Category Archive: 9a.) Real Investment Advice

What To Do When You Regret Retirement

Is Nvidia more than a market darling, and has it entered the "tulip stage?" (We don't know when the tulip will die.) How to invest with the maddening crowd without going mad. Candid Coffee preview (registration link is below!) Couples, Money, & Communication: Make it fun (Amazon shots?) Pensions vs Social Security: the confounding Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) rules. Why you cannot (fully)...

Read More »

Read More »

Are The Magnificent Seven Stocks In A Bubble?

Has Nvidia become the world's most-valuable company? The S&P is aiming at more all-time highs, but can they hold? Fed minutes reveal no rush to cut rates. The disconnect with markets' expecting more cuts. Will the Fed reduce QT as money flows into markets? Meanwhile, markets continue to test rising trendline at 20-DMA, as consolidation continues. No reason to be bearish on markets...yet. What markets missed from Fed Minutes: the quantity of...

Read More »

Read More »

Will Nvidia Break the Market?

It's Nvidia earnings reporting day, and as tech companies have driven markets of late, the results, and the company's forward guidance, could have a huge effect. Earnings expectations are extremely high; risk of disappointment is high. The S&P is testing a rising trendline at the 20-DMA, against a negative divergence in relative strength. The dichotomy is unsustainable. The Conference Board releases latest survey of leading economic indicators,...

Read More »

Read More »

Don’t Fear the All-time Highs

There are "Dow Days" and "NSDQ Days;" CPI inflation is still transitory; emerging influence of presidential election on Congress' ability to manage debt & spending, M-2 as % of GDP. There is little expectation for earnings growth this year. Markets remain in bullish trend, but a negative day today could trigger MCD Sell-signal. Time to reduce portfolio risk and wait until correction to put capital back to work. Instead of...

Read More »

Read More »

Should I Delay Social Security?

The Fed is in no rush to lower rates, based on the latest economic data; we've gone from transitory to permatory inflation; rents are not going to fall, but rates are not going to go up. Fed Gov. Bostick: Rates are not going down until later, based on Labor data. Candid Coffee preview: The problem with Financial Infidelity; does it pay to delay taking Social Security? (It depends...) What's the best claiming strategy? Rich & Danny critique...

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

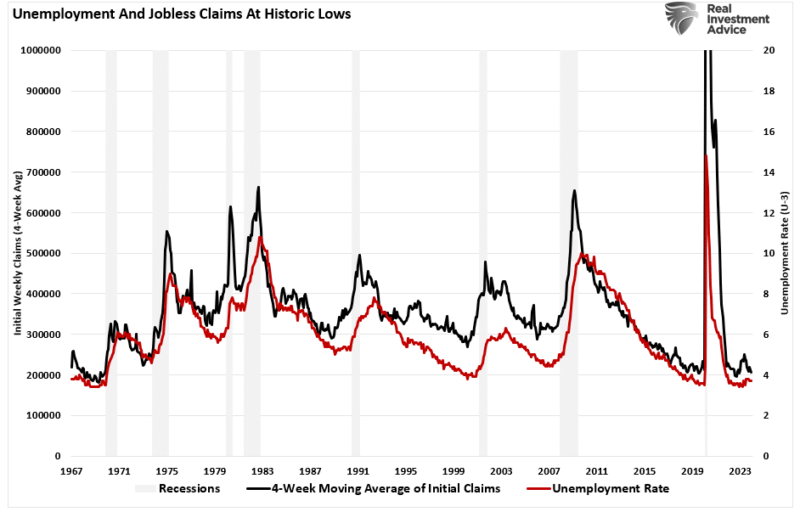

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Is Toyota the Next Tesla?

The post-Valentine's Day afterglow; Markets are not behaving like it's February (typically a weaker month), so far. The NFIB Small Business Survey belies weaker conditions and negative sentiment; there is a correlation between the NFIB and Small Cap Index. Markets continue to do well, despite weaker economic activity; bonds showing promise; NVIDIA captures 3rd place in S&P 500, unseating Amazon & Google. Commentary on pending legislation...

Read More »

Read More »

So You Think You’re Ready to Retire… (2/14/24)

(2/14/24) Financial advisors have significantly different perceptions of their clients’ retirement readiness than do the clients themselves, according to Allspring Global Investments’ annual retirement survey, released Tuesday.

While some two-thirds of retirees and near-retirees considered themselves ready for retirement, only 40% of advisors, who were included in the survey for the first time, said their clients were ready.

Hosted by RIA...

Read More »

Read More »

It’s CPI Day! – the Impact Gas prices may Have

(2/13/24) It's CPI Day (the Consumer Price Index increased .3% in January; on an annualized basis, CPI dropped from December 3.4% to 3.1% for January.) Actors, do not lie on your application (especially involving roller skates and the Super Bowl Halftime!) Amazon hit with class action lawsuit over upcharge for ad-free viewing. Markets start Monday flat, spike a bit, and end flat. Correction is one day closer today than yesterday; why managing risk...

Read More »

Read More »

Homes Are About to Get Less Affordable (2/12/24)

(2/12/24) Markets reached the magical 5,000 mark on Friday, and momentum will continue to carry investors forward, but for only so long; how we're preparing for the eventual pullback. A correction of between 2% and 5%, and up to 10% would not be out of the realm of possibility, and normal in any year. The cost of housing remains a hot-button topic with both Millennials and Gen-Z. Lance runs the charts to demonstrate market dynamics and...

Read More »

Read More »

How Your Social Security is Taxed

(2/9/24) Rich & Danny prepare for today's market action & economic releases; the notion that markets believe the Fed should lower rates is un-believable. Labor and unit costs will ultimately be the determining factor. Tesla is dropped from the Magnificent-7, replaced by Eli Lilly; should it be the "Sexy-7?" Mutant wolves roam Chernobyl; Taylor Swift & the Super Bowl: she is the epitome of the American Dream. Why Taylor Swift...

Read More »

Read More »

Why the 2020’s Aren’t the 1970’s

(2/8/24) Fair warning, fellas: Valentine's Day is one week away. What do all the numbers and charts really mean about the economy? Financial Obligation Ratio's look great for the upper 10%, but for the rest of the population, they're pretty dire. The markets don't care. Are we over-paying for equities? Market internals are very different from the headline data. The S&P almost hit 5,000, thanks to the EFT draft effect. Will "good"...

Read More »

Read More »

The Smartest Money Move You Can Make Right Now? (2/7/24)

(2/7/24) Early morning coffee snafus: That's no way to start the day. Headline economic data is not comporting with on-the-ground reality: Credit Card and Auto Loan delinquencies are on the rise because borrowers are out of money; there's been a drop in Labor Force participation. Under the surface, things are not that good. Are Valuations really that cheap? A look back at market performance: The S&P is hitting all-time highs, NASDAQ driven by...

Read More »

Read More »

The Bull Run Continues: S&P 5000? (2/6/24)

(2/6/24) Market Behavior in a Presidential Cycle: Markets are positioning for a GOP win in November; Jerome Powell is now more inclined to NOT cut rates any time soon. Markets now need a narrative to support their current thesis, but it's only fundamentals that really matter. The Apple Vision goggle phenom. Markets sell-off, but knocking on the door of 5,000 in the S&P 500: now dealing with gravitational pull. Yields are reversing. NYC giving...

Read More »

Read More »

Why Stocks are a Popular Hedge for Future Retirees

(2/5/24) Getting February underway with an "amazing" Employment Report (with seasonal adjustments!) Full Employment is trending downward; where did 4-million people go?? Interest Rate cuts have been pushed farther out in the year. Markets don't care about economic reports' details. Why Markets continue to do better: They're focused only on the headline data. February is typically a weaker month: Will there be negative rates of return? A...

Read More »

Read More »

Having the Money Conversation with Kids

(2/2/24) King Cakes, Ground Hog's Day, & Meta results: finally paying a dividend to investors. Fed commentary: will the labor markets crack? Will the Fed continue to move the goal posts? Our next Candid Coffee is February 24 (registration link is below): Couples' money communication; children are Trustees in training. Having the Money Conversation with kids; (The Ground Hog predicts an early Spring). Going back to work after retirement; the...

Read More »

Read More »

How the Fed Broke Doves’ Hearts

(2/1/24) Amelia Earhart was lost 83-years ago, and her missing plane may have been located in the Pacific Ocean, solving the mystery of her disappearance. The mystery of how the Fed operates, however, remains an enigma. And in 2024, there political implications the Fed must also consider (could Kennedy "Perot" the election?) Markets sold off after Jerome Powell promised no rate cuts anytime soon, but bonds had a good day as Treasury...

Read More »

Read More »

How Living Longer Will Impact Retirement

(1/31/24) Earnings season continues, with AMD, Google, Microsoft, and NVDIA expected to fall after turning in their reports: Earnings have been okay, but not as good as expected. After "good" reports, watch for increased volatility and rotation from the NASDAQ into the Dow. Bond prices are on the rise, yields are dropping, as Treasury announces a smaller than expected debt issuance. There's a Trojan Horse in the proposed Childcare Tax...

Read More »

Read More »

Was George Soros Right About Bubbles?

(1/30/24) Mega-cap Earnings reporting continues with Microsoft reporting today; companies are meeting (lowered0 expectations, but not blowing the doors off. Valuations & Reflexivity Theory teaser, FOMC Meeting preview: Will the Fed begin to cut rates sooner? Markets set another all-time high. Housing dynamics: Pricing & Size and living on $30k/year. Why the cost of Housing has risen as a result of Fed policy & mortgage rule changes. Why...

Read More »

Read More »

Money Market Myths that Won’t Die

(1/29/24) Markets look to wrap up January on an upward trend, but this week's FOMC meeting could affect that slope. the problem w economic data on the surface: Increasing GDP growth by adding debt. Who will provide the best policy mix to create stronger growth? Markets continue to rally as lowered earnings estimates and bigger beats provide support. Deviations from averages are difficult to maintain; look for market correction in the weaker month...

Read More »

Read More »