Category Archive: 9a.) Real Investment Advice

The Power of Tactical Asset Allocation in Risk Management

A static approach to investing is not enough. While long-term strategies remain foundational, flexibility in execution is key to preserving wealth and maximizing returns. That’s where tactical asset allocation comes in. Tactical asset allocation is a hands-on investment strategy that allows advisors to actively shift portfolio allocations based on changing market conditions. It’s not about …

Read More »

Read More »

7-16-25 The Rise and Fall of SPAC’s

SPAC's were so hot, sports figures like A-Rod and Shack were endorsing them: Give us your money, and we'll go find something to invest in. Unsurprisingly, the results were disastrous. And now, they're back.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

7-16-25 SPAC’s are Back!

SPACs (Special Purpose Acquisition Companies) are making headlines again. Lance Roberts & Danny Ratliff break down why SPAC investing is back in 2025, what’s driving the latest SPAC market trends, and what investors need to know before jumping in. Are these deals a golden opportunity or another speculative bubble? Earnings Season continues with Banks' reports and the effects of stock buy backs beginning to wane. Tuesday's CPI print had...

Read More »

Read More »

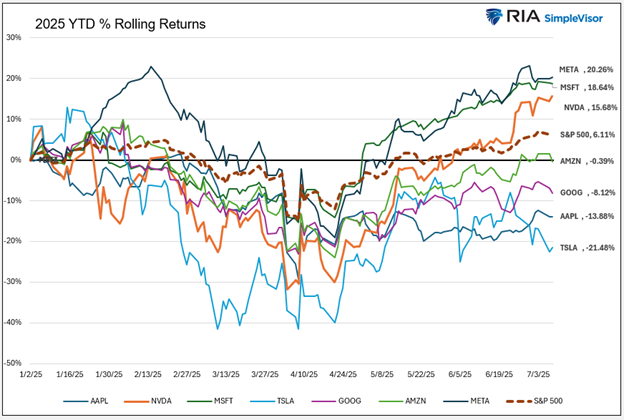

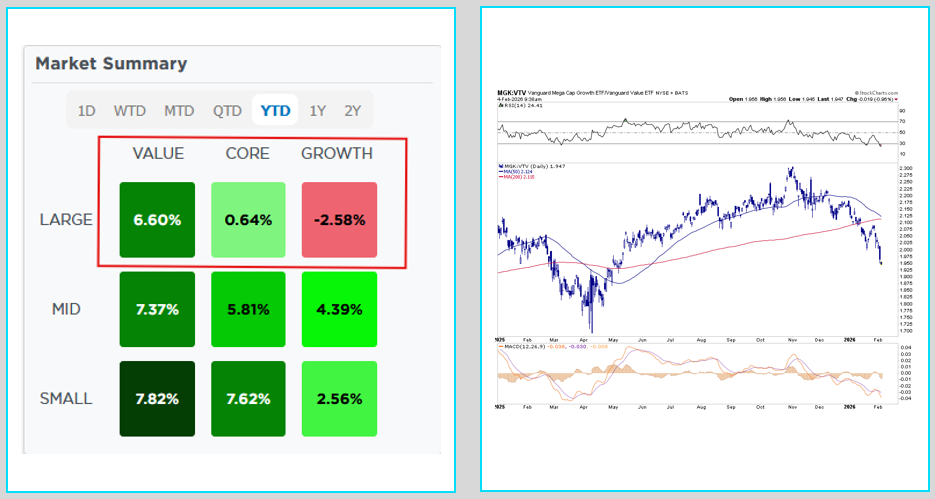

The Magnificent Seven Are Mediocre

In 2023, the "Magnificent Seven" (NVDA, META, TSLA, AAPL, MSFT, AMZN, and GOOG) became a popular nickname for the seven largest stocks by market capitalization. “Magnificent” was used because these stocks led the S&P 500 higher throughout the year. These same stocks had a strong showing again in 2024, as all seven were among the …

Read More »

Read More »

CPI Data Has Something For Everyone

Yesterday's CPI data was viewed by many as the first monthly BLS report to capture the full impact of tariffs. The headline CPI rose 0.3% and the core CPI data showed a 0.2% increase. The CPI data was slightly lower than Wall Street's expectations for a 0.3% increase for both figures. Those claiming that tariffs … Continue reading...

Read More »

Read More »

7-15-25 Before You Invest, Have an Emergency Fund First

How can you invest money when you don't have any? Life happens; be prepared. Have an emergency fund ready to cover life's little surprises to that you're not dipping into your investments to pay bills.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on...

Read More »

Read More »

7-15-25 Two Dad’s on Money

What's the best Money Advice you'd give your kids?

Lance Roberts & Jonathan Penn host our "Two Dad's on Money" episode of #TheRealInvestmentShow.

#FinancialAdviceForKids #MoneyLessonsFromDad #TeachingKidsMoney

Read More »

Read More »

Tariffs Cause The First June Surplus In Nine Years

For the first time since 2016, the Federal government ran a budget surplus in June. Before the Financial Crisis, a surplus was the norm. However, since then, deficits have been the rule, not the exception. The cause of the $27 billion surplus was $27 billion in tariffs taken in. For reference, the government took in …

Read More »

Read More »

How a Risk-Managed Investment Strategy Reduces Emotional Decision-Making

Investing is as much about mindset as it is about markets. When volatility strikes or headlines spark fear, even experienced investors can fall prey to emotional decision-making. Selling too soon, buying too late, or abandoning a plan entirely. These responses often do more harm than good. That’s where a risk managed investment strategy can make …

Read More »

Read More »

7-14-25 Market Predictions Need Three Things to be Valid

There need to be three things to quantify any market prediction to make it of any use whatsoever to investors: When? Why? ANd what course of action should be taken. If those three facts are missing, the outlook is useless.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow...

Read More »

Read More »

7-14-25 Relative Returns Or Absolute: What’s More Important?

Earnings Season has commenced with lowered expectations, meaning higher "beat" rates for companies, thanks to the lowered bar. Market react mildly to Mexican & Canadian 30% Tariffs; a warning for this week's CPI Report: The past four reports have been lower than expected, so a much higher number may be printed this time around. A three-month preview of market probabilities shows 50-50 chance of continued bullish activity; BUT, markets...

Read More »

Read More »

MP Materials Is Bought By Uncle Sam

In a unique event, the US government, specifically the Department of Defense (DoD), bought a 15% stake in the nation's largest rare earth miner, MP Materials (MP). The DoD is buying $400 million of MP’s convertible preferred stock. The transaction will make the government MP’s largest shareholder. The following quote on the benefits of the partnership …

Read More »

Read More »

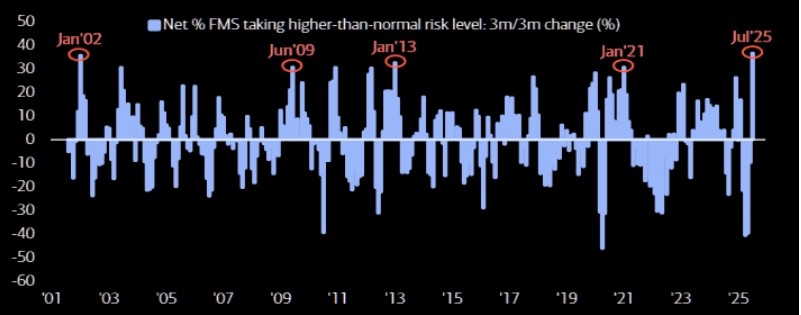

Relative Returns Or Absolute. What’s More Important?

A couple of years ago, I wrote about absolute versus relative returns. Given the latest market run, I am getting a lot of questions about chasing returns, and individuals comparing themselves to the S&P 500 index. Historically, trying to beat a benchmark index leads to poor outcomes. However, understanding absolute and relative returns can help …

Read More »

Read More »

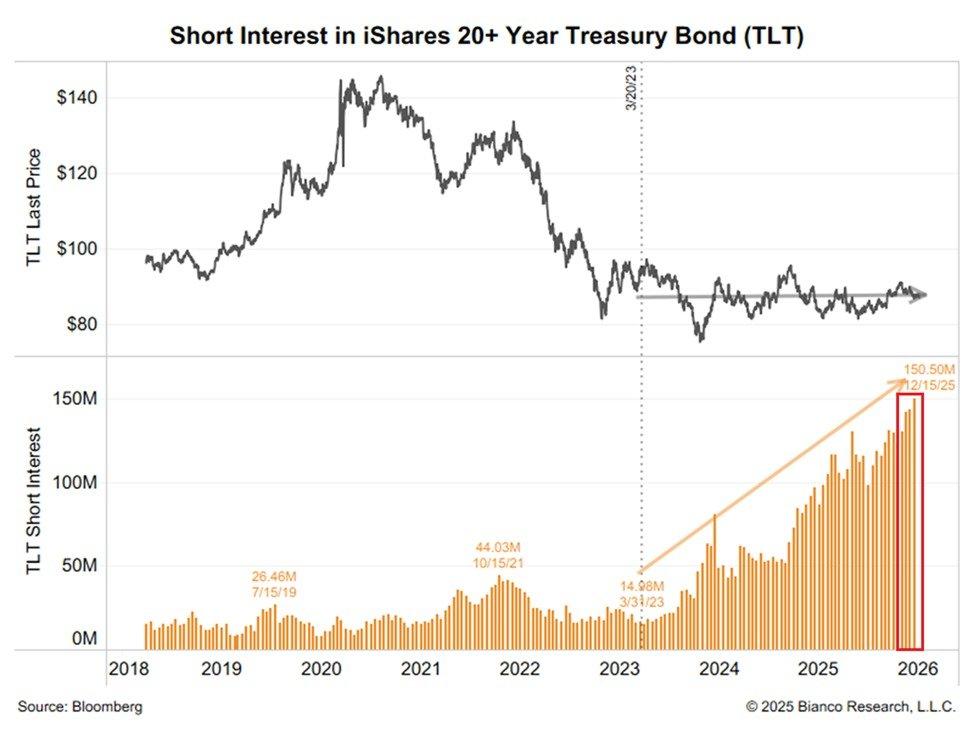

Is The Dollar Setting Up For A Comeback?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 … Continue...

Read More »

Read More »

7-11-25 Impact of the New $6,000 Tax Deduction on Middle-class Tax Payers

The "no-tax on Social Security" promise is a false premise, BUT passage of the $6,000 tax deduction DOES help a lot these middle class Americans who are paying taxes on social security.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-11-25 What the Big Beautiful Bill Means for Your Money

What is the impact of the recently-passed Big Beautiful Bill on your money and retirement plans? Richard Rosso & Jonathan McCarty plumb the depths of the legislation to find the good--and the bad--effects it will have. Richard review the latest round of tariffs on Canada (markets don't care), and AI is promising to be a game changer in the middle management job market. The Big Beautiful Bill has benefits and drawbacks: there are caps and...

Read More »

Read More »

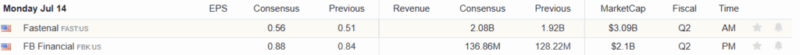

Q2-2025 Earnings Season Preview

Next week, the Q2-2025 earnings season will begin in earnest as a barrage of S&P 500 companies report, starting with the Wall Street money center banks on Tuesday and Wednesday. Since earnings drive the market by supporting investor expectations, what […] The post Q2-2025 Earnings Season Preview appeared first on RIA.

Read More »

Read More »

Is Immigration Not Tariffs Becoming Powell’s New Excuse

Jerome Powell has made it clear that tariffs could induce higher inflation. Accordingly, the Fed has resisted cutting interest rates. Despite his concerns, fears of tariff-based inflation, as judged by individual and business surveys, are fading. Moreover, even some Fed […] The post Is Immigration Not Tariffs Becoming Powell’s New Excuse appeared first on RIA.

Read More »

Read More »

7-10-25 Nvidia is Dead? Not Hardly.

Nvidia has defied the nattering naybobs of negativity who foretold its demise with the rise of AI. To the contrary, Nvidia beat out Apple as the first $4-Trillion company.

Beware the narratives!

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »