Category Archive: 1) SNB and CHF

Scotia says evidence points to Swiss National Bank intervening in CHF

FX strategist at Scotiabank cites the relative stability of EUR/CHF (above and around 1.06) in the past two weeks while turmoil in markets elsewhere.

Read More »

Read More »

Trois plans d’urgence sur cinq insuffisants, estime la Finma

mardi, 25 février 2020 Trois plans d’urgence sur cinq insuffisants, estime la Finma | Sky Suisse Finance Les plans d'urgence en cas d'insolvabilité des établissements systémiques Postfinance, Raiffeisen et Banque cantonale de Zurich ne sont pour l'heure pas encore exécutables, estime l'Autorité fédérale de surveillance des marchés financiers (Finma). En revanche, ceux d'UBS et Credit …

Read More »

Read More »

2019: Wertpapierdepots klettern um fast eine Billion Franken

Aktiendepots bei Schweizer Banken befinden sich auf Rekordniveau (Bild: shutterstock)Ende 2019 erreichte der Wertschriftenbestand in den Depots der Schweizer Banken laut den neuesten Daten der Schweizerischen Nationalbank SNB einen neuen Rekordstand von 6,72 Bio. Fr. Die Zunahme belief sich auf fast eine Bio. Franken.

Read More »

Read More »

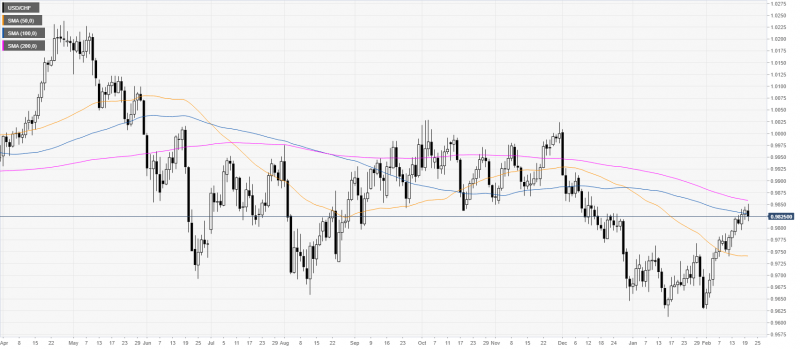

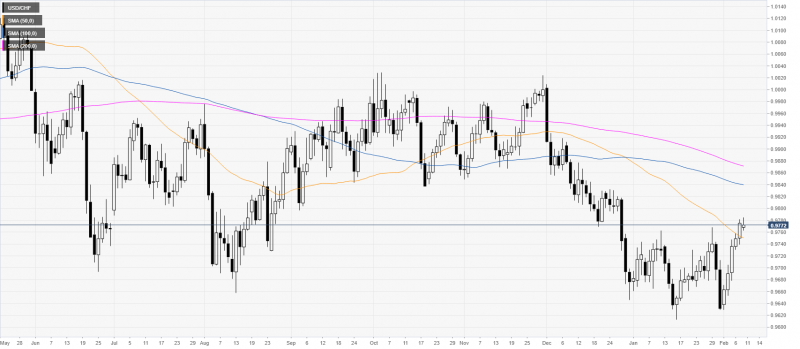

USD/CHF New York Price Analysis: Dollar eases from session highs, trades below 0.9830 vs. Swiss franc

USD/CHF prints another 2020 high and retraces down in the New York session. Bears are challenging the 0.9830 level. After hitting yet again a new 2020 high, USD/CHF is easing from session highs. The spot is trading below the 200-day simple moving averages suggesting an overall bearish momentum in the long term.

Read More »

Read More »

2020-02-17 – The SNB’s Karl Brunner Distinguished Lecture Series: Carmen Reinhart to hold fifth lecture

The Swiss National Bank is honouring Carmen Reinhart with this year’s Karl Brunner Distinguished Lecture Series. Carmen Reinhart is an influential economist who has made outstanding contributions to macroeconomics. She has been Professor of the International Financial System at Harvard Kennedy School since 2012, and also currently serves on the Economic Advisory Panel of the Federal Reserve Bank of New York.

Read More »

Read More »

Ein rationaler Erklärungsansatz für negative Zinsen

In einem Beitrag auf LinkedIn am 29. Dezember 2019 wirft Prof. Erwin Heri von der Universität Basel in die Runde, dass negative (Real-)Zinsen möglicherweise vernünftig sind. Sie wären das natürliche Ergebnis der Präferenzen der Wirtschaftssubjekte – und nicht primär das Ergebnis einer Manipulation von Zentralbanken.

Read More »

Read More »

“ECB Is Worst-Run Central Bank In The World” – Felix Zulauf Sees 30percent Plunge In US Stocks “Taking The World With It”

Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond.

Read More »

Read More »

Devisen: Euro stabilisiert sich nach neuem Tief seit fast drei Jahren

Derweil hält die Schwäche des Euro zum Franken weiter an. Aktuell notiert der Euro zwar mit 1,0634 wieder etwas höher als am frühen Morgen, als die Einheitswährung bei 1,0609 das Tagestief erreicht hatte. Unterhalb von 1,06 Franken hat die Gemeinschaftswährung letztmals im Sommer 2015 notiert. Der Dollar kostet aktuell etwas mehr mit 0,9807 Franken.

Read More »

Read More »

EUR/CHF: SNB does not find love in prices – Rabobank

The Swiss National Bank (SNB) has the mandate to maintain CPI inflation near 2% on a yearly basis but is currently running at just 0.2%. CHF’s strength is not welcomed by SNB, economists at Rabobank reports.

Read More »

Read More »

USD/CHF Price Analysis: Greenback grinding up vs. Swiss franc, clings to 2020 highs

USD/CHF is slowly advancing printing fresh 2020 highs by a few pips. The rising wedge formations can limit the upside on USD/CHF. USD/CHF is printing new 2020 highs while the quote is trading below the 100/200-day simple moving averages suggesting an overall bearish momentum.

Read More »

Read More »

Création d’une page dédiée à la Monnaie

Cet post a pour but de vous informer de la création d’une page dédiée à la Monnaie. Vous la trouverez à cette adresse: https://lilianeheldkhawam.com/monnaie-dossier/ Monnaie et globalisation marchent main dans la main. Elles sont intimement liées à l’avènement du Nouveau Monde.

Read More »

Read More »

USD/CHF Price Analysis: Rising wedge can halt the bulls

USD/CHF created a rising wedge pattern suggesting potential exhaustion in the medium term. The level to beat for bears is the 0.9770 support. USD/CHF is pulling back down slightly from the 2020 highs while reintegrating Friday’s range. The spot is trading below the 100/200-day simple moving averages suggesting an overall bearish bias.

Read More »

Read More »

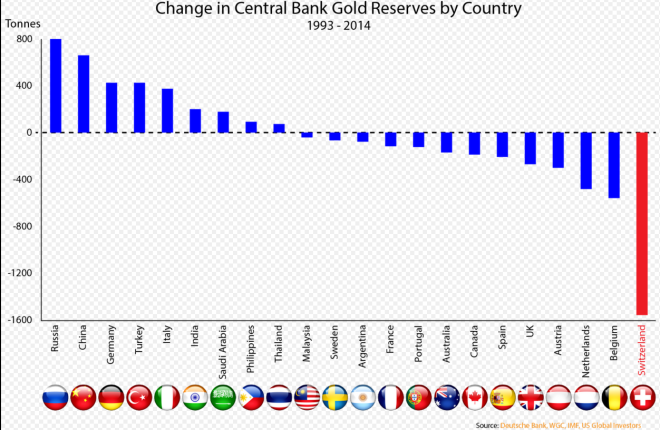

L’or de la Banque Nationale suisse

Note: Ce post est une erreur. Son contenu correspond en fait à la page dédiée à l’or suisse de la banque centrale. https://lilianeheldkhawam.com/lor-de-la-banque-nationale-suisse/ Cette erreur est intervenue dans le cadre de la création de la page sur la Monnaie, que je vous invite à visiter ici: https://lilianeheldkhawam.com/monnaie-dossier/

Read More »

Read More »

Cérémonie symbolique de remise du billet de 100 francs

Cérémonie de remise symbolique du billet de 100 francs à Ayent, le 12 septembre 2019

Orateurs:

Thomas Jordan, président de la Direction générale de la Banque nationale suisse

Marco Aymon, président de la Commune d’Ayent

Gustave Savioz, président du Consortage du Grand Bisse d’Ayent

Roberto Schmidt, président du Conseil d’Etat du Canton du Valais

Animation:

Romaine Jean

Read More »

Read More »

Cérémonie symbolique de remise du billet de 100 francs

Cérémonie de remise symbolique du billet de 100 francs à Ayent, le 12 septembre 2019 Orateurs: Thomas Jordan, président de la Direction générale de la Banque nationale suisse Marco Aymon, président de la Commune d’Ayent Gustave Savioz, président du Consortage du Grand Bisse d’Ayent Roberto Schmidt, président du Conseil d’Etat du Canton du Valais Animation: …

Read More »

Read More »

Grossbanken – Fünf valable Kandidaten für Rohner-Nachfolge als CS-Präsident

Nach der Absetzung von Tidjan Thiam als operativer Chef der Credit Suisse wurde von verschiedenen Seiten auch gefordert, dass VR-Präsident Urs Rohner bereits auf die kommende Generalversammlung hin seinen Hut nimmt, so etwa vom Stimmrechtsberater Ethos. Rohner will sich aber an der kommenden GV von Ende April für ein letztes Jahr noch einmal wählen lassen.

Read More »

Read More »

Credit Spy: Ende gut, alles gut?

Was ist es, was uns im Falle des Überwachungsskandals der CS so stark verstört hat? Mir fallen drei Punkte auf. Erstens die Tatsache, dass die Schweizer Grossbank offensichtlich einen eigenen internen geheimen Überwachungsdienst unterhält, der Arbeitnehmer auch ausserhalb des Arbeitsplatzes und ihrer Arbeitszeiten überwacht respektive bespitzelt.

Read More »

Read More »

USD/CHF trades at fresh 2020 highs above 0.9760 ahead of NFP

CHF struggles to find demand as a safe-haven on Friday. US Dollar Index pushes higher above the 98.50 mark. Nonfarm Payrolls in US is expected to come in at 160K in January. The USD/CHF pair closed the last four trading days in the positive territory and continued to edge higher on Friday to touch its best level since December 27th at 0.9772.

Read More »

Read More »

Is the SNB In Control of the Amount of Sight Deposits?

The current monetary environment in Switzerland is as far from ordinary as can be imagined: negative interest rates (from -0.75% in the short term to -0.25% for 50Y govt bonds) and oceans of liquidity (M0 has grown to 50% of M3 from pre-crises levels of around 8%).

Read More »

Read More »

USD/CHF Price Analysis: Greenback approaching January highs vs. Swiss franc

USD/CHF created a strong bullish recovery while nearing the 2020 highs. The level to beat for bulls is the 0.9770 resistance. USD/CHF is attempting to form a base near multi-month lows while trading below the main daily simple moving averages.

Read More »

Read More »