Category Archive: 1) SNB and CHF

“Darum schadet Vollgeld der Schweiz”, Referat – Conférence – Speech – Discorso, 03.05.2018

Referat Thomas Jordan – Conférence de Thomas Jordan – Speech by Thomas Jordan – Discorso di Thomas Jordan, “Darum schadet Vollgeld der Schweiz”, 03.05.2018

Read More »

Read More »

Will the SNB raise interest rates?

The Swiss National Bank (SNB) could be moving forward in their process of raising interest rates according to current reports with the previous Q4 2019 hike predicted to become reality in Q3. This minor shift in expectations is positive for the Swiss Franc and gives the market some news to be targetting and assessing in deciding the value of the CHF.

Read More »

Read More »

BNS, Initiative Monnaie Pleine veut lui donner les pleins pouvoirs

L’initiative «Monnaie pleine», qui sera soumise au peuple le 10 juin prochain, entend radicalement transformer le système bancaire suisse. Si elle est acceptée, la BNS obtiendrait les pleins pouvoirs. Décryptage des risques et des enjeux. L’initiative «Monnaie pleine», sur laquelle le peuple sera appelé à se prononcer le 10 juin prochain, demande que seule la Banque nationale suisse (BNS) puisse émettre de la monnaie.

Read More »

Read More »

La question de Monnaie pleine induit-elle le votant en erreur?

Le peuple suisse doit, le 10 juin 2018, répondre à cette question: Acceptez-vous l’initiative populaire « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la Banque nationale ! (Initiative Monnaie pleine). Le oui à la question sous-entend que ce concept monétaire garantit la monnaie suisse et les avoirs bancaires d’une part, et d’autre part que l’ensemble des avoirs bancaires relèvent de la banque centrale.

Read More »

Read More »

Why sovereign money would hurt Switzerland?

Ladies and gentlemen Today, the Swiss Institute of Banking and Finance at the University of St. Gallen celebrates its 50th anniversary. Let me extend my sincere congratulations on reaching this milestone. Our financial system has evolved steadily over the past five decades. In the early years of the institute, the world was still dominated by … Continue reading »

Read More »

Read More »

Trilogie des Fiatgeldes (III): Vollgeld ist reines Staatsgeld und somit längst erprobt

Als Abraham Lincoln (1809-1865) zur Finanzierung des „American Civil War“ bei den Banken um Kredit nachsuchte, sah er sich mit Zinsen von 24 bis 36% konfrontiert. Lincoln sträubte sich gegen solchen Zinswucher und suchte nach einer anderen Lösung. Sie kam von Colonel „Dick“ Taylor, einem Geschäftsmann aus Illinois. „Just get to Congress to pass a bill authorizing the printing of full legal tender treasury notes

Read More »

Read More »

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 2018

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 27.04.2018 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank – Jean Studer, président du Conseil de banque de la Banque nationale suisse – Jean Studer, president of the Bank Council of the Swiss National Bank – Jean Studer, presidente del Consiglio di …

Read More »

Read More »

Generalversammlung 2018 (Simultanübersetzung auf Deutsch)

Generalversammlung, 27.04.2018 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank 35:50 Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank

Read More »

Read More »

Assemblée générale 2018 (traduction simultanée en français)

Assemblée générale, 27.04.2018 00:00 Jean Studer, président du Conseil de banque de la Banque nationale suisse 35:50 Thomas Jordan, président de la Direction générale de la Banque nationale suisse

Read More »

Read More »

Assemblea generale 2018 (traduzione simultanea in italiano)

Assemblea generale, 27.04.2018 00:00 Jean Studer, presidente del Consiglio di banca della Banca nazionale svizzera 35:50 Thomas Jordan, presidente della Direzione generale della Banca nazionale svizzera

Read More »

Read More »

Konjunktur, Geldpolitik und eine riesige Bilanzsumme

Die Schweizer Konjunktur brummt wie schon lange nicht mehr. Vor allem zeigt der kürzlich publizierte Bericht der Seco-Expertengruppe, dass die Erholung auf breiter industrieller Basis stattfindet. Der Frankenschock von 2015 ist definitiv überwunden.

Read More »

Read More »

“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB.

Read More »

Read More »

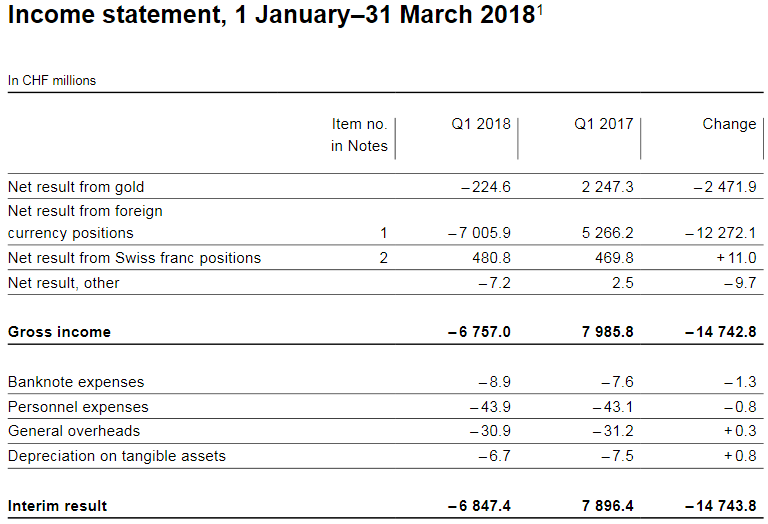

SNB loses 6.8 billion in Q1/2018

The Swiss National Bank (SNB) reports a loss of CHF 6.8 billion for the first quarter of 2018. A valuation loss of CHF 0.2 billion was recorded on gold holdings. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

Read More »

Read More »

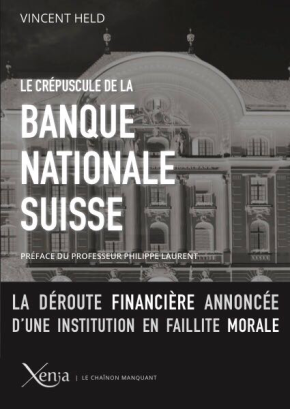

BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice

L’endettement et la spéculation sont au coeur de la stratégie de la BNS. On met quand et comment le stop? Il semblerait que la BNS fasse des pertes sur ce premier trimestre 2018 de 5 milliards. Une paille au vu de ce que nous pourrions craindre pour l’avenir. Mais le scoop n’est pas là. Il est dans la composition des causes de cette perte. Une des causes est révélatrice des mensonges des « experts » et de leurs relais un peu partout.

Read More »

Read More »

Weakening franc approaches symbolic mark

As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the number of francs needed to buy another currency signals a weaker franc, and vice versa if the exchange rate declines.

Read More »

Read More »

Monnaie pleine… ou monnaie vide?

Dans cette contribution critique de l’initiative, l’auteure souligne l’insuffisance totale de gages ou richesses tangibles pour couvrir la production massive d’une «monnaie centrale».

Read More »

Read More »

Elektronisches Zentralbankengeld hat Vorteile

Die Schweizerische Nationalbank hat dem E-Franken eine Absage erteilt – zu Unrecht, sagt Dirk Niepelt im Interview mit finews.ch. Der Direktor des SNB-nahen Studienzentrums Gerzensee erklärt, warum digitales Geld Vorteile bringt. Vergangene Woche hat sich Andréa Mächler, Mitglied des dreiköpfigen Direktoriums der Schweizerischen Nationalbank (SNB), kritisch zur Einführung eines elektronischen Frankens durch die SNB geäussert, wie auch finews.ch...

Read More »

Read More »

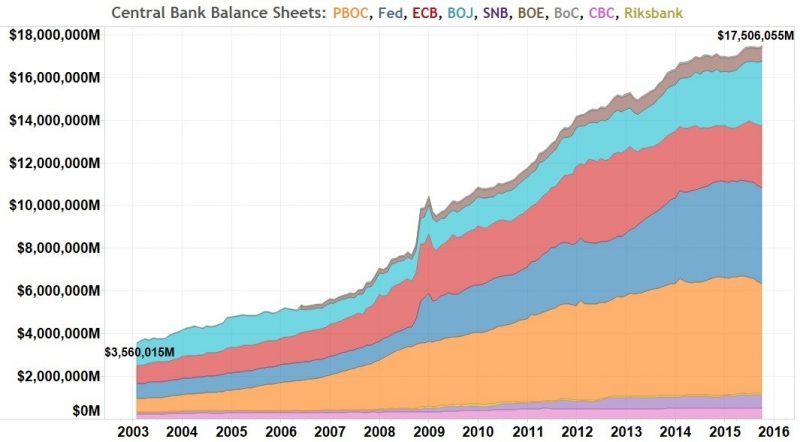

Création monétaire: Entente illégale entre banques centrales et commerciales sur fond de silence politique

Création monétaire: Entente illégale entre banques centrales et commerciales sur fond de silence politique. Les crises permanentes du marché financier ont permis, aux banques centrales qui comptent, de justifier des programmes communs de quantitative easing. Cela consiste en une transformation de la monnaie bancaire scripturale en centrale, passée en mains des banques centrales. Ainsi, celles-ci offrent au marché de la haute finance un socle...

Read More »

Read More »

Vers une décroissance inéluctable

Nous avertissons depuis quelques années sur les risques de récession. La déflation de la BNS qui s’est installée en 2011 en était un indicateur avancé. Le risque d’un effondrement global de l’économie ne peut être exclu pour les temps à venir.

Read More »

Read More »

Trilogie des Fiatgeldes (II): Das fraktionelle Reservesystem, die Mutter aller Finanzkrisen und die Quelle der Ohnmacht der Notenbanken

Genial aus der Sicht der Banken war, dass sie das fraktionelle Reservesystem in das Zeitalter des FED hinüberretten konnten – sie waren selber erstaunt, dass ihnen dies gelang und der Geniestreich nur von einigen wenigen Senatoren und Beobachtern durchschaut wurde. So konnten sie ihr eigenes Buchgeld weiterhin emittieren und dies einzig und allein mit dem Versprechen, es jederzeit in Bargeld umzutauschen.

Read More »

Read More »