Swiss National Bank maintains expansionary monetary policy

The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments.

| The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. In light of the highly valued Swiss franc, the SNB remains willing to intervene more strongly in the foreign exchange market. In so doing, it takes the overall exchange rate situation into consideration. Furthermore, it is supplying generous amounts of liquidity to the banking system via the SNB COVID-19 refinancing facility. The SNB’s expansionary monetary policy provides favourable financing conditions, counters upward pressure on the Swiss franc, and contributes to an appropriate supply of credit and liquidity to the economy.

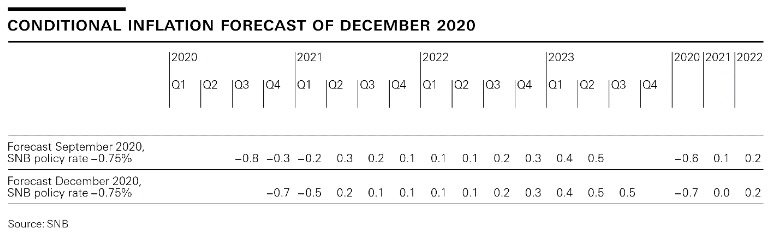

In the current situation, the inflation outlook remains subject to high uncertainty. The new conditional inflation forecast through to the end of 2021 is slightly lower than in September. This is primarily due to the renewed deterioration in the economic situation as a result of the second wave of the pandemic. In the longer term, the inflation forecast is unchanged from September. The forecast for 2020 is negative (−0.7%). The inflation rate is likely to be higher again next year (0.0%) and slightly positive in 2022 (0.2%). The conditional inflation forecast is based on the assumption that the SNB policy rate remains at −0.75% over the entire forecast horizon. |

SNB Switzerland Conditional Inflation Forecast, December 2020(see more posts on Switzerland inflation, ) Source: snb.ch - Click to enlarge |

| The coronavirus pandemic and the measures implemented to contain it led to a historic downturn in the global economy in the first half of 2020. This was followed by a strong recovery in the third quarter. Nevertheless, GDP remained significantly below pre-crisis levels in most countries.

Infection numbers have risen again rapidly in Europe and the US since October, and containment measures have once more been adopted. Recent indicators show that this is again having a detrimental impact on economic activity. However, the effects can be expected to be smaller than in spring given that many countries have opted for less severe containment measures. |

Conditonal Inflation Forecast of December 2020

|

In its baseline scenario for the global economy, the SNB anticipates that the pandemic will be brought back under control in the foreseeable future, and that appropriate measures will prevent further waves of infection. The economic recovery should therefore regain momentum in the course of next year. The monetary and fiscal policy measures adopted worldwide are providing important support in this regard. However, it is likely that global production capacity will be underutilised for some time to come and inflation will remain modest in most countries.

This scenario is subject to a high level of uncertainty, and there are risks on the upside and downside alike. On the one hand, the pandemic or trade tensions could additionally hamper economic activity. On the other, the fiscal and monetary policy measures implemented could support the recovery more strongly than anticipated.

Through to late summer, the Swiss economy also recovered markedly and more strongly thanoriginally expected from the first wave of the pandemic. Following a record increase, GDP was still 2% below the pre-crisis level in the third quarter, having been more than 8% below in the second quarter.

However, in October coronavirus also spread rapidly again in Switzerland. This has resulted in a renewed deterioration in the economic outlook. The containment measures implemented thus far are restricting economic activity less than was the case in the spring. Nevertheless, momentum is likely to be weak in Q4 2020 and Q1 2021.

The SNB expects that GDP will shrink by around 3% this year. At its monetary policy assessment in September, it had anticipated an even stronger decline. The revision is due to the fact that the decrease in GDP resulting from the first wave of the pandemic was not as substantial as originally expected.

Developments going forward largely depend on how successfully the spread of the virus can be contained in Switzerland and abroad. The SNB’s assumption is that there will not be a significant easing in the containment measures in Switzerland until the spring.

Against this backdrop, the SNB expects GDP growth of 2.5% to 3% for 2021. The recovery thus remains incomplete. Unemployment is likely to rise again, and production factors will remain underutilised for some time yet. The forecast for Switzerland, as for the global economy, is subject to high uncertainty.

Mortgage lending and residential property prices continued to rise in the second and third quarters. The vulnerability of these markets thus persists and continues to present a risk for financial stability.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter