Category Archive: 6a) Gold & Monetary Metals

Gold & Silver: Precious Metals Markets Outlook 2018 Stefan Gleason

Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist News Greg Mannarino Rob Kirby Reluctant. Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass …

Read More »

Read More »

Marc Faber – US Dollar Collapse Coming 2020 – The Crash of US Economy By China Effect

Daily Voice News – Economic Collapse Marc Faber: President Trump Is Doing A Great Job But He Is Not A Dictator Marc Faber joins Alex Jones live via Skype to give his academic opinion on how President Trump’s first year has been for the American people and people around the world.

Read More »

Read More »

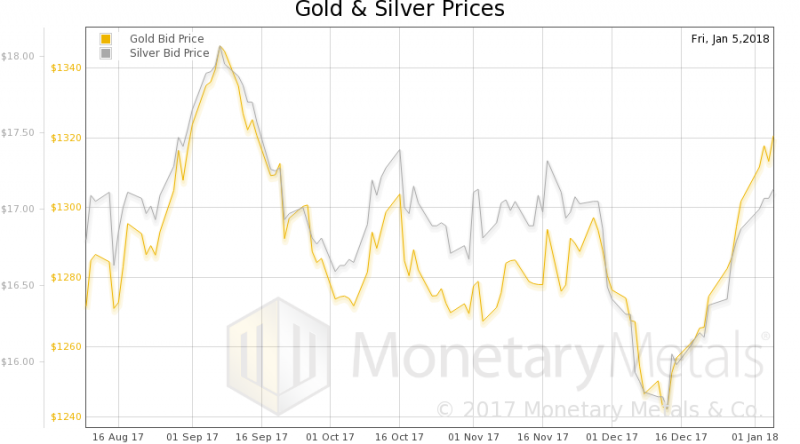

Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying. Equities fell sharply on the report as did Treasurys and the U.S. dollar. Chinese officials think U.S. debt is becoming less attractive compared to other assets. Trade tensions could provide a reason to slow down or halt U.S. debt purchases. U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt. Currency wars to return as China rejects U.S....

Read More »

Read More »

10 Reasons Why You Should Add To Your Gold Holdings

10 Reasons Why You Should Add To Your Gold Holdings. Gold currently undervalued. Since 2000, the gold price has beaten the S&P 500 Index. A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years. Reached ‘peak gold’ as exploration budgets continue to tighten. $80 trillion sits in global equities, a ‘ticking time bomb’. Gold remains an appealing diversifier in the current environment of high valuations and...

Read More »

Read More »

Gold & Silver Updates: Precious Metals Markets Outlook 2018 Stefan Gleason

Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist News Greg Mannarino Rob Kirby Reluctant. Follow along with a downloadable PowerPoint presentation here Economist and trading coach Jerry Robinson is joined. Peter Thomas: Investing in Gold, Silver, Copper, Platinum, …

Read More »

Read More »

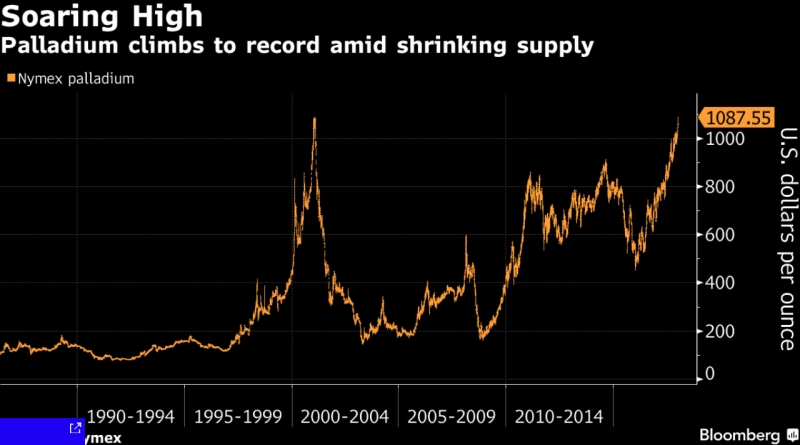

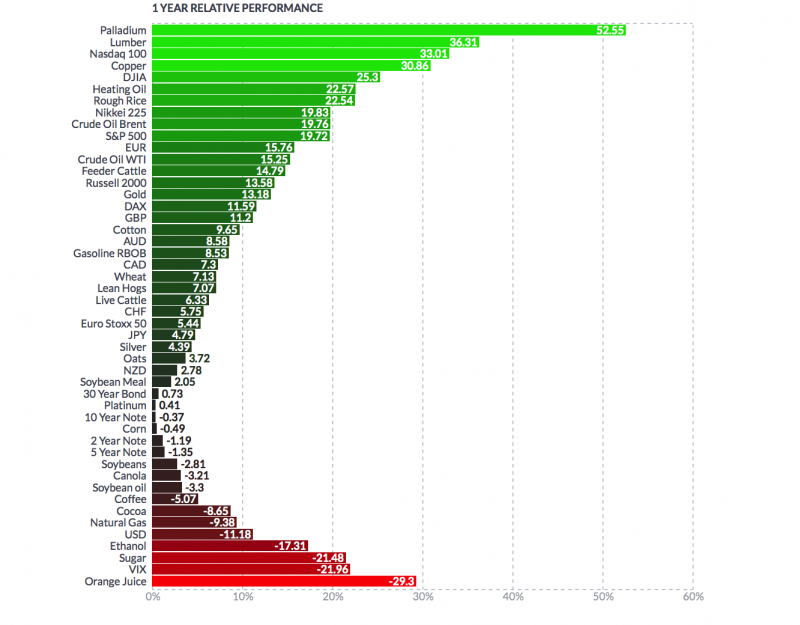

Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

Palladium prices surge to new record high over $1,100/oz today. Palladium surges past record nominal price seen in 2001 after 55% surge in 2017. Best-performing precious metal and commodity of 2017 is palladium. Palladium prices top platinum prices for first time in 16 years. Strong Chinese car demand and switch from diesel to petrol cars sees demand surge. Supply crunch as six year supply deficit & 2017 deficit expected to hit 83,000 ounces

Read More »

Read More »

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

Christmas film serves as reminder that savings are not guaranteed protection by banks. Savers are today more exposed to banking risks than ever before. Gold and silver investment reduce exposure to counterparty risks seen in financial system. Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price.

Read More »

Read More »

Gold Has Best Year Since 2010 With Near 14percent Gain In 2017

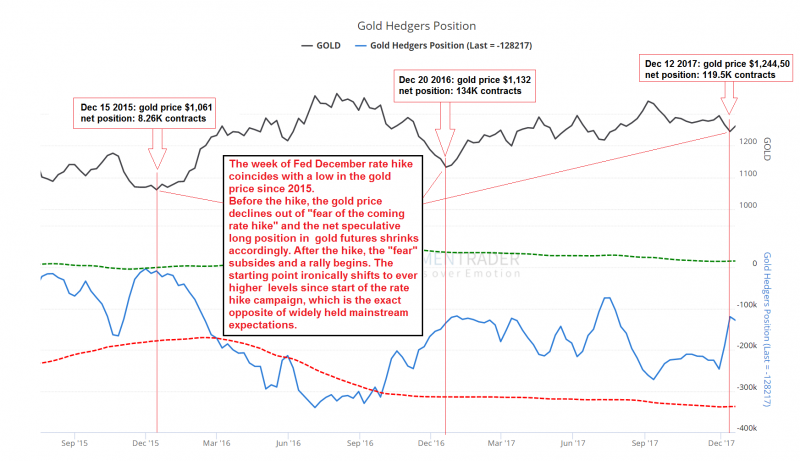

Gold Has Best Year Since 2010 With Near 14% Gain In 2017. Gold posted second straight annual gain in USD in 2017. Gold in 2017: up 13.6% USD, up 2.7% GBP, down 1.4% EUR. 2017 is gold’s best year since 29.5% gain in 2010. Strong performance despite rate hikes and stock bubble. India’s gold imports surged 67% in 2017, Turkish, Chinese demand strong. Gold finished 2017 with longest rally since June 2016. 2018: Currency War and The Year of the...

Read More »

Read More »

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift. Two years since bail-in rules officially entered EU regulations. EU bail-in rules have wiped out billions for savers and and businesses, with more at risk. Future of many failing banks now rests on depositors who may no longer be protected by deposit insurance.

Read More »

Read More »

98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018. World equity index market capitalization touching distance of $100 trillion dollars at beginning of December. Key indicators across global financial markets are looking decidedly bubble-like. Little indication that we are through the worst of the financial crisis that started in 2007. Apparent lack of concern regarding the over-heated and overpriced markets.

Read More »

Read More »

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future. Futurist guide to 2028 shows a world of uncertainty and disruption. One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems. Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit. Adoption of cryptocurrencies and blockchain will send gold price soaring....

Read More »

Read More »

Super Exclusive: Bubble of Bitcoin may burst in 2018, says Marc Faber

Marc Faber, editor of The Gloom Boom & Doom Report, speaks about Bitcoin’s future. About Zee Business ————————– Zee Business is one of the leading and fastest growing Hindi business news channels in India. Live coverage of Indian markets – Sensex & Nifty...

Read More »

Read More »

St Moritz becomes first Swiss ski resort to accept Bitcoin

Ski lifts in and around St Moritz in the Engadine Valley have started accepting Bitcoins as payment for passes. According to Swiss public television, SRF, and the newspaper Südostschweiz, Engadin St Moritz is the first Swiss lift company to recognise payments with cryptocurrencies.

Read More »

Read More »

MARC FABER Silver May Be More Desirable Than Gold

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Bitcoin: Attention à l’arnaque. Dossier.

C’est la monnaie préférée des pirates informatiques. Celle qu’exigent les hackers lorsqu’ils formulent une demande de rançon. Mais pas seulement ! Depuis que le bitcoin flambe (il a dépassé le 15 décembre les 17 000 dollars), de plus en plus de fonds d’investissement, alléchés par les perspectives haussières de son cours, s’y intéressent. Et de nombreux sites de commerce en ligne se mettent à facturer produits et services dans cette...

Read More »

Read More »