Category Archive: 9a.) Real Investment Advice

Understanding the Impact of Supply and Demand on Housing Prices

? Housing market insights! Supply and demand are key. Now it's easier to buy or sell a house with affordable loans available. #housingmarket #realestate ??

Watch the entire show here: https://cstu.io/c91c52

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Is Optimism Too Optimistic For 2025?

Inside This Week's Bull Bear Report Last Chance For Early Bird Registration Get your tickets for the 2025 Economic and Investing Summit before prices increase on January 1st. Seating is very limited. Did Santa Get Stuck In The Chimney? Last week, we discussed that the selloff heading into Christmas was the setup for the beginning …

Read More »

Read More »

How to Achieve Multiple Years of Gains in Just One Year

Turning 4% into 14% - that's the power of smart investing! ?? #Investing #FinancialGoals #StockMarket

Watch the entire show here: https://cstu.io/f5609a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Affordable Care Act & The Inflation Of Healthcare

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. …

Read More »

Read More »

2024 in Review

2024 was an unbelievable year for the S&P 500 up 28% YTD. The index constituents' average and median returns are 15.7% and 11.8%, respectively. Altogether, this year’s index returns dwarf the long-term average S&P 500 return of 7.9% since 1928. The Finviz heatmap pictured below shows the 2024 returns of the stocks in the index. … Continue...

Read More »

Read More »

Understanding the Impact of Inflation on Your Retirement Savings

Planning for retirement is a lifelong process, but inflation can pose significant challenges to even the best-laid plans. Inflation slowly reduces the purchasing power of your savings, which can leave retirees struggling to afford the lifestyle they envisioned. Understanding the inflation impact on retirement and taking proactive steps to protect your retirement savings is critical …

Read More »

Read More »

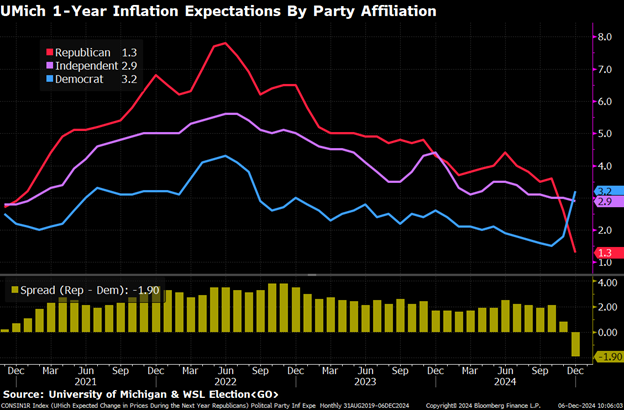

Inflation Forecasts Can Reflect Political Bias

The Fed uses many inflation gauges to develop its forecasts. An important one that Powell has flagged many times is inflation expectations. However, there is a weakness in using inflation expectations as an input to the Fed’s forecasts. Inflation expectations are collected from two primary sources: markets and surveys. Both traders and individuals have political …

Read More »

Read More »

Psychological Optimism and High Expectations for Next Year

? High expectations for next year driven by 'animal spirits' - everyone's optimistic due to America first policies. Exciting times ahead! ??? #EconomicOutlook

Watch the entire show here: https://cstu.io/21033b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Our Christmas Wish To You

We want to take this opportunity to wish you, your family, and your loved ones a very merry and joyful Christmas. We also want to say “Thank You” for all of your support, loyal readership, and the friends we have made through sharing ideas over the last year. While it may be deemed “politically incorrect” these days to say such …

Read More »

Read More »

Our Christmas Wish To You

We want to take this opportunity to wish you, your family, and your loved ones a very merry and joyful Christmas. We also want to say “Thank You” for all of your support, loyal readership, and the friends we have made through sharing ideas over the last year. While it may be deemed “politically incorrect” these days to say such …

Read More »

Read More »

The Widow’s Penalty: Understanding Single Tax Rates

Single tax rates may increase tax liability & impact retirement savings. Planning ahead is key! ? #FinancialPlanning #TaxTips #Retirement

Watch the entire show here: https://cstu.io/444875

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Comprehensive Guide to Retirement Planning for Every Stage of Life

Planning for retirement is a lifelong journey that evolves as you progress through different stages of life. A well-thought-out strategy not only ensures financial security but also helps you achieve the lifestyle you desire during your golden years. This retirement planning guide breaks down the process into manageable phases—from early career to post-retirement—emphasizing the importance …

Read More »

Read More »

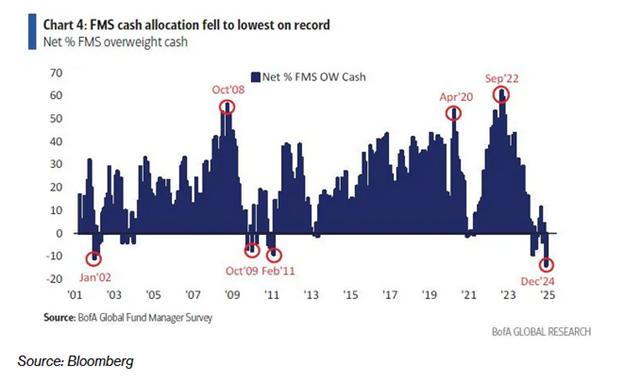

Cash Allocations Send an Ominous Signal

Administrative Note: We will not publish a daily market commentary tomorrow or Wednesday. Everyone at RIA Advisors would like to extend our sincere blessings to you and your families and our wishes for a very Merry Christmas. _________________ According to Bank of America, institutional fund managers are sitting on record low cash allocations as they …

Read More »

Read More »

The Impact of Regulation and Taxes on Consumer Prices and Economic Growth

Prices rising due to regulations and taxes are passed on to consumers. As wages increase, so do goods/services prices. It's all connected! ? #EconomyGrowth

Watch the entire show here: https://cstu.io/584ca2

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Why Mississippi Is Wealthier Than France: The Power of Free Markets

Why is America the richest country? In Mississippi, the poorest state, GDP per capita is higher than France. ?? #wealth #economy

Watch the entire show here: https://cstu.io/747d6d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

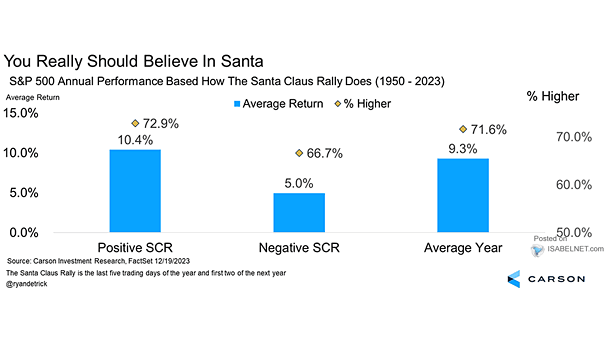

Santa Claus Rally Or Did The Fed Steal Christmas?

Inside This Week's Bull Bear Report Powell & A Government Shutdown Hits Stocks Last week, we noted the ongoing market churn that could last into this week's Fed meeting. To wit: "That certainly seemed the case this past week, with the market trading being fairly sloppy. Attempts to push the market higher were repeatedly met …

Read More »

Read More »

2024 Christmas Break

Yup--we're on a break until the New Year!

Wishing you and your family a safe and happy holiday, and while we're away you can playback your favorite audio podcast on iTunes and Spotify and other popular streaming platforms. The link to Audio on the Go is here on our website:

https://realinvestmentadvice.com/resources/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio...

Read More »

Read More »

Understanding Moving Averages: Essential Insights for Investors

? Understanding moving averages in trading! Shorter term rising faster = divergence, markets rising quickly. Closer averages = slowing momentum. #TradingTips #StockMarket ?

Watch the entire show here: https://cstu.io/e48796

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-20-24 What the Trump Win Means for Your Taxes

Rich & Danny's final live show of the year starts with coverage of Tariffs, inflation vs deflation, and Jerome Powell's performance as Fed Head. Being cautiously optimistic: We've been living in a government-driven economy: Markets aren't red or blue; they're green. How estate planning may evovled during the Trump presidency; will the SALT deduction return? Debt focus will change perspective. Richard discovers the NOK Box for estate planning....

Read More »

Read More »

Prediction For 2025 Using Valuation Levels

It’s that time of year when Wall Street polishes up its crystal balls and predicts next year's market returns. Since Wall Street never predicts a down year, these forecasts are often wrong and sometimes very wrong. For example, on December 7th, 2021, we wrote an article about the predictions for 2022. “There is one thing …

Read More »

Read More »