Category Archive: 9a.) Real Investment Advice

Super Micro Is Not So Super Anymore

Super Micro Computer Inc. (SMCI) was the market's darling only six months ago. Amazingly, Its stock, had risen 3x in just the first three months of 2024. Consequently, S&P Global announced its addition to the S&P 500 Index. The announcement is annotated below with a box in early March. Furthermore, the circle, which coincides with …

Read More »

Read More »

Strategies to Pocket Gains and Reduce Investment Risk in Any Market

Wouldn't you rather put some money in your pocket after tax? ?? #TaxTips #FinancialPlanning #MoneyMatters

Watch the entire show here: https://cstu.io/c19f49

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Market Peaks: Why Broad Participation Could Be a Red Flag

? Wise words from Sam Stovall at S&P ? When everyone's bought in, who's left to buy? Broad participation can be bullish but also a warning sign. #InvestingTips

Watch the entire show here: https://cstu.io/993271

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Assessing Debt Reduction Strategies in Today’s Economic Climate

Discussing the current economic environment and future predictions. Where are we headed? No other option? Demographics play a big role! ?? #EconomyTalks

Watch the entire show here: https://cstu.io/0dc8d7

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Election Over. Now What For The Market.

Inside This Week's Bull Bear Report S&P 6000...Already? Last week, we discussed the expected derisking heading into an uncertain election. "There is an important lesson in this week's action. Over the last several weeks, we have warned about the weakening of momentum and relative strength and the triggering of the MACD 'sell signal.' However, many …

Read More »

Read More »

Effective Strategies for Managing Risk in Stock Trading

Focus on smart risk management when trading stocks. It's not about capturing every bit of upside, but creating wealth along the way. ? #StockMarket

Watch the entire show here: https://cstu.io/d206e1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic …

Read More »

Read More »

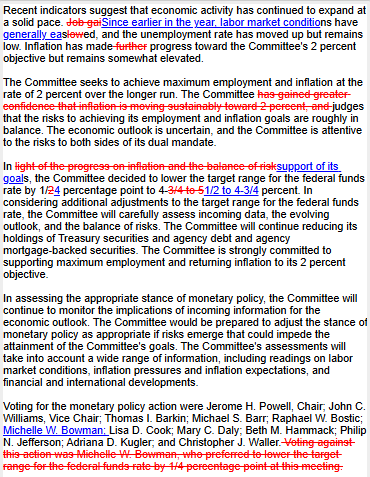

As Expected The Fed Cut Rates

As expected yesterday, the Fed cut the Fed Funds rate. With the expected 25bps rate cut, the new range for Fed Funds is 4.50-4.75%. The redlined second paragraph below, regarding inflation, is the only meaningful change to the FOMC statement. We think the Fed made the change to present a more hawkish stance. Furthermore, it …

Read More »

Read More »

11-8-24 Why COLA Doesn’t Get Any Respect

Why do COLA adjustments lack impact, and what are the Social Security COLA issues that affect you most? Richard Rosso & Danny Ratliff look at cost of living adjustment problems, the incredible Inflation and COLA disconnect, why understanding COLA and inflation is vital.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------...

Read More »

Read More »

Analyzing Post-Election Economic Data: What It Means for Future Investments

Navigating through post-election economy! ?? Stay informed on economic data and market trends. Changes take time to impact!

Watch the entire show here: https://cstu.io/6a2976

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events.

Here are some quick...

Read More »

Read More »

How New Presidential Policies Boost Small Business Optimism and Investment

? New president, new optimism! Small businesses are expected to thrive with a jump in confidence index post-election. ?? #SmallBusiness #ElectionBoost

Watch the entire show here: https://cstu.io/bbf4d1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Reality of Political Promises: What Truly Happens in Office

Political promises vs. reality! Campaign talk vs. getting things done in the White House. ?️? #Politics #CampaignTrail #RealityCheck

Watch the entire show here: https://cstu.io/e50a20

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Second Trump Term Stokes The Inflation Narrative

After Tuesday night's initial election results started to point to increasing odds of a Trump victory, bond yields began to rise sharply, as shown below. The surge in rates was not a sudden move. Over the past month, betting odds favoring a second Trump term and bond yields rose in unison. The narrative emerging from …

Read More »

Read More »

11-7-24 Fed Day Arrives

In the aftermath of the 2024 Election, attention now turns to today's Fed announcement, with odds makers giving 96% chance of a quarter-percent rate cut. Meanwhile, markets are roiling as foreign investors try to position after the election. Managers are scrambling to re-risk in time for year-end reporting; Wednesday was a huge day for Small Caps. Lance and Michael discuss the frequency of Mexican Food, our up coming 2025 Economic Summit, and what...

Read More »

Read More »

Economic Upheaval: How Reducing Government Size Can Lead to Recession

Clear communication is key! While reducing government size may cause short-term disruption, it's crucial for long-term benefits. Let's navigate through the economic changes together. ? #Government #Economy #Communication

Watch the entire show here: https://cstu.io/25b549

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Long-Term Investing: Focusing on Building Returns Over Time

Focus on what truly matters when trading - the rate of return. Don't let external factors like elections and debt affect your emotions. Trade wisely! ?? #TradingTips #Investing101

Watch the entire show here: https://cstu.io/2d8a35

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

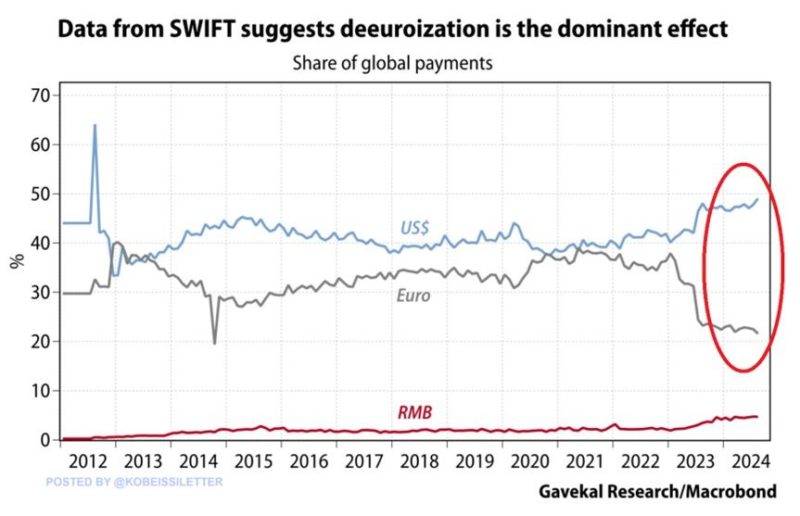

De-dollarization Or Re-dollarization?

Some gold and Bitcoin bugs claim the U.S. dollar is being inflated away and that our politicians and the Fed are abusing its status as the world's reserve currency. While the narrative may sound logical, the fact of the matter is that the opposite is occurring. Despite growing de-dollarization narratives in traditional and social media, …

Read More »

Read More »

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let's analyze historical correlations between gold and economic and market data. In addition to helping you …

Read More »

Read More »

11-6-24 Trump Wins!

The 2024 Election outcome is sharply affecting pre-market, with Donald Trump's election sending stocks higher. The S&P trendline is aiming for the 6000 or 6100 level. The question that remains is whether markets can sustain that trend. This time is different from the previous Trump win: Interest rates are falling and tax rates are lower now; yet, there are still plenty of questions for investors: what will Trump's tax policy be? What will be...

Read More »

Read More »