Category Archive: 1) SNB and CHF

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

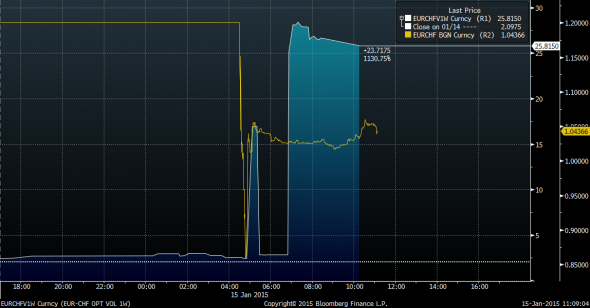

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

Central Europe and the Swiss franc: Currency risk

ANXIETY at the Swiss National Bank’s surprise decision today to drop its peg against the euro was nowhere more evident than in central Europe. The Swiss franc soared against all the region's currencies, including the euro, the Hungarian forint and especially the Polish zloty, and stock exchanges in Poland (pictured) and Hungary dropped sharply.

Read More »

Read More »

The SNB and the Russia/oil connection

A quick post to collate a few side theories on the reasons, justifications and consequences of the SNB move. Simon Derrick at BNY Mellon is first to point out that the euro floor/chf celing was leaving an open door to safe haven flows from Russia by ...

Read More »

Read More »

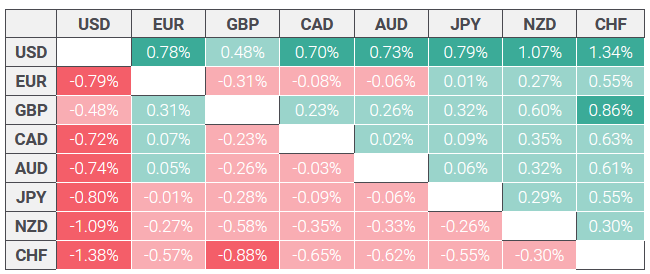

Currencies: Going cuckoo for the Swiss

CURRENCIES don't normally move that far on a daily basis—2 to 3% is a big shift. The exception is when a country on a fixed exchange rate suffers a devaluation; then a 20-30% fall is a possibility. But a 20-30% plus upward move is almost unprecedented. That, however, is what happened to the Swiss franc on January 15th, as Switzerland's central bank abandoned its policy (instituted back in 2011) of capping the currency at Sfr1.20 to the euro.

Read More »

Read More »

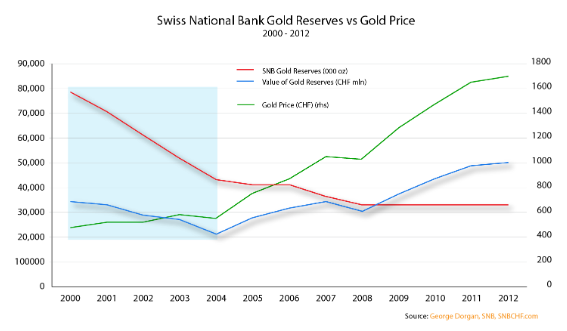

2014 Results: SNB expects profit of CHF 38 billion

The Swiss National Bank reported a profit of CHF 38 billion for the year 2014. They obtained price gains in all asset classes, in bonds, stocks and gold. Interest payments and dividends achieved a yield of 1.7%.

Read More »

Read More »

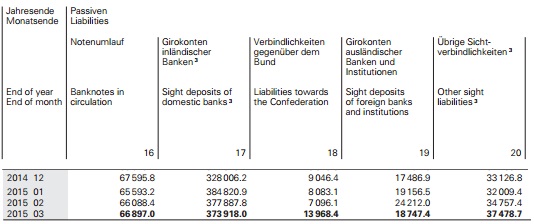

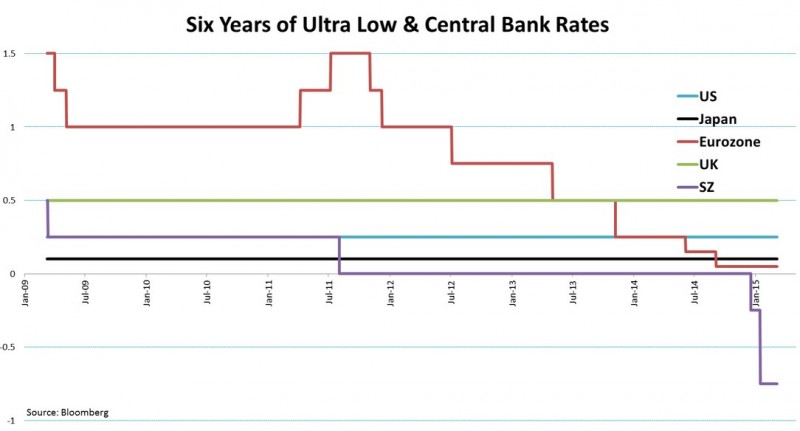

December 2014: SNB Introduces Negative Rates, a Toothless Measure?

The Swiss National Bank has introduced negative interest rates. They apply only to sight deposits in excess of 20 times minimum reserves. Therefore they will affect hardly any bank and can be considered symbolic or even toothless. The view of the SNB is different.

Read More »

Read More »

Setting monetary policy by popular vote: Full of holes

THE Swiss franc is a volatile currency that is fast becoming worthless. That, at least, is what some members of Switzerland’s right-wing People’s Party (SVP) would have you believe. Thanks to the SVP, Switzerland will vote on November 30th on a radical proposal to boost the central bank’s gold reserves. Bigger reserves, activists argue, will make the Swiss economy more stable and prosperous. In fact the opposite is true.

Read More »

Read More »

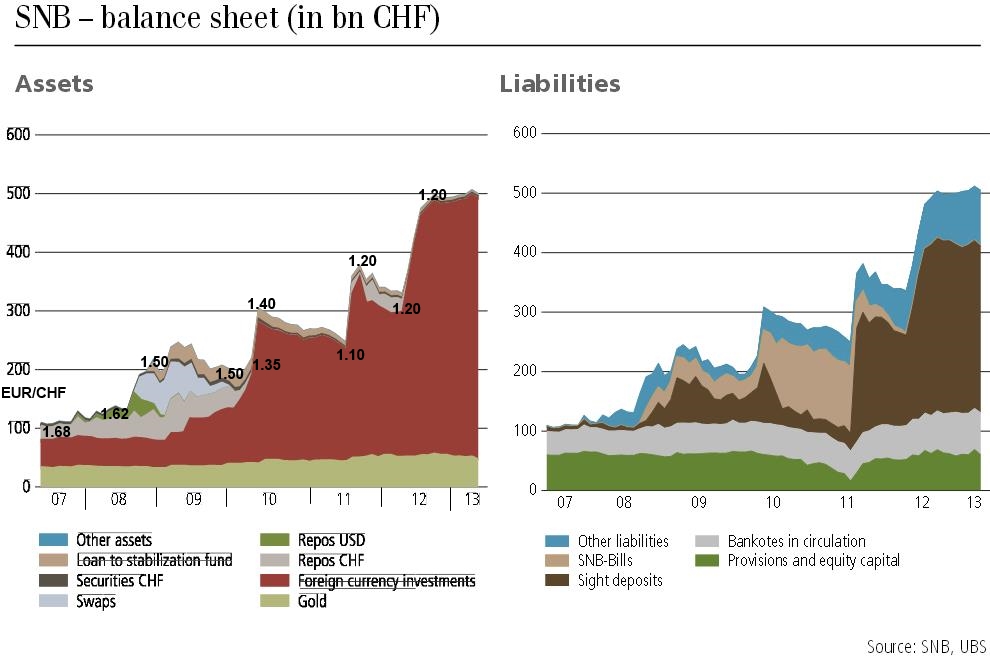

Keith Weiner: SNB Must Keep Euro over 1.20 To Avoid Losses of Swiss Banks

The recognized Austrian economist Keith Weiner and the Wall Street Journal argue that the SNB must keep the euro over 1.20 in order maintain stability in the Swiss banking system. A rapid appreciation of the franc would create losses on the balance sheet of Swiss banks.

Read More »

Read More »

History of SNB Interventions

High inflows of around 400 billion francs between 2009 and 2012 in the Swiss balance of payments could only be countered with an increase in reserve assets and interventions by the Swiss National Bank. This number is far higher than the one seen during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF). We look at the detailed history of...

Read More »

Read More »

Things That Make You Go Hmmm: This Little Piggy Bent The Market

About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm. You may detect some measure of surprise in my words, and the reason for that is quite simple: Luzi Stamm is a politician; and, as regular readers will know, I am no fan of that particular class.

Read More »

Read More »

Sept 2014, George Dorgan at the CFA Society: Predicted End of EUR/CHF Peg

George Dorgan held a presentation at the CFA society in Zurich on September 1. The subjects of his speech were:

Reasons why the EUR/CHF exchange rate will fall under 1.20 once the deflationary pressures in Europe have ended

The missing link in the CFA program between its chapters on micro-economy, macro and currencies

Does history repeat? From Bretton Woods to Bretton Woods 2 and its slow end. Why the unexpected, the black swan happens more...

Read More »

Read More »

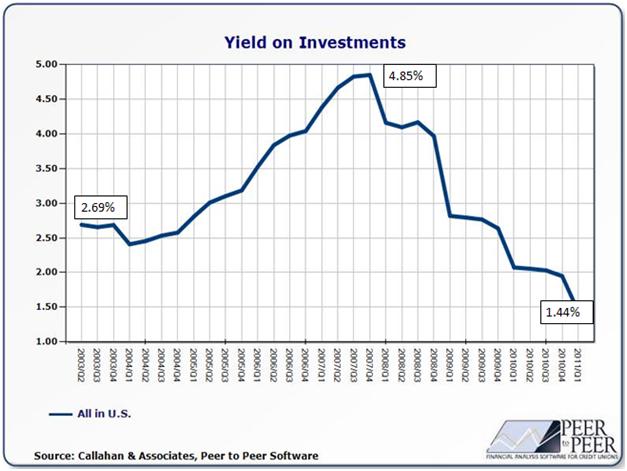

Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

Will the SNB be able to survive an upturn in inflation: We focus on income and yields for foreign exchange position and gold and find out if the SNB makes enough income to survive a franc appreciation.

Read More »

Read More »

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »

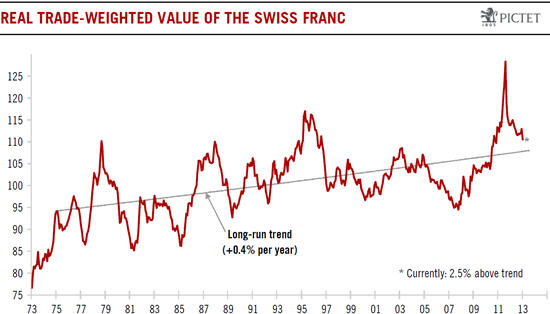

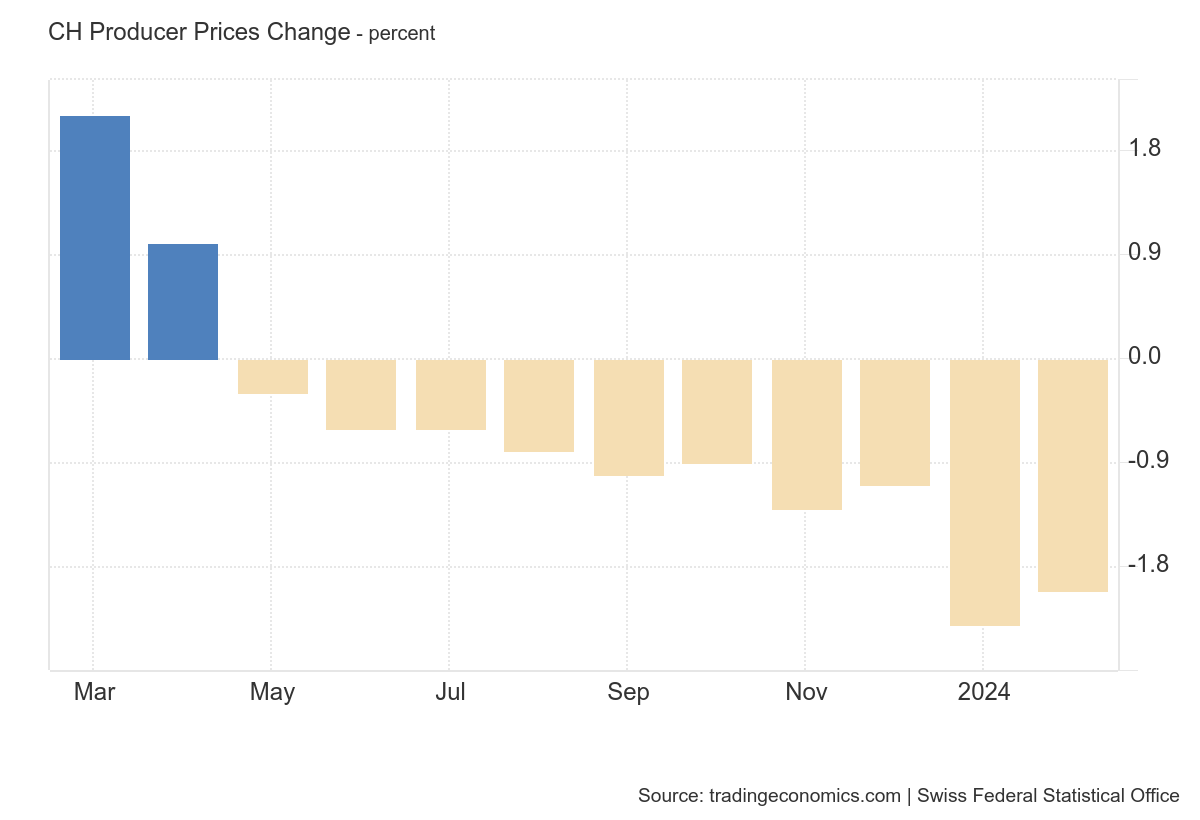

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

-638453232816314704.png)