Category Archive: 9a.) Real Investment Advice

10-10-25 Contrarian Trade That Could Shock Gold, Bitcoin & Stocks

➢ Listen daily on Apple Podcasts: The real contrarian trade is the dollar $DXY.

In this Short video, @michaellebowitz and I discuss how rapid dollar rally could catch markets off guard, forcing investors out of gold $GLD, Bitcoin $IBIT, and risk assets as money rushes back into the safety of the U.S. dollar.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-10-25 Maximize Your Money: The Hierarchy of Smart Savings Strategies

How do you make every dollar work harder for you?

Richard Rosso breaks down the Hierarchy of Smart Savings Strategies — a smart, structured approach to prioritize where to save and invest for maximum growth and minimum taxes. This simple yet powerful framework helps you build wealth efficiently, protect against taxes, and optimize your financial future.

0:19 - Foundational Basis & Economic Conundrum

8:05 - Prioritizing Saving Money - Pay...

Read More »

Read More »

The AI Trillion Dollar Question

According to The Wall Street Journal, on an inflation-adjusted basis, technology companies have spent more in the last three years on data centers, chips, and energy than has been spent over the past forty years building out the nation's interstate system. The massive amount of investments being put to work is stunning. But the Wall …

Read More »

Read More »

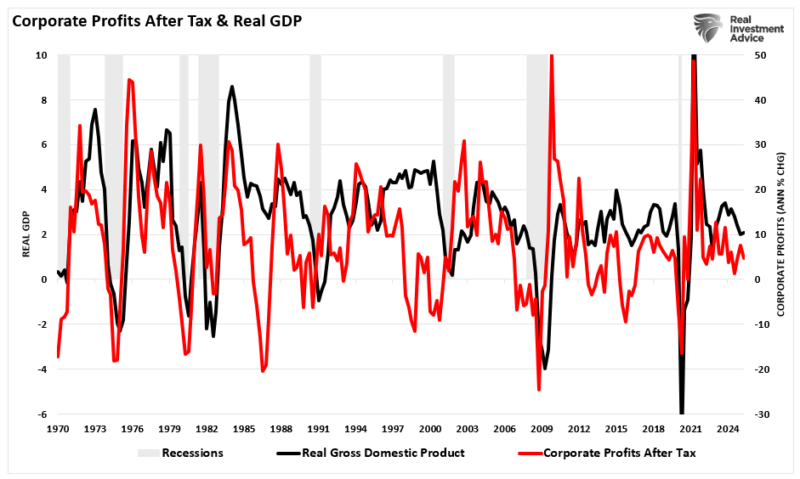

Corporate Profits: A Reading Without Rose-Tinted Glasses

If you want to understand where we are in the cycle, skip the noise and follow profits. Corporate profits are the lifeblood of investment, hiring, and market returns. Crucially, linkage to the real economy is very tight. In the national accounts (NIPA), the BEA’s “profits from current production” (with inventory valuation and capital consumption adjustments) …

Read More »

Read More »

10-9-25 The Bearish Case For AI Boom: Revenues, Power, & The Cost

The AI capex boom is real but fragile. It isn’t built on profits, but on promises – circular funding between $NVDA, $ORCL, OpenAI, and others – alongside soaring power costs and looming energy constraints.

In this Short video, @michaellebowitz and I discuss why this self-feeding cycle could expose weak links and lead to costly surprises for investors.

Full episode:

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-9-25 Recession & Bonds: What Happens When The Next Downturn Hits?

A recession usually means falling inflation and lower bond yields — good news for bond investors. But what if this time is different?

Lance Roberts & Michael Lebowitz break down how the next recession could flip the bond trade from bullish to bearish — and why government policy and fiscal stimulus may once again distort the relationship between inflation, yields, and bond prices.

0:19 - US Dollar Impact on Multi-national Companies

3:32 -...

Read More »

Read More »

Excess Liquidity: Where Art Thou?

The graph below, courtesy of the St. Louis Fed, charts the amount of money in the Fed’s overnight reverse repurchase agreement (ON RRP) facility. To understand why the current lack of a meaningful balance in the program could become concerning, let's revisit the Fed's response to the Pandemic. During the pandemic and global economic shutdown, …

Read More »

Read More »

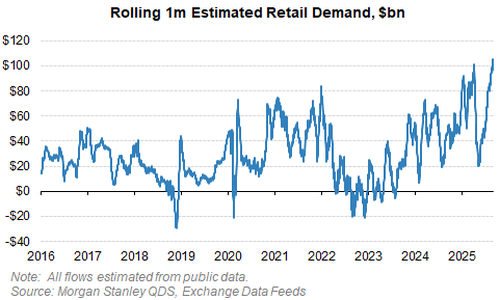

10-8-25 Retail Inflows Hit An All-Time Record – The Top Is Near?

Retail investors just poured record amounts into the market, much of it fueled by margin debt. Liquidity and FOMO are driving prices higher.

In this short video, I explain why this kind of late-cycle euphoria often appears right before markets peak.

Full episode: _Iqu1g

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-8-25 Markets, Money & Mindset: Live Q&A with Lance Roberts

JJoin Lance Roberts for a live open Q&A on markets, money, and investing.

We’ll cover what’s on your mind—from market melt-ups and Fed policy to portfolio positioning and economic risks. No scripts, no fluff—just real talk and real answers about what’s moving markets and shaping investor behavior.

0:19 - Markets are Absorbing Money

4:14 - Profit Taking in Bitcoin

9:15 - YouTube Poll - The #1 Thing on Your Mind About Markets

10:09 - How Do You...

Read More »

Read More »

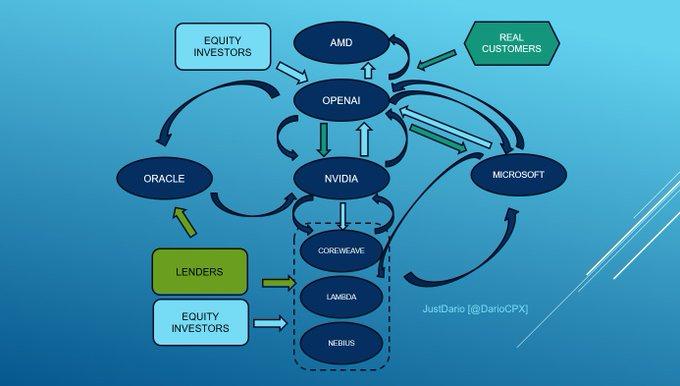

OpenAI: Fueling Massive AI Stock Gains

As we led in yesterday's Commentary, AMD rose 25% on the news that OpenAI would purchase 10% of AMD. In exchange, OpenAI will become a significant customer of AMD. This symbiotic relationship is just one of many that OpenAI is forming with companies at the forefront of the AI revolution. The bullet points and graphic …

Read More »

Read More »

Recession And Bonds: Navigating The Next Recession

It's odd to consider, but a recession could flip our bullish outlook on bonds to bearish. It's unusual because typically, inflation drops during a recession, leading to lower yields and higher bond prices. While we believe that if an economic downturn or recession occurs soon, the immediate effect on bonds will be favorable. However, the …

Read More »

Read More »

10-13-25 Markets vs Reality: Daniel LaCalle on the Coming Global Reset

Are markets completely disconnected from economic reality?

In this in-depth conversation, Lance Roberts sits down with Daniel LaCalle, Chief Economist at Tressis and author of "Freedom or Equality," to discuss the illusion of wealth, the rise of sovereign debt bubbles, and why the next financial crisis may already be unfolding beneath the surface.

Key takeaway: Markets may look strong, but the foundations are far weaker than investors...

Read More »

Read More »

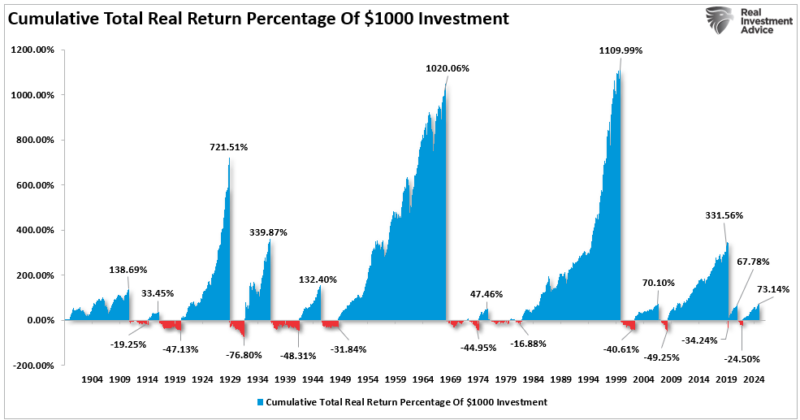

10-7-25 Why Markets Don’t Compound Over Time

Most investors believe markets compound steadily, but they don’t.

Losses break the compounding path, and timing matters more than most realize.

In this Short video, I show why managing risk—not chasing returns—is what truly builds wealth over time.

Watch the full episode: https://www.youtube.com/live/Oo1Ny37IaEs?si=5vnlpbRLq_FaAHQL

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-7-25 7 Midlife Money Traps That Destroy Wealth

In your 30s, 40s, or 50s, life gets busy—and money decisions get complicated. Many professionals fall into the same midlife financial traps that quietly erode their future wealth. Lance Roberts & Jon Penn unpack seven common midlife money mistakes that can derail your long-term goals—from lifestyle creep and poor diversification to credit card debt and get-rich-quick schemes. Learn how to stay focused, protect your growing assets, and build...

Read More »

Read More »

AMD Surges: Nvidia Competition Heats Up

Advanced Micro Devices (AMD) stock opened up by nearly 35% on Monday morning, following reports that OpenAI is acquiring a 10% stake in AMD. As part of the agreement, AMD will supply OpenAI with 6 gigawatts of AMD's Instinct GPUs.

Read More »

Read More »

10-6-25 The Hidden Math Wall St. Doesn’t Tell You About Buy & Hold

Most investors think market drops are just “blips,” but the math tells a different story — a 50% decline cuts total dollar gains in half, not by a small “blip.”

In this short video, I explain why legendary investors like Warren Buffett & Paul Tudor Jones focus on limiting losses, not blindly holding — and why right now, protecting capital beats chasing the rally.

Full episode: https://www.youtube.com/live/Oo1Ny37IaEs?si=5vnlpbRLq_FaAHQL...

Read More »

Read More »

10-6-25 Bear Market Losses: The Dangerous Illusion Investors Fall For

Investors often believe that when markets “recover,” their portfolios do too — but that’s a dangerous illusion. In this episode, Lance Roberts breaks down why percentage losses and gains are not symmetrical, and how a 50% loss requires a 100% gain just to break even.

We’ll discuss why bear market math destroys long-term returns, how emotional investors get trapped in the “illusion of recovery,” and why managing risk during drawdowns matters more...

Read More »

Read More »

Bear Market Losses – A Dangerous Illusion

When bear market losses occur, headlines talk in percentages: “The market dropped 20 %.” Investors nod. A 20 % decline sounds manageable, historical, and expected. As Ben Carlson recently penned: "Bear markets have some symmetry to them, at least in the short-term. In the long term, bull markets versus bear markets are asymmetric. Things are not balanced. Look at …

Read More »

Read More »

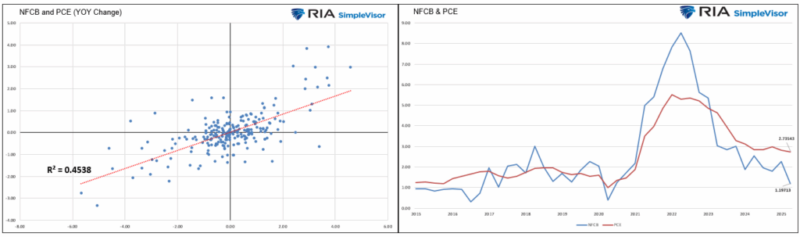

Corporate Prices Lead Consumer Prices

The following discussion is courtesy of Paul Mortimer Lee, as provided by Albert Edwards of Societe Generale. Paul makes an interesting case that PCE prices, the Fed’s primary gauge of inflation, are likely to decline. Supporting his view is a relatively wide and growing gap between the prices witnessed by the non-financial corporate business sector, …

Read More »

Read More »

Bubble In AI: Echoes Of The Past, Lessons For The Present

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »