Category Archive: 1) SNB and CHF

Trilogie des Fiatgeldes (II): Das fraktionelle Reservesystem, die Mutter aller Finanzkrisen und die Quelle der Ohnmacht der Notenbanken

Genial aus der Sicht der Banken war, dass sie das fraktionelle Reservesystem in das Zeitalter des FED hinüberretten konnten – sie waren selber erstaunt, dass ihnen dies gelang und der Geniestreich nur von einigen wenigen Senatoren und Beobachtern durchschaut wurde. So konnten sie ihr eigenes Buchgeld weiterhin emittieren und dies einzig und allein mit dem Versprechen, es jederzeit in Bargeld umzutauschen.

Read More »

Read More »

La FINMA s’inquiète de la cybersécurité en Suisse

La FINMA s’inquiète de la cybersécurité en Suisse Le directeur Mark Branson a plaidé en faveur de la création d’un centre national de compétences, soulignant le retard pris par la Suisse. SUBSCRIBE : https://goo.gl/gpUXB1

Read More »

Read More »

FINMA sees risk of money laundering in blockchain world

Digitalization and innovation in financial services entail new risks in new guises. That’s where the Swiss Financial Market Supervisory Authority, or FINMA, comes in. CNNMoney Switzerland’s Andreas Hohn spoke to FINMA director Mark Branson about blockchain technology, ICOs, money laundering and more. https://www.cnnmoney.ch/shows/living-markets/videos/blockchain-world-finma-sees-certain-risks-money-laundering

Read More »

Read More »

Postfinance und Finma im Clinch

Postfinance und Finma im Clinch Der Finanzdienstleister und die Finanzmarktaufsicht haben eine Meinungsverschiedenheit darüber, wie mit dem Risiko einer Zinsänderung umzugehen ist. SUBSCRIBE : https://goo.gl/ZUx557

Read More »

Read More »

Swiss central bank records huge profits after franc slide

The Swiss National Bank (SNB) was less active on the foreign exchange markets last year, acquiring CHF48.2 billion ($50.8 billion) in foreign currency to weaken the franc. On Thursday, the central bank nonetheless confirmed massive profits on currency holdings in 2017. In 2017, the SNB purchased CHF48.2 billion in foreign currency to stop the Swiss franc appreciating – down from CHF67.1 billion in 2016.

Read More »

Read More »

FINMA Guidelines and ICO Regulation in Switzerland | Fabien Gillioz, Ochsner & Associés | Law Firm

Watch Tokenestate.io legal advisor Fabien Gillioz of Ochsner & Associés present to a full house at Fusion in Geneva, Switzerland. Learn about ICO and Crypto regulation in Switzerland. Visit our website https://tokenestate.io for more information on our product. Join our Telegram on https://t.me/tokenestate to chat with our team and our awesome community.

Read More »

Read More »

„Vollgeld“ ist rotester Kommunismus – lanciert vom Ausland

Schuldfrei“ – so soll unser Geld zukünftig in Umlauf kommen. Das Wort „schuldfrei“ ist positiv besetzt. Wer möchte nicht schuldfrei sein? Jedermann. „Schuldfrei“ ist das zentrale Wort im Initiativtext der kommenden Vollgeld-Initiative, über die das Schweizervolk am 10. Juni 2018 abstimmen wird. Die Initiative kommt daher wie der Wolf im Schafspelz. Absatz 3 des Initiativtextes besagt.

Read More »

Read More »

BNS; les liquidités des banques suisses au service du QE de la communauté monétaire internationale

La BNS s’est arrimée à l’euro en 2011 sous le prétexte de soutenir les exportateurs suisses.Ce serait donc la raison de sa transformation en hedge fund. De notre côté, nous avons toujours soutenu depuis 2011 qu’elle n’avait fait que suivre ses collègues dans la pratique du quantitative easing, dans le but de soutenir les grandes banques et autres hedge funds, en les déchargeant de leurs créances publiques à haut risque.

Read More »

Read More »

Le regole svizzere per Initial Coin Offering

Vediamo cosa ha detto la FINMA sulle Initial Coin Offering. Se volete approfoindire qui trovate l’articolo: https://nextgenerationcurrency.com/tokens-finma-ico/ e qui un approfondimento precedente: https://www.blockchain4innovation.it/…/ico-initial-coin-of…/ #avvmax #ico #crypto #svizzera

Read More »

Read More »

New CHF200 banknote to be introduced in August

The Swiss National Bank (SNB) has announced that the latest addition to the new banknote series – the CHF200 note ($209) - will go into circulation on August 22. The brown note’s key motif will be physical matter. It will “showcase Switzerland’s scientific expertise”, the SNB said a press release on Monday.

Read More »

Read More »

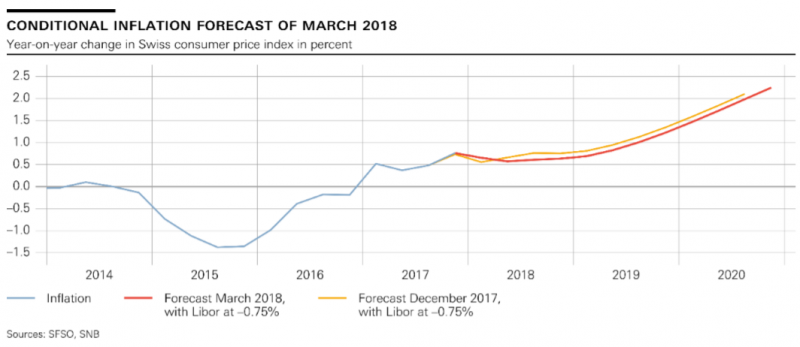

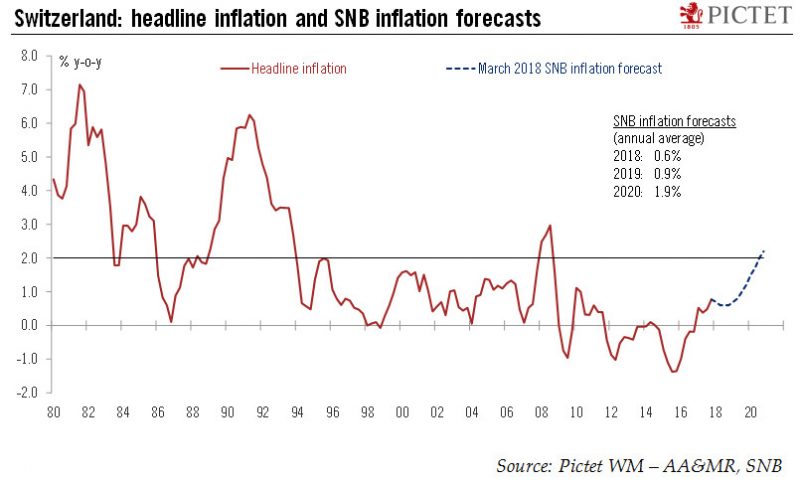

SNB Monetary policy assessment of 15 March 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Too early for Switzerland’s central bank to change policy…

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

FINMA Guidelines for ICOs | Fabien Gillioz & Alexandre de Boccard | Token Estate

Fusion had the pleasure of hosting TokenEstate, for a presentation concerning the Launch of FINMA regulations concerning ICOs, the fast evolving field of Cryptosecurities and regulated instruments intermediated through the blockchain. In this talk, Fabien Gillioz, and Alexandre de Boccard, Partners at Ochsner & Associés, will discuss the recent FINMA’s ICO guidelines. This meetup was …

Read More »

Read More »

ICO Regulation in Switzerland in a Nutshell

Dr. Andreas Glarner, Partner at the MME Crypto Team, provides a high level overview on how Switzerland’s regulator FINMA assesses ICOs / TGEs based on the guidelines recently published. Learn about the different token models (payment/currency, utility, asset) and their regulatory treatment during the different stages of your project. Further, understand which ones qualify as …

Read More »

Read More »

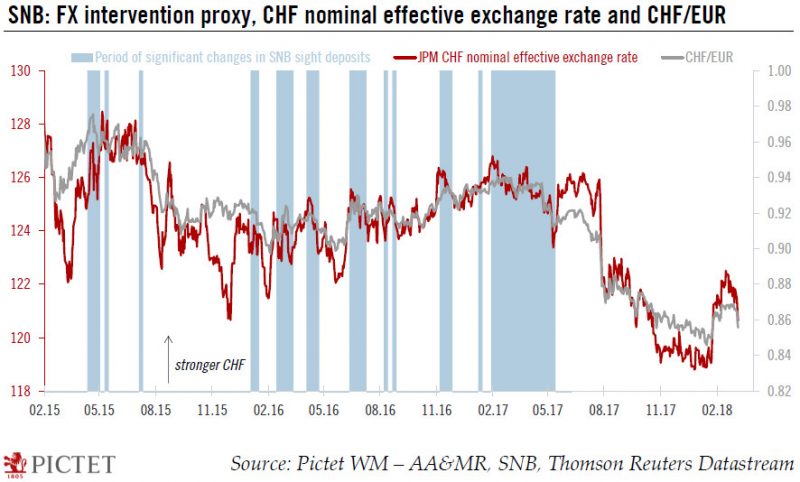

Europe chart of the week – SNB FX intervention

In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB.

Read More »

Read More »

SNB confirms record profit for 2017

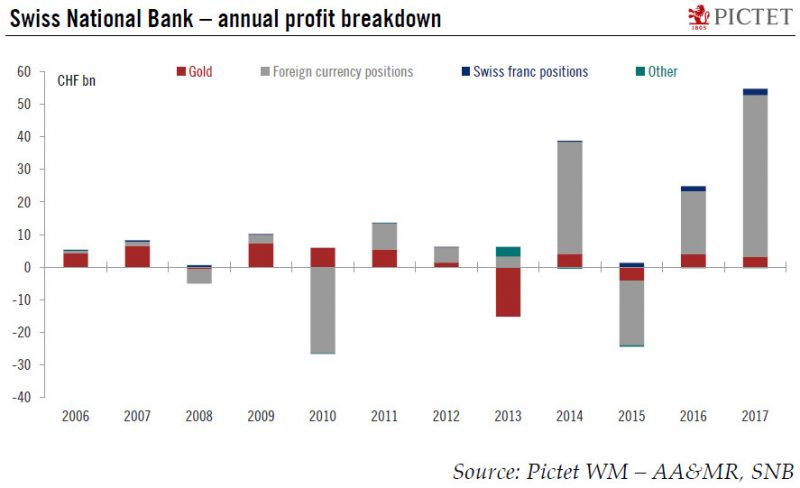

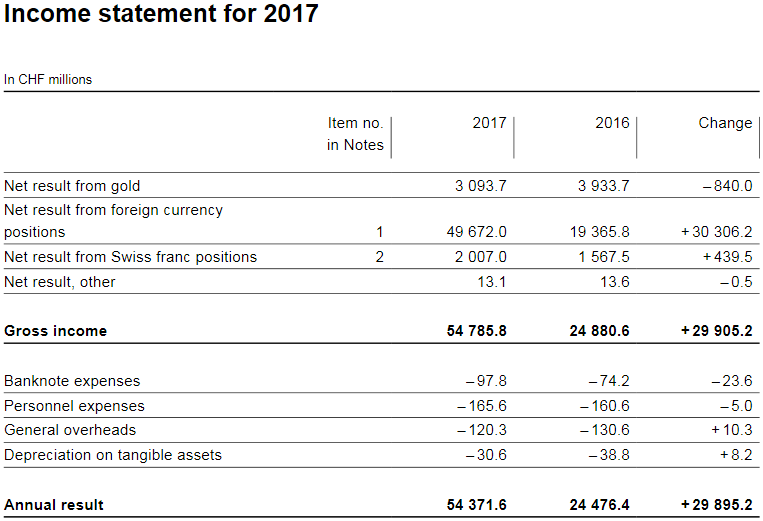

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below).

Read More »

Read More »

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

Swiss Regulator FINMA: AML, Securities Laws To Apply To Some ICOs

Swiss Regulator FINMA: AML, Securities Laws To Apply To Some ICOs Adam Reese February 16, 2018 10:20 PMFebruary 16, 2018 10:20 PMSwitzerland’s FINMA has issued guidelines stating that some ICOs will be subject to securities regulation and others to anti-money launde… ************************************* Thank fof watching. Don’t forget subscriber my channel.

Read More »

Read More »

CRYPTO NEWS #061 || Bittrex, Etherecash (ECH), Switzerland (FINMA), Credits ICO, Atari, GARMAN .

IMPORTANT Updates BITTREX EXCHANGE, ETHERECASH ECH, SWITZERLAND FINMA, CREDIT ICO, ATARI GAMING COMPANY, GARMAN SURVEY, U.S. STATES. ❤ Donation for humanity ❤ Paytm – 9568219897 Bitcoin Address- 18Dp4b8FqfJdBwrasSDN9fsCPobH67UVZU Ethereum Address- 0xC6C4966A3Cd0029273c0089841dB677D2E5942Db Bitcoin Cash- 1JV86mqjdVsiKDeVY1qxz9cUPTZ9SFfN7m ?Make Account on Top Exchnages? Binance Exchnage- https://goo.gl/Tpwsyk Cryptopia Exchange –...

Read More »

Read More »