Soon be Included in ECB Purchases

The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece's debt is sustainable, but the IMF disagrees.

Read More »

Read More »

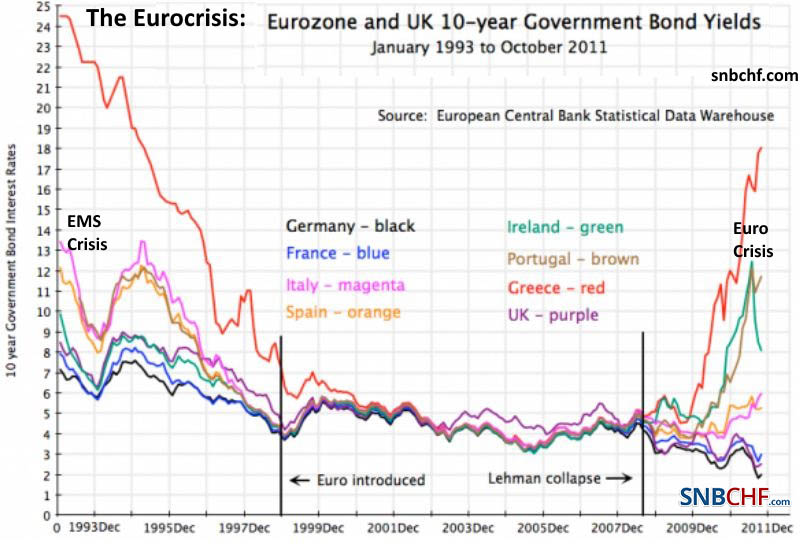

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

L’Allemagne est le patron-sponsor de l’Eurosystem.

Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique ci-dessous de quelques pays de la zone euro.

Read More »

Read More »

The Italian Job

Italy is the epicenter of the next potential populist "shock." A defeat of the referendum is seen as intensifying the political risk. Renzi has wavered again regarding his political future if the referendum loses.

Read More »

Read More »

Great Graphic: Euro-the Big Picture

Most economists are focusing on either US monetary policy or US fiscal policy. We focus on the policy mix. After the policy mix, politics is also a weigh on the euro. Our long-term call is for the euro to revisit the lows from 2000.

Read More »

Read More »

European break up now looks more likely, says Blond

If there’s one country with reason to resent the rise of populist movements, it’s Switzerland. Twenty-two months after it abandoned its 1.20-per-euro exchange-rate cap, the Swiss National Bank still finds the franc in focus every time there’s a major event that threatens to upset markets.

Read More »

Read More »

Serious Flaws in ECB’s Economic Thinking

Marc Meyer shows that the European Central Bank has big flaws in their economic thinking. Lowering the ECB Deposit Rate means depressing the economy. The ECB takes the risk when it buys Greek bonds. Should Greek bonds devalue then the ECB equity ratio falls under zero and European banks write must write-down their ECB Deposits.

Read More »

Read More »

Europe stocks split on Trump win with pharma gaining

The region’s largest industry group headed for its biggest jump in more than 14 months, tempering losses for equity benchmarks after Donald Trump won the race to govern the region’s biggest export market. Novo Nordisk A/S and Shire Plc rose more than 5 percent, after investors punished the shares in recent weeks amid disappointing earnings and speculation Hillary Clinton would push for drug-price controls as president. Citigroup Inc. had cut its...

Read More »

Read More »

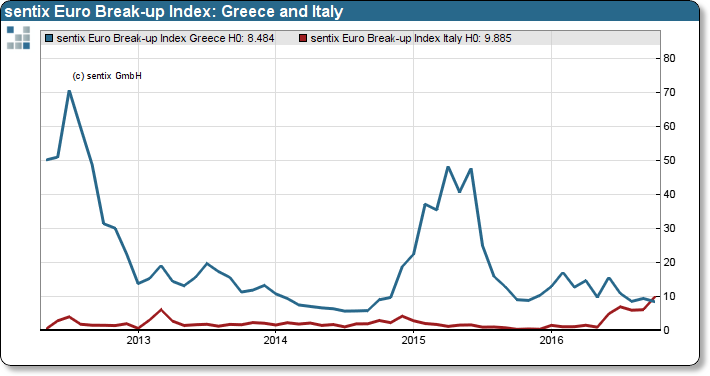

Great Graphic: Sentix Shows a Shift

The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi's political reforms.

Read More »

Read More »

When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Last year, I posted an article titled "If Sweden and Germany Became US States, They Would be Among the Poorest States" which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly reached the point of dogma with many leftists that European countries enjoy higher standards of living thanks to more government regulation and...

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

The ECB Made A Mistake During Its Daily Bond Purchases

Something unexpected happened when the ECB released its latest bond purchase data at during its scheduled release time on Monday: in addition to the purchase of at least 20 separate corporate bonds under the bank's CSPP bond buying program during the week ended October 14, amounting to a total of €1.84 billion, which lifted the number of securities held by the central bank to 660, bringing the total to amount of its holdings to €33.8 billion, or...

Read More »

Read More »

Great Graphic: US-German 2-Yr Differential and the Euro

The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction.

Read More »

Read More »

Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week - from settlement rumors to German blue-chip bailouts to Qatari investors - Germany's Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department.

Read More »

Read More »

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »