Category Archive: 9a.) Real Investment Advice

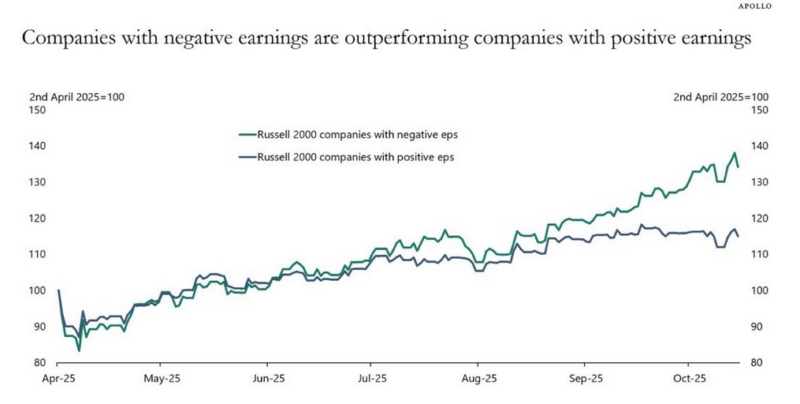

Negative Earnings: Another Speculative Favorite

The chart below, courtesy of Apollo’s Torsten Slok, shows that small-cap companies with negative earnings have outperformed small-cap companies with positive earnings by about 30% since early April. Per Torsten: “Something remarkable is going on in the equity market. Stock prices of companies with negative earnings have in recent months outperformed stock prices of companies …

Read More »

Read More »

Retail Leverage Goes to Extremes

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

10-24-25 Why Gold’s Boom Is More About Calls Than Coins

$GLD rally isn’t real demand – it’s speculation disguised as strength.

In this short video, @michaellebowitz and I explain why the boom in call options, not central bank buying, is driving #gold surge and why a sharp correction may be next.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-24-25 The Art of Retirement Income

Your greatest retirement risk isn’t the market; it’s living longer than you expect.

Richard Rosso shares the Art of Retirement Income—how to enjoy your savings early in retirement while protecting your future lifestyle.

💡 Topics covered:

• Why the 4% rule doesn’t match how most retirees really spend

• How to front-load income for early enjoyment without running out of money

• The role of inflation protection and flexible withdrawal plans

• How...

Read More »

Read More »

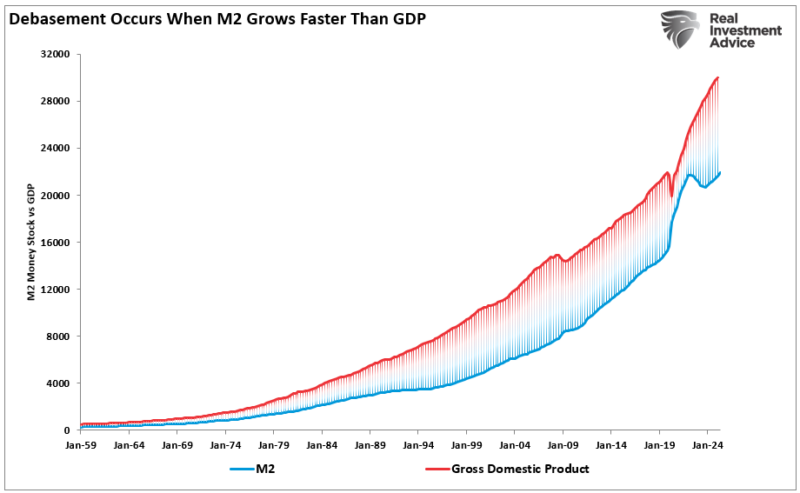

Money Supply Growth: A Thesis With A Fatal Flaw

Recently, MarketWatch ran a provocative headline: “When the world’s largest asset manager and the Bond King both agree: Run to gold, silver, and bitcoin.” The article highlighted how Larry Fink’s BlackRock and Jeffrey Gundlach, often dubbed the “Bond King,” see deficits and “money printing” as reasons for investors to escape fiat currencies and pile into …

Read More »

Read More »

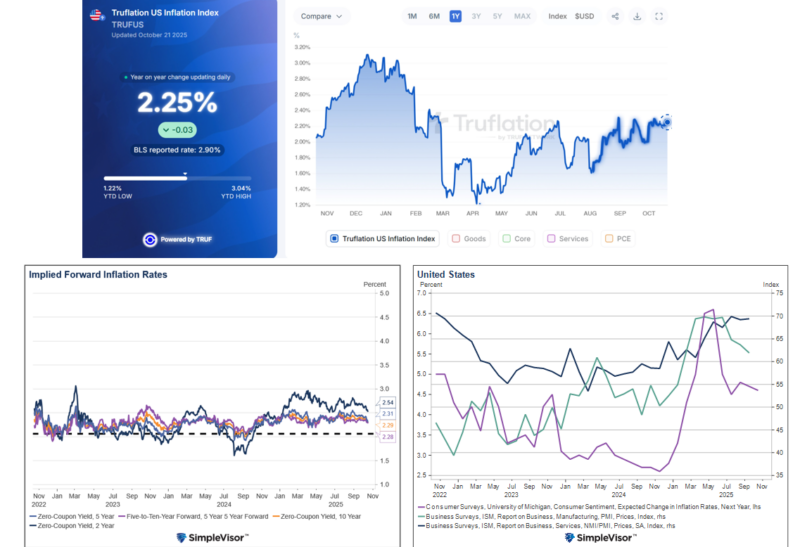

Inflation In Focus: What Market Data Tells Us

As we approach today's delayed CPI report, it's helpful to look beyond government statistics to focus on a more current and robust picture of inflation. Implied Inflation: This is derived from comparing the yields of nominal Treasury securities to Treasury Inflation-Protected Securities (TIPS). The graph below (bottom left) shows that implied inflation, also known …

Read More »

Read More »

10-23-25 Behind the Dollar “Collapse” Narrative – The Real Story

Despite the media noise, the dollar isn’t collapsing. The $DXY is near its long-term fair value, and foreign investors keep buying U.S. debt and equities $SPY / $QQQ – proof that global confidence in the dollar remains strong.

In this short video, Michael Lebwitz and I discuss why the “dollar crash” narrative is overblown.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-23-25 Dollar Debasement: Reality Or Dangerous Narrative?

Gold’s rally has investors shouting “dollar debasement!” — but is the narrative real, or just a speculative illusion?

Lance Roberts & Michael Lebowitz break down the popular debasement argument and expose the facts behind the gold surge. From money supply trends to Fed policy and global confidence in the U.S. dollar, we separate the data from the hype.

0:19 - Stresses Emerging in Lower End of Economy

4:45 - The Oil Price Pop

6:35 -Good News -...

Read More »

Read More »

Beyond Meat Surges: Another Meme Ponzi?

In August 2025, Beyond Meat (BYND), a plant-based meat producer, took to social media to call reports of its bankruptcy "unequivocally false". Despite the assurances, the company was floundering, and bankruptcy was a possibility. The company has significant liabilities and has lost money every year since its IPO. Adding to their woes, sales peaked in …

Read More »

Read More »

A Daily Dose Of Charts & Graphs October 22, 2025

In this Short video, I cover leverage, $GLD key support, the seasonality tailwind, liquidity and sentiment trends, Fed policy context, and valuation vs. narrative — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

📺Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-29-25 Bitcoin: Speculation, Blockchain, & the Future of Money

Why has Bitcoin captured the attention of investors and innovators alike?

Lance Roberts & Vinay Gupta break down what makes Bitcoin unique — from its blockchain backbone to its role as currency, commodity, and speculative asset. We’ll explore how to think about Bitcoin in a diversified portfolio, what risks investors need to understand, and why blockchain may reshape how business is done in the future.

#BitcoinInvesting #BlockchainTechnology...

Read More »

Read More »

Leveraged ETFs: Yet Another Sign Of Rampant Speculation

Not only is the market chasing the most speculative of assets, but it is employing record amounts of leverage to do so. Traditionally, investors use margin loans to gain leverage. More recently, however, leveraged ETFs allow investors to get leverage in one package. To wit, the graph below, courtesy of BofA, shows that there are …

Read More »

Read More »

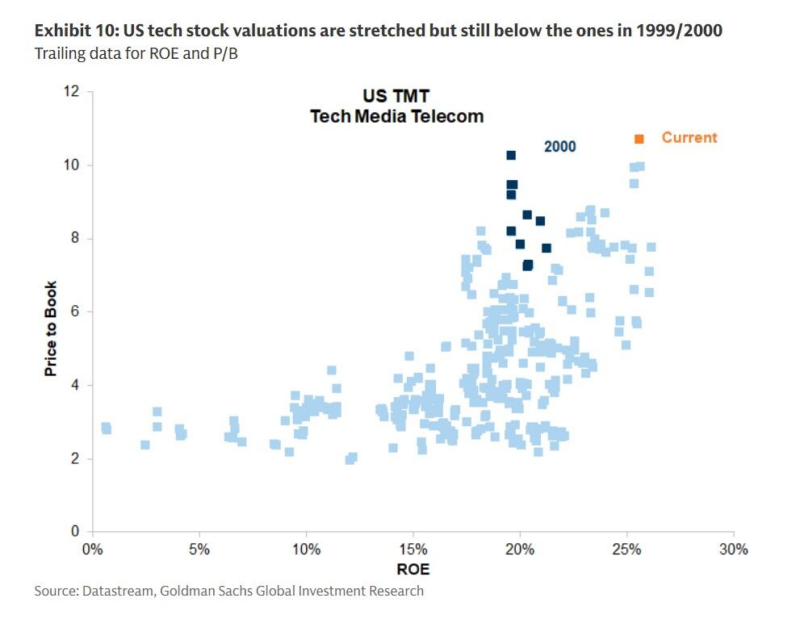

Dollar Debasement: Reality Or A Dangerous Narrative?

Gold prices are soaring. And with each tick higher, more and more market pundits and investors are coming out of the woodwork, asserting that dollar debasement is the reason. Is that the correct reason, or might gold be in a momentum-fueled speculative bubble like many other assets? The answer has significant implications for the price …

Read More »

Read More »

10-21-25 5x ETFs & Margin Debt: The Hidden Risk BehindThe Year-End Rally Narrative

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

10-21-25 Cash Value Life Insurance: Smart Strategy or Costly Mistake?

Cash value life insurance often sparks debate — is it a smart financial tool or an expensive way to mix insurance with investing? Lance Roberts & Jonathan Penn break down how cash value life insurance actually works and where it may (or may not) fit into your overall financial picture.

0:18 - Preview - Life Insurance & BYOB, Earnings Season Continues

6:00 - Markets Confirm Bullish Trend

10:55 - Private Credit Fund Warning - Subprime Credit...

Read More »

Read More »

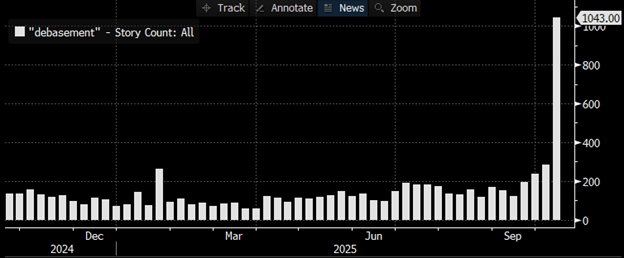

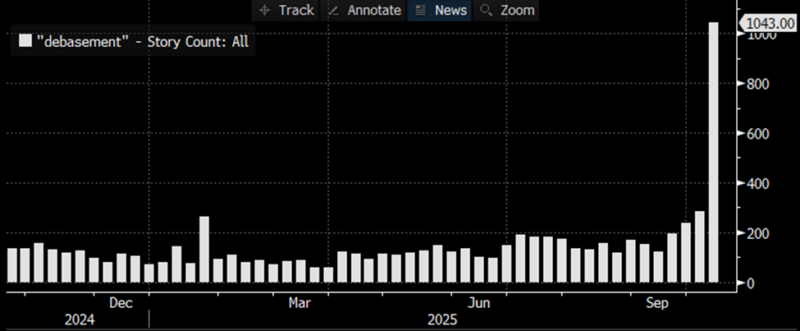

Joe Weisenthal’s Take Down Of The ‘Debasement’ Trade

Bloomberg's Joe Weisenthal wrote an interesting article (Maybe 'Debasement' Isn't The Best Way To Put it), sharing his opinion on the rising popularity of the so-called debasement trade. The debasement trade logic that Joe generally debunks is growing very popular in the media, per the Bloomberg graph below. While Joe thinks the debasement trade logic …

Read More »

Read More »

10-20-25 The Illusion Of Zero Risk: When Volatility Returns, This Market Will Break

Years of easy money trained investors to believe markets have no risk. Buying every dip still works because volatility is low, but this illusion of safety won’t last.

In this Short video, I argue that when volatility returns, this “zero-risk” market will break.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-20-25 Invest Like a Bull…Think Like a Bear

IInvest like a bull. Think like a bear.

Lance Roberts dives into the mindset of successful investors: staying bullish on opportunity, but thinking like a bear when it comes to risk.

Learn how to stay optimistic without losing discipline, why emotional control outperforms market hype, and how blending bullish conviction with bearish caution can help you thrive through any cycle.

* How to stay invested while protecting capital

* Recognizing when...

Read More »

Read More »

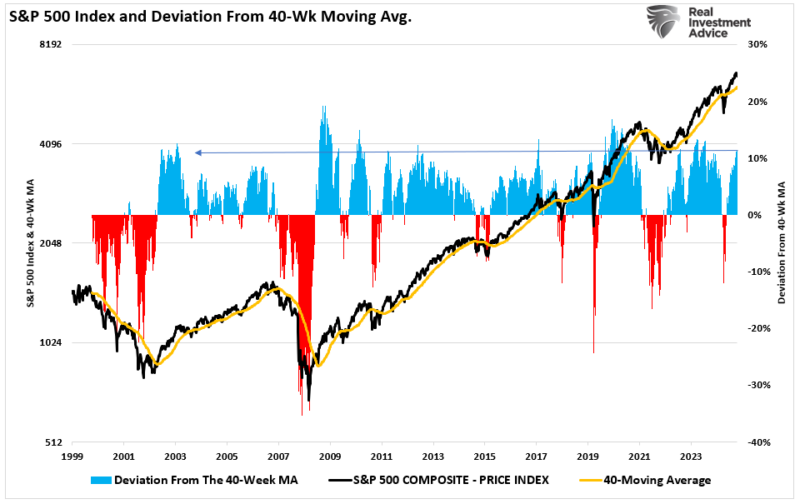

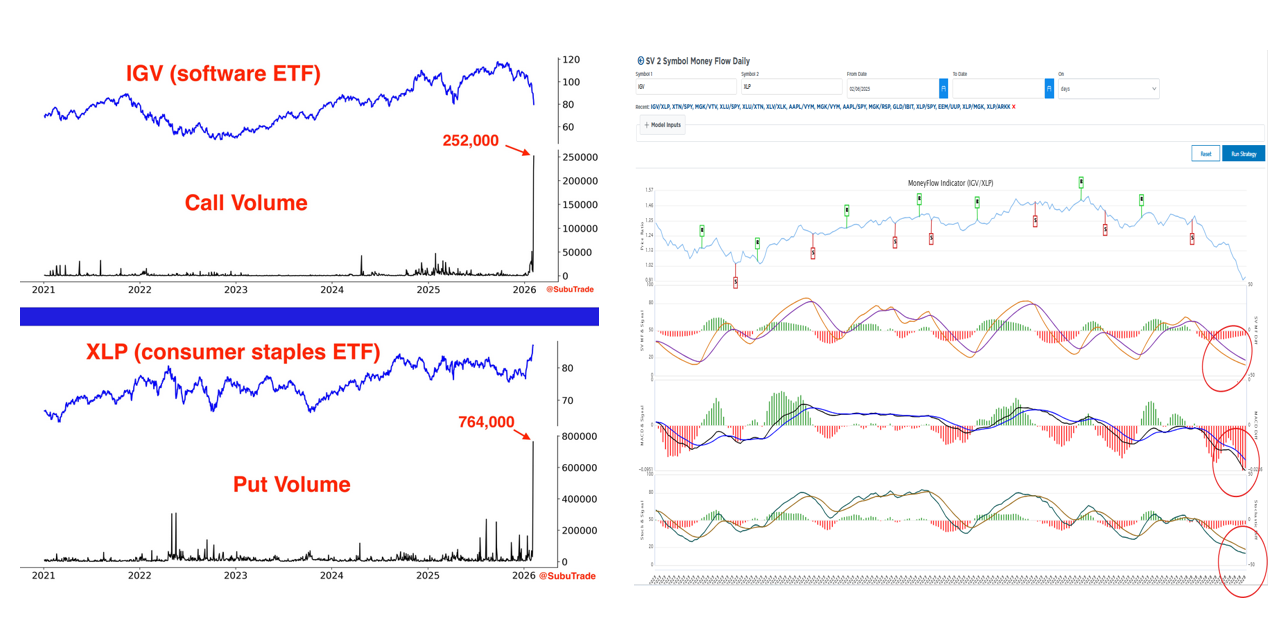

Speculative Bull Runs And The Value Of A Bearish Tilt

The recent market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are …

Read More »

Read More »

SRF: The Fed’s Newest Liquidity Backstop In Action

In July of 2021, after the pandemic and the liquidity issues that arose in 2019, the Fed established a new liquidity backstop. This program, the Standing Repo Facility (SRF), allows financial institutions to borrow on a collateralized basis from the Fed. Unlike the Overnight Reverse Repurchase facility (ON RRP), which allows financial institutions to park …

Read More »

Read More »