Category Archive: 1) SNB and CHF

Romeo Lacher and Christoph Mäder nominated for election to the SNB Bank Council

At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd.

Read More »

Read More »

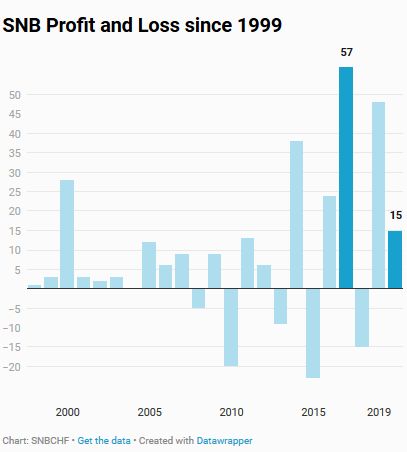

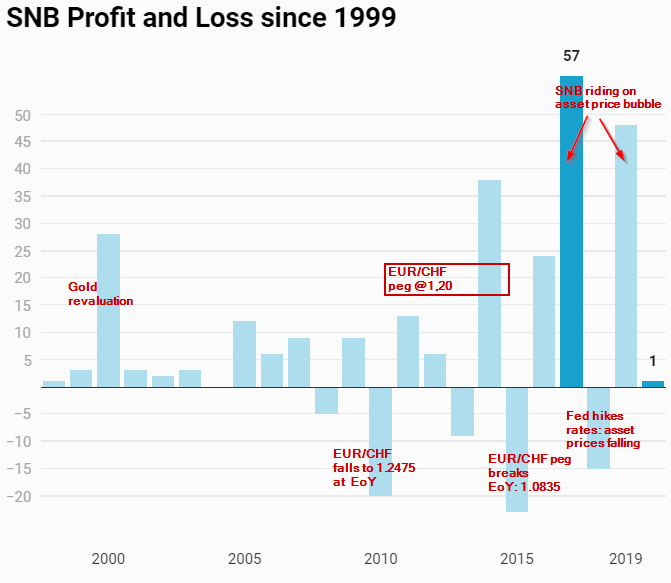

SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The Swiss National Bank reports a profit of CHF 15.1 billion for the first three quarters of 2020. We explain why these profits are possible.

Read More »

Read More »

2020-10-30 – Swiss Financial Accounts: quarterly data published for first time

The Swiss National Bank is expanding its data offering with respect to Switzerland’s financial accounts. It will now publish quarterly as well as annual data, and the time to publication will be shortened from ten to four months.

Read More »

Read More »

FINMA-Aufsichtsmitteilung 08/2020: LIBOR-Ablösung im Derivatebereich

Die Eidgenössische Finanzmarktaufsicht FINMA empfiehlt den von der LIBOR-Ablösung betroffenen Beaufsichtigten, das neue Rückfallprotokoll der International Swaps and Derivatives Association (ISDA) frühestmöglich zu unterschreiben.

Read More »

Read More »

Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 3 der Verordnung vom 27. August 2014 über Massnahmen zur Vermeidung der Umgehung internationaler Sanktionen im Zusammenhang mit der Situation in der Ukraine (SR 946.231.176.72) publiziert.

Read More »

Read More »

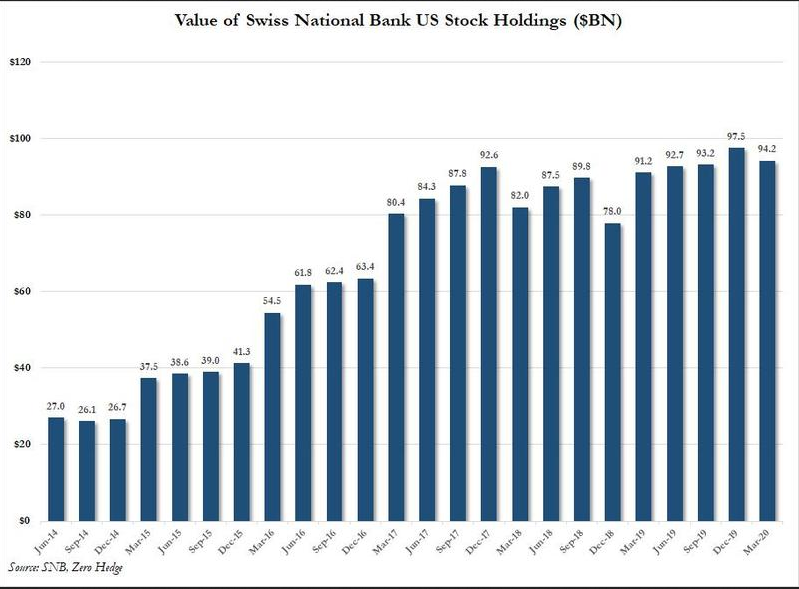

Swiss National Bank intervenes heavily to weaken Swiss franc

Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020.

Read More »

Read More »

Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements

Seven central banks and the BIS release a report assessing the feasibility of publicly available CBDCs in helping central banks deliver their public policy objectives. Report outlines foundational principles and core features of a CBDC, but does not give an opinion on whether to issue.

Read More »

Read More »

Swiss National Bank figures show burst of franc-dousing interventions

The Swiss National Bank (SNB) spent CHF90 billion ($97.8 billion) in the first half of the year, more than it has spent in the past three years combined, to hold down artificially the value of the wealthy alpine state’s currency.

Read More »

Read More »

How much blockchain does the financial world need?

Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word.

Read More »

Read More »

Adjustments to publication of data on money and foreign exchange market operations

Additional data on money market operations and more frequent publication of volume of foreign exchange market interventions

Read More »

Read More »

FINMA rügt Bank SYZ wegen Verstössen in der Geldwäschereibekämpfung

Die Eidgenössische Finanzmarktaufsicht FINMA hat in einem Enforcementverfahren festgestellt, dass die Bank SYZ SA gegen die Geldwäschereibestimmungen verstossen hatte. Die Verstösse erfolgten im Kontext einer sehr bedeutenden Geschäftsbeziehung mit einem Kunden aus Angola.

Read More »

Read More »

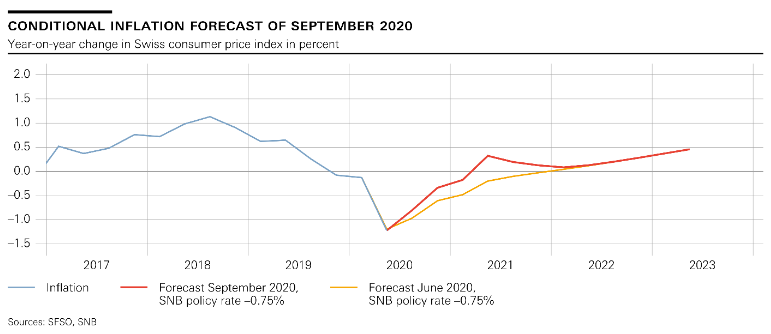

Monetary policy assessment of 24 September 2020

The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation.

Read More »

Read More »

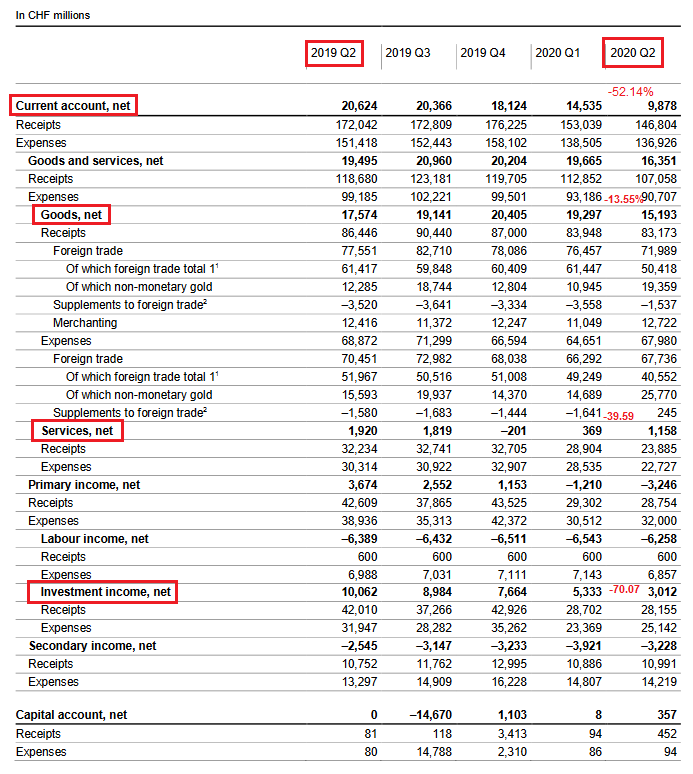

Swiss balance of payments and international investment position: Q2 2020

In the second quarter of 2020, the current account surplus amounted to CHF 10 billion; in the same quarter of 2019 it was CHF 21 billion. This decline was principally due to lower receipts from direct investment abroad. While the goods trade balance and the services trade balance changed only marginally, there was a significant decrease in receipts and expenses.

Read More »

Read More »

Versicherungsmarkt Schweiz: deutlich höhere Ergebnisse

Die aggregierten Daten über den Schweizer Versicherungsmarkt zeigen eine deutliche Steigerung der Ergebnisse 2019. Diese fallen pro Teilbranchen zwar unterschiedlich aus, sind aber hauptsächlich auf die Ergebnisse am Kapitalmarkt zurückzuführen.

Read More »

Read More »

Credit Suisse “Beschattungsaffäre”: FINMA eröffnet Enforcementverfahren

Die Eidgenössische Finanzmarktaufsicht FINMA hat im Kontext der "Beschattungsaffäre" ein Enforcementverfahren gegen die Credit Suisse eingeleitet.

Read More »

Read More »

U.S. dollar liquidity-providing operations from 1 September 2020

In view of continuing improvements in U.S. dollar funding conditions and the low demand at recent 7-day maturity U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to further reduce the frequency of their 7-day operations from three times per week to once per week.

Read More »

Read More »

As Markets Crashed, The Swiss National Bank Went On A Tech Stock Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and shore up confidence. That joke is now the truth.

Read More »

Read More »

Fed and ECB Money Printing Helps SNB Back into Positive Territory

Fed and ECB money printing and massive fiscal stimulus help the SNB to come back into positive territory for the year.

The renewed asset price inflation compensate for losses on the US dollar.

Read More »

Read More »

“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Von verschiedenen Seiten werden Ansprüche an den Gewinn der Nationalbank gestellt. Es sollte in der Kompetenz der SNB liegen, zu entscheiden, welchen Teil ihrer Bilanz sie nicht zur Erfüllung ihrer Aufgaben benötigt.

Read More »

Read More »

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »