Category Archive: 1.) SNB Press Releases

Interim results of the Swiss National Bank as at 30 September 2021

The Swiss National Bank reports a profit of CHF 41.4 billion for the first three quarters of 2021. The profit on foreign currency positions amounted to CHF 42.2 billion. A valuation loss of CHF 1.3 billion was recorded on gold holdings. The profit on Swiss franc positions amountedto CHF 0.8 billion.

Read More »

Read More »

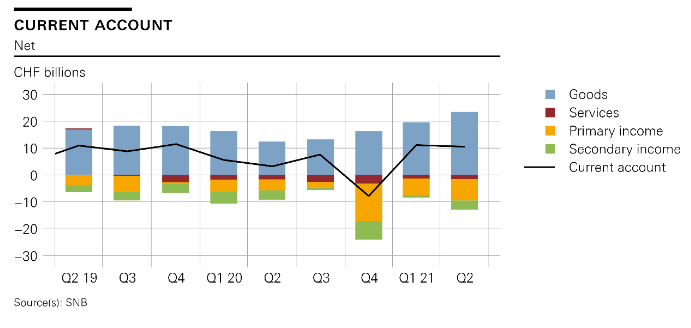

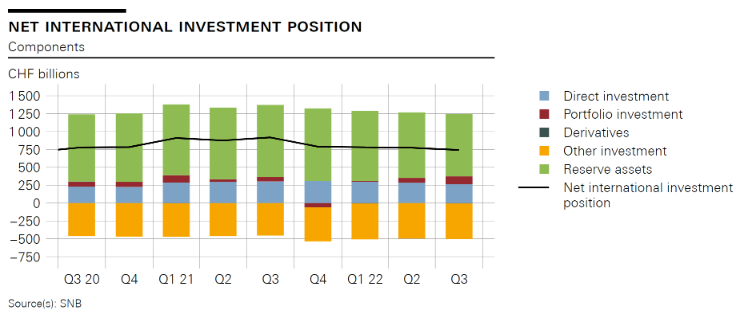

Swiss balance of payments and international investment position: Q2 2021

In the second quarter of 2021, the current account surplus amounted to almost CHF 11 billion, CHF 7 billion higher than in the same quarter of 2020. The rise was mainly attributable to a higher receipts surplus in goods trade.

Read More »

Read More »

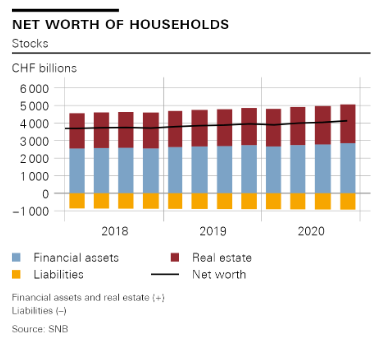

Swiss Financial Accounts: Household wealth in 2020 and focus article

Financial and real estate wealth of households increases. The Swiss National Bank is today publishing data on Q4 2020 as part of the financial accounts. Thus, household wealth data are now also available for the full year.

Read More »

Read More »

Astrid Frey appointed new SNB delegate for regional economic relations for Central Switzerland

With effect from 1 May 2021, Astrid Frey will take on the function of Swiss National Bank delegate for regional economic relations for the Central Switzerland region. She succeedsGregor Bäurle, who assumed the posit ion of Head of the SNB’s Regional Economic Relations unit on 1 January 2021.

Read More »

Read More »

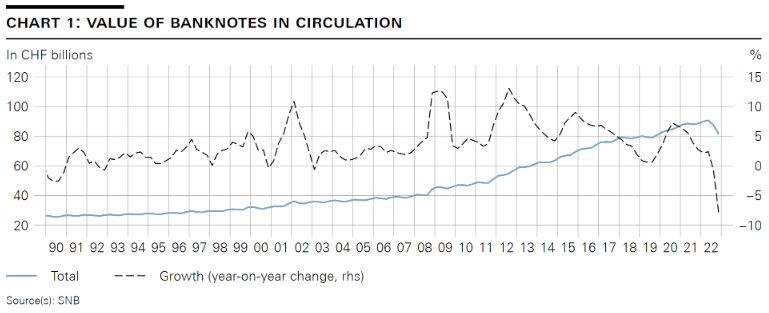

Recall of banknotes from eighth series

The Swiss National Bank is recalling its eighth-series banknotes as of 30 April 2021. From this date on, the banknotes from the eighth series lose their status as legal tender and can no longer be used for payment purposes.

Read More »

Read More »

2021-04-23 – U.S. dollar liquidity-providing operations from 1 July 2021

In view of the sustained improvements in U.S. dollar funding conditions and low demand at recent U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to discontinue offering dollar liquidity at the 84-day maturity.

Read More »

Read More »

COVID-19, financial markets and digital transformation

In many ways, the coronavirus (COVID-19) pandemic is unprecedented. The economic shock has been global and massive, affecting both economic supply and demand simultaneously. To mitigate the economic impact, the crisis response has had to be swift and innovative - including in Switzerland.

Read More »

Read More »

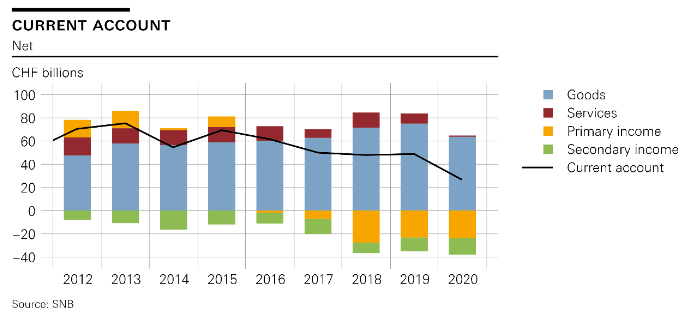

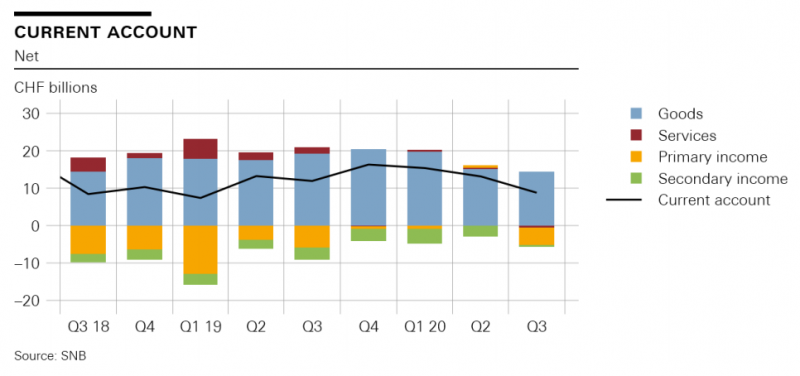

Swiss balance of payments and international investment position: 2020 and Q4 2020

The current account surplus in 2020 was CHF 27 billion, down CHF 22 billion on the previous year. This decline was particularly due to the lower receipts surpluses in trade in goods and services. In the case of goods, the decline in receipts – with expenses remaining unchanged – caused the balance to decrease by CHF 11 billion to CHF 64 billion.

Read More »

Read More »

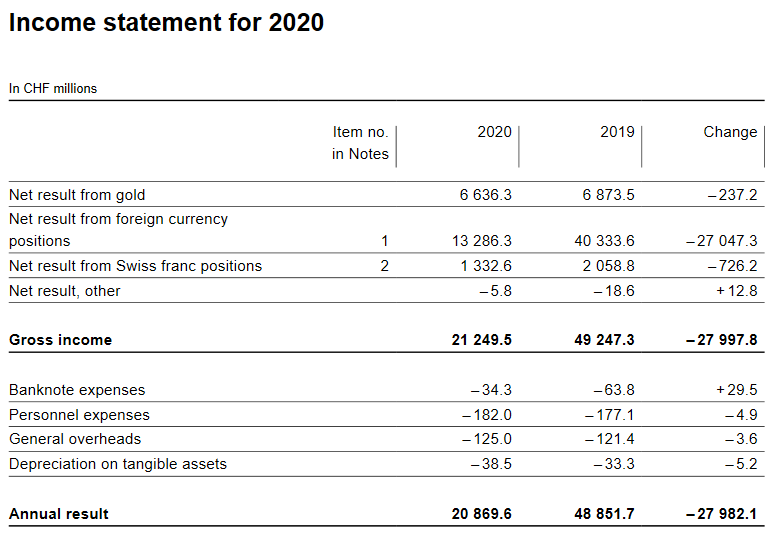

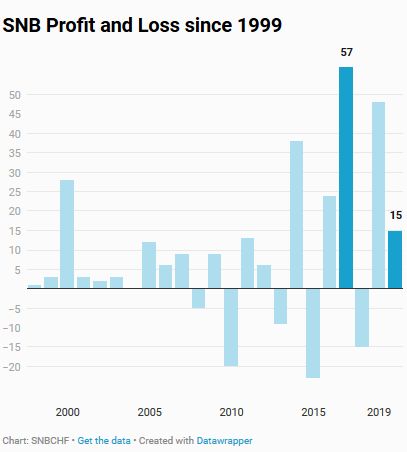

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion).

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion). The profit on foreign currency positions amounted to CHF 13.3 billion. A valuation gain of CHF 6.6 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.3 billion.

Read More »

Read More »

2021-01-08 – Swiss National Bank expects annual profit of around CHF 21 billion for 2020

According to provisional calculations, the Swiss National Ban k will report a profit in the order of CHF 21 billion for the 2020 financial year. The profit on foreign currency posi ti ons amounted to CHF 13 billion. A valuation gain of CHF 7 billion was recorded on gold holdings. The net r esult on Swiss franc posit ions amounted to over CHF 1 billion.

Read More »

Read More »

Swiss balance of payments and international investment position: Q3 2020

In the third quarter of 2020, the current account surplus amounted to CHF 9 billion, CHF 3 billion less than in the same quarter of 2019. This decline was particularly due to the lower receipts surplus in trade in goods and services. In the case of the goods trade, the decline was attributable to gold trading. This decrease was curbed by the expenses surplus for primary and secondary income, which decreased compared to Q3 2019.

Read More »

Read More »

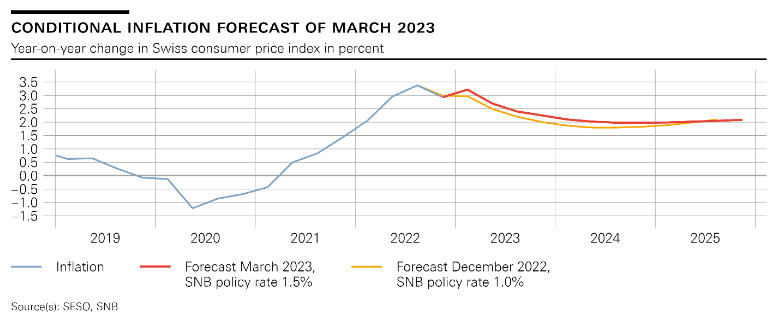

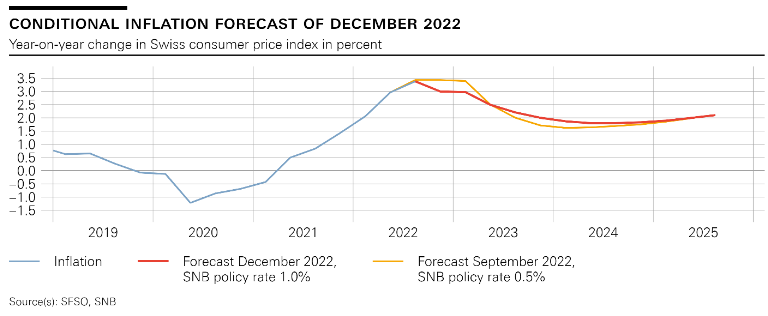

Monetary policy assessment of 17 December 2020

The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments.

Read More »

Read More »

BIS, Swiss National Bank and SIX announce successful wholesale CBDC experiment

Project Helvetia shows the feasibility of two proofs of concept (PoCs), using “near-live” systems to settle digital assets on a distributed ledger with central bank money.

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2021

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows:

Read More »

Read More »

Romeo Lacher and Christoph Mäder nominated for election to the SNB Bank Council

At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd.

Read More »

Read More »

SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The Swiss National Bank reports a profit of CHF 15.1 billion for the first three quarters of 2020. We explain why these profits are possible.

Read More »

Read More »

2020-10-30 – Swiss Financial Accounts: quarterly data published for first time

The Swiss National Bank is expanding its data offering with respect to Switzerland’s financial accounts. It will now publish quarterly as well as annual data, and the time to publication will be shortened from ten to four months.

Read More »

Read More »

Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements

Seven central banks and the BIS release a report assessing the feasibility of publicly available CBDCs in helping central banks deliver their public policy objectives. Report outlines foundational principles and core features of a CBDC, but does not give an opinion on whether to issue.

Read More »

Read More »

Adjustments to publication of data on money and foreign exchange market operations

Additional data on money market operations and more frequent publication of volume of foreign exchange market interventions

Read More »

Read More »

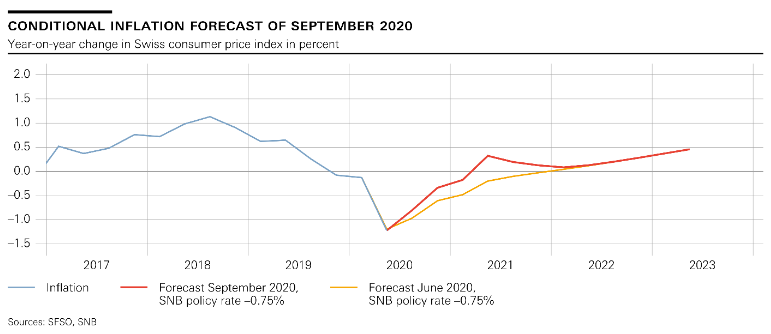

Monetary policy assessment of 24 September 2020

The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation.

Read More »

Read More »