Category Archive: 9a.) Real Investment Advice

DOJ Investigates Powell: Implications For Fed Policy?

Over the weekend, Jerome Powell revealed that the Department of Justice (DOJ) has opened a criminal investigation into his June testimony to Congress regarding the roughly $2.5 billion renovation of Federal Reserve headquarters. The DOJ has served subpoenas to the Fed and threatened a criminal indictment relating to that testimony. Such action by the DOJ …

Read More »

Read More »

1-12-25 How Market Narratives Push Investors Into Bad Trades

Market narratives don’t move prices—buyers and sellers do.

In this Short video, Lance Roberts explains why following headlines instead of data creates emotional bias and consistently pushes investors into bad trades.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-12-26 Investor Lessons From 2025 for 2026

Markets opened 2026 with early gains, improving breadth, and a rotation toward value—but mixed fundamentals and elevated expectations remain beneath the surface.

Lance Roberts break down the key investor lessons from 2025 that matter most as we head into 2026. We review what worked, what failed, and why market narratives once again misled investors. Topics include value versus growth, volatility versus risk, the role of cash, earnings-driven...

Read More »

Read More »

2026 Earnings Outlook: Another Year Of Optimism

The Wall Street consensus forecast for 2026 earnings growth is strong by historical standards. Analysts are giddy and projecting another year of double-digit growth in S&P 500 earnings per share (EPS). FactSet’s most recent data showed an expected 2026 earnings growth rate for the S&P 500 of about 15 percent. That is well above the …

Read More »

Read More »

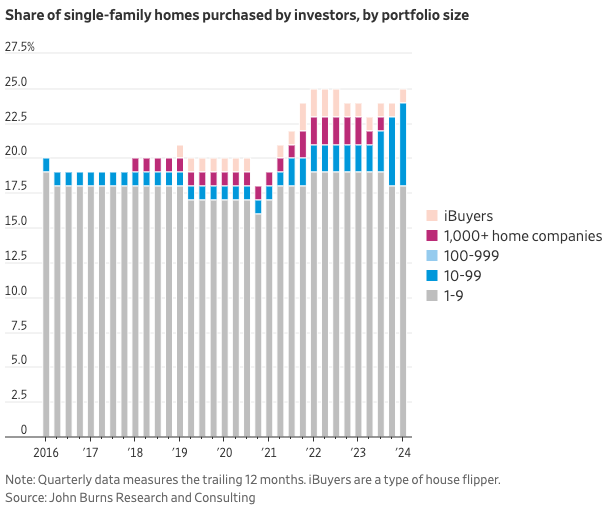

Fannie And Freddie To The Rescue

President Trump is using Fannie Mae and Freddie Mac to help make housing more affordable. According to a TruthSocial post, the President claims Fannie and Freddie have a combined $200 billion in cash. Accordingly: I am instructing my Representatives (Fannie and Freddie) to buy $200 billion dollars In mortgage bonds. The hope is that increased …

Read More »

Read More »

1-10-26 How to Rotate Sectors Without Blowing Up Your Portfolio

Sector rotation isn’t about picking the next winner. It’s about managing risk as conditions change.

In this Short video, Michael Lebowitz & Lance Roberts discuss how to rotate gradually, rebalance winners, and adapt portfolios as market leadership changes.

📺Full episode:

Catch Lance

daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

entadvice/

#Markets #Money #Investment_Advice

Read More »

Read More »

Investor Lessons From 2025 For 2026

🔎 At a Glance 💬 Don't Miss Our Upcoming "Live & In Person" Investing Summit Our 2026 Summit is THIS COMING WEEKEND and is a limited-seating event, so secure your tickets now before they sell out. Topics Include: I look forward to seeing you there. 🏛️ Market Brief - Market Starts Off The Year With … Continue reading...

Read More »

Read More »

1-9-26 Big Beautiful Tax Breaks – 7 Changes for the 2026 Tax Season

The 2026 tax season is shaping up to look very different—especially for retirees, near-retirees, and late-career workers.

Richard Rosso & Jonathan McCarty break down some major tax changes tied to the “One Big Beautiful Bill” and recent retirement legislation that could materially impact your tax planning strategy. From higher standard deductions and new age-based write-offs to expanded SALT limits, auto-loan interest deductions, and larger...

Read More »

Read More »

1–9-26 Why This QE Won’t Send Stocks “To the Moon”

This QE is not the kind that launches stocks into a runaway bull market.

In this Short video, Michael Lebowitz and I discuss why today’s liquidity injections are far smaller than past cycles and why headline charts are overstating their impact.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Stagnation Is Lulling The Fed To Sleep

The JOLTs data released on Wednesday paint a picture of labor market stagnation. The graph below shows that the number of job openings has fallen to levels similar to those right before the pandemic. While the number of openings seems somewhat stable, layoffs are slowly increasing, while new hires are near a 15-year low. Similarly, …

Read More »

Read More »

New Year’s Resolutions For 2026 – Investor Version

Every January, it happens like clockwork: you drive by gym parking lots that look like a Taylor Swift concert. Go to the store, and the salad aisles are ransacked like there’s a lettuce shortage, and half of your coworkers suddenly start quoting Warren Buffett while buying stock in companies they can’t spell. You got it, …

Read More »

Read More »

1-8-26 Markets Don’t Need a Crash to Go Down in 2026

Markets don’t need a crash to go down in 2026—valuation compression alone can do the damage.

In this Short video, Michael Lebowitz and I discuss why stretched multiples, normal volatility, and rotation risk matter more than bullish forecasts.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-8-26 2026 Market Forecasts: Why Wall Street Gets It Wrong

Lance Roberts & Michael Lebowitz explain why year-ahead market forecasts are largely an exercise in false precision. Instead of offering a price target with zero confidence, we walk through the key forces that are likely to shape markets in 2026—including stretched valuations, liquidity injections disguised as “reserve management,” the Federal Reserve leadership transition, midterm elections, fiscal uncertainty, AI-driven capital spending,...

Read More »

Read More »

Fed Challenges: Bill Dudley’s Take On 2026

Bill Dudley, a respected economist and President of the New York Fed during the Financial Crisis, penned a Bloomberg editorial outlining six challenges facing the Fed in 2026. Given his deep background in economics and intimate knowledge of the Fed, it's worth providing a brief summary of his views. Independence is at the top of …

Read More »

Read More »

Understanding Inflation Impact On Investments

How Inflation Affects Your Investments & Ways to Protect Against It Inflation has a sneaky talent; it rarely arrives with fireworks. It shows up in the small stuff first. A higher grocery bill. A pricier dinner out. A “wait, when did flights get this expensive?” moment. Then, if it sticks around, it starts changing the …

Read More »

Read More »

1-7-25 Live Chat Q&A – Ask Us Anything!

Markets are hitting all-time highs, earnings expectations are rising, and investors are navigating everything from oil prices to Roth conversions. Lance Roberts & Danny Ratliff take live viewer questions and explore the themes investors are most focused on right now.

Topics discussed include why earnings may be the primary market driver this year, what recent all-time highs signal for forward returns, and how capital flows are shifting across...

Read More »

Read More »

1-7-26 Let’s Talk About Venezuela, Oil Prices & Energy Stocks

Energy stocks $XLE are running ahead of oil fundamentals, and that gap won’t last forever.

In this Short video, Lance Roberts explains how Venezuela, supply risk, and slowing demand could push #crudeoil prices lower and force energy stocks to catch up.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

2026 Forecast: Tis The Season For Wild Guesses

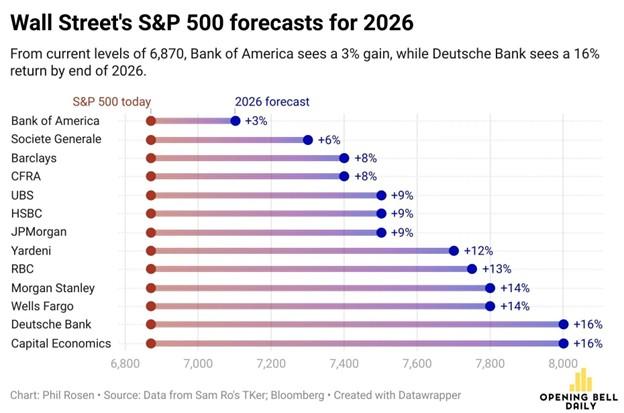

It's that time of year when every Wall Street analyst posts their forecast for where the S&P 500 will close at the end of 2026. This year, as in every other, Wall Street expects the S&P 500 to post positive returns. As shown below, Bank of America is the most cautious, with a 3% gain, … Continue reading »

Read More »

Read More »

Minerals, Russia, China & Iran: More On Venezuela

Yesterday’s Commentary discussed the potential impact of regime change in Venezuela on the energy sector. Today, we extend the analysis and examine other reasons for the invasion. The following theories are based on a Substack commentary from Tracy Shucart, an economist and resources trader. For starters, Tracy makes it clear that oil is not the …

Read More »

Read More »

1-6-26 The Most Dangerous Risk Is The One No One Sees

Markets don’t crash on risks everyone is watching—they’re already priced in and hedged.

In this Short video, Lance Roberts explains why the real danger is an unexpected shock that forces earnings lower and triggers a rapid repricing of valuations.

📺Full episode: -Z7mJI

Catch Lance daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »