Category Archive: 6a) Gold & Monetary Metals

Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that...

Read More »

Read More »

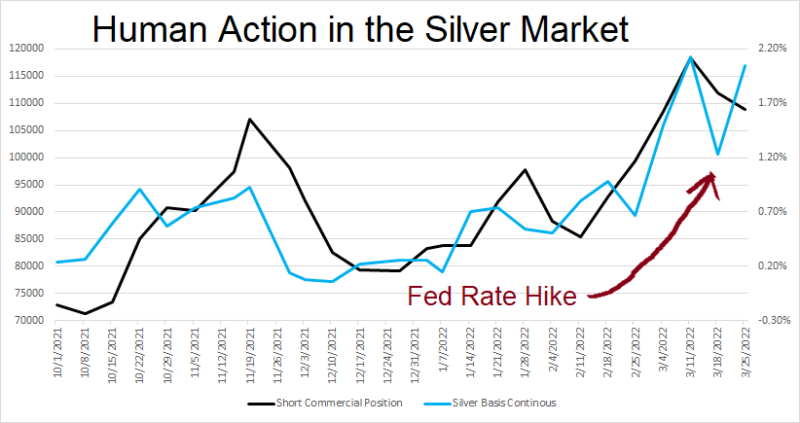

Should Investors Fear Fed Rate Hikes?

The prospect of Federal Reserve rate hikes continues to rattle Wall Street and cloud the outlook for precious metals. On Wednesday, the central bank strongly signaled it will raise its benchmark Fed funds rate for the first time in three years – likely at its March policy meeting.

Read More »

Read More »

Oklahoma to Consider Holding Gold and Silver, Removing Income Taxes

(Oklahoma City, Oklahoma -- January 20, 2022) - An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver.

Read More »

Read More »

Pro-Sound Money Lawmaker Wants To End Income Taxes on Gold and Silver in Oklahoma

(Oklahoma City, Oklahoma, USA – January 20, 2022) - Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver.

Read More »

Read More »

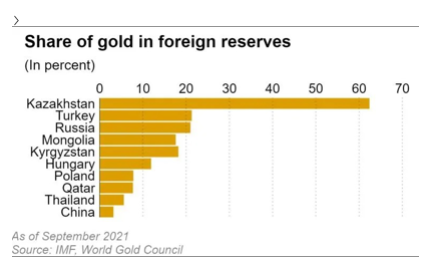

Central Banks’ record gold stockpiling

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly...

Read More »

Read More »

Gold Price Today – Gareth Soloway

2022-03-24

by Stephen Flood

2022-03-24

Read More »