Category Archive: 1.) CHF

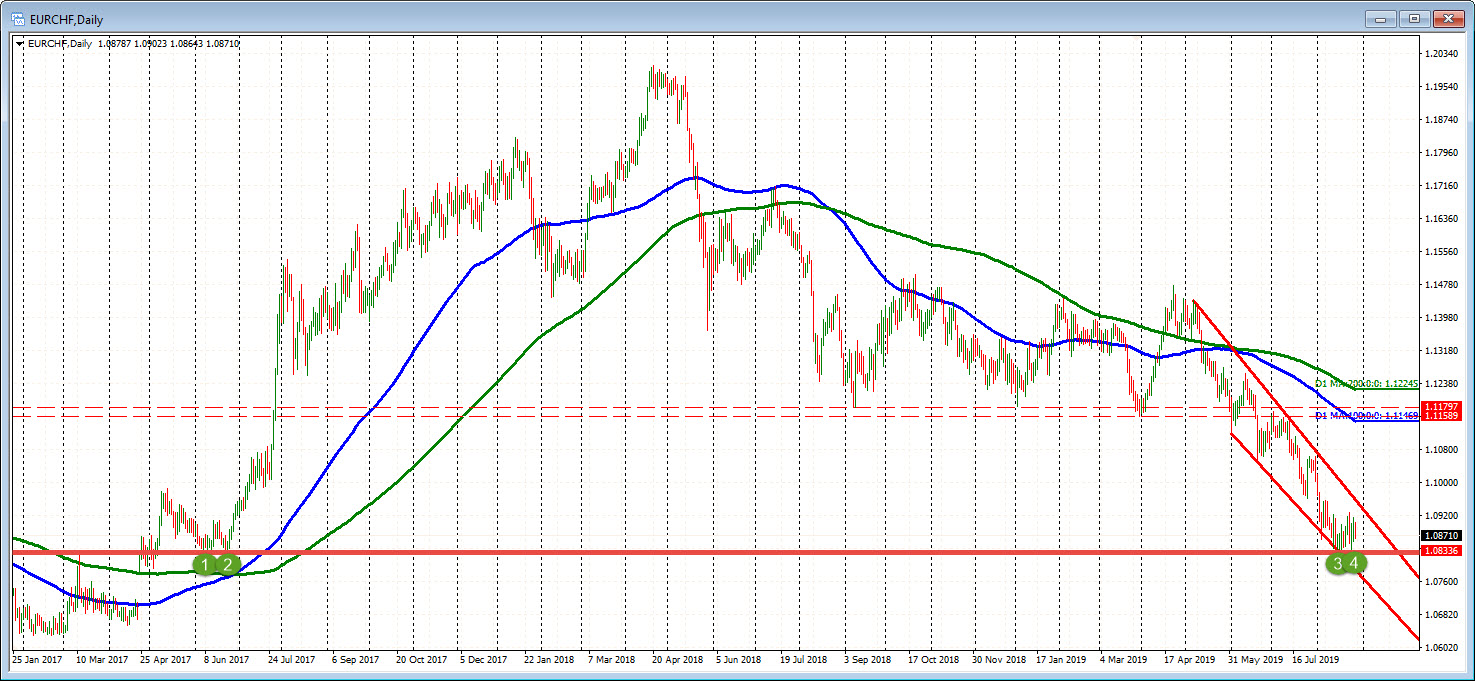

Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »

Swiss industry has learned to live with strong franc

The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency.

Read More »

Read More »

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

Swiss franc slides 4 percent in one week

On 24 July 2017, the Swiss franc was 1.101 to the euro. One week later on 31 July 2017 it was 1.145, according to Bloomberg. Over the month it dropped from 1.095 to 1.145, a drop Reuters described as the biggest monthly drop in six years. The Swiss National Bank (SNB) has been working hard to bring down the value of the Swiss franc. Speaking to the newspaper Le Temps last week, SNB president Thomas Jordan described the currency as “significantly...

Read More »

Read More »

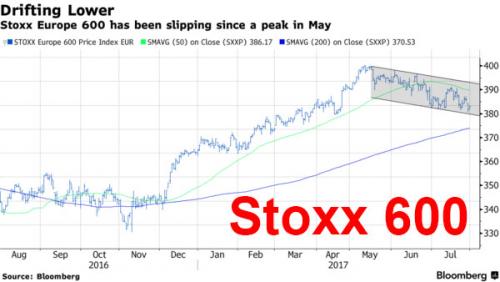

Great Graphic: What Is the Swiss Franc Telling Us?

Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc.

Read More »

Read More »

Swiss franc weakens to symbolic low

The Swiss franc has fallen to its lowest point since the January 2015 unpegging of the currency from the euro. The symbolic moment will be a huge relief to Swiss exporters and the tourism industry. As of Thursday morning, the franc was trading at 1.12 to the euro, a drop of 1.8 percent since Monday. It is the weakest level reached since the decision by the Swiss National Bank (SNB) to remove the cap two-and-a-half years ago.

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

Swiss franc more overvalued than 6 months ago according to Economist burger index

The Economist magazine’s 6-monthly Big Mac index shows the Swiss franc to be even more overvalued than it was in January 2017. The index, which compares the US$ price of a Big Mac around the world places Switzerland at the top with a price of US$ 6.74. This is 27.2% more expensive than the United States where the same burger costs US$ 5.30.

Read More »

Read More »

Swiss franc outstrips other currencies over last 117 years

Recent analysis by Credit Suisse, London Business School and Cambridge Judge Business School shows the Swiss franc’s enduring strength. The reports says that for a small country with just 0.1% of the world’s population and less than 0.01% of its land mass, Switzerland punches well above its weight financially.

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

Strong Swiss franc could be over reckons currency strategist at UBS

Tribune de Genève. After more than two years of a highly overvalued franc, relative to the euro, the currency should ease in the near term reckons Thomas Flury, senior currency strategist at UBS. He expects a euro to be worth 1.14 francs in 6 months and 1.16 within a year.

Read More »

Read More »