Category Archive: 9a.) Real Investment Advice

Technically Speaking Tuesday | LIVE (4/13/21): Market Analysis & Personal Finance Commentary

4/13/21 The Real Investment Show Live stream

_________

➢ Blog:

New articles daily: https://realinvestmentadvice.com/real-investment-daily/

➢ RIA Newsletter:

Subscribe to our free newsletter for market updates, analysis, financial tools and more: https://realinvestmentadvice.com/newsletter/

➢ Podcast: The Real Investment Show:

Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757...

Read More »

Read More »

A History of Corporate Earnings (and Millennial Soccer) [4/13/21]

The next round of corporate earnings reports are set to begin later this month. The issue of how to tell companies' fiscal story to attract would-be investors, while placating regulators is an age-old war of ying and yang, made a little more confusing by the allowance of Performa Earnings vs GAP Earnings methodologies. Lance's tracking of the numbers sheds an interesting light on what we may see in a few weeks, and posits the question of whether...

Read More »

Read More »

Technically Speaking Tuesday | The Real Investment Show [Full Show: 4/13/21]

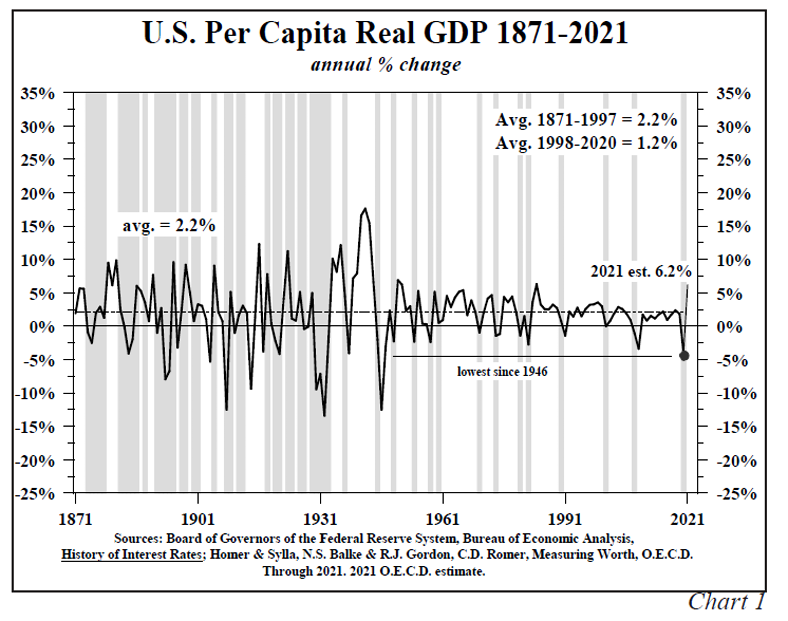

00:00 Are We Really Growing that Much?

10:00 When the Fed Tries to Taper

29:59 A History of Earnings & Millennial Soccer

35:29 The Fed Depends Upon You Not Being Crazy

Hosted by Lance Roberts, RIA Advisors Chief Investment Strategist

_________

Articles mentioned in this show:

➢ Fundamentally Speaking: Earnings Optimism Explodes:

https://realinvestmentadvice.com/fundamentally-speaking-earnings-optimism-explodes/

_________

➢ RIA...

Read More »

Read More »

Prelude to the Dance: Kicking off Earnings Season 2021 | 3 Minutes on Markets & Money [4/13/21]

2021 Earnings Estimates are now being pegged at $158/share--an astounding recovery from the end of 2020's 4th Quarter, where earnings were in the $90-range...but that's lower than the projected earnings estimate at the beginning of 2020. We're paying more per value than the actual earnings would justify! Expectation are exceptionally high at a time of peak pricing. Changes to estimates and outlooks have a lot of impact. CPI is expected to be...

Read More »

Read More »

Encore Presentation: Candid Coffee/Financial Spring Cleaning [4/10/21]

Here is an encore presentation of the April 10, 2021 "Financial Spring Cleaning" episode of Candid Coffee, direct from the kitchen tables of Richard Rosso, CFP, RIA Advisors' Director of Financial Planning, and Senior Advisor, Danny Ratliff, CFP.

Richard and Danny identify the financial dust bunnies lurking in your money management habits...the primary areas are couples' communication and financial organizational issues:

* Women are...

Read More »

Read More »

Inflection Point Episode (4/12/21): Market Analysis & Commentary from RIA Advisors Chief Investme…

Inflection Point Episode (4/12/21): Market Analysis & Commentary from RIA Advisors Chief Investme...

Read More »

Read More »

The Inflection Point Episode | The Real Investment Show [Full Show: 4/12/21]

00:00 Stimmie Checks--then, what??

9:53 Jerome Powell & The Missing Jobs

22:55 Expectations for Economic Growth vs Reality

35:28 There's No Benefit to 'Beating the Index'

Read More »

Read More »

Markets Weaken w Extreme Exuberance | Three Minutes on Markets & Money [4/12/21]

(4/12/21) Markets weaker following Jerome Powell's comments on the Sunday talk shows; now are extremely over-bought. Investors now have the highest asset allocation to equities since the Dot Com Crisis. Money flow indicators have been extremely positive following portfolio rebalancing at the end of March, leading to "re-investment" process for the past two weeks, which is now showing weakness. Money Flow indicators are back up to previous highs,...

Read More »

Read More »

Lacy Hunt & Expectations For Decelerating Inflation

Lacy Hunt at Hoisington Management has some interesting thoughts regarding the inflation debate and the potential for decelerating inflation. Case For Decelerating Inflation In its Quarterly Review and Outlook for the First Quarter of 2021 Lacy Hunt makes a case for decelerating inflation.

Read More »

Read More »

Financial Fitness Friday (4/9/21): Market Analysis & Personal Finance commentary from RIA Advisor…

Financial Fitness Friday (4/9/21): Market Analysis & Personal Finance commentary from RIA Advisor...

Read More »

Read More »

Retirement, 401k vs Pension, & Working Post-Pandemic | Financial Fitness Friday [Full: 4/9/21]

00:00 Coffee Infrastructure, Chucky-Cheese Birthdays, & Post-Pandemic

9:59 Looking at Retirement Through a Different Lens

23:00 Working at Buc-cee's: Why Dave Ramsey is Wrong About a 401k vs. Pension in Retirement

35:30 Working Post-Pandemic

Read More »

Read More »

Inflation in 2021: Making the Complex, Simple

This is a companion segment to the article written by Michael Lebowitz (linked below); despite what the government wonks tell us about "no inflation," a quick visit to the grocery store or the gas station refutes that narrative. The real source of inflation is the devaluation of the Dollar, which requires more money to purchase goods. What what happens when money takes on an "expiration date," as the Chinese are considering imposing on their...

Read More »

Read More »

The Inflation Episode (4/8/21): Market Analysis & Commentary from RIA Advisors Chief Investment S…

The Inflation Episode (4/8/21): Market Analysis & Commentary from RIA Advisors Chief Investment S...

Read More »

Read More »

The Inflation Episode | The Real Investment Show with Lance Roberts [Full Show: 4/8/21]

00:00 Raising Taxes to Pay for Spending... Riiight

10:00 The Indirect Bailout of Banks

23:00 Inflation: Making the Complex Simple

35:27 Earnings Growth Estimates vs Reality

Read More »

Read More »

Consolidation Before Correction | 3 Minutes on Markets & Money [4/8/21]

Money Flow buy-signals occurring at the 50-yard line with a 30-yard pass, as markets get back into an over-bought condition. MACD Signals are also turning positive; the upside is becoming limited. No surprise to us to see a correction process beginning soon. Consolidation is likely, and Summer will likely bring deeper, 5% corrections.

3 Minutes on Markets & Money hosted by Lance Roberts, RIA Advisors Chief Investment Strategist.

_________

➢...

Read More »

Read More »

The Real Investment Show (4/7/21): Market Analysis & Personal Finance commentary from RIA Advisor…

[DESCRIPTION]

--------

Articles mentioned in this episode:

--------

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ Listen on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Sign Up for RIA Pro. Analysis, Research, Portfolio Models, and More. Try Our 30 Day Free Trial:

https://riapro.net/home

➢ Subscribe to our Youtube Channel:...

Read More »

Read More »

Corporate Tax Myths and the Effect on Economic Growth [4/7/21]

Corporations are being excoriated for their use/abuse of tax law to avoid paying taxes, even as the Biden Administration is making overt plans to raise the corporate income tax to 38%. The problem is not with taxes or rates, but with the tax code itself, which enables the largest companies to pay little or nothing. The reality of taxes--and higher taxes--is that they impede economic growth, and accelerate inflation--which will be the death-knell of...

Read More »

Read More »

The Corporate Tax Hike Episode | The Real Investment Show with Lance Roberts [Full Show: 4/7/21]

00:00 The 2 Ways to Remedy Over-Valuation

10:00 Corporate Tax Myths & MMT (Modern Monetary Theory)

22:26 Higher Market Valuations Lead to Lower Earnings

34:57 Debt is a Cancer on Economic Growth

The Real Investment Show hosted by Lance Roberts, RIA Advisors Chief Investment Strategist.

_________

➢ Blog:

Inflation: Making the Complex, Simple – Part 1:

https://realinvestmentadvice.com/inflation-making-the-complex-simple-part-1/

_________

➢...

Read More »

Read More »

Long Term Stock Market Outlook 2021 | 3 Minutes on Markets & Money with Lance Roberts

From a weekly perspective, markets have remained on a bullish uptrend since the lows of March; money flow indicators are positive on a weekly basis, suggesting more upward bias in the short term. However, what's concerning is the extension between the 50- and 200-week moving average, what are really extended now. Big deviations tend to lead to short-term corrections in the market. We're looking for more of a correction in the Summer; over-bought...

Read More »

Read More »

Technically Speaking Tuesday (4/6/21): Market Analysis & Commentary from RIA Advisors Chief Inves…

[DESCRIPTION]

--------

Articles mentioned in this episode:

--------

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ Listen on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Sign Up for RIA Pro. Analysis, Research, Portfolio Models, and More. Try Our 30 Day Free Trial:

https://riapro.net/home

➢ Subscribe to our Youtube Channel:...

Read More »

Read More »