Category Archive: 1.) SNB Press Releases

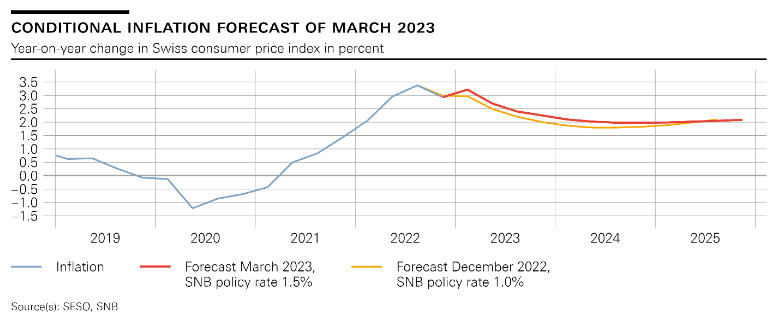

Andréa M. Maechler: Introductory remarks, news conference

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion.

Read More »

Read More »

Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely.

Read More »

Read More »

Thomas Jordan: Decision-making under uncertainty: The importance of pragmatism, consistency and determination

It is my pleasure to welcome you to this high-level conference on global risk, uncertainty and volatility. Thank you all for accepting our invitation to join the discussions. I am very pleased to see such a distinguished group of central bank officials and academics. I would like to thank our colleagues at the Bank for International Settlements and the Federal Reserve Board for working together with us in organising this event.

Read More »

Read More »

Swiss National Bank, Banque de France, Monetary Authority of Singapore and BIS Innovation Hub to explore cross-border trading and settlement of wholesale CBDCs using DeFi protocols

Project Mariana explores automated market makers (AMM) for the cross-border exchange of hypothetical central bank digital currencies (CBDCs) in Swiss francs, euros and Singapore dollars between financial institutions to settle foreign exchange trades in financial markets.

Read More »

Read More »

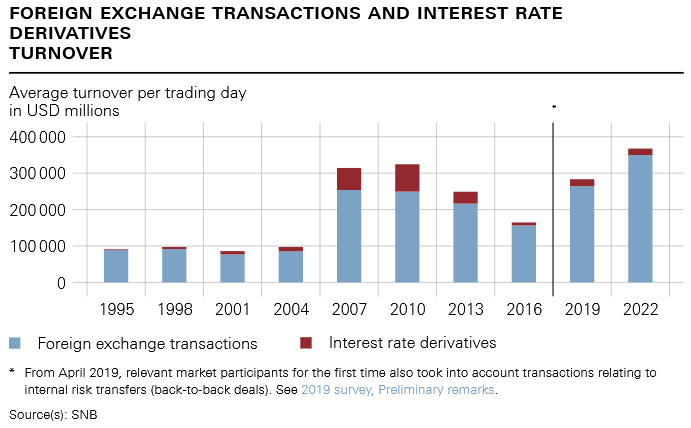

Turnover in foreign exchange and derivatives markets in Switzerland

The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed.

Read More »

Read More »

Thomas Jordan: Current challenges to central banks’ independence

In the recent past, the political and economic backdrop has changed dramatically. Inflation is far too high almost everywhere, and central banks are raising their policy interest rates at a time when stocks of government debt are large. In some places, central bank independence is being publicly called into question.

Read More »

Read More »

Publication on the centenary of the Swiss National Bank’s main building in Zurich: The Pfister Building 1922-2022

To mark the centenary of the Swiss National Bank’s main building at Börsenstrasse 15, the SNB is publishing ‘The Swiss National Bank in Zurich: The Pfister Building 1922-2022’ (Verlag Scheidegger & Spiess).

Read More »

Read More »

Prof. Dr. Thomas Jordan – Die Geldpolitik der SNB in Zeiten der Inflation

Für die Schweizerische Nationalbank (SNB) sind zwei ordnungspolitische Prinzipien von grosser Bedeutung: Die Unabhängigkeit von der Politik und ein Mandat, das sich auf die Gewährleistung der Preisstabilität konzentriert.

Read More »

Read More »

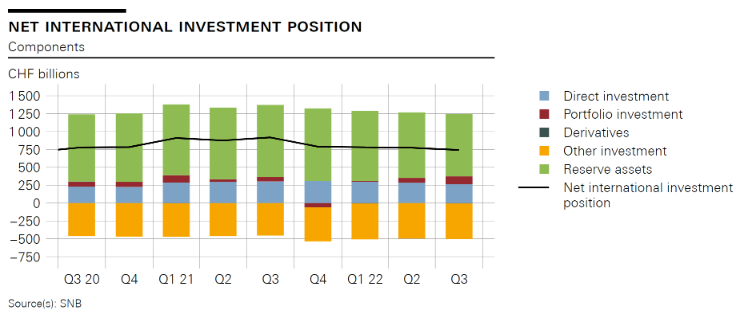

Swiss Balance of Payments and International Investment Position: Q2 2022

In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021.

Read More »

Read More »

Thomas Jordan: Sixth Karl Brunner Distinguished Lecture – Introduction of Benjamin M. Friedman

I am very pleased to welcome you all to the sixth Karl Brunner Distinguished Lecture. The Swiss National Bank established this annual lecture series in honour of the Swiss economist Karl Brunner, one of the leading monetary economists of the last century. Our aim with these lectures is to reach a broad audience, and to contribute to the public debate on issues related to central banking and economics more broadly.

Read More »

Read More »

Thomas Jordan: Carl Menger Award Ceremony 2022: Introductory remarks on Ricardo Reis

I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee.

Read More »

Read More »

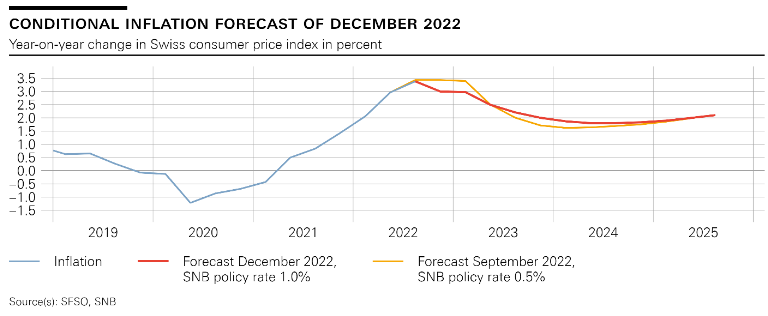

Thomas Jordan: Monetary policy under new constraints: challenges for the Swiss National Bank

The pandemic and the war in Ukraine have fundamentally changed the constraints on monetary policy. Uncertainty has increased strongly in many respects, and there has been a sharp rise in inflation.

Read More »

Read More »

Swiss National Bank Crime Syndicate THOMAS JORDAN – GOLDFINGER – MARTIN SCHLEGEL FBI Scotland Yard

MAINSTREAM NEWS MEDIA EXTRACTS: I

British Royal Family well seasoned commentators are known to have remarked that the genesis of the Gerald 6th Duke of Sutherland identity theft case lies in the forging of the birth certificate which effectively brought about a wide cadre of public figures who took advantage following the death of his mother and father respectively HRH The Princess Marina Duchess of Kent and George 5th Duke of Sutherland later...

Read More »

Read More »

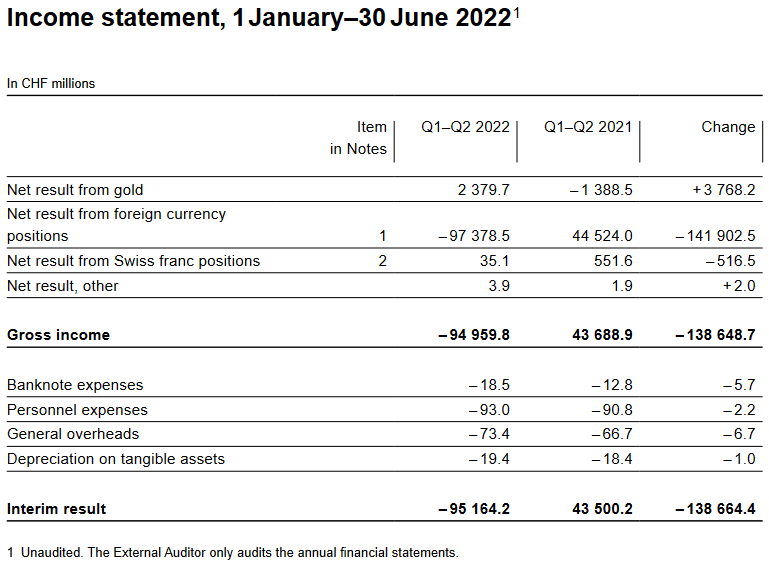

SNB Results Q2/2022: 95 Billion Loss, Close to my Predictions

I was predicting for many years that the SNB will suffer a big loss when inflation comes. The time of reckoning has come. I expected some 150 billion loss in one year: at half time we are 95 billion CHF.

Read More »

Read More »

Swiss National Bank reports massive losses

The Swiss National Bank (SNB) has taken a hit of CHF95.2 billion ($100 billion) for the first half of this year, mainly owing to losses on foreign currency positions.

Read More »

Read More »

Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount.

Read More »

Read More »

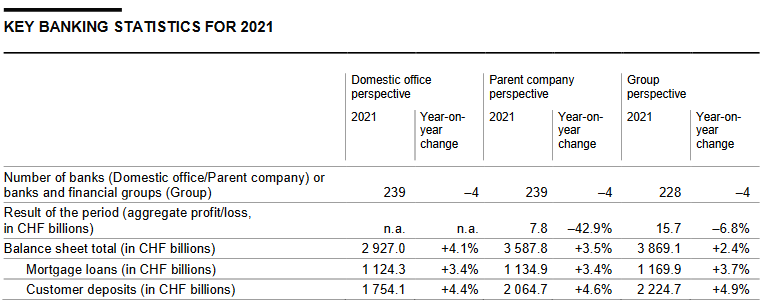

Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective).

Read More »

Read More »