Category Archive: 1) SNB and CHF

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will present this year’s Financial Stability Report. After that, Andréa Maechler will review developments on the financial markets. Finally, we will – as ever – be pleased to take your questions.

Read More »

Read More »

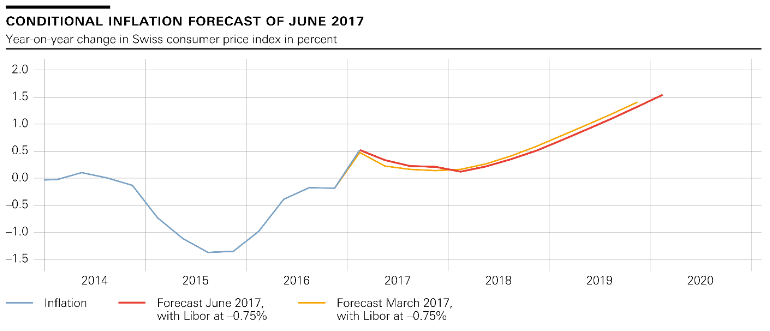

SNB Monetary Policy Assessment June 2017 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

News conference Swiss National Bank 2017, Fritz Zurbrügg

In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will look at the situation of the big banks, focusing on the progress made in implementing the revised ‘too big to fail’ regulations (TBTF2) that came into effect almost a year ago.

Read More »

Read More »

SNB Monetary Assessment June 2017, Introduction

I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically

the establishment of SARON as the leading reference rate for interest rate derivatives and the adoption of a global code of conduct for foreign exchange market transactions.

Read More »

Read More »

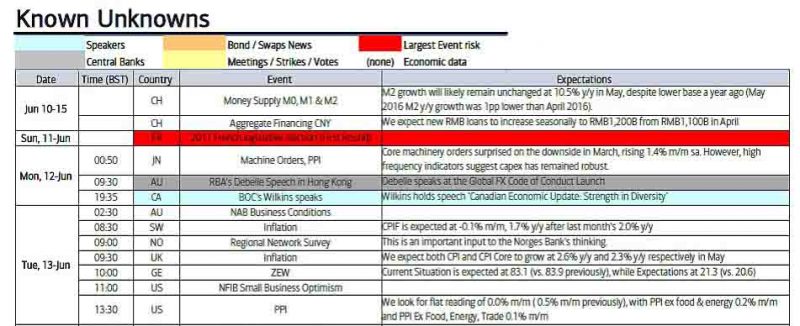

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

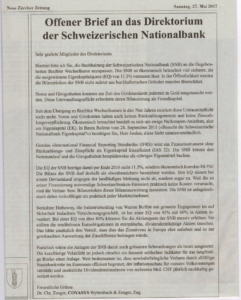

Ist unser Geldsystem etwa doch teuflisch?

In seinem Standpunkt „Wie entsteht Geld“ (Inside Paradeplatz vom 31.5.2017) bekräftigt Marc Meyer seine These, dass die herrschende Geldschöpfungstheorie grundlegend falsch sei, weil sie auf Goethes Mephisto basiere. Schon vor vielen Jahren hat sich Meyer für eine alternative Theorie der Geldschöpfung eingesetzt. Dass er deswegen seine Stelle verlor und ein Leben lang vom Arbeitsmarkt der Banken ausgeschlossen wurde, ist ein Skandal.

Read More »

Read More »

The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that - it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

Read More »

Read More »

Wie entsteht Geld? Nicht so, wie Thomas Jordan uns weismachen will

Technik und Wissenschaften haben sich rasant weiterentwickelt. Nur die Volkswirtschaftslehre ist auf ihrem spätbarocken Niveau sitzengeblieben. Die heutigen Notenbanken betreiben eine spätbarocke Geldpolitik, basierend auf Goethes Faust. Mephisto, der Teufel in Goethes Stück, lügt den König an, er könne einfach Geld drucken und einen Wert darauf schreiben: „Zu wissen sei es jedem, der’s begehrt: Der Zettel hier ist tausend Kronen wert.“ So entstehe...

Read More »

Read More »

Remembering A Still Falling Hero: Small Business

On this holiday weekend known here in the U.S. as Memorial Day, I would like to make a slight turn in the narrative that many give little to no attention too, yet, is one of the most important underlying principles or fundamentals which helped shape, lift, mold, sustain, and create one of the world’s greatest economic powerhouses bar none.

Read More »

Read More »

Strong Swiss franc could be over reckons currency strategist at UBS

Tribune de Genève. After more than two years of a highly overvalued franc, relative to the euro, the currency should ease in the near term reckons Thomas Flury, senior currency strategist at UBS. He expects a euro to be worth 1.14 francs in 6 months and 1.16 within a year.

Read More »

Read More »

Swiss National Bank releases updated banknote app

The Swiss National Bank (SNB) is releasing an app for mobile devices, designed to help the public familiarise themselves with the new banknotes. The app – an updated version of the ‘50-franc’ app launched last year to accompany the issue of the new 50-franc note – is now called ‘Swiss Banknotes’ and can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

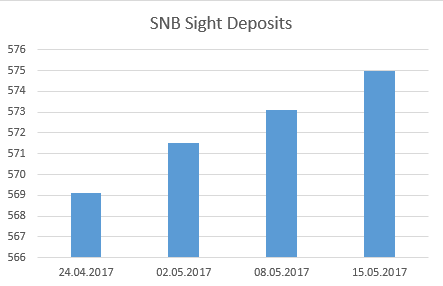

Weekly SNB Interventions and Speculative Positions: More Interventions at higher Euro rate

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

New 20 Swiss franc note officially launched

The Swiss National Bank is the process of issuing new bank notes. A new 50 franc note hit the streets last year. Now it is the new 20 franc note’s turn. Officially launched today, it will enter circulation on 17 May 2017.

Read More »

Read More »

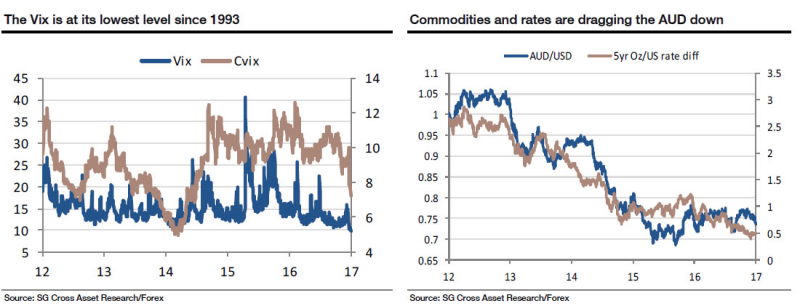

SocGen: Beware The Ghost Of 1993

With Monday's financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen's Kit Juckes with his overnight note, "The ghost of 1993"

Read More »

Read More »

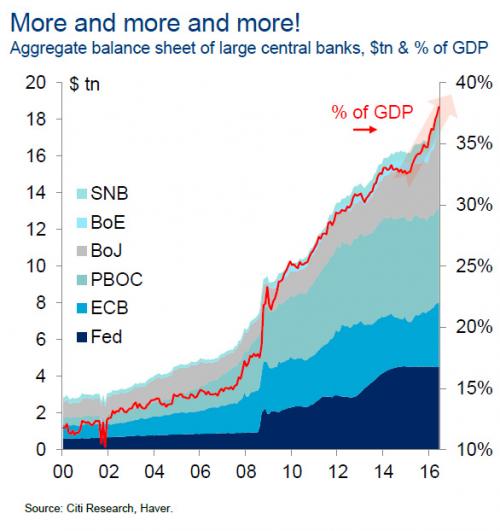

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

Die neue 20-Franken-Note – Impressionen von der Präsentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 20-Franken-Note am 10. Mai 2017 in Bern. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, und Thomas Wiedmer, stellvertretendes Mitglied des Direktoriums der Schweizerischen Nationalbank, stellen die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor.

Read More »

Read More »