Category Archive: 9a.) Real Investment Advice

7-10-25 Will Lower Rates Cure Higher Prices?

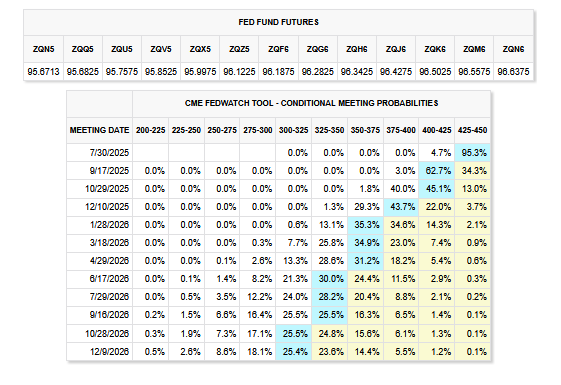

As inflation remains elevated and the Federal Reserve begins to shift its tone, markets are asking: Will lower interest rates actually bring prices down — or make them worse? Lance Roberts and Michael Lebowitz unpack the delicate balance between monetary policy, consumer behavior, and price pressures:

* The historical relationship between rate cuts and inflation

* Why inflation may be more “sticky” than expected

* How consumer demand and debt loads...

Read More »

Read More »

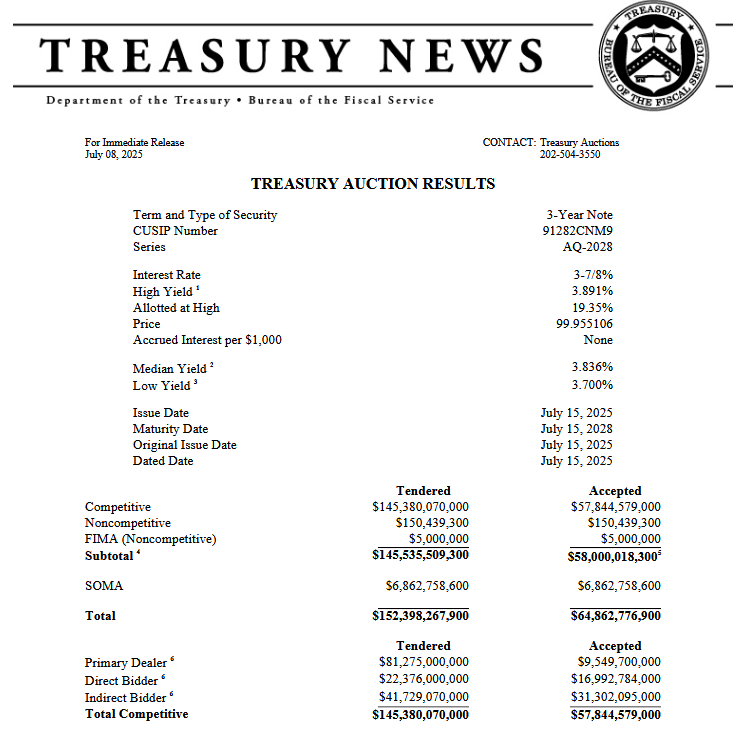

Treasury Auctions In Plain English

With the amount of Treasury debt now in sharp focus, it's worth cutting through the technical jargon used by the media to quantify demand at Treasury auctions. This summary of key Treasury auction terms will help you judge the auctions for yourself and not rely on others.

Read More »

Read More »

Capital Preservation Strategies for Retirees with Over $1 Million in Assets

When you've accumulated more than $1 million for retirement, your financial priorities shift. It's no longer just about growth but about protecting what you’ve built and generating reliable income that will support your lifestyle for decades to come.

Read More »

Read More »

Retirees with guaranteed income spend more.

David Blanchett and Michael Finke penned a June 2024 research paper for the Retirement Income Institute that shared insight into why retirees with a guaranteed income spend more. They deem guaranteed retirement income a "license to spend."

Read More »

Read More »

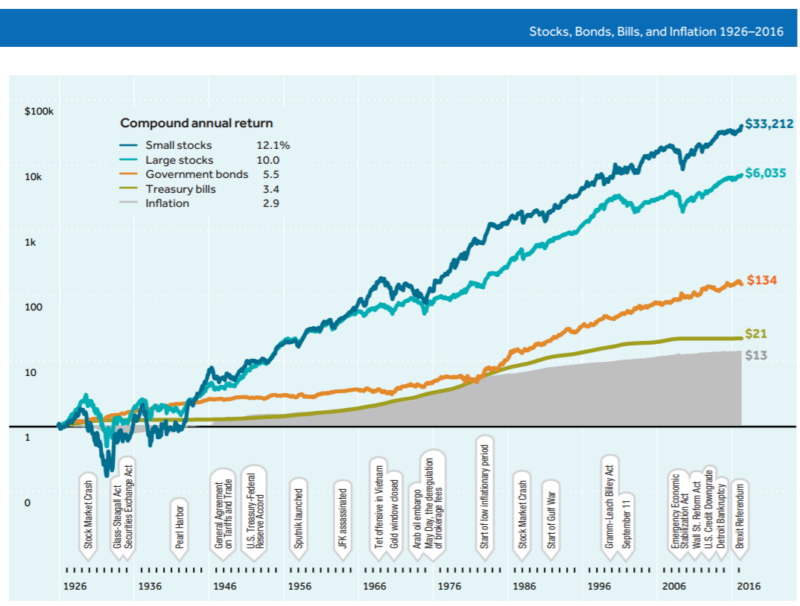

7-9-25 Make Sure You’re Not Too Conservative in Your Allocations

Yes, you can be too conservative in managing your retirement portfolio...just as you can be too risky. But don't be so conservative that you hamper your portfolio's ability to perform. And never wear a suit to a Radio show.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube...

Read More »

Read More »

7-9-25 How to Protect Your Multi-decade Retirement from Inflation

More Tariff trouble on the horizon, but markets have seen this movie before (The Stick & Carrot Show). Market risk remains, as markets are highly deviated. Sentiment remains positive; there's a large gap between market performance and economic data, however. Deviations tend to resolve themselves to the downside. Lance Roberts & Danny Ratliff reveal how to shield your retirement savings from decades of inflation: The necessity of Inflation...

Read More »

Read More »

Crisis At Apple: Can They Catch Up In The AI Race?

Apple (AAPL) shares are languishing this year. As we share below, the stock is down over 16% year-to-date and significantly lags all of the Magnificent Seven stocks except Tesla. While weak revenue growth and relatively few new products are culprits, it's also worth noting that Apple is considerably behind in AI development. Some Apple employees, …

Read More »

Read More »

Might Lower Rates Be The Cure For Higher Prices?

The Fed is resisting interest rate cuts to help soften inflation to its 2% target. Supporting their policy is the belief that high interest rates lead to lower inflation. Most investors assume that the Fed is all-knowing and that its theories are logical. Are they? Might they be wrong, and lower interest rates are what … Continue...

Read More »

Read More »

7-8-25 Implications of Surge in ETF Investing

The level of investor greed is "off the chain," levels we haven't seen since the late '90's. It's not necessarily a bad thing--that's how markets work--but it's also a warning sign.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-8-25 Are ETF’s Eating the World?

Earnings season is upon us; will volatility pick up? A bigger question will be how tariffs may affect corporate earnings. Employment numbers are dipping into contraction zone as the economy slows. Markets sell off on renewed tariff news. Crude oil prices are creeping back up. No one is expecting correction...which is when they usually appear. Exchange-Traded Funds (ETFs) have exploded in popularity—driving a massive shift from active to passive...

Read More »

Read More »

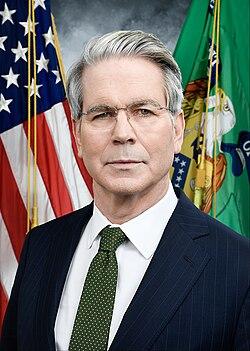

Can Bessent Juggle The Treasury And The Fed?

Hidden within a Bloomberg article published over the July 4th weekend was the following quote alluding to the possibility that Treasury Secretary Scott Bessent could simultaneously replace Jerome Powell as the Fed Chair, while continuing to serve as the Treasury Secretary. The president said Tuesday he has “two or three top choices” to potentially succeed …

Read More »

Read More »

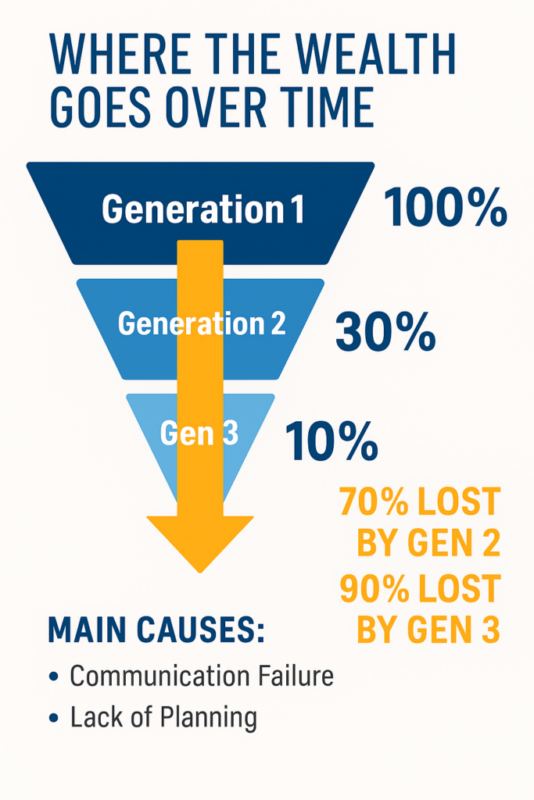

What High Net Worth Families Should Know About Generational Wealth Transfer

For high-net-worth families, passing wealth to the next generation involves more than just distributing assets. It’s about preserving a legacy, protecting what you’ve built, and preparing heirs to become responsible stewards. Generational wealth transfer is both a technical process and an emotional journey, and getting it right requires clarity, preparation, and expert guidance. In this …

Read More »

Read More »

7-7-25 Understanding Tariff Impact on Consumer Spending

Lance's recent visit to a U.K liquor store reinforced his thesis that tariffs are unlikely to trigger much inflation, if any, because merchants will eat the cost to remain competitive.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

7-7-25 The Bull Market Is Alive And Well

Lance is back from vacation, and the markets did not crash in his absence! On the contrary, they're doing very well. President Donald Trump's Big Beautiful Bill has been signed into law; still to be seen: its impact on earnings. We express our sentiments for the families and friends of loved ones lost in the Central Texas Flash Floods over the July 4th Weekend. Investor greed is a record levels, along with technical indicators, meaning markets are...

Read More »

Read More »

Intel Pushes For Change: Will It Save Them?

In no uncertain words, Intel's stock has been a dog. As we share below, Intel stock has increased by a mere 2% over the last 20 years, while the tech-heavy NASDAQ 100 (QQQ) has risen by over 1,200%. Over the previous 20+ years, Intel's management has made many missteps, including: With dirt-cheap valuations compared to … Continue reading...

Read More »

Read More »

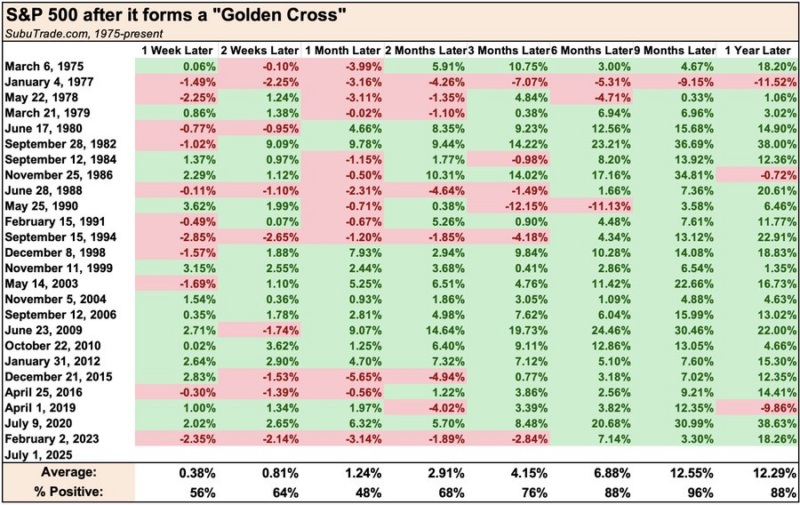

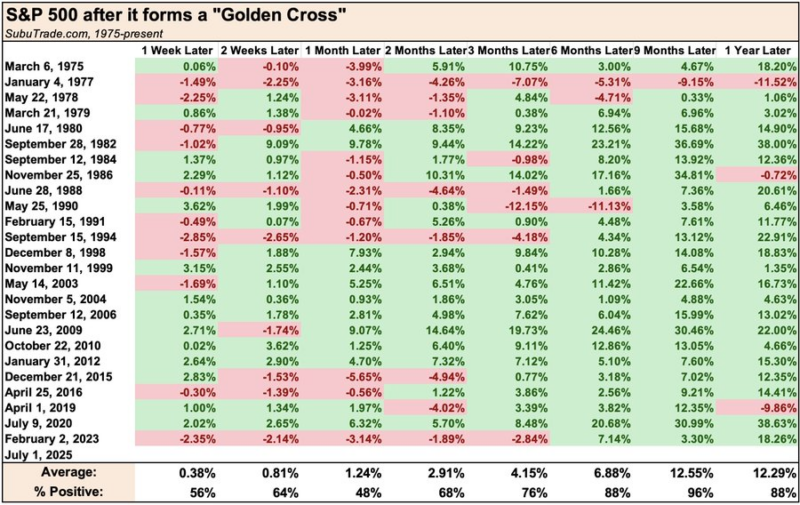

The Bull Market Is Alive And Well

The bull market is alive and well, even amid widespread talk of the “death of U.S. exceptionalism.” Early 2025 saw a sharp shift in investor sentiment. Concerns over erratic trade policy, soaring debt, and weakening dollar pressure challenged America’s long-standing market dominance. Markets fell sharply in April and May, feeding a narrative of declining "US …

Read More »

Read More »

Investor Greed Returns With A Vengeance

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 …

Read More »

Read More »

Annuities Are Not Your Enemy.

Utter the word ANNUITY and watch facial expressions. They range from fear to disgust to confusion. But hear me out: Annuities are not your enemy. Billionaire money manager and financial pitchman Ken Fisher appears as a haunting senior version of Eddie Munster in television ads. He stares with deep eyes ablaze with intensity. The tight camera …

Read More »

Read More »

What Sets a Fiduciary Financial Advisor Apart for High Net Worth Clients

When your wealth reaches seven figures or more, every financial decision carries greater weight and consequences. That’s why choosing the right financial advisor isn’t just a preference. It’s a necessity. High-net-worth individuals need more than cookie-cutter advice or product-driven sales pitches. They need strategic, objective, and comprehensive guidance. That’s where a fiduciary financial advisor stands …

Read More »

Read More »

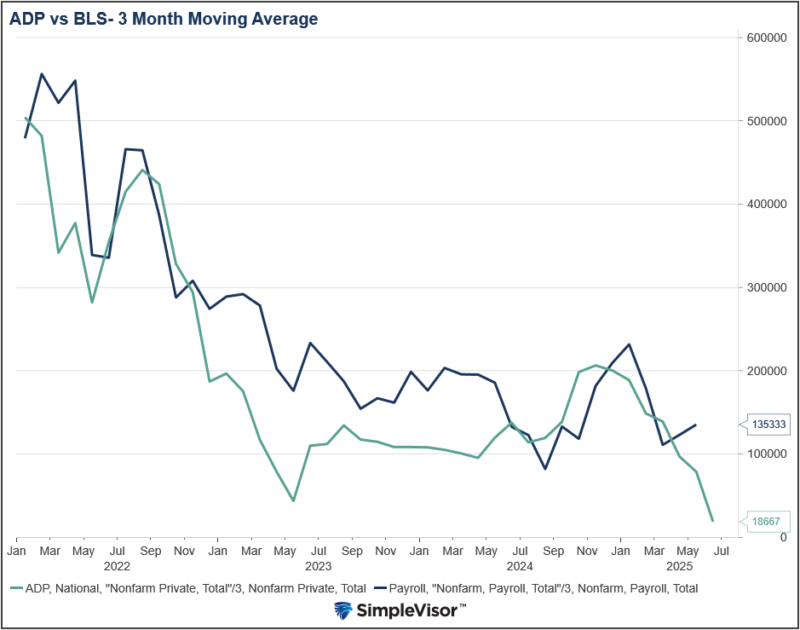

ADP Signals Labor Market Weakness

The Fed and most investors primarily assess the labor market based on the monthly BLS employment report. To better guide those estimates, various reports, such as the monthly ADP report, can be helpful. We say "can be" because, since the pandemic, ADP has been less correlated with the BLS than it was before the pandemic. … Continue...

Read More »

Read More »