Category Archive: 9a.) Real Investment Advice

5-23-25 Are There Warts on The One Big Beautiful Bill?

Are there hidden flaws in the One Big Beautiful Spending Bill?

Danny Ratliff & Jonathan Penn expose what they're not telling you, diving into the fine print of the 2025 federal spending bill. Is it as beautiful as they claim—or are there costly warts hidden beneath the surface?

Danny & Jon break down the economic risks inherent in the politics and pork.

0:18 - Will Investors Pause for Memorial Day Weekend?

11:55 - Wart on the One Big...

Read More »

Read More »

Why Are Yields Surging In Japan?

The short answer is that the Bank of Japan (BOJ) is letting the market set yields. For years, the BOJ has run an extremely loose monetary policy, including capping yields at extremely low levels and negative interest rates. Limited economic growth and disinflation made such a policy possible. However, inflationary pressures and a weak yen …

Read More »

Read More »

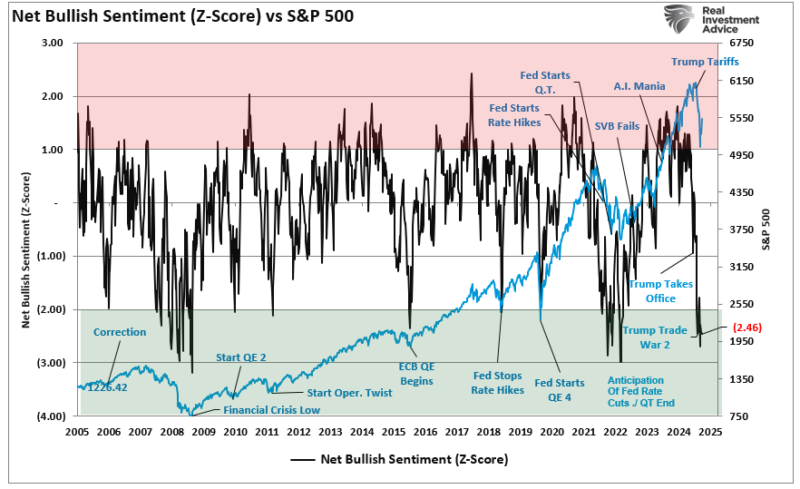

The Anchoring Problem And How To Solve It

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment. Notably, we …

Read More »

Read More »

5-22-25 Bonds are Cheap?

Are bonds cheap?

Lance Roberts & Michael Lebowitz discuss whether or not bonds are a good buy now, with a composite bond market outlook, and the relationship of interest rates and bond prices.

0:22 - Hurricane Season & Market Pullback

11:53 - Bond Auction Reality - What did the dealers do?

27:42 - Debunking the Narratives & Bad, Scary Charts

41:26 - Why Bonds Are a Good Buy Now

Hosted by RIA Advisors Chief Investment Strategist, Lance...

Read More »

Read More »

The Role of Bonds in a Well-Balanced Investment Portfolio

When building a strong and diversified portfolio, most investors focus heavily on stocks. But bonds play an equally important role—especially when it comes to managing risk and providing consistent income. Incorporating bonds into your investment portfolio can lead to more […] The post The Role of Bonds in a Well-Balanced Investment Portfolio appeared first on …

Read More »

Read More »

Bond Yields Are Surging: Narratives Vs. Fundamentals

Fiscal worries, the dollar’s imminent demise, and soaring tariff-related inflation expectations are among the concerns driving bond yields higher. At the same time, inflation, the historical determinant of US Treasury yields, continues normalizing. As a bond investor, it is difficult […] The post Bond Yields Are Surging: Narratives Vs. Fundamentals appeared first on RIA.

Read More »

Read More »

5-21-25 Has the Correction Started?

Is this the beginning of a market correction—or just a healthy pullback?

Lance Roberts & Danny Ratliff break down recent volatility, key technical signals, and what smart investors should be watching right now; a review of Target & WalMart's earnings reports. Lance rebuts claims by Fisher Investments that stock buy backs do not affect markets. Convincingly. A review of Jamie Dimon's market complacency warnings, and Lance and Danny discuss...

Read More »

Read More »

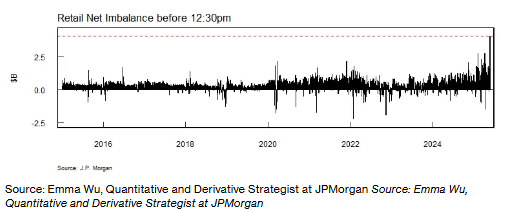

Retail Is Fearless: Buy The Dip Is On Steroids

Monday was a record-setting day. Stocks opened down 1% on news that Moody's downgraded the US credit rating to AA. While some perceived the downgrade as problematic, retail investors, aka individuals, bought stocks at the highest rate ever. Per JP Morgan, retail investors purchased a net of $4.1 billion of US stocks in the first …

Read More »

Read More »

Death Of The Dollar: An Eternal Tale

The following paragraph, courtesy of Amazon, reviews the book Death of the Dollar by William Rickenbacker. Death of the Dollar by William F. Rickenbacker is a critical examination of the economic policies and monetary mismanagement that the author argues are eroding the value of the U.S. dollar and threatening financial stability. Rickenbacker contends that the …

Read More »

Read More »

5-20-25 Are the Markets Too Complacent?

Are investors dangerously ignoring risk? Despite signs of slowing economic growth, elevated valuations, and geopolitical uncertainty, markets continue to trend higher with remarkably low volatility. Lance Roberts & Jonathan Penn address whether or not markets too complacent, remembering wedding anniversaries, and whether the ratings agencies are to be believed: Why even rate Treasuries at all?

A look at bad headlines (If it bleeds, it leads),...

Read More »

Read More »

USA Versus JNJ

Over the last fourteen years, as we share below, the US government credit rating has slipped from AAA to AA. Moody's was the first to cut the USA from AAA to AA in 2011. Fitch followed in 2023, and Moody's did the same last weekend. Now that the USA government is fully rated AA by … Continue reading »

Read More »

Read More »

How to Achieve Financial Independence and Retire Early (FIRE)

The FIRE movement—short for Financial Independence, Retire Early—has gained popularity among those who want more control over their time and financial future. Unlike traditional retirement models, FIRE encourages aggressive saving and disciplined financial planning to reach financial independence far earlier than the typical retirement age. Whether you dream of leaving the 9-to-5 grind in your …

Read More »

Read More »

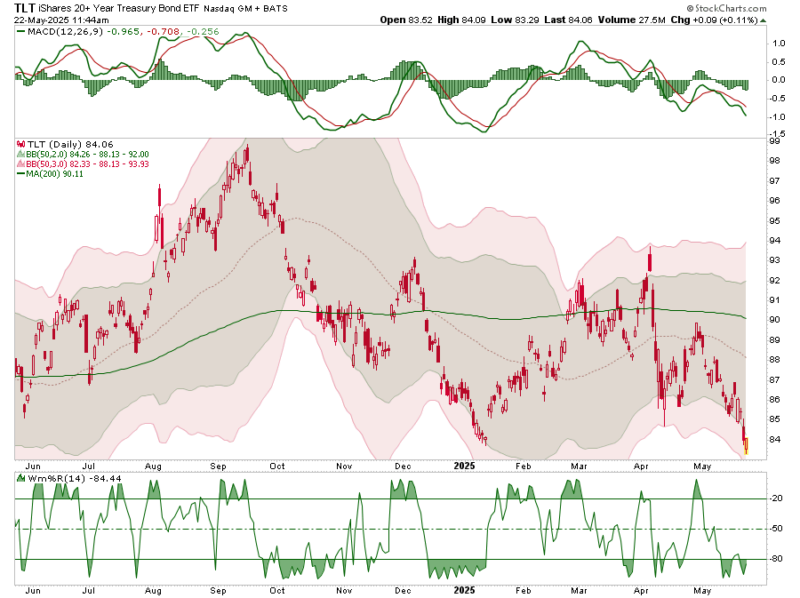

The TLT Short Trade Is Crowded

Short positions in TLT, the popular 20-year US Treasury Bond ETF, have spiked to over 130 million shares, up from 107 million last month. TLT has 541 million shares outstanding. Consequently, the short interest has risen from 20% to 24% of the float. Furthermore, TLT's days to cover ratio (short position/average trading volume) is nearly …

Read More »

Read More »

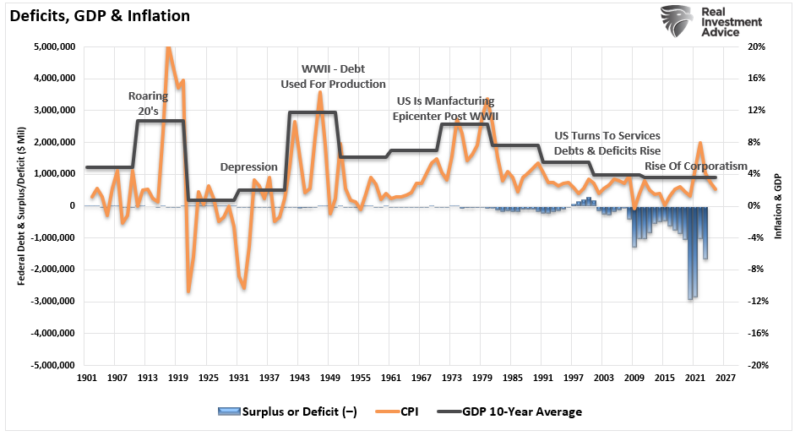

Moody’s Debt Downgrade – Does It Matter?

This morning, markets are reacting to Moody's rating downgrade of U.S. debt. For those promoting egregious amounts of "bear porn," this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and …

Read More »

Read More »

Recession Probabilities Decline

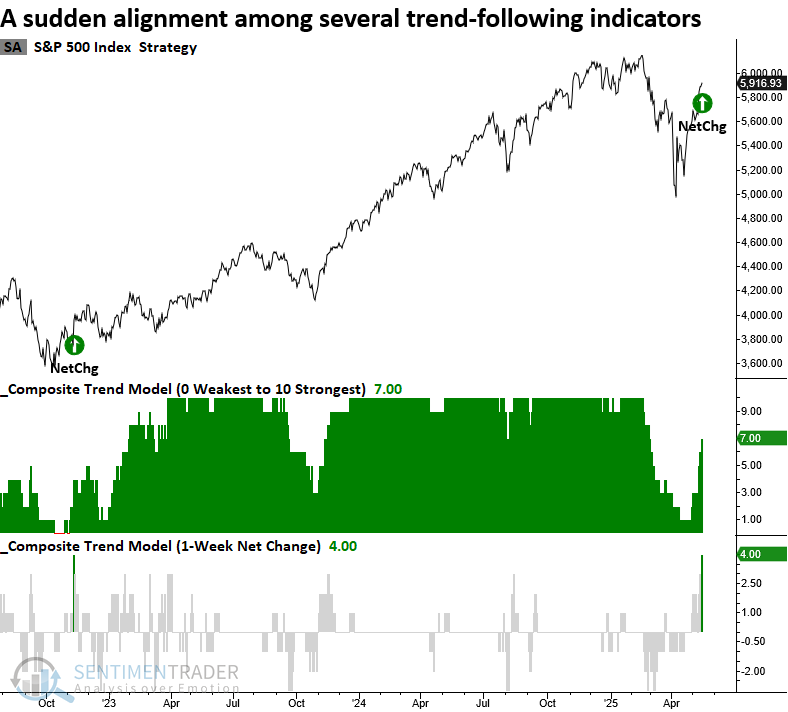

Inside This Week's Bull Bear Report The "Can't Stop, Won't Stop" Rally Last week, we discussed how the rally had repaired much of the previous damage following "Liberation Day." However, we also made competing cases for the bulls and bears on the market's next move. "It is always difficult to say whether this is a 'bear market' rally while you are in the midst of it.

Read More »

Read More »

5-16-25 You Are Much More Economically Sensitive (when you’re an investor)

Investors have a "spidey-sense" of what's going on in the world around them, noticing things like restaurant occupancies and the number of freight trucks on the highway.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

5-16-25 “Tax-Free Social Security: Dream or Deception?”

What if your Social Security benefits were no longer taxed?

A new bill in Congress could make that happen — but is it real policy or just political posturing?

Richard Rosso unpacks the proposal to eliminate federal income tax on Social Security, what it could mean for retirees, and the fiscal reality behind the promise.

🧾 What’s in the proposed legislation

💸 How it could impact retirement income

⚖️ The budget math Congress doesn’t want to talk...

Read More »

Read More »

Bank Regulators Will Help The Treasury

Per an article in the Financial Times titled US Poised To Dial Back Rules Imposed In Wake of 2008 Crisis, US bank regulators are preparing to reduce bank capital requirements. Of particular interest to the bond market is the supplementary leverage ratio, better known as SLR.

Read More »

Read More »

Corporate Stock Buybacks – Do They Affect Markets?

Fisher Investments recently wrote an interesting article asking whether corporate stock buybacks affect markets. Here is their conclusion: "Yes and no? Stocks move on supply and demand. Stock buybacks, where a company buys and takes shares off the market, theoretically reduce supply.

Read More »

Read More »

5-15-25 If You Don’t Raise Cash You Can’t Buy the Dip

Now is not the time to be greedy. Markets operate in cycles, and in post-election years tend to have a decent rally in May and June; July tends to be weak, strong August, weak September, followed by October, November, & December rallies. These will offer opportunities to buy into dips. If you don't have cash at the ready, to cannot take advantage of those opportunities.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w...

Read More »

Read More »