Category Archive: 9a.) Real Investment Advice

10-13-25 Markets vs Reality: Daniel LaCalle on the Coming Global Reset

Are markets completely disconnected from economic reality?

In this in-depth conversation, Lance Roberts sits down with Daniel LaCalle, Chief Economist at Tressis and author of "Freedom or Equality," to discuss the illusion of wealth, the rise of sovereign debt bubbles, and why the next financial crisis may already be unfolding beneath the surface.

Key takeaway: Markets may look strong, but the foundations are far weaker than investors...

Read More »

Read More »

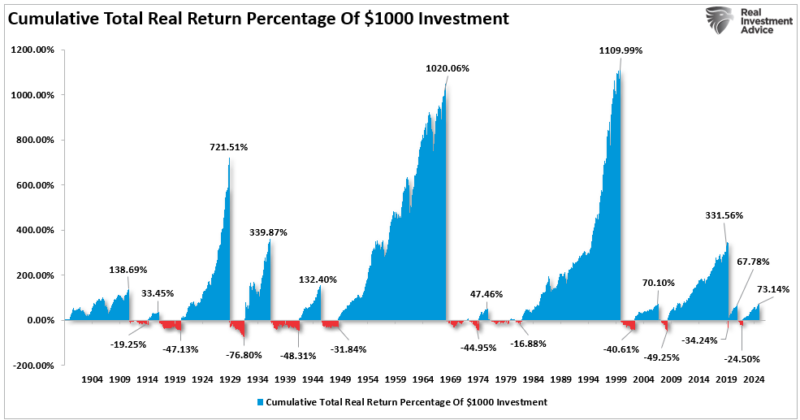

10-7-25 Why Markets Don’t Compound Over Time

Most investors believe markets compound steadily, but they don’t.

Losses break the compounding path, and timing matters more than most realize.

In this Short video, I show why managing risk—not chasing returns—is what truly builds wealth over time.

Watch the full episode: https://www.youtube.com/live/Oo1Ny37IaEs?si=5vnlpbRLq_FaAHQL

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-7-25 7 Midlife Money Traps That Destroy Wealth

In your 30s, 40s, or 50s, life gets busy—and money decisions get complicated. Many professionals fall into the same midlife financial traps that quietly erode their future wealth. Lance Roberts & Jon Penn unpack seven common midlife money mistakes that can derail your long-term goals—from lifestyle creep and poor diversification to credit card debt and get-rich-quick schemes. Learn how to stay focused, protect your growing assets, and build...

Read More »

Read More »

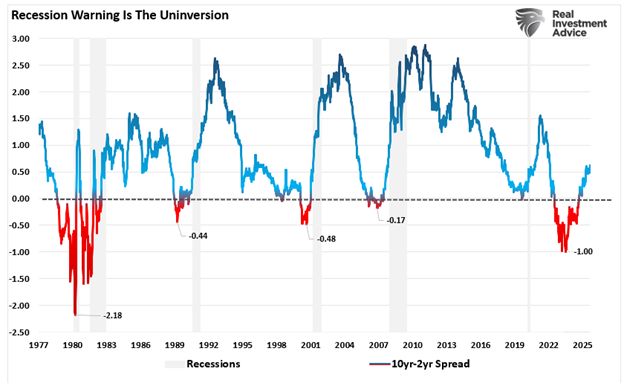

AMD Surges: Nvidia Competition Heats Up

Advanced Micro Devices (AMD) stock opened up by nearly 35% on Monday morning, following reports that OpenAI is acquiring a 10% stake in AMD. As part of the agreement, AMD will supply OpenAI with 6 gigawatts of AMD's Instinct GPUs.

Read More »

Read More »

10-6-25 The Hidden Math Wall St. Doesn’t Tell You About Buy & Hold

Most investors think market drops are just “blips,” but the math tells a different story — a 50% decline cuts total dollar gains in half, not by a small “blip.”

In this short video, I explain why legendary investors like Warren Buffett & Paul Tudor Jones focus on limiting losses, not blindly holding — and why right now, protecting capital beats chasing the rally.

Full episode: https://www.youtube.com/live/Oo1Ny37IaEs?si=5vnlpbRLq_FaAHQL...

Read More »

Read More »

10-6-25 Bear Market Losses: The Dangerous Illusion Investors Fall For

Investors often believe that when markets “recover,” their portfolios do too — but that’s a dangerous illusion. In this episode, Lance Roberts breaks down why percentage losses and gains are not symmetrical, and how a 50% loss requires a 100% gain just to break even.

We’ll discuss why bear market math destroys long-term returns, how emotional investors get trapped in the “illusion of recovery,” and why managing risk during drawdowns matters more...

Read More »

Read More »

Bear Market Losses – A Dangerous Illusion

When bear market losses occur, headlines talk in percentages: “The market dropped 20 %.” Investors nod. A 20 % decline sounds manageable, historical, and expected. As Ben Carlson recently penned: "Bear markets have some symmetry to them, at least in the short-term. In the long term, bull markets versus bear markets are asymmetric. Things are not balanced. Look at …

Read More »

Read More »

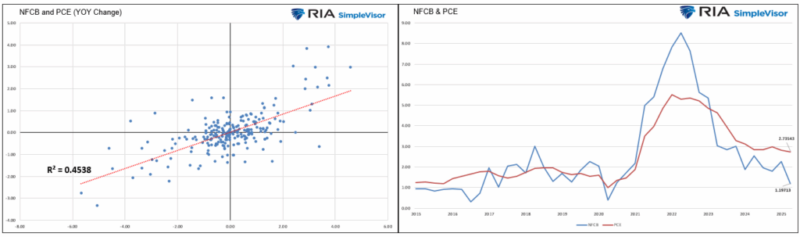

Corporate Prices Lead Consumer Prices

The following discussion is courtesy of Paul Mortimer Lee, as provided by Albert Edwards of Societe Generale. Paul makes an interesting case that PCE prices, the Fed’s primary gauge of inflation, are likely to decline. Supporting his view is a relatively wide and growing gap between the prices witnessed by the non-financial corporate business sector, …

Read More »

Read More »

Bubble In AI: Echoes Of The Past, Lessons For The Present

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

The real story isn’t the government shutdown. ADP just showed another 32,000 job losses, with prior months revised lower.

In this short video, @michaellebowitz and I discuss why the labor market is deteriorating even without the BLS report and what it means for $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-3-25 Protecting Your Family’s Future: Financial Basics You Cannot Ignore

Protecting your family starts with the right financial basics. Jon Penn & Jonathan McCarty break down the must-have estate planning tools, insurance coverage, and financial safeguards every household needs.

🔔 Subscribe for more practical strategies to protect your wealth, family, and future.

#FamilyProtection #EstatePlanning #FinancialBasics #MoneyTalk #WealthPlanning

Read More »

Read More »

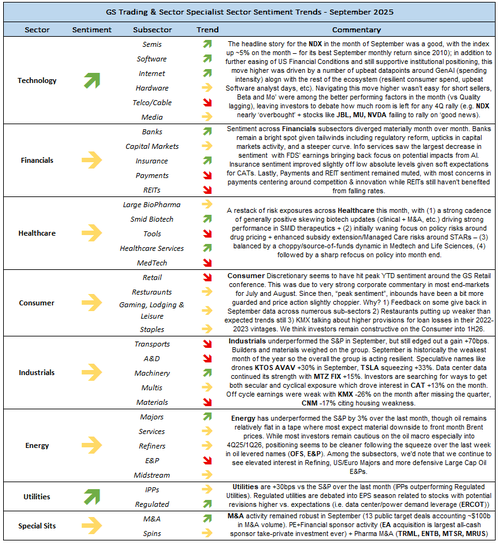

Eli Lilly And Its Competitors Pop On The Pfizer News

Eli Lilly and other US-based drug makers have led the market over the last few days. The reason appears to be Pfizer’s agreement with President Trump to sell its drugs through Medicaid at cheaper prices. It's not just Pfizer; Eli Lilly is reportedly in active discussions with the administration to participate in a similar deal. …

Read More »

Read More »

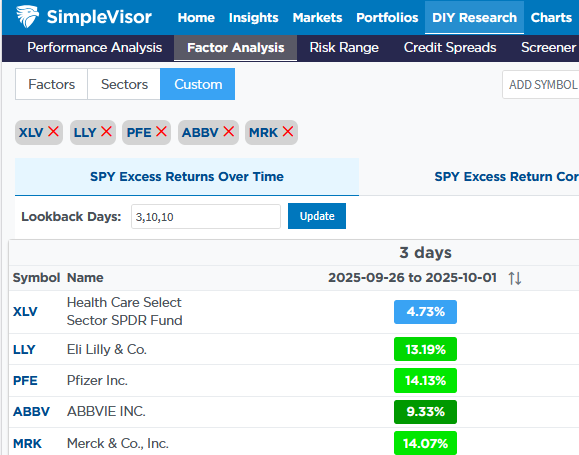

Promised Recession…So Where Is It?

Over the past three years, the economic conversation has been a "promised recession." If you read the headlines, tracked economist surveys, or even listened to Wall Street strategists, you would have assumed a downturn was imminent. Many investors, bloggers, and YouTubers have had a "parade of horribles" promising a recession is just on the horizon.The logic was …

Read More »

Read More »

10/2/25 Valuations Don’t Matter… Until They Do

Markets are trading at near all-time record valuations with little fundamental support.

Momentum is currently driving prices across all asset classes, but when earnings reality fails to match lofty expectations, valuations start to matter. And that’s when the music stops.

In this short video, I show why history warns against ignoring valuations and what it means for risk and returns ahead.

Full episode:

Catch me daily on The Real...

Read More »

Read More »

10-2-25 Who Needs the BLS:? Shutdown Silences Jobs Report

The government shutdown has silenced the Bureau of Labor Statistics, leaving investors without the monthly jobs report. But does Wall Street really need the BLS to keep moving?

Lance Roberts & Michael Lebowitz explore what happens when government labor data goes missing, how traders adapt, and what alternative indicators might offer clues about the state of the economy. Lance and Mike also examine valuation metrics in the markets, and discuss...

Read More »

Read More »

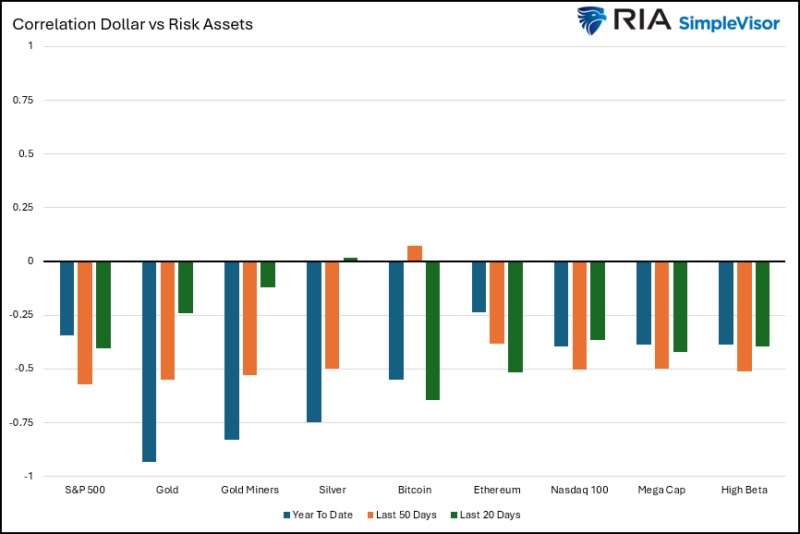

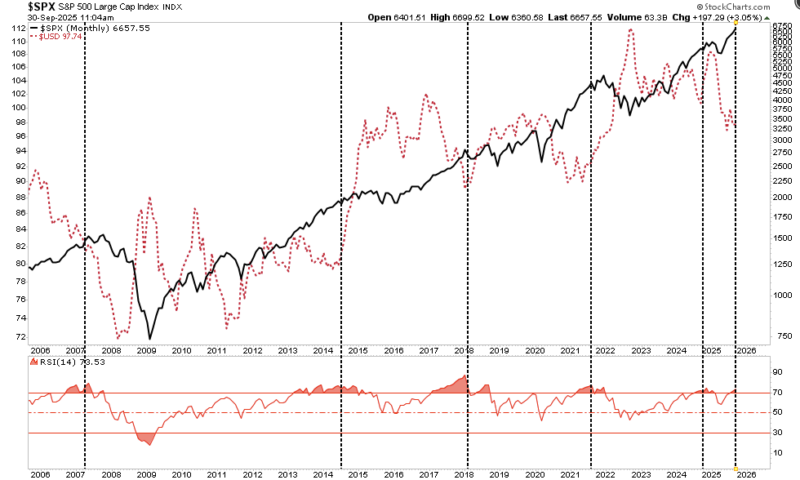

A Dollar Reversal Could Halt The Gold Bull

In Monday’s Commentary, we alerted readers that the dollar could be setting up for a reversal higher. Furthermore, we noted that if such a turn comes to fruition, some investors may encounter surprises. To wit: As such, investors should examine their portfolios for risks that have developed with the reversal of the previously overbought dollar, to …

Read More »

Read More »

AI Boom: This Time Is Different… Or Is It?

AI is undoubtedly transformative, but massive spending and debt-fueled deals, such as $ORCL $300B investment with OpenAI, reveal a circular flow of money between $ORCL, $NVDA, & OpenAI that bears a striking resemblance to the dot-com bubble.

In this short video, I explain why current expectations likely exceed what AI companies can realistically deliver.

Full episode: ?si=T7XTri40KAdGXnO4

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-1-25 Government Shutdown Begins: What It Means for Markets & Investors {REVISED*]

The U.S. government shutdown has officially started. What does this mean for the economy, markets, and your investments? Lance Roberts covers the immediate fallout from the shutdown on federal spending, workers, and services ; how markets have historically reacted during shutdowns—and what to expect this time; the risk to GDP, delayed economic data releases, and consumer confidence.

This shutdown is more than politics—it’s a real test for the...

Read More »

Read More »

Kimonos For Bitcoin: 150 Year Old Company Goes Crypto

In a bold and unusual pivot, a traditional Japanese manufacturer of Kimonos is transitioning to a cryptocurrency treasury company. Marusho Hotta, which has been manufacturing kimonos since 1861, will rebrand as the Bitcoin Japan Corporation. The transformation stems from a June acquisition by Bakkt Holdings (BKKT), which took a controlling stake in the company to …

Read More »

Read More »

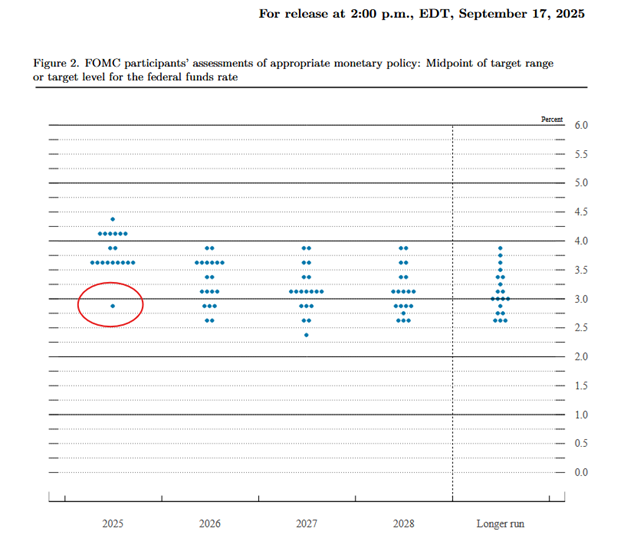

Miran Says Rates Are Too High: Politics Or Reality?

Stephen Miran, Donald Trump's recent addition to the Fed, joined the Federal Reserve the day before the last meeting. At that meeting, he was the only dissenting vote, supporting a 50-basis-point rate cut. All other members voted for a 25-basis-point cut. Additionally, Miran is likely the FOMC participant who thinks the Fed Funds rate should …

Read More »

Read More »