Category Archive: 1) SNB and CHF

SNB Monetary policy assessment September 2016 and Comments

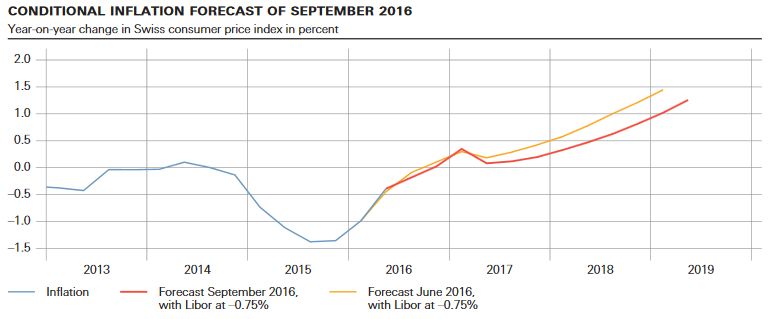

The SNB inflation forecast showed a strange diversion of conditional inflation forecasts: Draghi expected inflation to rebound to 1.2% next year and 1.6% in 2018.

The SNB, however, predicts 2017 inflation at 0.2% and 2018 at 0.6%. For us, one of the two is wrong.

Read More »

Read More »

Seven years of inaction on SNB rates day won’t end this week

Anyone feeling let down that the European Central Bank didn’t do much last week might just want to skip the Swiss rate decision on Thursday to avoid more disappointment. While the Swiss National Bank may be infamous for some seismic policy changes in the last few years, those bombshells weren’t dropped at scheduled meetings. In fact, the last time the institution altered interest rates at a decision in its public calendar was more than seven years...

Read More »

Read More »

Strong Swiss growth lessens chance SNB will act

Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.

Read More »

Read More »

Swiss trains the most expensive in Europe

A study by GoEuro, compares the cost of travelling 100km by train. Switzerland led the ranking with the most costly train trips in Europe. Travelling 100km in Switzerland cost CHF 52.

Read More »

Read More »

Swiss National Bank: Carl Menger Prize

Despite her incredible money printing and FX purchases, the SNB has many roots in the Austrian School of Economics, a school that maintains that money printing leads to price inflation. One of the major Austrian economists was Carl Menger.

Read More »

Read More »

Cash in a box catches on as Swiss negative rates bite

It’s a sign the world is getting used to negative interest rates when what once seemed bizarre starts looking like the norm. Consider Switzerland, where more and more companies are taking out insurance policies to protect their cash hoards from theft or damage.

Read More »

Read More »

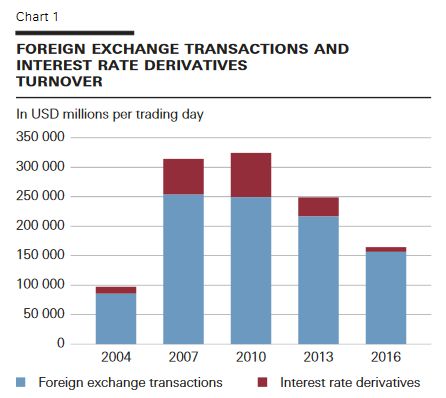

SNB Survey: 2016 Foreign Exchange Turnover

This press release presents the results for a Swiss National Bank (SNB) survey on turnover in foreign exchange and derivatives markets. The request for data was sent to 30 banks that operate in Switzerland and have a sizeable share in the foreign exchange and over-the-counter (OTC) derivatives markets. These banks reported the turnover of their domestic offices.

Read More »

Read More »

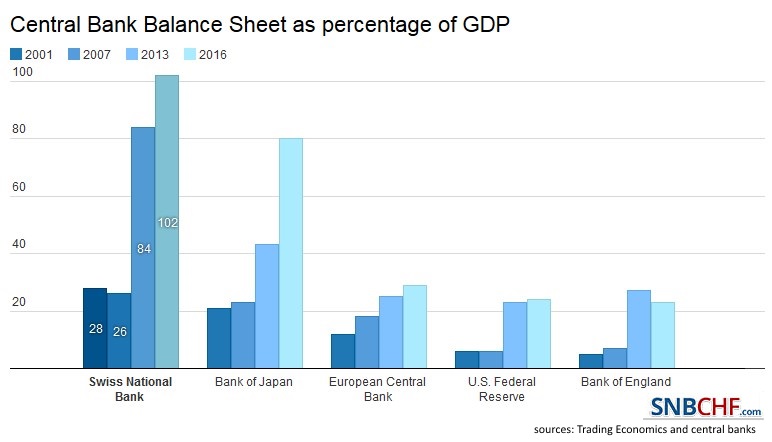

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

Wir wollen nicht in die EU. Stoppt diese SNB!

Politischen Druck auf die SNB hält Wirtschaftsprofessor Aymo Brunetti für „fatal in einer derart schwierigen Situation“. Dabei macht die SNB Politik, sie führt die Schweiz in den Euro.

Read More »

Read More »

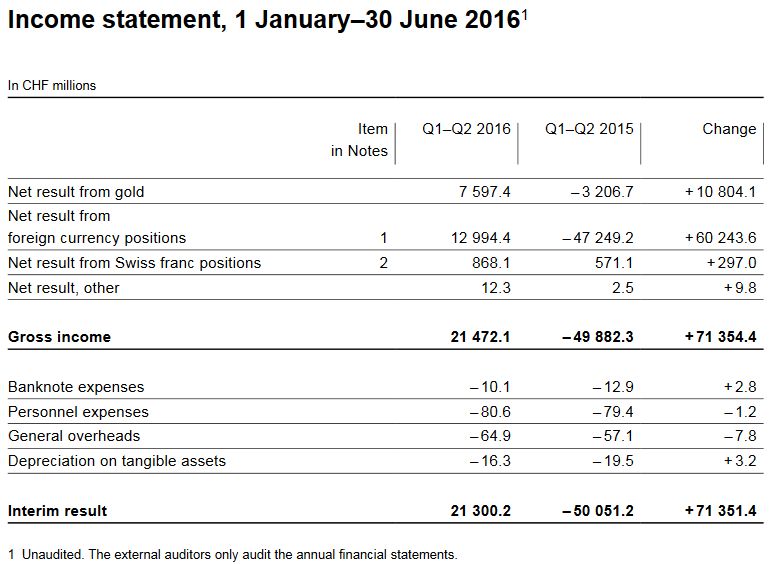

Interim results of the Swiss National Bank as at 30 June 2016

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

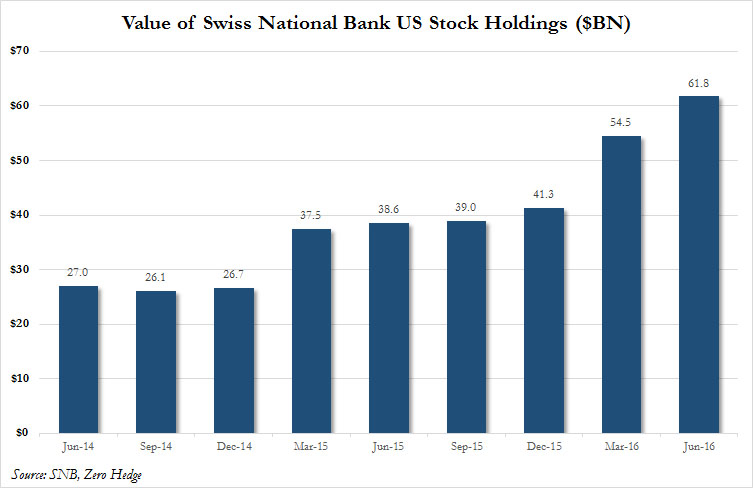

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on Wednesday.

Read More »

Read More »

Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency.

Read More »

Read More »

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

The relationship between CHF and gold

Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels.

Read More »

Read More »

CHF Price Movements: Correlations between CHF and the German Economy

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time.

Read More »

Read More »