Category Archive: 9a.) Real Investment Advice

11-21-24 Will Trump Tariffs be Inflationary?

A preview of risks on the horizon, including Trump Tariffs, interest rates, and how debt and deficits are economic drivers. What are the effects on corporate profitability?Will valuations be problematic next year? Lance revews Nvidia's stellar quarterly report and analysts' expectations for 2025. Bitcoin is tracking WITH the US Dollar, not against it as a de-dollarization asset. CNBC completely misses "first man in space" trivia question...

Read More »

Read More »

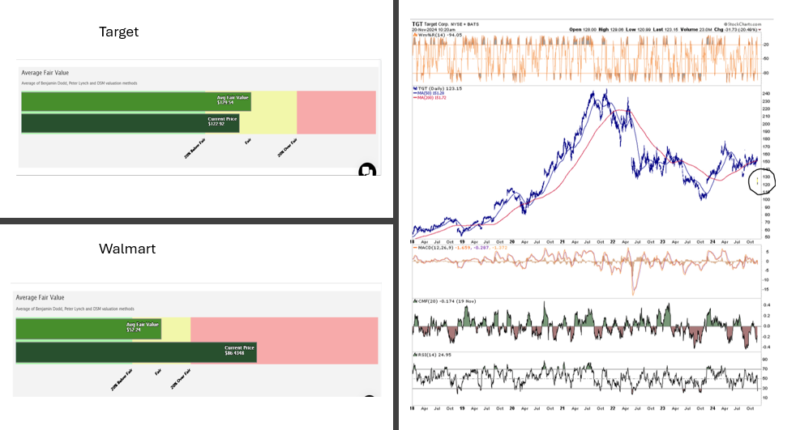

Target And Walmart: Same Business But Different Trends

Yesterday's Commentary shared Walmart's outstanding earnings report and reviewed its surging share price from a technical basis. Despite being a head-to-head competitor of Walmart, Target is heading down a completely different path. Walmart beat EPS and revenue expectations easily, while Target was short. Target reported EPS of $1.85, well below estimates of $2.30. Unlike Walmart, …

Read More »

Read More »

11-20-24 Wall Street Lowers 2025 Expectations: Should You Be Concerned?

It's Nvidia Day--markets will respond accordingly tomorrow. Expectations are high for earnings and forward guidance. Analysts are generally looking for lowered expectations in 2025, as President Trump faces a waning economy. Meanwhile, markets have had a good test of support at the 20-DMA. Volatility anticipated in a holiday-shortened trading week next week. Lance and Danny plead for planning ahead at the end of the year, so as not to pile EOY...

Read More »

Read More »

Market Stability at Risk: Predicting a Possible Decade of Turbulence Ahead

? Brace yourselves for the stock market rollercoaster! ? Enjoy the ride while it lasts! #stockmarket #volatility #investmenttips

Watch the entire show here: https://cstu.io/8333b3

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

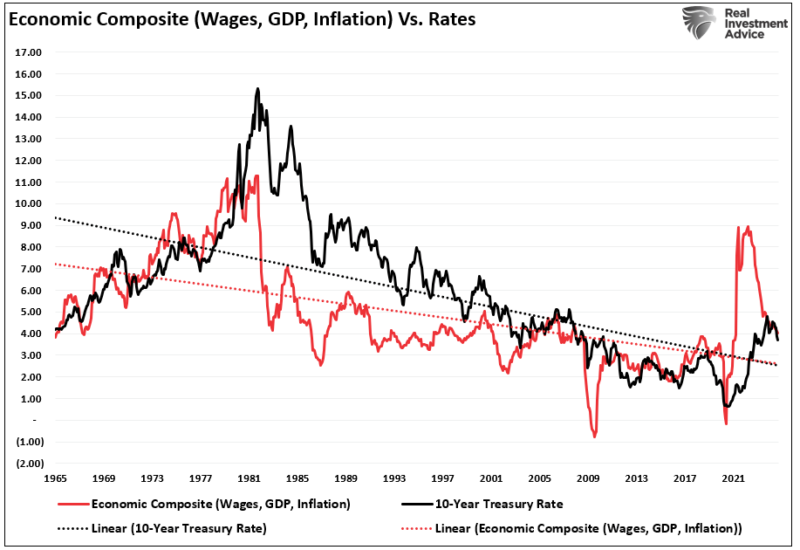

Trump Tariffs Are Inflationary Claim The Experts

The headlines regarding Trump's proposed tariffs and their inflationary consequences are undoubtedly worrying, but will they prove correct? Instead of taking the "experts" word, let's consider how tariffs may affect the prices of all goods and services, not just the items subject to tariffs. Furthermore, it's worth discussing how tariffs could impact the economy, as …

Read More »

Read More »

Walmart Shares: Great Fundamentals But At A Frothy Price

Walmart's (WMT) shares opened higher as its earnings report surpassed expectations. EPS and revenues beat expectations. Moreover, the company increased its sales guidance for next year by a full percent. As its latest earnings report reminded us, Walmart is doing very well financially. Furthermore, its share price has surged, reflecting the company's health.

Read More »

Read More »

11-19-24 Yardeni And The Long History Of Prediction Problems

Following President Trump’s re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets.The rush by perma-bulls to make long-term predictions is remarkable. Economist Ed Yardeni believes this upward momentum will continue, and has revised his long-term forecast to project that the S&P 500 will reach 10,000 by 2029. This forecast reflects a mix of factors that Yardini...

Read More »

Read More »

Fed Rate Cut Expected to Fuel Markets Bullish Momentum

Bullish market outlook! ?? Short-term perspective shows optimism and potential for assets. Federal Reserve expected to cut rates on Dec 18. #StockMarket

Watch the entire show here: https://cstu.io/b2a7ac

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Gold Miners Enter The Bears Den

Many investors consider a decline of 20% or more to be a bear market. We can debate the merit of the random 20% figure, but according to that definition, gold miners, down 25% from its peak on October 22, are in a bear market. We have noted numerous times in the last month or so … Continue reading »

Read More »

Read More »

Yardeni And The Long History Of Prediction Problems

Following President Trump's re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets. Unsurprisingly, the rush by perma-bulls to make long-term predictions is remarkable.

Read More »

Read More »

Why Emerging Markets Are Not as Cheap as They Seem

Emerging markets may seem cheap compared to the US, but are actually expensive relative to their own country's growth. ? #Investing"

Watch the entire show here: https://cstu.io/e53b03

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Reality of Guaranteed 6-8% Annual Income Expectations

Looking for a bond portfolio with 6-8% reliable income, no risk, full access to principal, and liquidity? Realistic or unrealistic? #investmentgoals #bonds #finance

Watch the entire show here: https://cstu.io/c58ebf

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

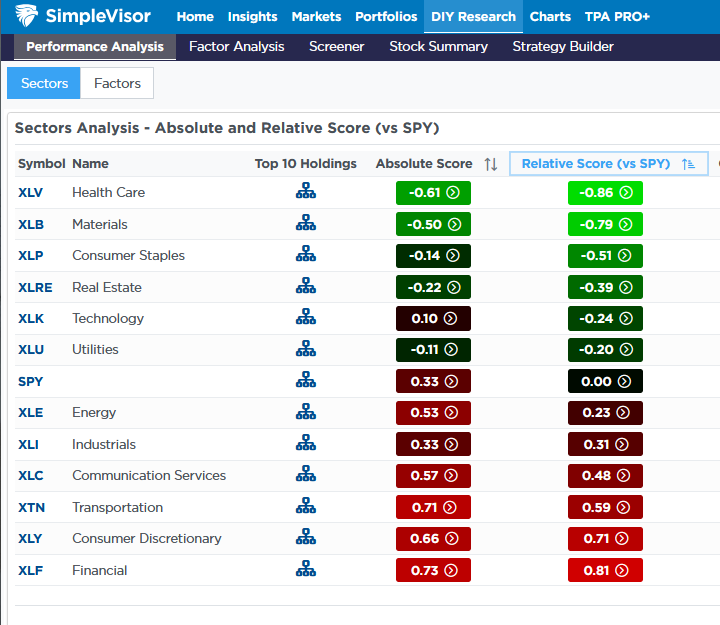

11-18-24 “Trump Trade” Sends Investors Into Overdrive

It's the last full week of trading before Thanksgiving. Expectations for US GDP growth in the new year are on the plus side of 3%, vs the EU's negative expectations: Where do you want to put your money? First place the "Government Efficiency Department" can start is at the Department of Defense, failing its past seven audits. Risks are building in certain market areas where “Trump Trade” exuberance has likely exceeded the grasp of...

Read More »

Read More »

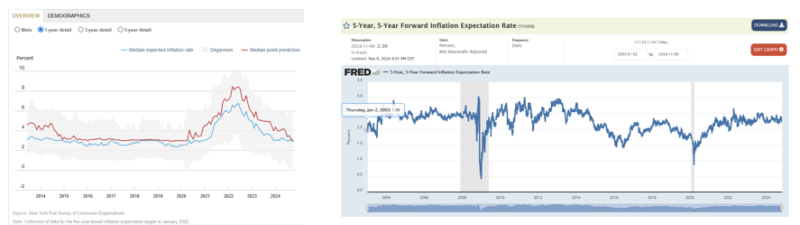

5X5 Inflation Expectations: A New Benchmark To Follow

At the last FOMC meeting, Jerome Powell was asked if they were concerned that inflation expectations are “de-anchoring, or put another way, are anchoring at a slightly higher level?” His answer specifically referenced the 5x5 forward inflation expected rate. He could have used many data points to answer the question. However, the fact that he …

Read More »

Read More »

Key Considerations for Healthcare Costs Before Medicare in Early Retirement

Planning for retirement before Medicare age? ? Main concern often is medical expenses in the gap. How do you plan to cover it? #retirementplanning"

Watch the entire show here: https://cstu.io/863a99

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Volatility: The Fear and Greed Index Explained

? Exploring market volatility with Michael! ? Understand the fear greed index and implied volatility. Stay informed! #Finance101

Watch the entire show here: https://cstu.io/a3ab0e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

“Trump Trade” Sends Investors Into Overdrive

Inside This Week's Bull Bear Report A Pause That Refreshes? Last week, we discussed that with the election over and the Federal Reserve cutting interest rates, many market headwinds were put behind us. To wit; "As a result, the market surged higher, hitting our year-end target of 6000 on Friday. Furthermore, since election day, the …

Read More »

Read More »

Understanding Market Patterns: Why Analog Trends Can Be Misleading

An important reminder about market analogs ? Things may seem similar to the past, but every situation is unique! #MarketTrends #FinanceTips

Watch the entire show here: https://cstu.io/d6f878

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Paul Tudor Jones: I Won’t Own Fixed Income

Paul Tudor Jones recently voiced concerns that rising U.S. deficits and debt and increasing interest rates could lead to a fiscal crisis. His perspective reflects the long-standing fear that sustained borrowing will trigger inflation, raise interest rates, and eventually overwhelm the government’s ability to manage its debt obligations. In short, his thesis is that interest …

Read More »

Read More »

2% CPI Is Here

2% CPI is a headline you won't find in today's Wall Street Journal. The reason is that official inflation gauges, such as CPI, are in the mid to upper 2% range. Last Wednesday, for instance, the year-over-year CPI rate clocked in at 2.6%. We claim inflation is at 2% because we know that 40% of … Continue reading »

Read More »

Read More »