Category Archive: 6a) Gold & Monetary Metals

Live Analysis Room Show 554th + interview Bron Suchecki

Join us for a unique Forex experience in the FXStreet Live Analysis Room. The #FXroom is being hosted by Dale Pinkert, long time and popular contributor on FXStreet. Trading in community. Know our Mastermind concept as we all edify each other 1+1=11 at http://www.fxstreet.com/webinars/live-analysis/ and chat with experts and traders. Don’t miss the interview with …

Read More »

Read More »

Marc Faber: Markets Are Manipulated by Clowns in Central Banks

Thanks for watching/listening. Subscribe, Share, Like Please visit Dr. Mrac Faber http://gloomboomdoom.com Please visit Rory http://thedailycoin.org

Read More »

Read More »

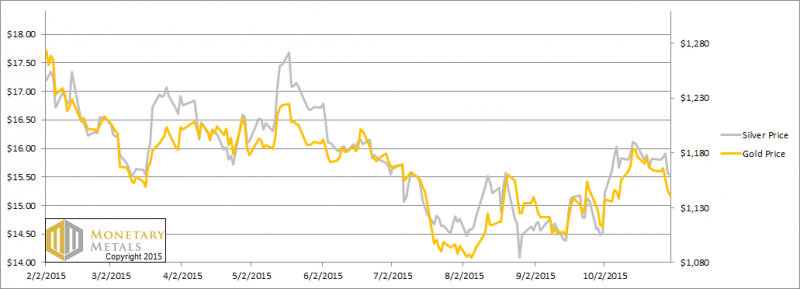

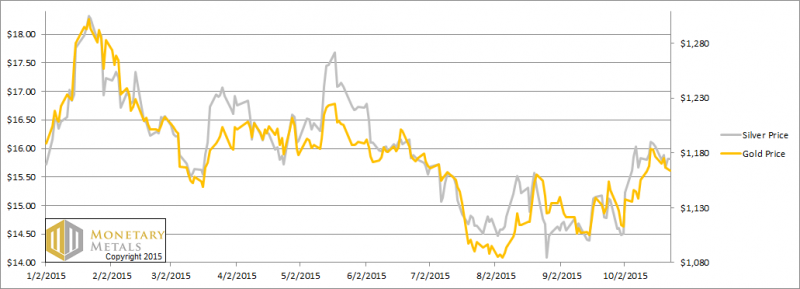

A 14 Handle On Silver Again?! 1 Nov, 2015

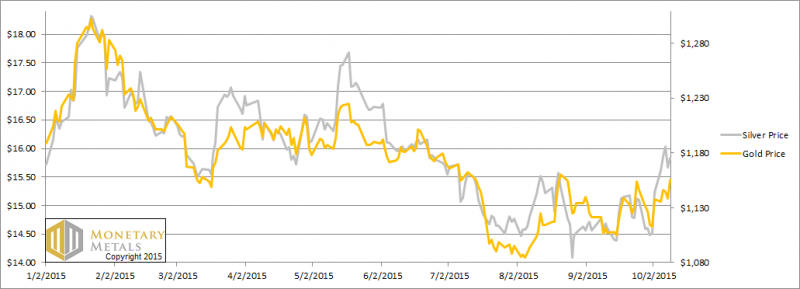

The prices of the metals dropped by 20 bucks and 20 pennies this week. In other words, the dollar went up ½ milligram gold or 30 mg silver. It wasn’t the euro, which ended the week unchanged. It wasn’t the US stock market, which ended up seven bucks.

What was it? ...

Read More »

Read More »

Marc Faber : Réserves d’or des banques centrales et le dollar américain

Interview de Marc Faber sur le prix de l’or, les réserves des banques centrales, la hausse du dollar US, et l’initiative sur l’or de la Suisse (référendum du 30 novembre 2014). Transcription: https://www.goldbroker.fr/actualites/marc-faber-or-dollar-chine-referendum-or-suisse-649

Read More »

Read More »

Marc Faber: China Has Credit Bubble of Epic Proportions

Oct. 26 — Marc Faber, publisher of the “Gloom, Boom and Doom” Report, examines China’s economic slowdown and what he sees as an “epic” credit bubble in the nation. He speaks on “Bloomberg ‹GO›.”

Read More »

Read More »

Little Change to Supply and Demand Report 25 Oct, 2015

At the risk of being boring, there’s not a lot to say about the markets for gold and silver this week (and frankly being on a challenging travel itinerary, flying from Vienna to Sydney to give a keynote at the Gold Symposium this week, is part of it). There was a modest drop in the prices of the metals, $13 in ....

Read More »

Read More »

Hedging in the Gold Miners

There are two ways to run a gold mining company. One respects the simple fact that it is producing money. It is not eager to trade its the money it produces for government paper, legal tender laws be damned. It keeps its books in gold, and produces and trades to earn more money (i.e. gold).

This article is about the...

Read More »

Read More »

And Then There Was None (Backwardation) 18 Oct, 2015

The dollar dropped about half a milligram gold, and 50mg silver.

But who wants to read about the universal currency falling, failing? Few people are so barbarous as to think of the dollar’s value as being priced in terms a monetary metal. As all right thinking folks know, the value of these commodities ...

Read More »

Read More »

Gold Bullion’s Outlook, Currency Reset & Asset Allocation with John Butler

Register Now for Webinar next Thursday and have your question answered by John Butler: https://attendee.gotowebinar.com/register/2239182188163807746 Gold’s Outlook For Year End 2015 and In 2016 Gold’s Performance in the Coming Years: 2016-2020 Coming Global Currency Reset Asset Allocation – How Much Gold? Owning Gold – How and Where?

Read More »

Read More »

Gold – Currency Reset and Asset Allocation Today

Register Now for Webinar next Thursday and have your question answered by John Butler:

https://attendee.gotowebinar.com/register/2239182188163807746

Gold's Outlook For Year End 2015 and In 2016

Gold's Performance in the Coming Years: 2016-2020

Coming Global Currency Reset

Asset Allocation - How Much Gold?

Owning Gold - How and Where?

Read More »

Read More »

The Decline and Fall of Silver Backwardation 11 Oct, 2015

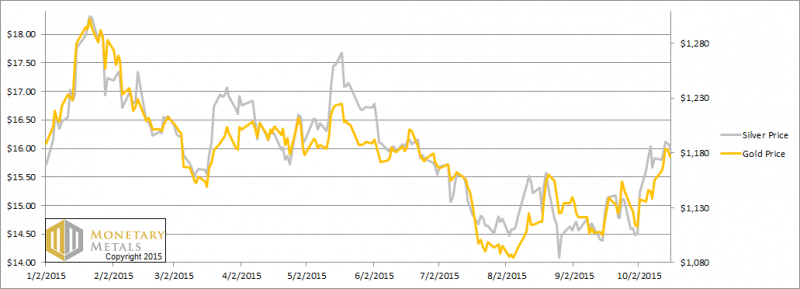

The gold price moved up $18. However, the silver price moved up 60 cents which is a much bigger percentage. The silver community is getting pretty excited.

A market trend will often begin when a small number of traders learn something new. As they begin buying (or selling), the price begins to move. Others become aware of the ....

Read More »

Read More »

Offener Brief an Alexis Tsipras

Keith Weiner zeigt, dass Griechenland bankrott gehen wird, egal ob es im Euro bleibt oder auf Dollar oder eine neue Drachme umstellt. Er schlägt eine Umstellung auf gold-denominierte Obligationen vor. Nur die Sicherheit von Gold wird Kapital wieder in das Land locken.

Read More »

Read More »

Marc Faber: Commodities Could Hit Bottom and Stay There

Oct. 5 — Marc Faber, publisher of the Gloom, Boom & Doom Report, comments on the outlook for commodities during an interview with Bloomberg’s Joe Weisenthal, Scarlet Fu and Alix Steel on “What’d You Miss?”

Read More »

Read More »

Marc Faber: We Have Colossal Asset Inflation

Oct 5 — Gloom, Boom & Doom Report Editor Marc Faber discusses how low interest rates have helped to raise asset prices with Bloomberg’s Scarlet Fu, Joe Weisenthal and Alix Steel on “What’d You Miss?” (Source: Bloomberg)

Read More »

Read More »

Marc Faber: Markets Could Crash Like 1987

Oct. 5 — Marc Faber, publisher of the Gloom, Boom & Doom Report, comments on the outlook for stocks during an interview with Bloomberg’s Joe Weisenthal, Scarlet Fu and Alix Steel on “What’d You Miss?”

Read More »

Read More »

Silver Price Spikes, But What Demand 4 Oct, 2015

For a few frenzied minutes, while everyone was sleeping, the price of silver spiked 56 cents. Well, at least the West Coast of America was sleeping. It began at 8:30 in New York, where presumably most traders were not sleeping. And of course, it was afternoon here in London (where Monetary ....

Read More »

Read More »