Category Archive: 9a.) Real Investment Advice

Understanding Long-Term Drivers in the Bond and Stock Markets

Short-term fluctuations in bond yields and stock prices don't alter long-term trends. Focus on fundamental drivers for lasting impact. ?? #Investing

Watch the entire show here: https://cstu.io/bbdf3c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-14-25 Tactically Bearish As Risks Increase

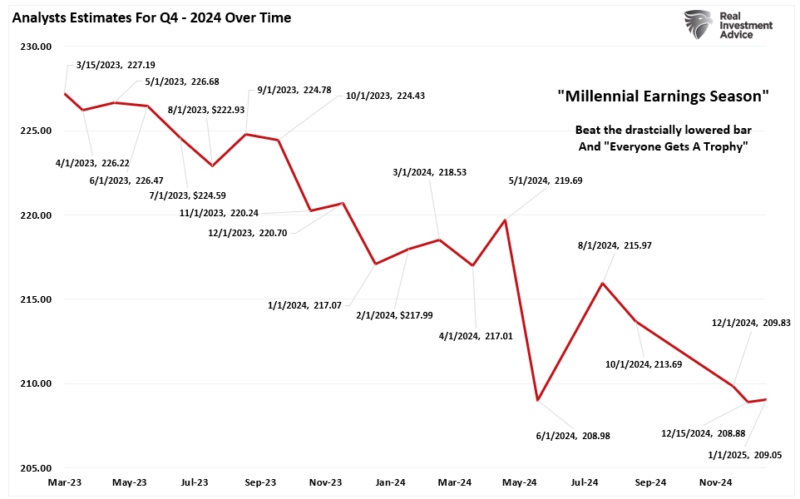

PPI & CPI Preview: Earnings season is about to commence, followed by the opening of the Buy Back window. Higher yields (and term premiums) are weighing on markets. Term premiums are just a measure of sentiment; watch what companies say, impacted by higher yields. Markets rally to just above the 100-DMA. Lance reviews investor sentiment, credit spreads, and market valuation (which charts). Noting the (limited) impact of taffis on a...

Read More »

Read More »

Tactically Bearish As Risks Increase

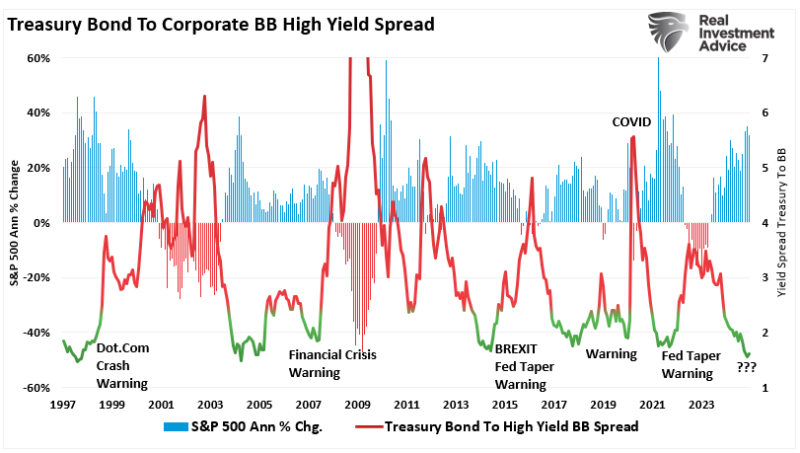

In last week's discussion with Thoughtful Money, I noted that we are becoming more "tactically bearish" as we progress into 2025. While we have remained primarily bullish in equity positioning over the last two years, several risks are now worth considering. However, it is critical to note that being "tactically bearish" does NOT mean we …

Read More »

Read More »

Buffett Is Worrying, Should You?

Warren Buffett’s company, Berkshire Hathaway, has about $325 billion in cash, accounting for over a quarter of its portfolio—the highest percentage in over 30 years. The question begging an answer is, what is worrying Warren Buffett? We believe the answer is valuations. We have shared numerous charts over the last few months showing how valuations …

Read More »

Read More »

Strategies to Combat Emotional Bias in Investing

Emotional biases can lead to bad investment decisions. Remember the rules and stay calm when things aren't going as expected. #InvestingTips

Watch the entire show here: https://cstu.io/3a37ce

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

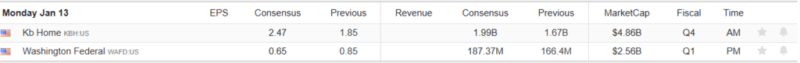

1-13-25 Investor Resolutions for 2025

The Cleveland Fed's expectations for increased inflation; Oil prices rise on increased Russia sacntions (thanks, Joe Biden); economic impact of California wildfires & the Broken Window Theory: There will be a short-term uptick from rebuilding activity. Markets point lower on hawkish Fed tone; current correction process is normal. There is not data to support investor sentiment on inflation sparked by tariffs; how we really create inflation....

Read More »

Read More »

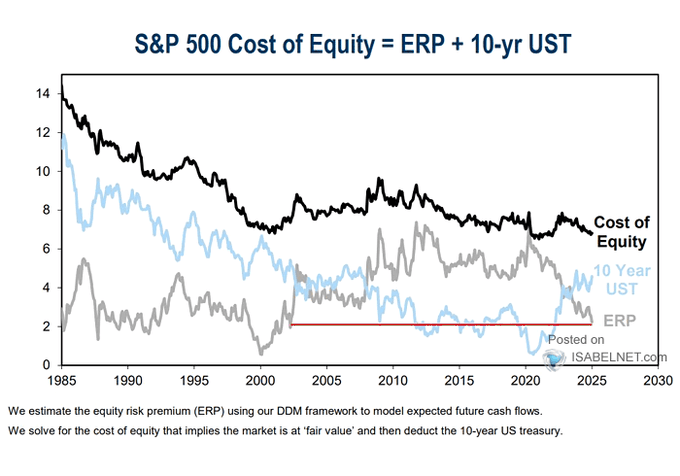

Jobs, Stocks, And Bonds Oh My!

The initial reaction to Friday's BLS jobs report was a yield surge and a sharp stock decline. Stock investors are finally noticing higher yields. While sentiment can certainly cause stocks and bonds to deviate from fundamentals, at the end of the day, they both have fundamental roots in economic activity. Over the past couple of … Continue...

Read More »

Read More »

How to Create a Comprehensive Financial Plan for Retirement

Planning for retirement is one of the most important financial tasks you’ll ever undertake. A comprehensive retirement planning strategy can help ensure you achieve your goals, maintain your desired lifestyle, and manage risks effectively. Whether you’re just starting or nearing retirement, this guide walks you through the essential steps to create a solid financial plan …

Read More »

Read More »

Why Predictions for 2025 Are All Over the Place

? Financial experts predicting 20% returns for 2025? ? Don't be fooled, nobody knows for sure what the market will do! #InvestingTips #MarketPredictions ?

Watch the entire show here: https://cstu.io/16c04a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Future of US Large Company Stocks: Why 2025 Could Be Their Year

? Are large company growth stocks the place to be in 2025? ? Probably yes, but not for the reason you think! ? #Stocks #Investing #2025Prediction

Watch the entire show here: https://cstu.io/7a5c4d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Consolidation Continues

Inside This Week's Bull Bear Report One Week Left To Get Your Tickets Don't miss the opportunity to get your tickets for the 2025 Economic and Investing Summit. Seating is extremely limited, and this year's event is almost sold out. We have set aside time to visit with attendees one-on-one to answer your burning questions … Continue...

Read More »

Read More »

1-10-25 What the Social Security Fairness Act Means for Your Retirement

Richard and Jonathan discuss the narratives that are driving the markets, and the fear factor for bond investors. Is the response to tariff threats an over-reaction? How to deal with emotions in investing. Menwhile, job satisfaction is highest among the 60+ crowd: The group has been working longer, and understands the value of socialization; retirement planning shold include qualitative elements. A look at Gen-z Worth Ethic. The Social Security...

Read More »

Read More »

Examining Policy Impact on Economic Growth and Corporate Earnings

Possible economic risks ahead due to government policies like tariffs or deportations impacting economic growth and earnings. Stay informed! ?? #Economy #PolicyChanges

Watch the entire show here:https://cstu.io/6601c6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Investor Resolutions For 2025

I publish an updated version of my New Year “investor” resolutions yearly. The purpose of the process is to take an annual inventory of what I did and did not do over the last year to improve my portfolio management practices. As with all resolutions made at the beginning of a new year, it is not uncommon … Continue reading...

Read More »

Read More »

The Quantum Computing Bubble Is Leaking

The latest stock market bubble may be one of the shortest-lived bubbles in recent times. Quantum computing stocks rose in November and took off in December when Google touted the immense power of quantum computing. The following is from Google (LINK): Willow performed a standard benchmark computation in under five minutes that would take one …

Read More »

Read More »

Debunking Tariff Myths: A Historical Perspective on Tariffs vs Taxes

Did you know? In the past, most taxes came from tariffs, not personal income tax. Learn how this historical perspective can change our views on tariffs! ?? #TaxFacts #EconomicHistory

Watch the entire show here: https://cstu.io/bff20e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Differences Between Traditional and Roth IRAs

When planning for retirement, choosing the right Individual Retirement Account (IRA) is a crucial decision. Traditional and Roth IRAs are two popular options, each with distinct advantages and limitations. Understanding the differences between traditional vs Roth IRA accounts will help you make an informed decision based on your financial situation and retirement goals. Contribution Limits …

Read More »

Read More »

1-9-25 Why Are Bond Yields Rising?

Markets barely achieved a positive close on Wednesday, to create a string of positive action for the first five trading days in January. (Markets are closed today in honor of the late President Jimmy Carter.) There's a market consolidation underway, with the 20-DMA and 50-DMA about to cross. Lance & Michael discuss the Fed's sentiment shift about inflation, and the non-corellation between interest rates and inflation. The Fed may have cut...

Read More »

Read More »

Inflation Concerns Scare The Bond Market

As we share below, bond market sentiment, known officially as the term premium, has been almost entirely responsible for the recent surge in bond yields. Specifically, behind the move is investor concern regarding another round of inflation stemming from the recent Fed's rate cuts. The poor sentiment is very apparent when comparing news to a …

Read More »

Read More »

1-8-25 The Most Important Investing Lesson You’ll Ever Need

Lance discusses the importance of an investing process: Rules to offset emotional bias. Write them down, learn them, live them. Fundamentals matter over the long term. Understand how you got to the decision that you made to buy a stock. Lance also addresses the importance of balance, bonds vs stocks.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

This segment is...

Read More »

Read More »