Category Archive: 6a) Gold & Monetary Metals

BOOM: Wyoming Ends ALL TAXATION of Gold & Silver

Cheyenne, Wyoming (March 14, 2018) – Sound money activists rejoiced as the Wyoming Legal Tender Act became law today. The bill restores constitutional, sound money in Wyoming. Backed by the Sound Money Defense League, Campaign for Liberty, Money Metals Exchange, and in-state grassroots activists, HB 103 removes all forms of state taxation on gold and silver coins and bullion and reaffirms their status as money in Wyoming, in keeping with Article 1,...

Read More »

Read More »

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony. Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England. Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil. Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes. Central bank gold purchases continue to be major drivers of gold market.

Read More »

Read More »

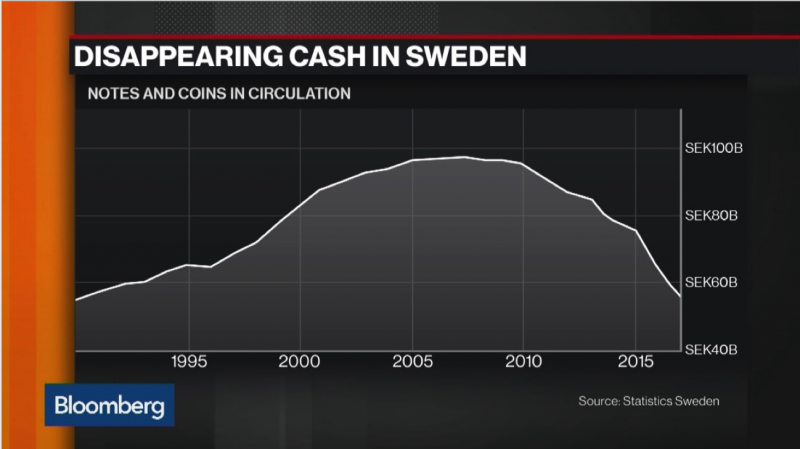

Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable. Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’. Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash. Cash usage in Sweden falling both as share of GDP and in nominal terms. Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona. Cashless is not a disincentive for illegal drug...

Read More »

Read More »

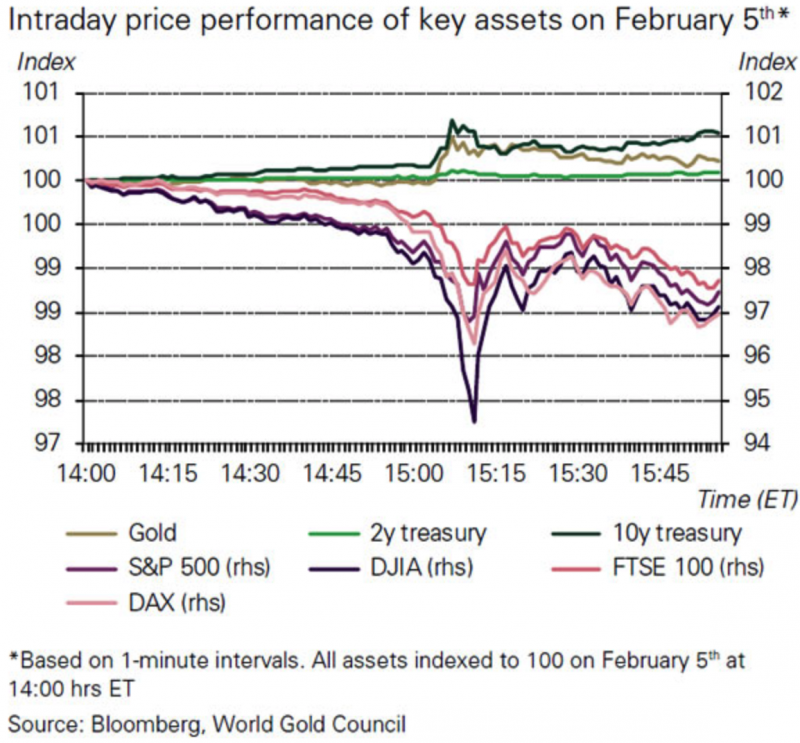

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold...

Read More »

Read More »

Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers.

– International Women’s Day highlights the underreported UK Women’s pension crisis.

– 2.66 million affected by UK government’s change to state pension act.

– Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees.

– Changes by government highlights the counterparty risks pensions are exposed to.

– Global problem as pensions gap of developed...

Read More »

Read More »

Gold Does Not Fear Interest Rate Hikes

Gold Does Not Fear Interest Rate Hikes. Gold no longer fears or pays attention to Fed announcements regarding interest rates. Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it. Higher interest rates on horizon will make debt levels unsustainable. New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load. Higher interest rates are good for gold as seen...

Read More »

Read More »

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge. Sales in London property market at ‘historic lows’. 65% fall in pre-tax profits in 2017 to £6.5m reported by London estate agents Foxtons. Foxtons warns 2018 will ‘remain challenging’ for London property. Norway’s sovereign wealth fund is backing London’s property market. RICS: UK property stock hits record low as buyer demand falls. Own physical gold to hedge falls in physical...

Read More »

Read More »

Silver bullion will likely outperform gold bullion going forward

Normally the action in the gold and silver futures markets tends to be pretty similar, since the same general forces affect both precious metals. When inflation or some other source of anxiety is ascendant, both metals rise, and vice versa. But lately – perhaps in a sign of how confused the world is becoming – gold and silver traders have diverged.

Read More »

Read More »

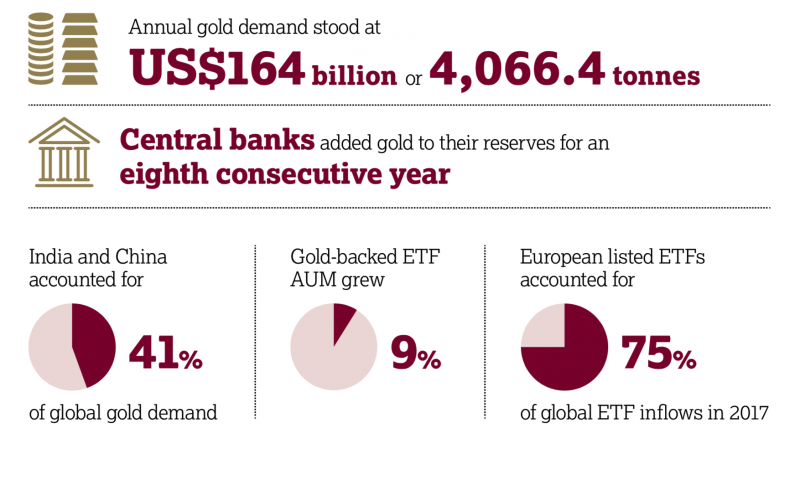

Four Key Themes To Drive Gold Prices In 2018 – World Gold Council

Four key themes to drive gold prices in 2018 – World Gold Council annual review. Monetary policies, frothy asset prices, global growth and demand and increasing market access important in 2018. Weak US dollar in 2017 saw gold price up 13.5%, largest gain since 2010. “Strong gold price performance was a positive for investors and producers, and was symptomatic of a more profound shift in sentiment: a growing recognition of gold’s role as a wealth...

Read More »

Read More »

Gold Corridor From Dubai to China Sought By China

Gold corridor from Dubai to China sought by Chinese Gold & Silver Exchange Society. New Asian gold trading corridor could boost demand for 1 kg gold bars. Should increase turnover for yuan-denominated gold coins and bars – President. Secure supplies of physical gold from Middle East and Asia for China. China positioning itself as leading gold trading and owning nation.

Read More »

Read More »

Digital Gold Provide the Benefits Of Physical Gold?

Will digital gold provide the benefits of physical gold? Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold. They are yet to provide the same benefits or safety as owning physical gold. National mints jumping in on the ‘sexy blockchain’ act. BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product.

Read More »

Read More »

Russian Central Bank Buys Gold – 600,000 Ounces Or 18.7 Tons In January As Venezuela Launches ‘Petro Gold’

Russian central bank buys gold – large 600,000 ounces or 18.7 tons of gold in January. Russia increased its holdings to 1,857 tons, topping the People’s Bank of China’s ‘reported’ 1,843 tons. Russia surpasses China as 6th largest holder of gold reserves – after U.S., Germany, IMF, Italy and France. Turkish central bank added 205 tons “over 13 consecutive months” – Commerzbank

Read More »

Read More »

Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney. Bitcoin is neither a store of value nor a useful way to buy things – BOE’s Carney. Project fear against crypto-currencies or an out of control investing bubble? Bitcoin will likely recover in value but is speculative and not for widows and orphans. British pound has been a terrible store of value – unlike gold. Pound collapsed 30% in 2016 and down 11.5% per annum versus...

Read More »

Read More »

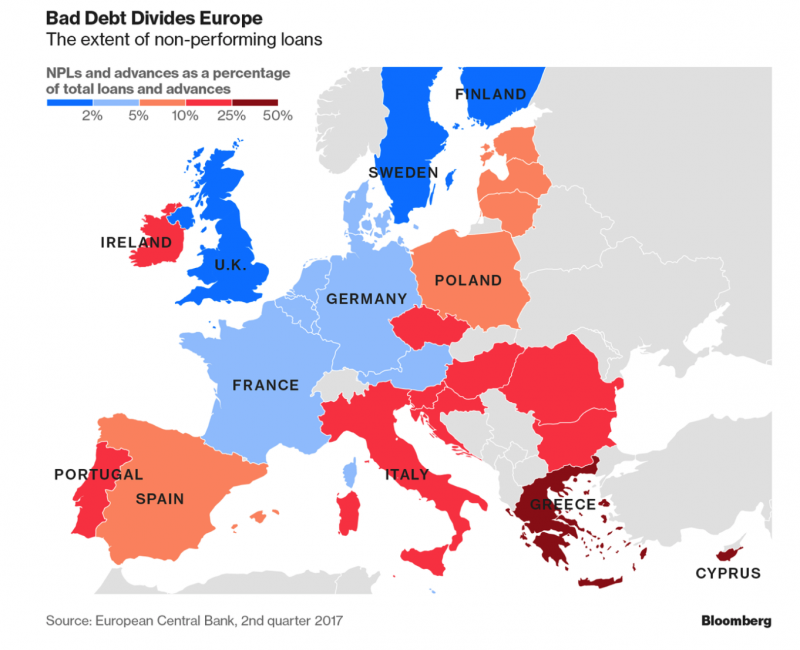

Bank Bail-In Risk In European Countries Seen In 5 Key Charts

Bank Bail-In Risk In Europe Seen In 5 Charts. Nearly €1 trillion in non-performing loans poses risks to European banks’. Greece has highest non-performing loans as a share of total credit. Italy has the biggest pile of bad debt in absolute terms. Bad debt in Italy is still “a major problem” which has to be addressed – ECB. Level of bad loans in Italy remains above that seen before the financial crisis. Deposits in banks in Greece, Cyprus, Italy,...

Read More »

Read More »

Gold Up 3.8percent In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years

Gold Up 3.8% In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years. Gold rose as the dollar fell to near a three-year low against a basket of currencies on Friday, heading for its biggest weekly loss in nine months, as a slew of bearish factors including firming inflation and a fall in retail sales and industrial production hit the dollar.

Read More »

Read More »

Is The Gold Price Heading Higher? IG TV Interview GoldCore

Is The Gold Price Heading Higher? IG TV Interview GoldCore. Research Director at GoldCore, Mark O’Byrne talks to IG TV’s Victoria Scholar about the outlook for the gold price. In this interview, Mark O’Byrne, research director at Goldcore, says the fact that the gold price did not spike during last week’s equity sell-off was to be expected.

Read More »

Read More »

Global Debt Crisis II Cometh

Global Debt Crisis II Cometh

– Global debt ‘area of weakness’ and could ‘induce financial panic’ – King warns

– Global debt to GDP now 40 per cent higher than it was a decade ago – BIS warn

– Global non-financial corporate debt grew by 15% to 96% of GDP in the past six years

– US mortgage rates hit highest level since May 2014

– US student loans near $1.4 trillion, 40% expected to default in next 5 years

– UK consumer debt hit £200b, highest...

Read More »

Read More »

Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

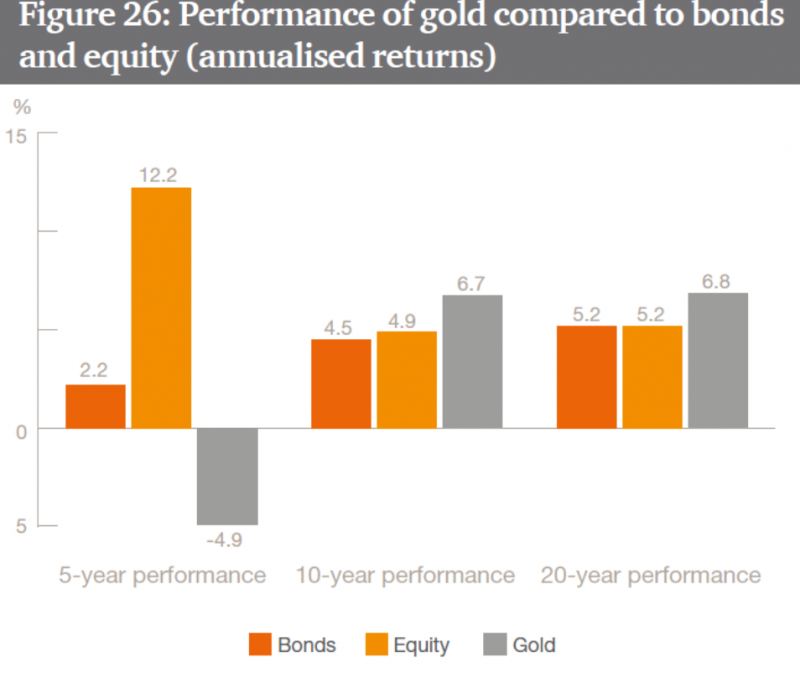

Sovereign wealth funds investing in gold for long term returns – PwC. Gold has outperformed equities and bonds over the long term – PwC Research. Gold is up 6.7% and 6.8% per annum over 10 and 20 year periods; Stocks and bonds returned less than 5.2% respectively over same period (see PwC table). From 1971 to 2016 (45 years), “gold real returns were approximately 10% while inflation increased 4%”.

Read More »

Read More »