Category Archive: 9a.) Real Investment Advice

Markets: Bullish Vs Bearish Case

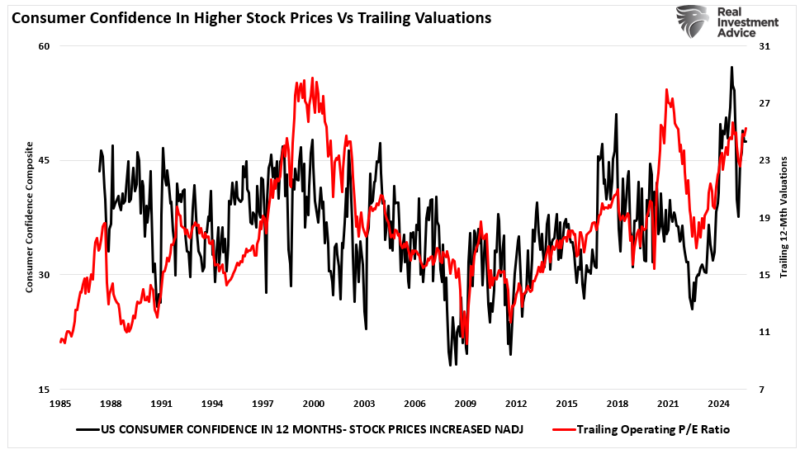

Just recently, Scott Rubner of Citadel Securities wrote an excellent piece discussing the bull versus the bear case for the markets. You look at the markets today and see a tension between expectation and reality. On one hand, equities—especially tech and growth—are pushing to fresh highs. Optimism about rate cuts, AI and productivity gains, global …

Read More »

Read More »

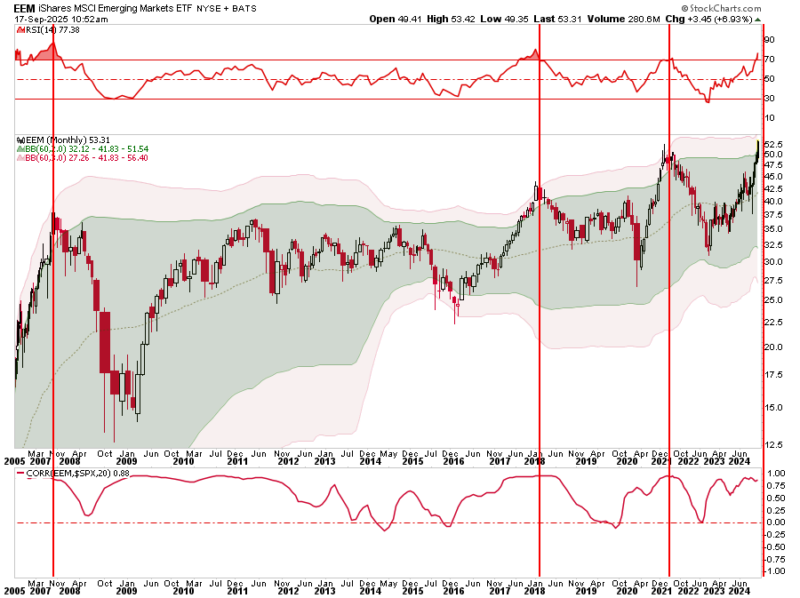

Overbought Conditions Across Multiple Markets

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

9/19/25 Why Fighting The Data Is A Losing Trade

Regardless of whether you believe CPI or jobs data reflects reality, markets trade on the official numbers.

In this short video, @AxelMerk & I discuss that even if employment or inflation numbers are flawed, what matters is how the Fed reacts, since liquidity and rate policy drive asset prices.

Watch the full episode here:

#CPIInflation #JobsReport #FederalReserve #MarketTrading #AxelMerk

Read More »

Read More »

9-18-25 Savvy Medicare Planning –

Planning for Medicare can feel overwhelming, but understanding your options is the key to protecting your health and finances in retirement. In this Savvy Medicare Planning Webinar, Richard Rosso & Danny Ratliff walk you step-by-step through what Medicare covers, who’s eligible, enrollment periods, penalties, premiums, Medigap, Medicare Advantage, and long-term care planning.

✅ What you’ll learn in this Medicare webinar:

The basics of...

Read More »

Read More »

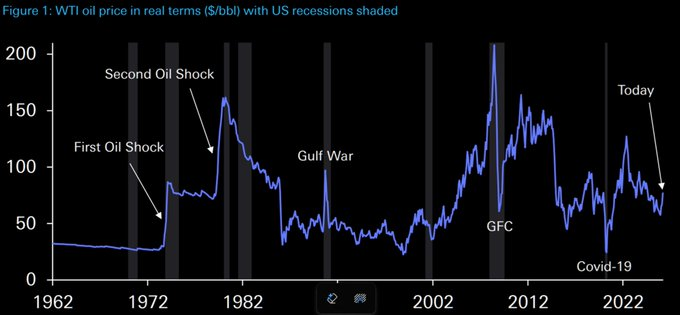

9/11/25 There Ain’t No Inflation

Markets and the Fed keep talking about inflation, but what’s really happening? Lance Roberts previews the upcoming CPI, PPI reports, and real-world data to explain why the official numbers don’t always match what you're feeling. From wages and rents to energy prices--is inflation is truly under control, or just hiding in plain sight.

Discover how “disinflation” differs from “deflation,” why Wall Street’s narrative matters for stocks, and what it...

Read More »

Read More »

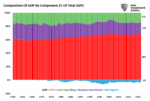

Data Centers And The Power Grid: A Path To Debt Relief?

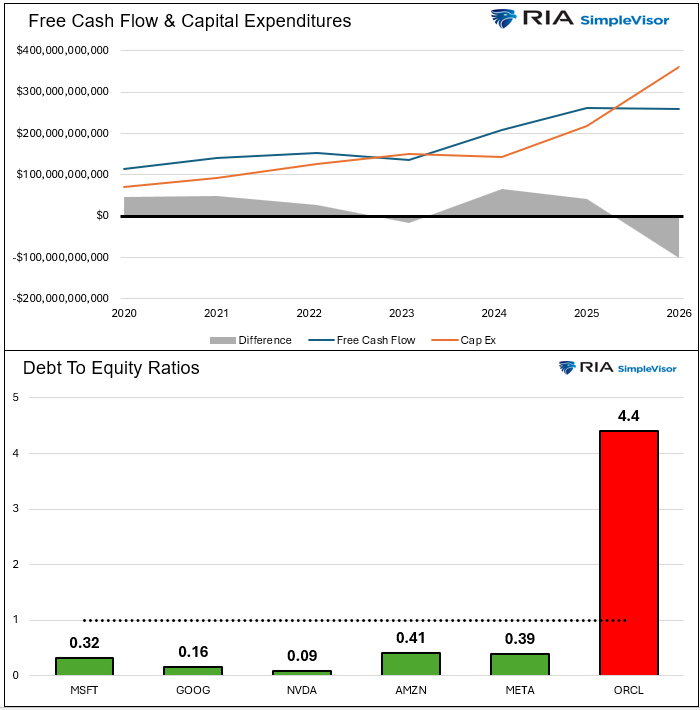

Could data centers and the power grid be America's next "renaissance?" With the U.S. national debt exceeding $37 trillion and interest payments surpassing defense spending, many articles have been written about the "debt doomsday" event coming. Such was a point we made in "The Debt and Deficit Problem." "In recent months, much debate has been …

Read More »

Read More »

Market Mechanics Override Weakening Economic Data

Since the middle of July, UST 10-year yields have fallen from 4.50% to 4.00%. While the yield decline has been profitable for bondholders, it has also aided many other investors. Such a finding may seem counterintuitive, considering that lower yields are the result of a significant weakening in the labor market and a range of …

Read More »

Read More »

9/18/25 The Real Reason The Market Popped After the Fed Cut

The Fed cut rates as expected, but Powell admitted uncertainty and insisted policy is still "restrictive."

@michaellebowitz and I discuss why markets see it as "accommodative" and are rallying on that perception, with $INTC & $NVDA helping big.

#FedRateCut #StockMarketRally #PowellSpeech #NvidiaStocks #InterestRates

Read More »

Read More »

9/18/25 No Risk-free Path for the Fed

The Federal Reserve cut rates on Wednesday, September 17, 2025 — but the path forward is anything but risk-free. Markets had already priced in much of the move, leaving investors to wonder if Powell’s guidance will calm volatility or spark fresh uncertainty.

Lance Roberts and Michael Lebowitz look at what the Fed’s latest decision means for stocks, bonds, and the economy.

Why Powell’s words may matter more than the rate cut itself.

The risks of...

Read More »

Read More »

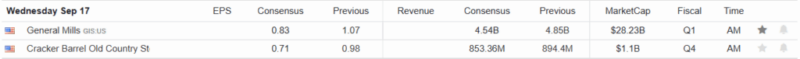

The Fed Cuts Rates: What Comes Next?

Not surprisingly, the Fed cut rates by 25 basis points at yesterday's meeting. With the cut, the Fed Funds rate sits at 4.00-4.25%. While the market was nearly certain of a 25bps cut, it is less clear about what the road ahead holds for Fed policy. To help us start thinking about how policy may change at the upcoming meetings, we share a few comments from yesterday's FOMC meeting.

Read More »

Read More »

9/17/25 Big Day: Fed Day

It’s Fed Day – the most anticipated event for markets this month. The Federal Reserve’s rate decision and Jerome Powell’s press conference could shape the direction for stocks, bonds, and the economy heading into year-end.

Lance Roberts & Danny Ratliff break down:

• What the Fed is likely to announce today

• The impact on interest rates, inflation, and growth

• How markets ($SPY, $QQQ, bonds, gold) typically react to Fed decisions

• Why...

Read More »

Read More »

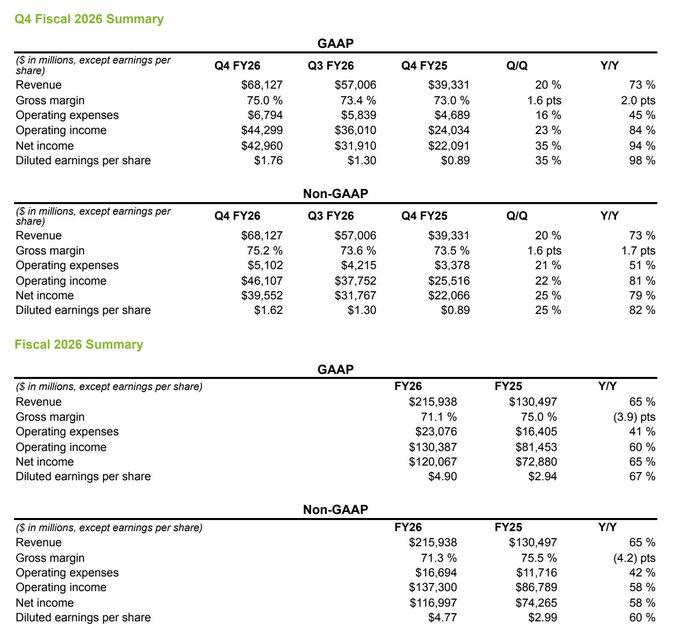

Semiannual Reporting Requirements Are Overhyped

President Trump is pushing to reduce the SEC’s financial reporting requirements from quarterly to semiannual reporting. He's framing the idea in a positive light: it would allow managers to focus on the business, lower compliance costs, and fight “short-termism” in markets. In reality, it would weaken one of the hallmarks of U.S. capital markets: timely …

Read More »

Read More »

Trump’s BLS Reform Faces Steep Obstacles

The White House has turned its attention to the Bureau of Labor Statistics after a series of steep payroll revisions rattled confidence in the government’s jobs data. President Trump fired the agency’s commissioner last month and has nominated a longtime critic to take her place, pledging reforms to improve accuracy. But the problems run deeper …

Read More »

Read More »

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

Overnight Funding Costs Signal Liquidity Strain

After years of abundant liquidity, U.S. overnight funding markets are beginning to show signs of strain. Interest rates on overnight repo agreements have climbed steadily this month as the Treasury rebuilds its cash balance and the Fed continues quantitative tightening. Usage of the Fed’s overnight reverse repo (RRP) facility, a key gauge of excess liquidity, …

Read More »

Read More »

Covered Call Strategies Gone Wild

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

9-9-25 Gold, Jobs & the Fed: Axel Merk’s Market Outlook

From the Fed’s next move to the outlook for gold and gold miners, Axel Merk, CEO of Merk Investments, shares with Lance Roberts his take on today’s biggest market risks: The largest jobs revision ever, the Fed’s lagging response, why active management beats passive distortions, and how investors should think about risk, contrarian views, and the role of gold in their portfolios.

0:18 - Introduction of Alex Merk, CEO Merk Investments

2:01 -...

Read More »

Read More »

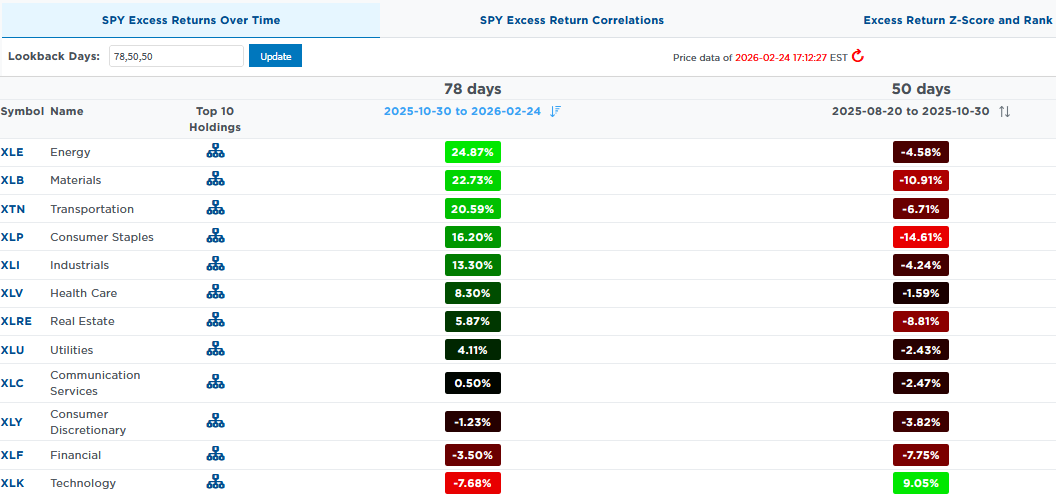

9/12/25 Pullback Cancelled? We’re Setting Up For Year-End Rally

A correction in September would've set up a healthier base, but if it doesn’t happen soon, the odds of one fade as corporate buybacks return, funds stay underweight, and the seasonal push kicks in – setting $SPY / $QQQ up for a year-end rally.

In this Short video, I break it all down for you.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #YearEndRally #SPY #QQQ #MarketOutlook

Read More »

Read More »

9-12-25 The Essential Hierarchy of Money Goals

Where should your money go first? Too often, people skip ahead to investing or wealth strategies before laying the right foundation. Richard Rosso and Matt Doyle break down the essential hierarchy of money goals—a clear order of priorities to help you stay on track.

From emergency savings and debt reduction to investing, wealth protection, and legacy planning, this framework shows you exactly how to progress step by step.

By focusing on the right...

Read More »

Read More »