Category Archive: 6a) Gold & Monetary Metals

Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

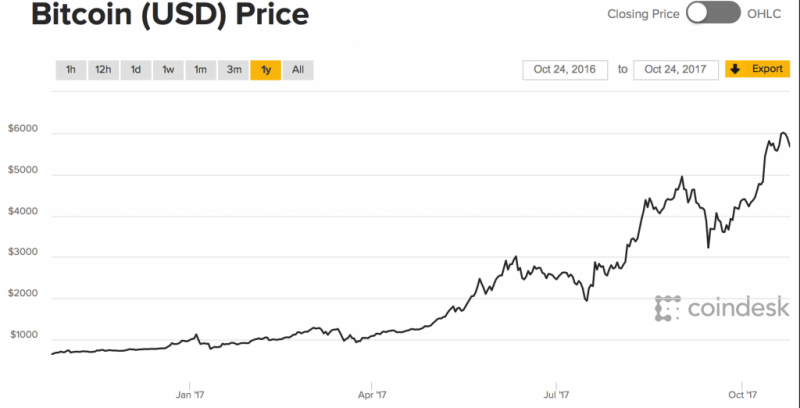

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic.

Read More »

Read More »

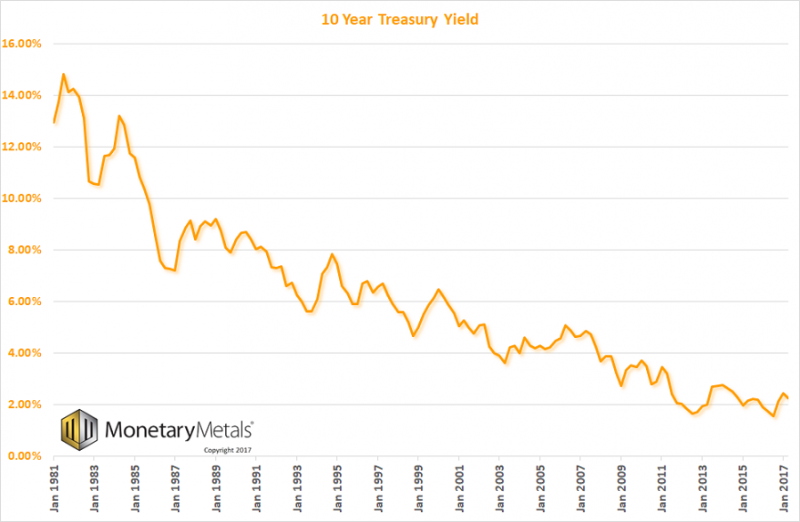

The Big Reversal: Inflation and Higher Interest Rates Are Coming Our Way

This interaction will spark a runaway feedback loop that will smack asset valuations back to pre-bubble, pre-pyramid scheme levels. According to the conventional economic forecast, interest rates will stay near-zero essentially forever due to slow growth. And since growth is slow, inflation will also remain neutral.

Read More »

Read More »

German Investors Now World’s Largest Gold Buyers

Today, gold is increasingly viewed by German investors as a regular form of saving: 25% of those surveyed in 2016 said their gold purchase had been part of a regular review of their investments, while 23% said it was part of their retirement planning.

Read More »

Read More »

Gold Price Reacts as Central Banks Start Major Change

Bank of England raised interest rates for the first time in ten years. President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve. Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news. Inflation now at five-year high of 3%. Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners.

Read More »

Read More »

Why Switzerland Could Save the World and Protect Your Gold

Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world. Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property.

Read More »

Read More »

Invest In Gold To Defend Against Bail-ins

Italy’s Veneto banking meltdown destroyed 200,000 savers and 40,000 businesses. EU bail-in rules have wiped out billions for savers and and businesses, with more at risk. Bail-ins are not unique to Italy, all Western savers are at risk of seeing savings disappear. Counterparty-free, physical gold bullion is best defence against bail-ins.

Read More »

Read More »

How to Clean Silver Coins: 7 Simple Steps to Remove Tarnish & Grime

Learn how to clean silver coins without damaging them: https://www.moneymetals.com/guides/how-to-clean-silver-coins

Buy silver coins here: https://www.moneymetals.com/buy/silver/coins

This simple method of cleaning silver with a small list of supplies can brighten up almost any tarnished silver. Not all tarnish can be removed, but this technique often works wonders.

==================

Follow Money Metals:

==================

Facebook:...

Read More »

Read More »

How to Clean Silver Coins: 7 Simple Steps to Remove Tarnish & Grime

Learn how to clean silver coins without damaging them: https://www.moneymetals.com/guides/how-to-clean-silver-coins Buy silver coins here: https://www.moneymetals.com/buy/silver/coins This simple method of cleaning silver with a small list of supplies can brighten up almost any tarnished silver. Not all tarnish can be removed, but this technique often works wonders. ================== Follow Money Metals: ================== Facebook:...

Read More »

Read More »

Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

Gold versus bitcoin debate makes further headlines as tech experts weigh in. Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold. Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar. Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency. Gold continues to hold its value and has multiple uses,...

Read More »

Read More »

Le vol de l’or de Chine.

L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays perdait l’équivalent de milliers d’années de...

Read More »

Read More »

Learn Why Axel Merk Sees Problems Ahead for the Dollar …

Congress May Eliminate State Tax and 401(k) Deductions

-----------------------------------------------------

Thanks for Watching!!!!!

Read More »

Read More »

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

Gold is better store of value than bitcoin – Goldman Sachs report. Gold will continue to perform well thanks to uncertainty and wealth demand. Bitcoin’s volatility continues to impact its role as money. Gold up 12% in 2017, bitcoin over 600%. BTC is six times more volatile than gold – see chart.

Read More »

Read More »

Marc Faber – Massive Fraud In This Financial Bubble

A big difference between the market today and that of the 1987 crash is unfunded pensions. Renowned investor Dr. Marc Faber, who holds a PhD in economics, says, “The unfunded liabilities have gone up. They did not go down. So, if in rising asset markets the pension funds unfunded liabilities go up, can you imagine …

Read More »

Read More »

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

Learn Why Axel Merk Sees Problems Ahead for the Dollar…

Read the full transcript here: https://goo.gl/D3sbKU Listen to a previous interview with Axel Merk here: https://www.moneymetals.com/podcasts/2017/07/14/diversify-with-gold-and-cash-001114 Axel Merk of Merk Investments and the Merk Funds describes why he believes the “buy the dip” mentality has overtaken mainstream financial advisors, warns about the danger of buying into conventional wisdom and also chimes in on gold and …

Read More »

Read More »

Russia Buys 34 Tonnes Of Gold In September

Russia adds 1.1 million ounces to reserves in ongoing diversification from USD. 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest. Russia’s gold reserves are at highest point in Putin’s 17-year reign. Russia’s central bank will buy gold for its reserves on the Moscow Exchange.

Read More »

Read More »