Category Archive: 9a.) Real Investment Advice

Real-time Data Transforming Employment Surveys

Real-time data collection is key for accurate insights. Large companies providing real numbers, not estimates, is crucial for economic analysis. ? #DataCollection #Insights

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Entire show here: https://cstu.io/1ea4b0

Read More »

Read More »

9-4-24 Big Down Day

The S&P 500 sank 2.1%, the Nasdaq lost 3.3%, and while the tech sector led stocks into the red, the Dow wasn't excluded from the bad day either, shedding over 600 points for a 1.5% loss. What's next? The Tuesday market dump was accompanied by weak manufacturing reports suggesting the economy is weakening. The Yield Curve actually un-inverted briefly, and then re-inverted. Markets sold off more sharply than expected for no apparent reason, led...

Read More »

Read More »

Bull Steepening Is Bearish For Stocks – Part Two

Part One of this article described the burgeoning bull steepening yield curve environment and what it implies about economic growth and Fed policy. It also discussed the three other predominant types of yield curve shifts and what they suggest for the economy and Fed policy.

Persistent yield curve shifts tend to correlate with different stock performances. With the odds growing that a long bull steepening may be upon us, it’s incumbent upon us...

Read More »

Read More »

Fundamentals vs Momentum: How Trading Strategies Have Changed

Trading on quick news and momentum vs. fundamentals - interesting insights on investing trends! ? #Investing #Trading #Finance

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/52ded6

Read More »

Read More »

9-3-24 “Past Performance is No Guarantee…”

It's a holiday-shortened trading week to kick off the new month: September & October tend to be weaker trading months. Look for light volume and the impact of the corporate buy back window open and closing; markets tend to de-risk ahead of elections. Markets closed Friday at July's all-time high amid much bullish optimism. Markets today could retest 20- 50-DMA for support. despite a loss of momentum, take caution to not become overly negative....

Read More »

Read More »

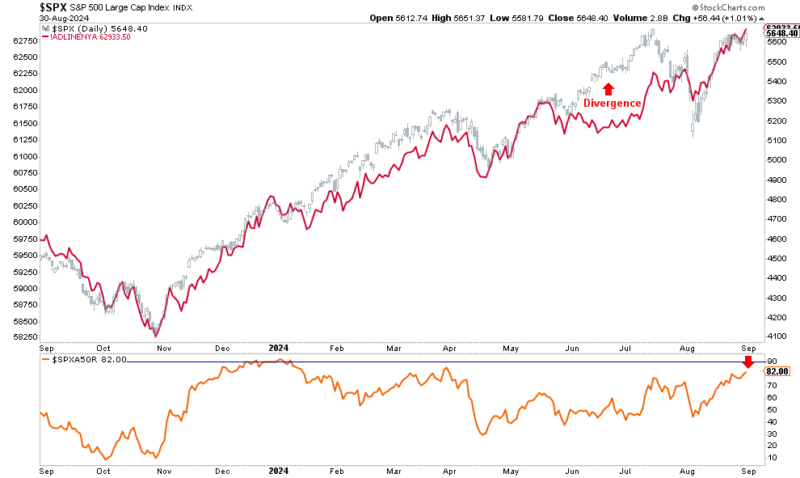

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

Risk Mitigation Strategies Every Investor Should Know

? Avoiding losses is key! Focus on risk mitigation to protect your portfolio from negative impacts over time. ? #InvestingTips #RiskManagement

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/fcffe2

Read More »

Read More »

Max Out Your 401K for Maximum Financial Benefits

Max out your 401K every year for financial growth! Invest in S&P 500 index and watch your savings grow. Start early! ?#401K #Investing

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/e684ec

Read More »

Read More »

Truth About Credit Scores: Do You Really Need Credit Cards?

Say no to credit card debt! You don't need it for a good credit score. Pay your bills on time and have the money talk with your kids. ? #FinancialTips

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/2b069a

Read More »

Read More »

Historical Perspective on Economic Cycles

Unpacking Kamalanomics and economic cycles in America. Check out my article for more insights. #EconomicGrowthMyth #Kamalanomics

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/13b832

Read More »

Read More »

8-30-24 Can Social Security Clawback Your Payments?

Market Resiliency: It's always about the Fed. Nvidia and the AI story is still alive; Treasuries are overbought; Dollar General and Big Lots are struggling, surprisingly; where are the cracks in the economy? The unwinding of the Tech sector, and how Google lets you know you're fired. The push to working longer; more and more are depending more and more on Social Security. legislation introduced to prevent SS clawbacks after 3-years: Is it a good...

Read More »

Read More »

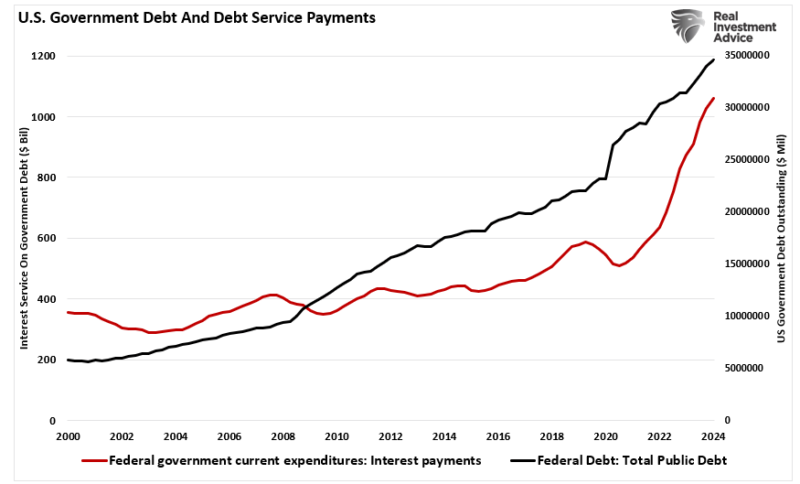

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

Understanding the Correlation Between PPI and CPI in Inflation Trends

Price gouging claims debunked! Implementing price controls can lead to shortages. Let's talk inflation. ?? #EconomicInsights

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/897c1b

Read More »

Read More »

8-29-24 Is Nvidia Priced for Perfection?

Nvidia beat average analyst expectations to deliver on high expectations. But for investors accustomed to excessively large beats, a just "above-expectations" delivery tastes a little flat. Lance Roberts & Michael Lebowitz also explain how the level of U.S. Treasury yields and the changing shape of the Treasury yield curve provide investors with critical feedback regarding the market’s expectations for economic growth, inflation, and...

Read More »

Read More »

Market Conditions Limit Stock Choices for Investors

Struggling to find stocks for your portfolio? Check out our weekly newsletter with stock screens! ?? #StockMarket #InvestingTips

Watch the entire show here: https://cstu.io/0f0798

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-28-24 Stop Worrying About Taxes

Markets and Investors await today's earnings report from Nvidia, which has been tagged, 'The Most Important Stock in the World.' Expectations are VERY high, so there is little room for marginal results: There is more risk of disappointment than odds of exceeding expectations. Markets continue to hang on following the mini-correction last week, followed by sharp market recovery. For now, correction is over if Nvidia delivers. Dollar pressure...

Read More »

Read More »

Yield Curve Shifts Offer Signals For Stockholders

The level of U.S. Treasury yields and the changing shape of the Treasury yield curve provide investors with critical feedback regarding the market’s expectations for economic growth, inflation, and monetary policy. Short- and long-term yields have recently fallen, with short-term maturities leading the charge. The changes result in what bond traders call a bull steepening yield curve shift. The shift is due to weakening economic conditions,...

Read More »

Read More »

How Inflation Data Influences the Economy and Markets

? Understanding data trends is crucial! ? Inflation drives the economy. Stay informed for smart investments. ? #EconomicInsights #DataTrends

Learn more:

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/0e1c66

Read More »

Read More »

8-27-24 Overbought Conditions Set Up Short-Term Correction

Today's show is all over the place: Durable Goods take a big jump...unless you remove Aircraft. Astronauts stuck in space: Elon Musk to the rescue. Markets are overbought; risk remains in Carry Trade. Market correction will likely be short and shallow. What if: Nvidia's report tomorrow. Stocks are setting up for correction: Stocks on sale? Fallacies about the Dollar and where best to store currency. Viagra, Blue Chews, Him's/Her's: Demographics and...

Read More »

Read More »

Overbought Conditions Set Up Short-Term Correction

As noted in this past weekend’s newsletter, following the “Yen Carry Trade” blowup just three weeks ago, the market has quickly reverted to more extreme short-term overbought conditions.

Note: We wrote this article on Saturday, so all data and analysis is as of Friday’s market close.

For example, three weeks ago, the growth sectors of the market were highly oversold, while the previous lagging defensive sectors were overbought. That was not...

Read More »

Read More »