Category Archive: 9a.) Real Investment Advice

Extreme Speculation Has Returned

Inside This Week's Bull Bear Report A Note Of Thanksgiving While belated, we sincerely hope you had a happy and fulfilling Thanksgiving holiday. In the words of Henry David Thoreau, “I am grateful for what I am and have. My Thanksgiving is perpetual.” All of us at RIA Advisors and Real Investment Advice are grateful … Continue...

Read More »

Read More »

Understanding the Risks and Rewards of High-Yield Funds

High yield doesn't always mean high reward! ?? Do your homework before investing in junk bonds. #InvestWisely #FinancialTips

Watch the entire show here: https://cstu.io/83ecb2

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Key Drivers Behind Interest Rate Movements

Understanding interest rates explained! ?? Don't panic over debt & deficits impacting rates - there are many factors at play! #Finance101

Watch the entire show here: https://cstu.io/37fd2e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Gen Z Embracing Communal Living: A New Trend in Modern Housing

Reevaluating priorities ? Gen Z embracing communal living over solo! My daughter already planning to live with friends, a shift from my solo days! #GenZ #CommunalLiving

Watch the entire show here: https://cstu.io/a8fe46

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Tiny Homes: A Practical Solution for Independent Living Close to Family

Thinking about getting a tiny home for grandma! It's a perfect solution for her to have her own space close to family. ?? #family #tinyhome

Watch the entire show here: https://cstu.io/a5b50d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

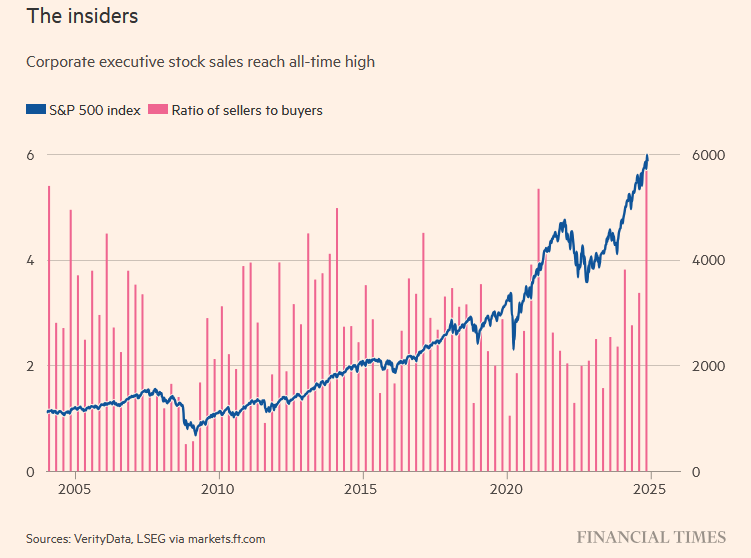

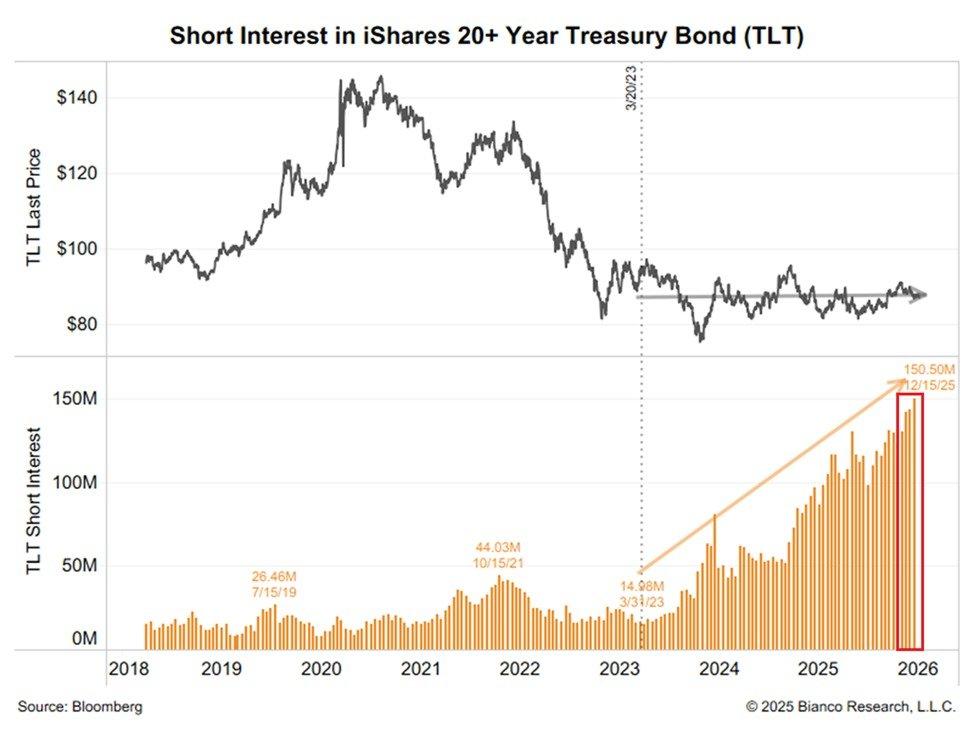

Leverage And Speculation: Signs Of A Raging Bull Market

In a recent Commentary- MicroStrategy Is A Leveraged ETF In Disguise - we discussed the company's business model, which revolves almost entirely around highly speculative bitcoin and leverage. To wit: So, what is MicroStrategy? It’s a leveraged Bitcoin fund disguised as a non-profit technology company. Regarding leverage and speculation, we also recently discussed the surging …

Read More »

Read More »

Understanding Deficits: How Debt Service Supersedes Economic Growth

Growing deficits, slowing inflation. More debt diverts productive dollars into debt service. Interest on debt surpassing military budget! ?

Watch the entire show here: https://cstu.io/56307d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2025 Thanksgiving Break

Yep, we're out of the studio for the Thanksgiving break, returning on Monday, December 2, 2024 for more of your favorite live financial talk programming.

From our gang to yours, have a safe and happy Thanksgiving!

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming...

Read More »

Read More »

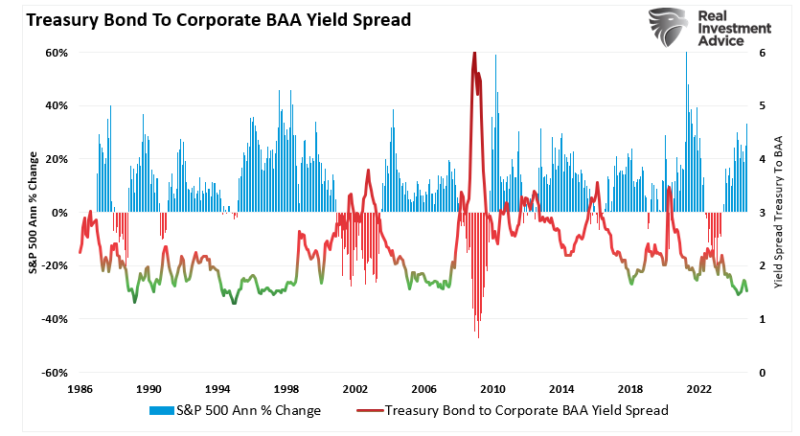

11-26-24 Why Credit Spreads Matter

Credit spreads can greatly assist in determining the risk of a correction or bear market by reflecting the perceived risk of corporate bonds compared to government bonds. The spread between risky corporate bonds and safer Treasury bonds remains narrow when the economy performs well. This is because investors are confident in corporate profitability and are willing to accept lower yields for higher risks. Conversely, during economic uncertainty or...

Read More »

Read More »

The 3-3-3 Rule

Donald Trump nominated seasoned hedge fund manager Scott Bessent as the next Treasury Secretary. While the Treasury Secretary has many responsibilities, debt management is one of the most important. Therefore, given the recent scrutiny the bond market has been paying to high deficits and associated debt, Scott Bessent appears to be a timely appointment. Bessent …

Read More »

Read More »

Credit Spreads: The Markets Early Warning Indicators

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge …

Read More »

Read More »

The Detachment of Democrats from Working Class Issues

?️ Democrats lost support from the working class in the election. This article highlights their detachment from working class issues. Check it out! ? #ElectionAnalysis #WorkingClassIssues

Watch the entire show here: https://cstu.io/5bb2b5

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

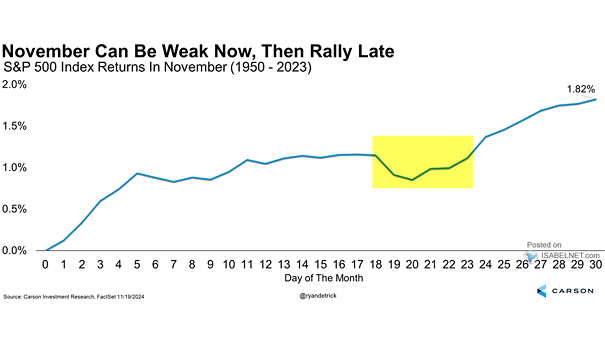

11-25-24 Markets Look for a Holiday Rally

Thanksgiving week is spread out before us like a serving table laden with food: Markets will trade in a holiday-shortened week with moods of expectation for high consumer spending. Lance reveals his strategy for Christina's Christmas present. Markets' goal is to generate 50-points, targeting S&P 6,000, despite limited downside. Bond Yields are dropping with Scott Bessent's nomination as Treasury Secretary. The Dollar and Bitcoin are...

Read More »

Read More »

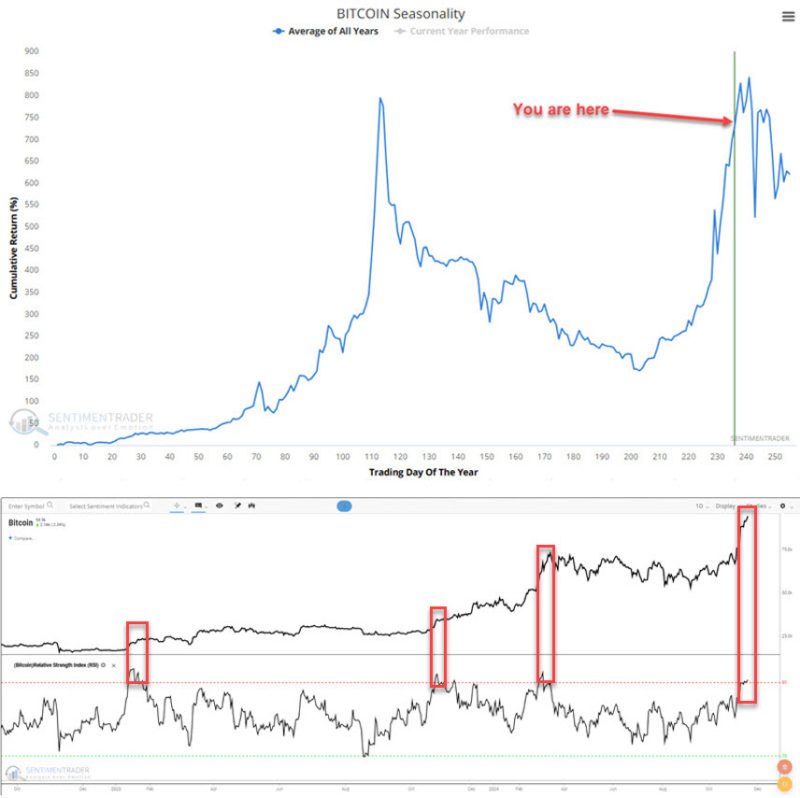

Bitcoin Is Entering Volatility Season

Since the election, Bitcoin has risen nearly 50%. While Bitcoin investors are licking their chops, believing the magnificent rally will continue, they need to realize that Bitcoin is entering a period of pronounced seasonal volatility. The graph below from Sentimentrader shows that the recent performance has tracked the typical performance for the time of year. …

Read More »

Read More »

The Real Impact of Trump’s Tariffs: What Investors Should Know

Uncertainty ahead! ?? Trump's tariffs may not cause the chaos some predict. Stay cautious with your investments and avoid hasty decisions. #FinanceTips

Watch the entire show here: https://cstu.io/8bb550

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Robert Kennedy Targets Big Pharma: Vaccine Makers Under Fire

? New administration targeting specific areas like big pharmaceutical companies! ? Exciting times ahead in the healthcare sector! #InvestingInsights #HealthcareRevolution ?

Watch the entire show here: https://cstu.io/b7cd6b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

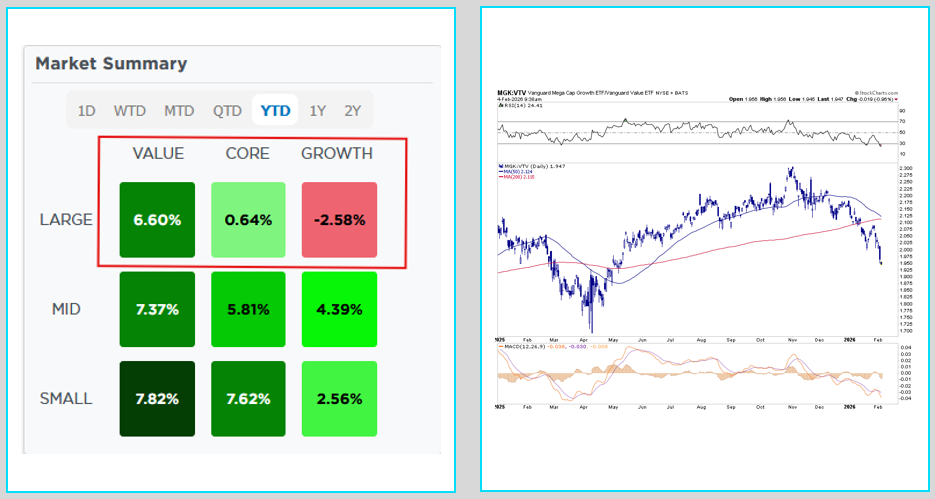

Market Forecasts Are Very Bullish

Inside This Week's Bull Bear Report A Holiday Rally Is Likely Last week, we discussed the impact of the Trump Presidency on the financial markets based on expectations of tax cuts, tariffs, and deregulation. Since then, the "Trump Trade" went into full swing, pushing the markets higher; however, as we noted, that the trading had gotten a …

Read More »

Read More »

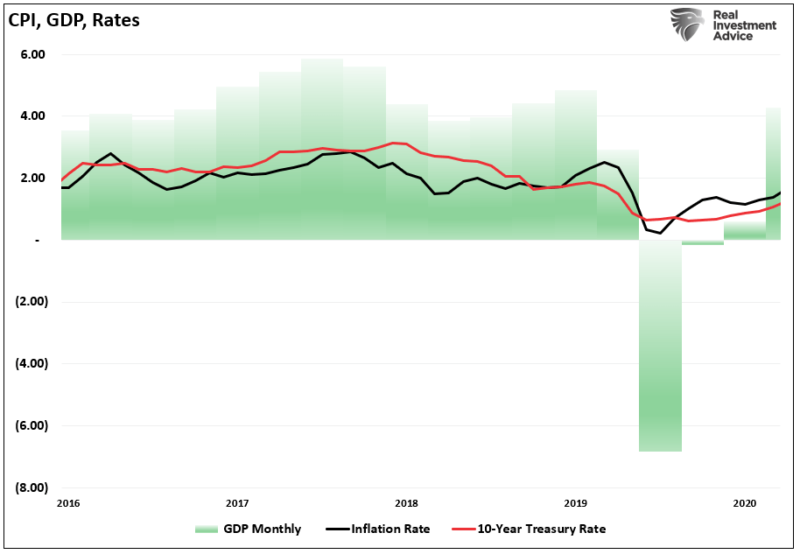

“Trumpflation” Risks Likely Overstated

With the re-election of President Donald Trump, the worries about tariffs and pro-business policies sparked concerns of "Trumpflation." Inflation has been a top concern for policymakers, businesses, and everyday consumers, especially following the sharp price increases experienced over the past few years. However, growing evidence shows inflationary pressures continue to ease significantly, paving the way …

Read More »

Read More »

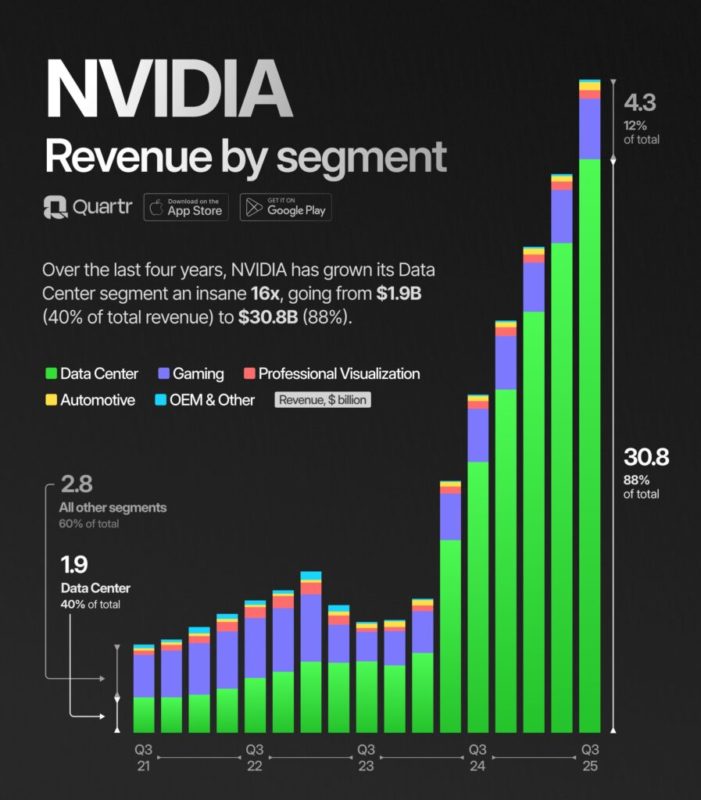

AI Is Steaming To Nvidia’s Benefit

Wall Street's poster child for AI is Nvidia. With an overwhelming market share in AI chip design, Nvidia is up over 200% year to date and a whopping 2680% over the last five years. Driving the price surge are incredible earnings, revenue growth, massive profit margins, and promising outlooks. Since 2020, Nvidia's sales have increased …

Read More »

Read More »

The Impact of AI on Employment and Demographics Explained

AI advancements are changing the job market. Demographics show a decline in birth rates. What will the future workforce look like? ? #AI #FutureOfWork

Watch the entire show here: https://cstu.io/9f7cb1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »