Category Archive: 9a.) Real Investment Advice

Investor Dilemma: Pavlov Rings The Bell – Draft

Classical conditioning teaches us a valuable lesson regarding the current investor dilemma. Pavlov's research discovered a basic psychological rule: when a neutral stimulus is repeatedly paired with a reward‑stimulus, eventually it will trigger the same response even when the reward is absent. The famed experiment by Ivan Pavlov illustrated that dogs would salivate at the …

Read More »

Read More »

Hindenburg Strikes: Omen Or False Alarm?

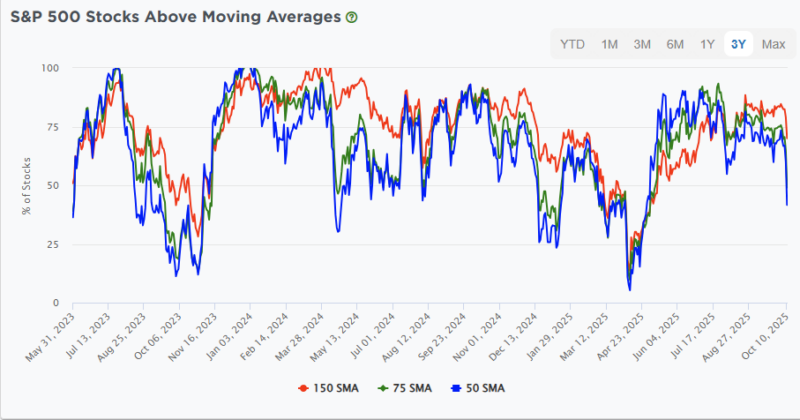

Last Wednesday, for the first time since November 2021, a Hindenburg Omen hit. This gauge is triggered when an upward trend is met with a growing number of stocks hitting both new 52-week highs and lows. Such indicates bad breadth, weakening momentum, and indecision. If all five conditions listed below are met, the indicator gives …

Read More »

Read More »

SimpleVisor Alert

Please be advised that we are making changes to the backend of the SimpleVisor website. As a result, we are facing a few complications with subscriptions and logins. We are currently working on the problems and hope to have them resolved shortly. Thank you for your patience. The post SimpleVisor Alert appeared first on RIA.

Read More »

Read More »

Fed QT Ends. What Does That Mean For Markets?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

10-31-25 A Daily Dose Of Charts & Graphs

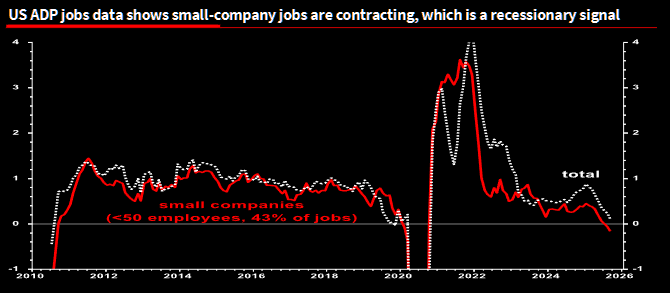

In this Short video, I cover the $DXY breakout from a long base, the EUR weakening outlook, and why $EURUSD could revert toward 1.12 over the next 18 months.

I also touch on labor market strain hinting at a stealth recession, collapsing market breadth, and what these signals mean as we enter the seasonally strongest six months of the year $SPY $QQQ — everything you need in one visual macro update.

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-22-25 Business Owners’ Retirement Plan Options

Tom Allen, our Senior Benefits Consultant, and Tom Pohlan, the Regional Director with Retirement Plan Consultants, explore how small business owners can create effective retirement plans that benefit both employees and owners.

Starting with Simon Sinek’s “Start with Why” framework, we’ll discuss why offering a retirement plan isn’t just a perk—it’s a powerful financial strategy for growth, retention, and tax efficiency.

💡 Key topics covered:...

Read More »

Read More »

10-31-25 Why Risk Tolerance Questionnaires Don’t Work

Most investors have filled out a risk tolerance questionnaire—but does it really measure how you’ll behave when markets crash? Richard Rosso & Jonathan McCarty break down why traditional risk tolerance tools fail to predict investor behavior, how emotions override risk profiles, and why time horizons, liquidity needs, and cash flow matter far more than a few survey questions.

Understand risk before markets remind you what it really feels...

Read More »

Read More »

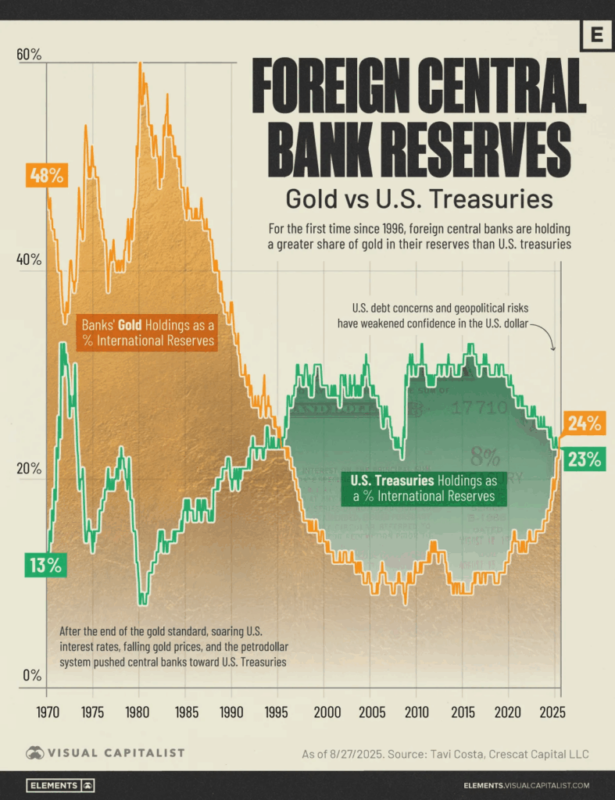

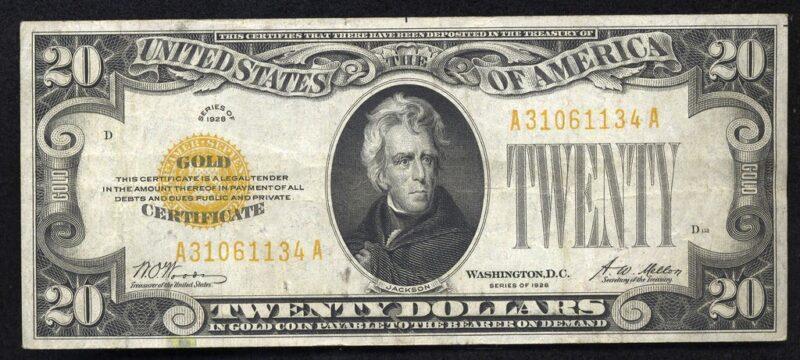

Gold Myths Luring Investors Into Risk

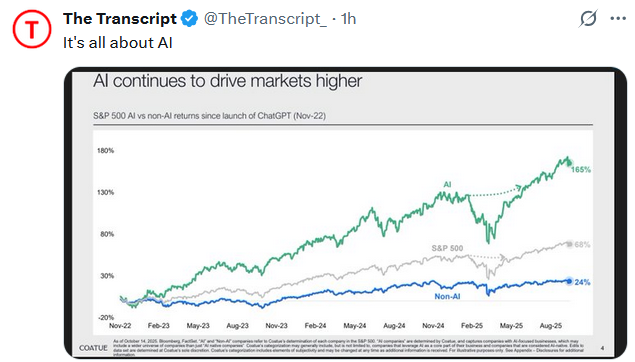

In case you haven't heard, precious metals, particularly gold, have risen sharply this year. Of course, whenever any asset class experiences a more speculative melt-up, investors are quick to rationalize why "this time is different." In stocks, it is about "artificial intelligence" and "data centers." The cryptocurrency community believes all fiat currencies will fail and …

Read More »

Read More »

Dow Theory: A Concerning Divergence Or Artifact?

Dow Theory is a market tool developed by Charles Dow in the very early 1900s. Dow also created the Dow Jones Industrial Average. The basic gist of Dow theory is that market trends are confirmed when gains or record highs are established in the broader market indexes, and then confirmed by similar trends and/or record …

Read More »

Read More »

10-30-25 Microstrategy & Leverage ETFs Trap Explained

$MSTR turned debt into a massive #Bitcoin bet, becoming a leveraged proxy for $BTC. But leverage cuts both ways—especially for 2x ETFs like $MSTU or $MSTX that suffer from volatility decay, turning sharp drawdowns into long-term underperformance.

In this short video, Vinay Gupta and I discuss how MicroStrategy’s debt-fueled Bitcoin strategy works, why leveraged ETFs on $MSTR are so dangerous, and what investors often miss about volatility decay...

Read More »

Read More »

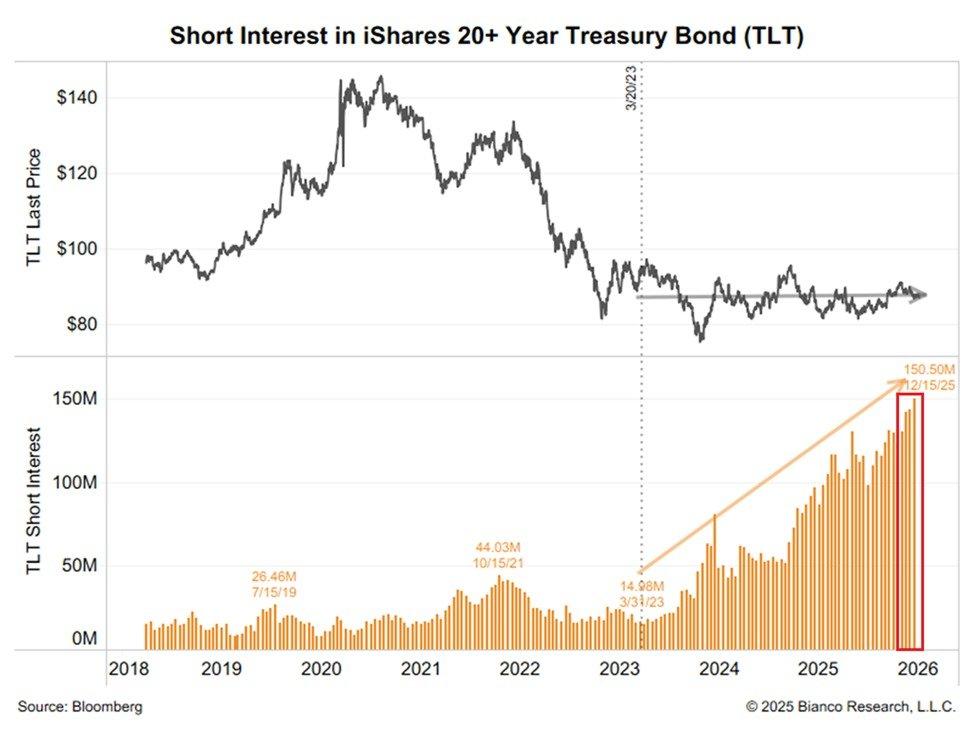

Liquidity Concerns Put An End To QT

Two weeks ago, Jerome Powell stated, "We may be approaching the end of our balance sheet contraction in the coming months.” In simple terms, as we wrote HERE, he is prepping the market for a quicker end to QT than was previously expected. While Powell was cryptic about why, the answer is obvious: liquidity concerns. … Continue reading...

Read More »

Read More »

10-29-25 A Daily Dose Of Charts & Graphs

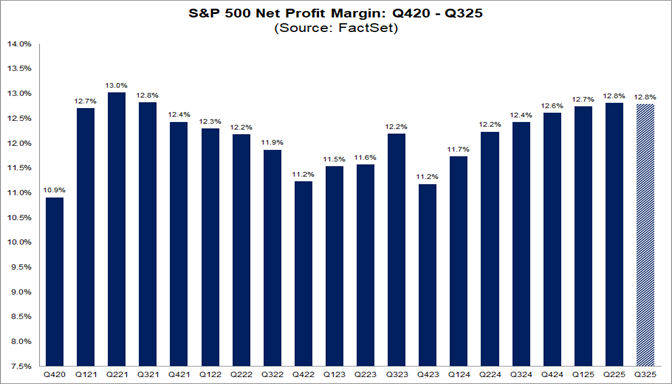

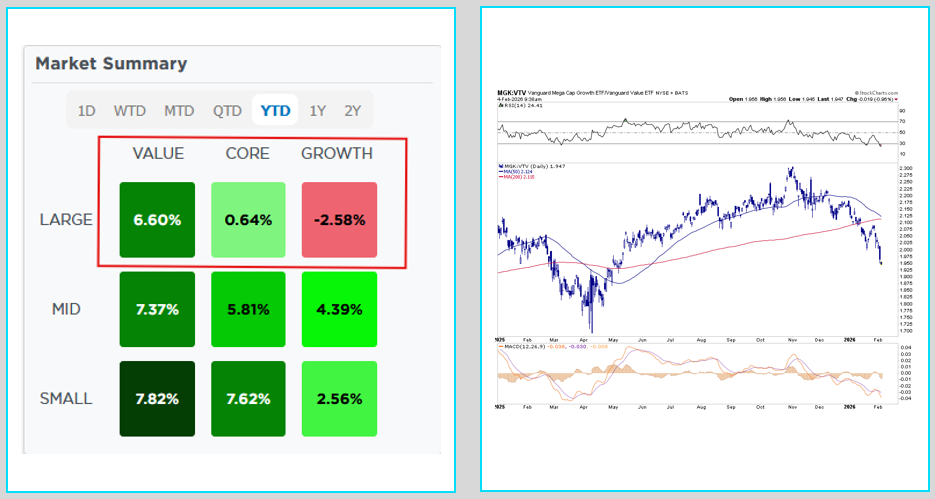

In this Short video, I cover $SPY / $QQQ breakout to new highs, $NVDA $5T surge and its potential trade-deal boost, the seasonality tailwind into year-end, and why overbought mega-cap growth may soon rotate into oversold low beta.

I also touch on the strong earnings breadth, Fed rate-cut backdrop, and sentiment parallels to the late-’90s melt-up — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch...

Read More »

Read More »

Rebasing The Dollar: Another Look At The Debasing Narrative

The phrase “debasing the currency” is all the rage in the media. Moreover, the debasement narrative is used to support the significant surge in gold and other precious metal prices. We have written a few articles on the subject of debasement, for example: Dollar Debasement and Debasement: What It Is and Isn’t. To help further …

Read More »

Read More »

CAPE Valuations: Does Nvidia Overstate Its Ominous Warning?

As equity valuations approach the record highs of 1999, investors are growing anxious. This unease is partly driven by the media issuing grim warnings, often based in part on CAPE valuations. Consider the following headlines and their summaries. The graph shows the S&P 500 and CAPE since 1920. Given how the market performed after the …

Read More »

Read More »

10-28-25 Navigating Overbought Markets: Don’t Let FOMO Ruin Your Portfolio

FOMO destroys more portfolios than bad stocks ever will.

In this short video, I explain why timing the market never works—and how rebalancing and managing risk can keep you invested when markets get overbought.

📺Full episode: _bQP4

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-28-25 Profit Taking Made Simple

Taking profits sounds easy—until you try it with a smaller account.

Lance Roberts & Jonathan Penn answer listeners' question about managing portfolios spread across myriad stocks, with allocations similar to the S&P 500. When positions are small, trimming into strength or reinvesting during market highs can feel nearly impossible.

0:19 - Profit Taking, Earnings, & FOMC Meeting Previews

4:48 - Market Bullishness Confirmed

10:05 -...

Read More »

Read More »

Gold Or Bitcoin: Which Is The ‘Right’ Dollar Hedge?

Gold and bitcoin are touted as the "anti-dollar", or in some people's minds, possible replacements for the US dollar. Thus, one would expect the dollar-debasement trade to benefit gold and bitcoin similarly. The reality throughout this year has not been what many would expect. For example, gold is up over 50% this year, while bitcoin …

Read More »

Read More »

10-27-25 How Greed, Innovation & Leverage Create Every Market Bubble

Speculative bubbles don’t appear overnight – they evolve through cycles of greed, innovation, and leverage.

In this Short video, I explain how the same cycle of easy money and speculation keeps repeating, just with new assets and fancier language each time.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-27-25 The Most Dangerous Era in History

We’re living through one of the most dangerous eras in history — not because of war or politics alone, but because of the extraordinary convergence of economic, financial, and geopolitical risks.

In this episode, we break down:

* How record global debt, AI-driven speculation, and geopolitical instability are colliding.

* Why the current market optimism masks systemic fragility.

* What investors can learn from past cycles — from 1929 to 2008 — to...

Read More »

Read More »

The Most Dangerous Era In History

We live in what Brett Arends claimed as "The Dumbest Stock Market In History," but I believe it is potentially the most dangerous era. That phrase is not hyperbole as it reflects structural distortion, extreme valuations, and an investor base intoxicated by momentum and narrative. The MarketWatch piece puts it bluntly: “At one level, there …

Read More »

Read More »