Category Archive: 1) SNB and CHF

News conference Swiss National Bank 2016, Fritz Zurbrügg

UBS and Credit Suisse: Capital Situation improved further: fully compliant. Domestically focused banks have capitalisation well above regulatory minimum requirements, but mortgage lending and risk exposure increased in 2015. In case of an interest rate shock, this could lead to problems.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

SNB rate remains –0.75%, SNB is ready to intervene in the FX market, Inflation will rise faster over the coming quarters, Swiss economy to grow 1% to 1.5% in 2016

Read More »

Read More »

Monetary policy assessment of 16 June 2016

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market, as neces sary. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc...

Read More »

Read More »

With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

Read More »

Read More »

FINMA regulated forex dealer CIM Banque

Bank, independent dealer. FX Trading powered by Interactive Brokers. In industry since: 1990. CIM is a licensed bank.

Read More »

Read More »

FINMA regulated broker Dukascopy – overview

Dukascopy – Swiss broker regulated by the Association Romande des Intermediares Financiers (ARIF) and Swiss Financial Market Supervisory Authority (FINMA) is a licensed bank.

Read More »

Read More »

FINMA regulated broker Dukascopy – Forex Trading Review

Forex broker, Dukascopy, based in Switzerland and regulated by Swiss Financial Market Supervisory Authority (FINMA) and the Association Romande des Intermediares Financiers (ARIF).

Read More »

Read More »

Need Safe havens: CHF or Gold?

In times of negative interest rates and falling earnings per share, gold is the ultimate safe haven. Due to negative rates, it is not the Swiss Franc.

Read More »

Read More »

Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.

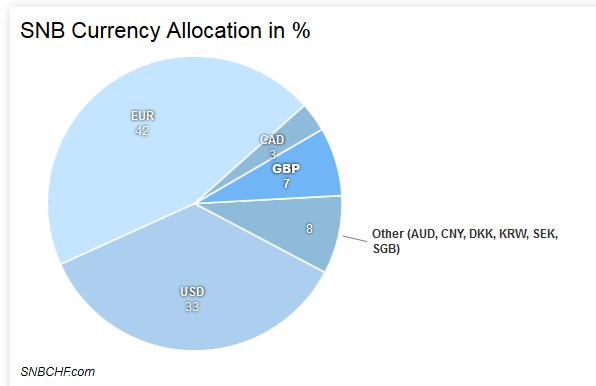

SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.

Read More »

Read More »

Fintech 2016 Röportajları: Izabella Kaminska

FT Alphaville’den Izabella Kaminska, Fintech ve Blockchain endüstrileri hakkındaki fikirlerini paylaştı.

Read More »

Read More »

The new banknotes – production and circulation

This film shows the production process for the new Swiss banknotes, including substrate production, printing, inspection, storage and entry into circulation. It shows the special Durasafe® substrate and provides details of the various printing processes used.

Read More »

Read More »

The new banknotes – security features at a glance

This film shows the five main security features that can be used to check easily and quickly if a new Swiss banknote is genuine. Additional features are shown in the film ‘The new banknotes – design and security features’.

Read More »

Read More »

The new banknotes – journey to the public and back

This film shows the journey of the new Swiss banknotes, from storage and quality assurance at the Swiss National Bank to their entry into circulation. It also describes how the notes from the old banknote series are sorted and destroyed.

Read More »

Read More »

The new banknotes – printing process

This film shows how the new Swiss banknotes are printed. The process uses traditional techniques such as offset, silkscreen, intaglio and letterpress printing, together with special processes such as foil application and microperforation. This gives the new Swiss banknote series a unique combination of design elements and security features.

Read More »

Read More »

The new banknotes – substrate

This film shows how the substrate for the new Swiss banknotes is produced. The issuance of these notes marks the first time that the substrate will be used for banknote production anywhere in the world. Called Durasafe®, it is a specially developed, three-layer substrate, comprising an inner polymer layer sandwiched between two outer layers of …

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

Grüezi, ich möchte gern eine Kuh einzahlen

Diese Filmsequenz gehört zum Thema “Alles über unser Geld” des Informationsangebots “Unsere Nationalbank”. Sie zeigt auf humorvolle Weise, was man auf ein Bankkonto einzahlen kann – und was nicht.

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

SNB Increased Equities Share to 20 percent, A High Risk Game for a Conservative Investor

A share of 20% equities is too much for a conservative investor.

- She increases the CHF debt with continuing interventions at a pace of 10% per year.

- yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive.

Read More »

Read More »