Category Archive: 9a.) Real Investment Advice

What Happens with No Penalty for Failure

(3/28/22) The Oscar Slap heard 'round the world; The Billionaires' Tax explains, and why it won't pass muster; How the Flu was eliminated by COVID, and now...the impact of legislation, and why the Fed uses Quantitative Easing. The moral hazard for investors, and what happens when there's no penalty for excess; the "new" method for dealing with ecession: Don't let them occur. Emergency Assistance and whose at fault when investments for...

Read More »

Read More »

When Your Financial Plan Isn’t Working

(3/25/22) How do you adequately plan your financial future with a Fed that is as outdated as a rectal thermometer? Their answer to every problem is sending a check. Gasoline Prices & Animal House; inflation and the "significant passage of time." What happens when your financial plan isn't working? Social Security COLA, tracking inflation's impact on your financial goals; dealing with volatility in distribution-mode. Improving credit...

Read More »

Read More »

The Rate Hike Outlook Episode, Pt-2

(3/24/22) Markets' recent rally providing nice relief; bullish appetite for stocks remains, despite Ukraine, Interest rates, and inflation concerns. What happens when the Fed "prints" money; at what point will the Fed have gone too far? Life w The Roberts'; why Recessions aren't a bad thing; gasoline rebates are financial lunacy. Implications and consequences of 3% interest rates; how debt allows excessive lifestyles; Gov't. not allowing...

Read More »

Read More »

Markets to End March Bullishly

(3/24/22) Markets' recent rally back above resistance levels sets up for a bullish advance into the end of the month. Markets are over-bought, short-term, so some consolidation at current levels would not be surprising. There is good support as markets sit atop the 50-DMA, and the 20-DMA is starting to turn upwards as another bullish barometer. As the end of the month approaches next week, mutual funds will need to rebalance portfolios, thanks to...

Read More »

Read More »

The Rate Hike Outlook Episode, Pt.-1

(3/24/22) Markets' recent rally providing nice relief; bullish appetite for stocks remains, despite Ukraine, Interest rates, and inflation concerns. What happens when the Fed "prints" money; at what point will the Fed have gone too far? Life w The oberts'; why ecessions aren't a bad thing; gasoline rebates are financial lunacy. Implications and consequences of 3% interest rates; how debt allows excessive lifestyles; Gov't. not allowing...

Read More »

Read More »

Is the Bear Market Already Over? | 3:00 on Markets & Money

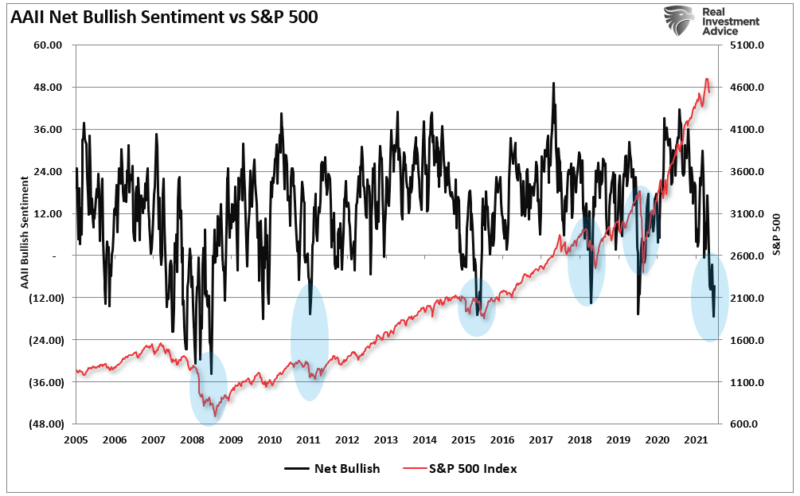

(3/23/22) Negative sentiment tends to be bullish for stocks, and lately everyone's been convinced the world is about to end. The technicals bear this out: We've had several re-tests of market lows since January, which would include the Russian invasion of Ukraine. But look at how markets rallied, breaking about the 50- and 200-DMA's. Markets need to hold above that resistance level, and reach up to touch the upper limits of the Bollinger Bands. In...

Read More »

Read More »

Who’s Afraid of the Yield Curve?

(3/23/22) Lance's mystery Peppermint Patty source; investor sentiment remains negative, but there are technically constructive signs providing portfolio relief; concerns over geopolitics, energy, and food shortages are valid, but they're driving emotional responses by investors. Yield Curves and the story Bonds are telling; the impact of higher rates on pensions; you could be working for free; the reality of retirement now; the consequences of poor...

Read More »

Read More »

Is It Time to Buy Bonds Yet? | 3:00 on Markets & Money

(3/22/22) Maybe not yet, but we're probably getting close: The Fed this week has said it'll need to raise rates faster than previously thought because of rampant inflation. We might get a 50-basis point hike in May because of persistent inflation they didn't see coming (they also didn't see a war between Russia and Ukraine.)

Read More »

Read More »

Sanctions Stink, but Markets Perform Despite Geopolitics

(3/22/22) Markets continue to perform remarkably, despite geopolitical distractions and Fed meddling; there seems to be no demand destruction from high energy prices. Yet. The conundrum is markets' readiness to rally amidst negative sentiment.

Read More »

Read More »

6 percent Market Rally – Markets Over-bought | 3:00 on Markets & Money

(3/21/22) Markets rallied an astounding 6% last week, coming off an over-sold, very negative sentiment scenario--which was the perfect set-up for a counter-trend rally. Our advice was to use such a rally to rebalance risk. Did you? The Fed's 25-basis points rate hike, and Friday's quadruple witching deadline, which spurred activity, gave markets the lift necessary to rise into the 200-DMA, which will be challenging resistance this morning.

Read More »

Read More »

Why Today’s Inflation is Not Like the ’70’s

(3/21/22) Markets decided to goose the index 6% while we're on vacation, and the Fed raises rates 25-basis points, as expected. Cash is now trash, thanks to inflation; why this is not like the '70's. The Greatest Generation and American Manufacturing strength; why CNN is wrong about solving inflation; Permanent DST, Congress' stealth pay raise, Bloomberg's $300k inflation threshold; the Fed is expected to continue to raise interest rates.

Read More »

Read More »

Market Perspective Is Important To Avoid Mistakes

Market perspective is essential in avoiding investing mistakes. With CNBC airing “Markets In Turmoil” every time the market dips, it’s no wonder investor sentiment is now the lowest we have seen financial crisis lows.

Read More »

Read More »

Yes, We’re on Vacation This Week!

Even a work-a-holic like Lance needs to take a break now and then.

Please visit our website at https://realinvestmentadvice.com/insights/podcasts/ for easy access to all of our media productions. We'll see you back here Monday morning, March 21, at 6:06am CDT.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live daily on our Youtube Channel:...

Read More »

Read More »

How to Include Inflation in Your Retirement Planning

(3/11/22) Markets are in a coiled-spring state, like the bear in "The Revenant," waiting to pounce. What the Fed says next week could change everything--one way or the other. Why not solve the Russian-Ukraine War with a cage match between Putin and Zelensky? The money lessons we teach our kids should be taken to heart by adults. The importance of including inflation in retirement planning cannot be under emphasized.

How we're handling...

Read More »

Read More »

Outsized Rallies Continue to Fail | 3:00 on Markets & Money

(3/10/22) The NASDAQ chalked up a 3% gain, and he S&P bounded nearly as much in the biggest one-day gain we've seen in a while. But even with this volatile behavior, markets have been in a consistent decline since January. The out-sized rallies have continued to fail--a hallmark of the correctional process. Below the surface of the average, individual companies are recording losses of up to 30- and 40% off their peaks. The S&P is being...

Read More »

Read More »

Who’s Really to Blame for High Energy Prices?

(3/10/22) Next Week's Fed Meeting and monetary policy are front and center...but tightening is already occurring, thanks to higher energy prices. Will the Fed back off inflationary stance--and protect financial markets, or go full-speed ahead with higher interest rates? The Amazon 20:1 stock split AND $10-B stock buy-back--a defacto move for larger companies. Who's really to blame for high energy prices? The consequences of virtue signaling and...

Read More »

Read More »

FAFSA Season: How to Avoid Mistakes that Could Cost You Money

Parents of upper-level high school and college students should be well into the college planning phase of life. The FAFSA is an essential part of planning for college expenses, and one incorrect answer could cost you money, time, and opportunity. RIA Advisors Senior Advisor, Danny Ratliff, CFP, and Senior Risk Management Consultant, Chris Liebum, LUTCF, share insights and advice for successfully maneuvering through the financial aid maze associated...

Read More »

Read More »

Equities Markets Opening Strong…Commodities, meh

(3/9/22) Oil prices on Tuesday spiked on expectations of sanctions on Russian oil, and as it came to pass, oil futures dropped 2%. Oil had been over-sold by more than three standard deviations, so a pullback was not unexpected. An oil price correction back down to $100/bbl would not be surprising, as a re-test of the 50-DMA--and that could set oil prices to go even higher, still. But high prices are the cure for high prices, and that dynamic is...

Read More »

Read More »

Did Ukraine Eliminate COVID?

(3/9/22) The news moves markets, and as the Russian invasion of Ukraine remains in the headlines, COVID has been all but eliminated! After sanctions on Russian oil were put in place, oil futures shed 2%. NFIB Survey shows sentiment waning, wage expectations falling, and anticipated sales down. The Fed bet: raise rates or hold firm? Nickel trading suspended until Friday; what then? Manipulation of commodities markets--nothing new. Markets' next...

Read More »

Read More »

How to use Rallies to Lower Risk | 3:00 on Markets & Money

(3/8/22) Markets sold off on Monday, breaking through support all the way back to October's levels. Markets are not yet on a sell-signal, and not really all that over-sold--meaning, there's still some downside risk with which to be reckoned. We will likely re-test the intra-day lows established when Russia invaded Ukraine. Sentiment remains negative--the CNN Fear & Greed gauge is in the "extreme fear" category. This would suggest we...

Read More »

Read More »