Category Archive: 1) SNB and CHF

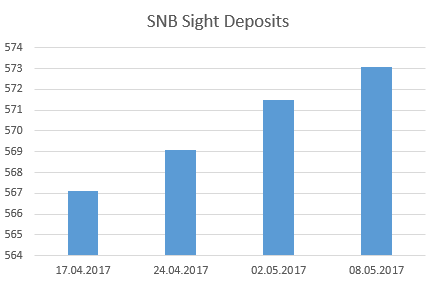

Weekly SNB Interventions and Speculative Positions: After French Elections

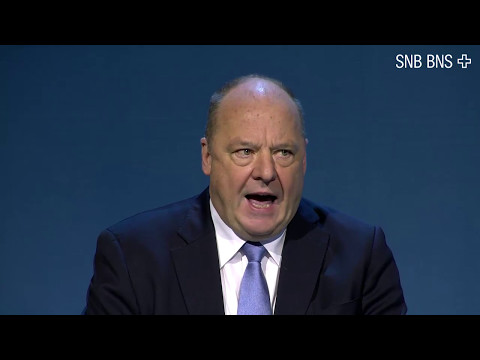

The centre-left politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0960, mostly caused by FX speculators. But serious investors - i.e. not FX speculators - did not follow the political event. The SNB had to intervene for 1.6 bn francs.

Read More »

Read More »

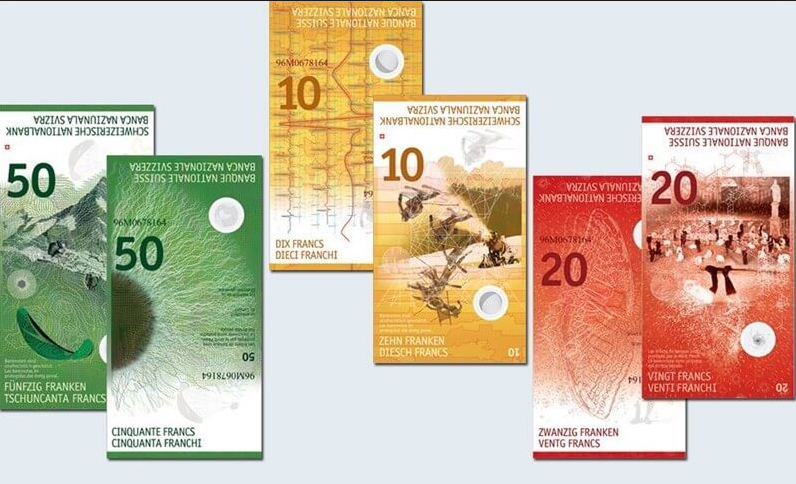

Swiss National Bank releases new 20-franc note

Second ninth-series note showcases Switzerland’s creativity. The Swiss National Bank (SNB) will begin issuing the new 20-franc note on 17 May 2017. It is the second of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice.

Read More »

Read More »

Assemblea generale 2017 (traduzione simultanea in italiano)

Assemblea generale, 28.04.2017 00:00 Jean Studer, presidente del Consiglio di banca della Banca nazionale svizzera 32:40 Thomas Jordan, presidente della Direzione generale della Banca nazionale svizzera

Read More »

Read More »

Assemblée générale 2017 (traduction simultanée en français)

Assemblée générale, 28.04.2017 00:00 Jean Studer, président du Conseil de banque de la Banque nationale suisse 32:40 Thomas Jordan, président de la Direction générale de la Banque nationale suisse

Read More »

Read More »

Generalversammlung 2017 (Simultanübersetzung auf Deutsch)

Generalversammlung, 28.04.2017 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank 32:40 Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank

Read More »

Read More »

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 2017

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 28.04.2017 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank – Jean Studer, président du Conseil de banque de la Banque nationale suisse – Jean Studer, president of the Bank Council of the Swiss National Bank – Jean Studer, presidente del Consiglio di …

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future.

Read More »

Read More »

Gefühlskältester Event des Jahres: Die GV der grössten Zockerin aller Zeiten

Wie jedes Jahr fand auch diese letzte Aprilwoche der wohl gefühlskälteste Grossanlass der Schweiz statt: die Generalversammlung der Schweizerischen Nationalbank (SNB) im alten Casino in Bern. Der Ort „altes Casino“ hätte nicht treffender gewählt sein können von der grössten Zockerin aller Zeiten.

Read More »

Read More »

Weekly SNB Interventions and Speculative Positions: Interventions despite Positive Outcome in France

The centre-left politician Macron has won the French elections. He is a politician that - similar to Hollande four years ago - promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to Hollande. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators, but the SNB had to intervene.

Read More »

Read More »

New 50 Swiss franc note wins international beauty contest

The new 50 franc note, launched last year, was voted the best new bank note in 2016 by the International Bank Note Society, a society founded in 1961. Nearly 120 new banknotes were released worldwide in 2016. The Swiss 50 only narrowly beat the Maldive Islands 1000 Rufiyaa bill, Argentina’s 500 Peso jaguar, and the Royal Bank of Scotland’s 5 Pound first polymer note.

Read More »

Read More »

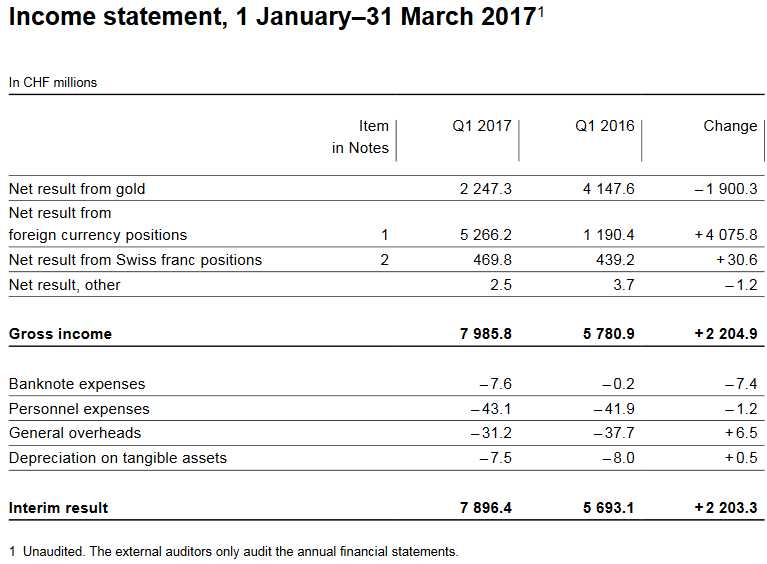

SNB posts 7.9 billion CHF Profit in Q1

The SNB reports a profit of 7.9 bn CHF, of which 2.2 bn come from the gold holdings. Given that the bank has introduced a "minimum euro rate" around 1.06-1.07, this is not very difficult. It comes at the price of continuing interventions.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

Euro gains against Swiss franc on French election result

The official French presidential election results place Emmanuel Macron (23.8%) and Marine Le Pen (21.5%) in first and second places in the first round of the French presidential race. The run off between these two will take place on 7 May 2017, when most forecasters expect Macron to win and become France’s next president.

Read More »

Read More »

Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer will represent Switzerland at the meeting of G20...

Read More »

Read More »

Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before.

Read More »

Read More »

Weekly SNB Interventions and Speculative Positions: Back to 2.4 bn Intervention per Week

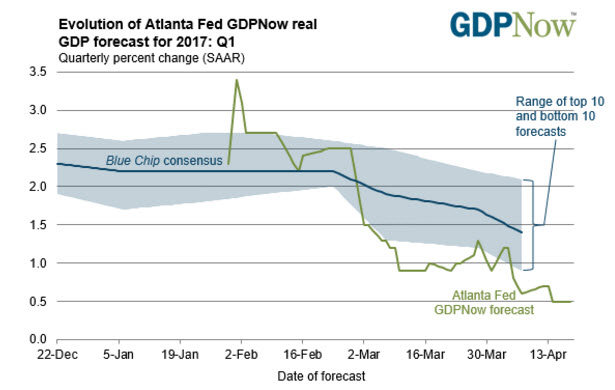

SNB sight deposits changed by 2.4 bn last week, hence the SNB intervened for this amount. This value is a movement back to the weekly intervention trend. We expect a further downtrend of EUR/CHF in the next 2 years.

Read More »

Read More »

End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so,...

Read More »

Read More »

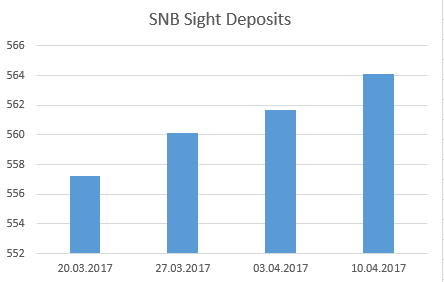

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »