Category Archive: 1.) CHF

Every country will be digital – John Chambers & Izabella Kaminska at Web Summit 2016

This panel includes John Chambers of Cisco Systems and Izabella Kaminska of Financial Times. We are currently going through the biggest digital transition in history and if companies and countries don’t adapt they will die. What needs to be done to make sure countries and companies do not get left behind in this changing landscape? …

Read More »

Read More »

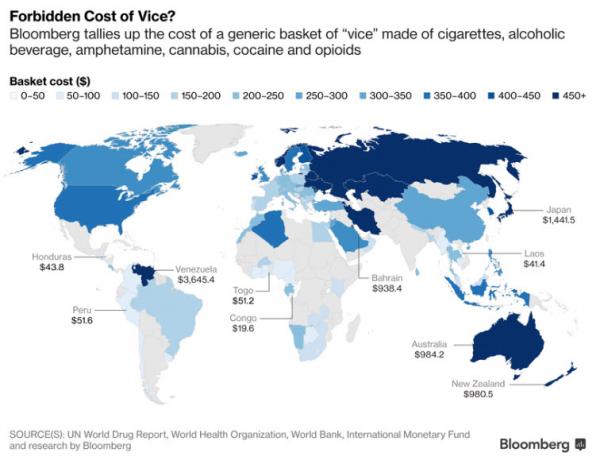

What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index.

Read More »

Read More »

Swiss franc less overvalued according to latest Big Mac index

On 12 January 2017, the Economist came out with its latest Big Mac index. Also known as the burger benchmark, the index compares the price of a Big Mac around the world. This catchy, if highly incomplete means of comparing the relative purchasing power of different currencies, uses the United States and the US$ as its base. Countries where Big Macs cost less than in the United States (in US$ terms) have weak currencies, and those where they are...

Read More »

Read More »

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

Swiss Franc exchange rates receive double boost from UK uncertainty

The Pound has had its worst day in two months yesterday, with exchange rates against most of its major currencies now reaching a two month low, and Swiss Franc exchange rates reaching down to the much dearer end of the 1.20’s once more.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Evidence Matters: The Role of Evidence in Uncertain Times; Izabella Kaminska

Read our blog on the seminar here: http://www.iffresearch.com/evidence-matters/ On the 17th of November 2016 IFF gathered an audience of users and producers of evidence at RSA House to discuss how we can use our influence to make progress in the face of uncertainty. The event featured talks from a host of leading industry experts and …

Read More »

Read More »

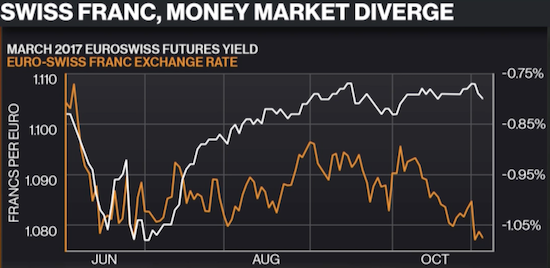

THIS Time A Swiss Franc Hedge Makes More Sense

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election. Moreover, shorts against the Swiss franc have risen. This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election. This time I agree with the strategy even as I suspect that, once again, any subsequent incremental strength in the Swiss franc will be...

Read More »

Read More »

Major Currency Pairs & The Election (Video)

We focus on the Election effects regarding the major currency pairs and the US Dollar in this video. Check out the Swiss Franc and the Mexican Peso Price Action after the election. This election has probably been great for CNN`s ratings, that would be a short after the election cycle is over.

Read More »

Read More »

SNB Line in Sand Breaks, EUR/CHF under 1.08

We have always emphasized that the SNB intervenes between 1.08 and 1.0850. Even if there was no change in sight deposits the 1.08 "line in sand" broke.

Read More »

Read More »

Risk Happens Fast

As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn't for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast.

Read More »

Read More »