Category Archive: 9a.) Real Investment Advice

12-4-25 Why Markets Are Nervous About a New Fed Chair

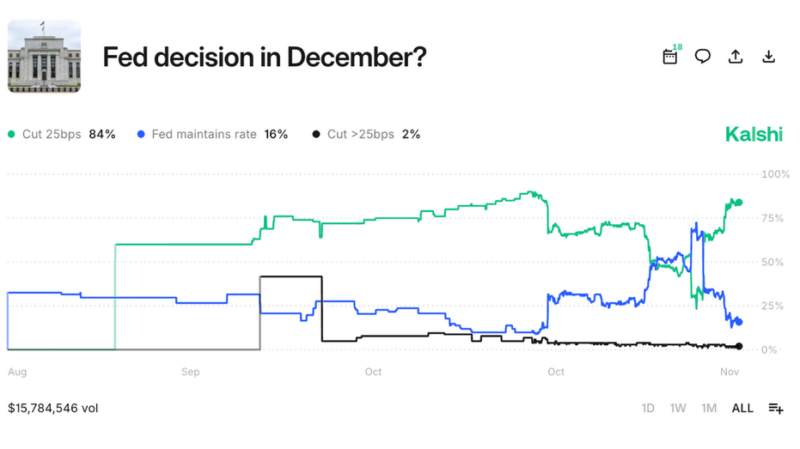

Markets are reacting to the rising odds of Kevin Hassett becoming the next Fed Chair. His pro-growth, lower-rate stance raises concerns that inflation might not get enough attention.

In this short video, Michael Lebowitz & Lance Roberts discuss why investors worry about inflation being underweighted and why one chair’s vote still doesn’t decide Fed policy.

📺Full episode: -iyGgj0

Catch me daily on The Real Investment Show:...

Read More »

Read More »

12-5-25 Roth Conversions, Money Rules & Financial Wellness: What Actually Works?

Richard Rosso breaks down a study that modeled hundreds of thousands of retirement scenarios to determine which Roth conversion strategy performs best over a 10-year period:

• Staying in a traditional IRA/401(k) and taking RMDs

• A one-time Roth conversion

• A gradual, multi-year conversion strategy

RIA Advisors’ Financial Guardrails are timeless principles for building lasting wealth and protecting your financial future. Rich also shares...

Read More »

Read More »

12-4-25 Fed Regime Change: Is Groupthink Finally Ending?

Is the era of Fed groupthink finally coming to an end?

For over a decade, the Federal Reserve has operated under a powerful consensus framework—one where dissent has been rare and the Chair’s view has dominated policy outcomes. But shifting politics, rising dissenting votes, and increasing disagreements among FOMC members may signal a new regime change at the Fed.

Lance Roberts & Michael Lebowitz break down:

0:00 - INTRO

0:19 - ISM Report...

Read More »

Read More »

Natural Gas Prices: Weather, Data Centers And LNG

As we share below, courtesy of FinViz, natural gas prices have risen by over 50% since late October. Moreover, natural gas prices, approaching $5, are at three-year highs. The primary cause of the recent price surge is increased heating demand driven by colder-than-expected winter weather, which is resulting in greater-than-average inventory draws. Per the EIA, …

Read More »

Read More »

Year-End Financial Planning Checklist: 7 Steps to Maximize Your Wealth Before December 31

The end of the year tends to sneak up on people. One minute it’s late summer; the next, you’re staring at a calendar and wondering how to wrap up your financial goals before the deadline hits. A thoughtful approach can make a measurable difference in what you keep, what you owe, and how prepared you …

Read More »

Read More »

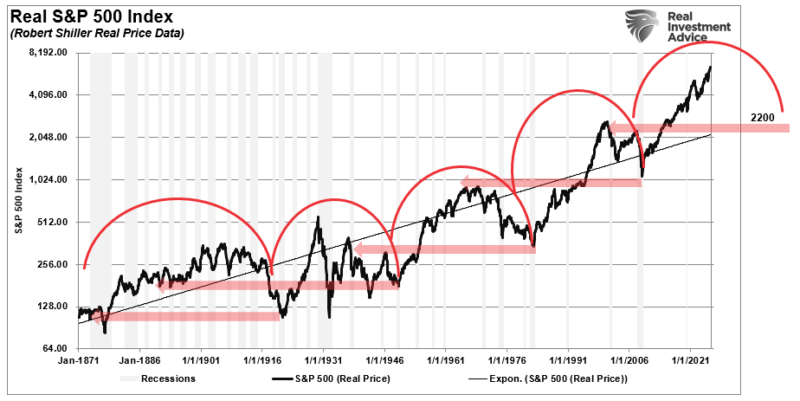

12-3-25 Anyone Can Spot a Market Cycle But Few Can Survive It

Identifying market cycles is easy; surviving them is the hard part. Long-term cycle narratives often break investors emotionally.

In this short video, I explain why focusing on shorter, manageable timeframes leads to better decisions and fewer mistakes.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-3-25 Trump Accounts Explained: Who Qualifies for the Dell Deal?

What exactly are Trump Accounts, and who qualifies under the new expansion backed by Michael and Susan Dell’s $6.25 billion donation? Lance Roberts and Danny Ratliff break down how the Dell Deal works, which families benefit, and why this initiative could reshape financial planning for millions of children.

If you’re a parent, grandparent, or financial planner, this is essential information about how these accounts may impact a child’s financial...

Read More »

Read More »

Fed Regime Change: Groupthink May Be Ending

Starting in the aftermath of the 2008 financial crisis, a profound change to the Fed’s liquidity-providing role in the capital markets was underway. We can sum up the Fed regime change with a popular quip: The Fed has shifted from lender of last resort to the lender of only resort! In our articles QE Is … Continue...

Read More »

Read More »

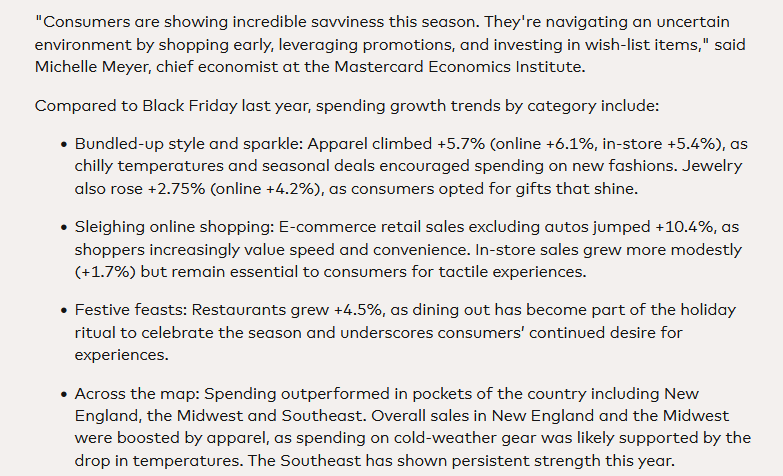

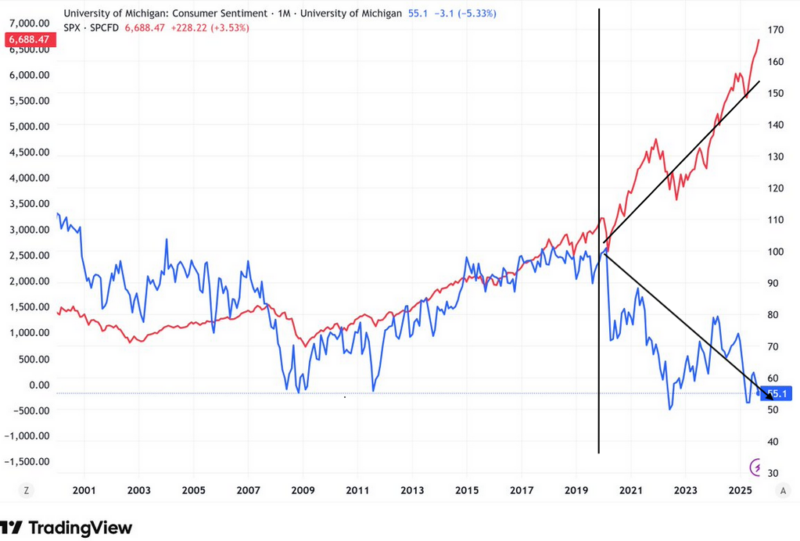

Black Friday Sales Results

Based solely on Black Friday sales data, the holiday shopping season may be decent despite poor consumer sentiment. According to Adobe Analytics, which draws data from over one trillion retail site visits, Black Friday online sales hit a record $11.8 billion, up 9.1% from last year. Per MasterCard's SpendingPulse, retail sales, including online and in-store …

Read More »

Read More »

12-2-25 Don’t Buy The “Death of the Dollar” Story$DXY

The #USDollar isn’t dying and its global dominance isn’t under threat.

In this short video, I explain why the fear-driven “death of the dollar” narrative ignores economic reality and relies on misleading charts rather than facts.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-2-25 LIVE Q&A: Ask Us Anything About Markets & Money

Welcome to our LIVE Q&A session!

Lance Roberts is taking your questions directly from the YouTube live chat—covering markets, investing, retirement planning, inflation, interest rates, the Federal Reserve, portfolio strategy, risk management, and your personal finance questions.

No scripts, no agenda—just real-time answers based on data, history, and risk-focused investing principles.

We’ll break down what’s moving the markets, how to think...

Read More »

Read More »

How to Reduce Taxes on Investment Gains: Advanced Strategies for High Net Worth Investors

Building wealth requires more than market awareness; it requires keeping as much of your earnings as possible. High net worth investors face steeper tax exposure, wider reporting thresholds, and more complex investment structures. Learning how to reduce taxes on investment income is one of the most effective ways to strengthen long‑term performance. Below are the …

Read More »

Read More »

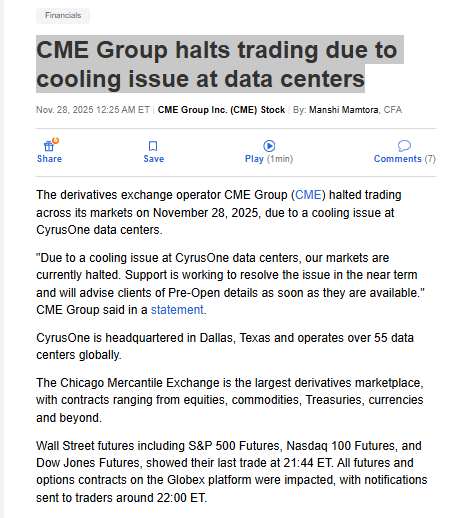

Overheating Financial Markets Highlight Data Centers Handicap

The Chicago Mercantile Exchange (CME) trading platforms were shut down for approximately 4 hours due to overheating after its cooling system at its Illinois data center failed. The outage began around 10:00 p.m. ET on November 27, halting about 90% of global derivatives volume on the Globex platform across futures and options for equities, bonds, …

Read More »

Read More »

12-1-25 A Perfect Year-End Rally Setup But With One Big Warning

Markets $SPX $NDX followed classic seasonality with a November dip that set up a potential year-end rally. But after six straight monthly gains, the odds of a pullback are rising.

In this short video, I explain why seasonality supports upside, but this streak makes risk management more important than ever.

Read More »

Read More »

12-1-25 Bear Markets Are a Good Thing

Bear markets aren’t the enemy—they’re the reset that creates future returns.

Lance Roberts breaks down why market downturns are a normal, necessary, and even healthy part of a full market cycle. We explore how bear markets cleanse excess speculation, reset valuations, restore forward returns, and give disciplined investors long-term opportunities to improve financial outcomes.

We’ll discuss why drawdowns feel worse than they are, why expectations...

Read More »

Read More »

A Bear Market Is A Good Thing.

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from "The Godfather." "“These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten … Continue reading »

Read More »

Read More »

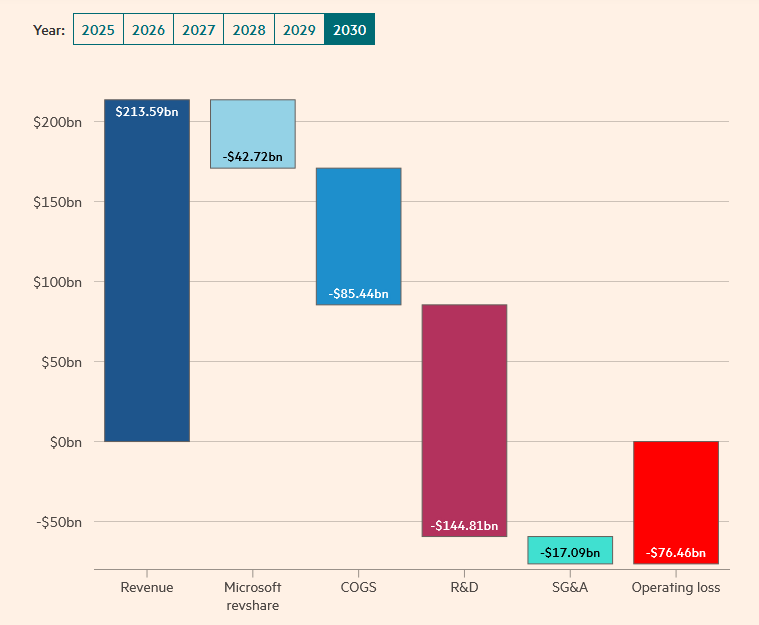

HSBC Casts Doubt On OpenAI’s Future

Per the Financial Times (LINK), HSBC has serious doubts about OpenAI's financial wherewithal. The following bullet points outline HSBC's assumptions, which highlight the challenging financial path OpenAI faces. The graphic below from the article shows that HSBC expects OpenAI to run a massive operating loss in the year 2030. Accordingly, they have serious concerns about …

Read More »

Read More »

Year-End Rally Begins

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

From Secular Bull To Secular Flat: The Next Likely Market Regime

We’re nearing the end of a remarkably long secular bull market.

In this short video, I explain why the next phase is usually a long period of sideways, volatile returns as valuations reset and the market shifts into a secular flat regime.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

The K Shaped Economy In One Graph

Tuesday's weak Consumer Confidence report was a good reminder of why some economists are calling our economy the K shaped economy. The Conference Board Consumer Confidence Index fell 6.8 points to 88.7 in November, below expectations of 93. Moreover, it sits at levels similar to those of early 2020, when the pandemic shuttered the economy. …

Read More »

Read More »