Category Archive: 9a.) Real Investment Advice

6-5-24 Could Roaring Kitty’s Wealth Top $1-Billion?

Ore weak economic data from the Atlanta Fed; semiconductors are outperforming software stocks, 3:1; look for consolidation in that sector. Domestic stocks are outperforming all other markets. A fairly big correction in Oil Prices over the past few days is now setting up an opportunity for investors to take profits and rebalance energy portfolios, which are by necessity tied to the price of their underlying commodity. Curious about Roaring Kitty's...

Read More »

Read More »

Dangers of Market Timing: Why You Might Lose Out

Don't get caught in the trap of trying to predict the market long-term. Focus on what the market is doing today to make money. #InvestingTips #MarketTrends #election2024 ??

Are you considering market timing as a strategy? Lance Roberts breaks down the pitfalls and risks of trying to predict the market.

- Challenges of predicting market trends months in advance

- Consequences of sitting out of the market until a specific event

- The trap of...

Read More »

Read More »

6-4-24 Dangers of Market Timing: Why You Might Lose Out

Should you wait until after the Presidential Election to invest? Are you considering market timing as a strategy? Lance Roberts breaks down the pitfalls and risks of trying to predict the market: Challenges of predicting market trends months in advance; Consequences of sitting out of the market until a specific event; the trap of waiting for the perfect moment to invest; How market run-ups can leave you behind; The psychological cycle that keeps...

Read More »

Read More »

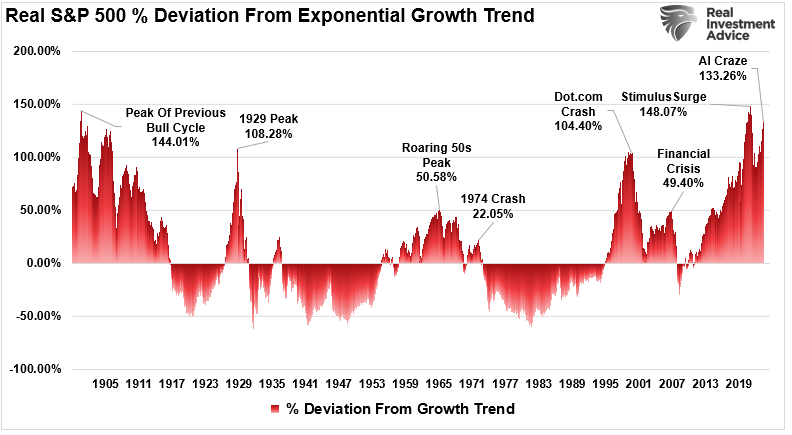

Deviations From Long-Term Growth Trends Back To Extremes

In 2022, we discussed the market’s deviations from long-term growth trends. That discussion centered on Jeremy Grantham’s commentary about market bubbles.

Read More »

Read More »

Timing in Investing: Choosing Between Momentum and Value Strategies

? Momentum vs. value investing. ? Know when to ride the wave and when to play the long game. ? #InvestingTips #Finance101 #StockMarket

Lance Roberts dives into the nuances of momentum and value investing, highlighting when each strategy is most effective. Gain insights on how to effectively apply these investment styles to maximize returns.

- The importance of timing in investing

- Differences between momentum and value investing

-...

Read More »

Read More »

6-3-24 The Momentum Chase Is On. What Happens Next?

Will the Fed begin cutting rates and restarting monetary accommodation? Such is all that seems to matter. At the same time, investors continue to chase stocks higher based on the current theme. In 2020, it was disrupter stocks. Today, it is artificial intelligence and semiconductor providers. The markets have evolved into a “get rich quick” industry, where Wall Street creates products to fill hungry investors’ demand for the next “hot opportunity.”...

Read More »

Read More »

Risks of Investing All Your Money in Physical Gold

Protect your future! Diversify your investments, don't put all your eggs in one basket (like physical #gold). Stay informed and make wise financial decisions. ? #investmenttips #financialplanning

In this episode, we discuss the pros and cons of investing heavily in physical gold. We also explore alternative investment strategies.

- The risks of putting all your funds into physical gold.

- The popularity of self-directed IRAs for purchasing...

Read More »

Read More »

5-31-24 What To Do With Your 401k When There Are No Good Choices

We answer emails like this one: " Idon't like the limited options inside my 401k but I am told I can't get the money out until I leave the company. Are there any tricks to getting my money out and into my roth ira without quitting my job?" Also--is it "safer" to move money out of 401ks into gold?

Stay tuned...

Hosted by RIA Advisors Senior Financial Advisor, Danny Ratliff, CFP, and introducing our Senior Relationship Manager,...

Read More »

Read More »

Is Bitcoin Mining Wasting Energy? The Debate on Economic Benefits and Power Consumption

Bitcoin mining accounts for almost 2% of electricity generation, not significant for grid expansion, but still considerable. AI data centers offer more economic benefits. #Bitcoin #AI #EnergyConsumption

Join Michael Lebowitz as he digs into the nuances of bitcoin mining and its energy consumption. This short segment critiques the productivity and economic benefits of bitcoin mining.

- Bitcoin mining's energy consumption and its impact on the...

Read More »

Read More »

5-30-24 How to Benefit from the Coming Power Grid Expansion

Houston is finally #1 in something: Home Foreclosures; Q1 economic data suggests conflict with narrative the economy is doing fine vs anecdotal evidence. The Fed's Beige Book summary shows not as much concern for inflation as for weakening consumer demand. Weaker stock pricing is also emerging; Can markets hold the 20-DMA? Risk assets are momentum-based trade (Bitcoin); also beginning to weaken. Hedge funds are long semiconductors and AI-related...

Read More »

Read More »

Debunking Inflation Myths: The Truth About Money Printing and Demand

Understanding inflation: it's all about supply and demand. Government's not just printing money but issuing debt. #economics101 #inflation

In this video, Lance Roberts breaks down the basics of inflation and how supply and demand influence its rise and fall. Understand the common misconceptions about inflation and the truth behind money circulation.

- Explanation of inflation using supply and demand principles.

- Impact of a slowing economy...

Read More »

Read More »

5-29-24 Corporate Greed is Not the Cause of Inflation

Economic Numbers: It's all about the Fed, never mind the fundamentals. markets have gone essentially nowhere, driven almost entirely by Nvidia. Markets are close to a short-term sell signal. It's time to rebalance portfolios. Corporate Greed does not cause inflation: The simple truth. 401k rollowver problems; why few receiving required 402(f) notifications; the tax implications of rollovers. If you've lost a 401k, Beagle.com may be able to help you...

Read More »

Read More »

Memorial Day 2024

We are closed Monday (5/27) in honor of those Americans who gave the last, full measure to defend our freedoms. Remember the fallen. We'll be back Tuesday with market. investing, and economic info for you!

Key links are below:

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢...

Read More »

Read More »

Retirement Timing and Presidential Elections | Tips from a Financial Planner

? Worried about taxing unrealized gains? Don't let political rhetoric affect your retirement plans. Stay focused and informed! ?? #FinancialTips

In this video, we discuss the impact of presidential cycles on retirement decisions and financial planning.

1. Importance of maintaining a steady financial plan during times of political change.

2. Example of clients delaying retirement due to upcoming election.

3. Considerations for retiring...

Read More »

Read More »

5-24-24 What If I Get Named Executor of an Estate?

Markets falter; Nvidia and Cracker Barrel keeping up with the times; the Fed's impact on Markets: Could rates actually go back up? How spending habits are shifting; the need for a Sell Discipline when bad news is good news. Caution against investing emotionally because of politics. What happens when you're the executor: Business decisions vs family/emotional issues. The Graceland financial fiasco: An executor's nightmare. How many generations does...

Read More »

Read More »

Who Will Profit Most from the Next Tech Boom? Insights from Michael Lebowitz

Exploring the potential winners in the tech industry beyond AI giants like Nvidia. Could the next big profiters be more unexpected, like Levi Strauss back in the gold rush era? ? #techindustry #potentialwinners

Join us as Michael Lebowitz delves into the parallels between historical economic booms and today's tech landscape. Could someone other than tech giants be the biggest winners?

- Comparison between the California gold rush and the current...

Read More »

Read More »

5-23-24 Who Will Profit Most from the Next Tech Boom?

Markets sold off on release of the latest FOMC Meeting minutes, which are a sanitized, finely-crafted version of what went on behind closed doors. The hawkishness seems to be continuing; Deflation seems to be a bigger risk to the economy than inflation. There's too little demand, resulting in price cuts to move inventory. Insight on why we reduced our stake in Nvidia before its report was released, which attests to the growth potential of AI...

Read More »

Read More »

5-22-24 Why the Dot-com Crash Feels Like a Distant Memory to Investors

All eyes are on NVDIA's quarterly report: Why did we trim our position? How might this company disappoint investors? It's all about the guidance. FOMC Meeting Minutes also could trigger markets, based on what they reveal about the Fed's interest rate intentions. Markets are at all-time highs, trading in a tighter range. Markets have gone 315-days without a 2% correction; we think they're primed for a pullback. Lance's wife is home; hilarity ensues....

Read More »

Read More »

Why the Dot-Com Crash Feels Like a Distant Memory to Modern Investors

Remember the.com crash? Many young investors today never experienced a financial crisis like 2008. It's important to learn from history to navigate market uncertainties. #financialcrisis #investing

The dot-com crash was a pivotal moment in financial history, but its impact is often forgotten. Join Lance Roberts as he revisits this era and discusses its relevance to today's market.

- The gradual decline of the dot-com crash

- Opportunities for...

Read More »

Read More »

Impact of Stock Failures on Your Portfolio and Index Funds

Diversification is key! Learn how indexes manage portfolio risks efficiently by swapping stocks without costs or challenges like taxes and fees. #InvestingTips #PortfolioManagement

Dive into the intricacies of index rebalancing with Lance Roberts as he breaks down how indices manage stock changes seamlessly. Learn why private portfolios might face challenges replicating such moves.

- The impact of a stock going to zero on an index versus a...

Read More »

Read More »